Summary

Key takeaways

- Multi-stakeholder (investors, the scientific community and issuers) needs to work handin-hand to channel capital towards adaptation solutions that are able to deliver material impact across sectors as mitigation efforts alone cannot halt the negative effects of climate change.

- Climate adaptation and resilience remains underfinanced, with a significant and growing gap of US$194-366 billion per year, or 0.6%-1.0% of GDP for developing countries1.

- For investors, climate impacts that materialize through chronic and acute physical risks have a direct or indirect influence on investments. Investors need to examine their physical risk exposures across the supply chain of investee companies.

- Although there are limitations for integrating physical risk due to data and methodologies challenges, it is critical for investors to start pricing in these risks into their financial modelling and their investment decision process. This paper will explore the different ways and methods investors may use to start doing accounting for these climate risks.

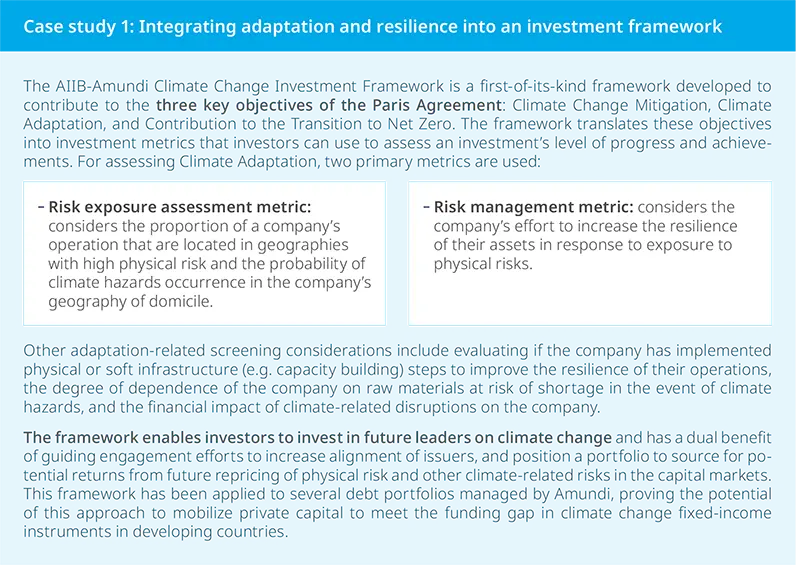

- To support investors in this journey, Amundi integrates adaptation consideration into investments through various ways, including a dedicated climate change framework via AIIB-Amundi Climate Change Investment Framework, and green bond funds investing in resilience bonds or similar instruments. In addition, physical climate risk is part of Amundi’s responsible investment approach and stewardship activities.

- Additional investment solutions exist to break financing barriers include blended finance arrangements, public-private partnerships, and investment instruments such as resilience bonds, catastrophe bonds, and insurance-linked securities.

1) The climate adaptation finance gap continues to widen

The science is clear: mitigation efforts alone cannot halt the negative effects of climate change. The world needs to prepare for physical climate changes even if we successfully meet the Paris Agreement goals. The increase in frequency and severity of acute climate hazards is expected to surge in the coming years, and will have a profound impact in several parts of the world. Moreover, the distribution of anticipated acute weather events is disproportionate and uneven, biased toward more vulnerable populations.

According to the World Economic Forum, extreme climate events are of upmost global concern both in the short- and long-term horizon (ranked as top 2 risk over the next 2 years, and top 1 risk over the next 10 years)2. Notwithstanding the persistent signals of worsening climate risks and related impacts, the climate adaptation financing gap continues to widen: for this decade it is estimated at US$194bn to US$366bn per year for developing countries1. As such, adaptation finance needs are 10 to 18 times greater than current flows, 50% more than previous estimation.

The rate of change and the severity of climate impacts is, however, highly dependent on near-term mitigation and adaptation efforts. The planning and implementation of adaption and resilience, and the iteration of adaptation cycles need to be accelerated in this decade. Similarly, mitigation efforts to limit the increase of the global average temperature can help ensure that the largest number of adaptation options remain available to us, thus avoiding the worse possible impacts from climate changes and associated loss and damage down the road. Hence, a dramatic increase in financing for both mitigation and adaptation are required to close the global investment gap and achieve long-term climate goals.

2) Physical risks and investors’ perspective

a) Defining physical climate risks

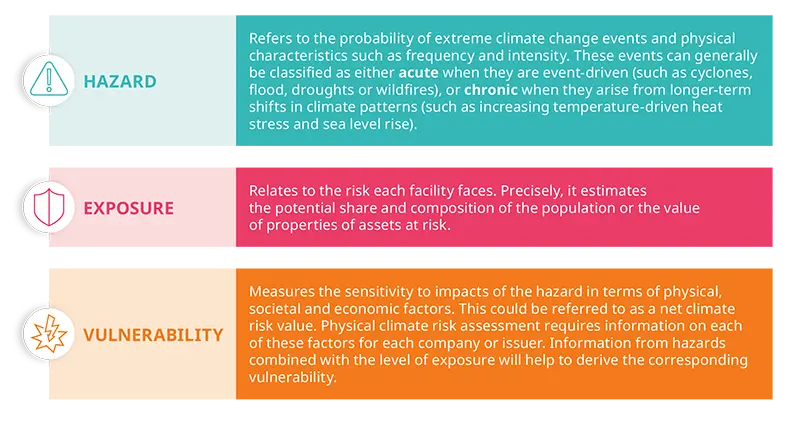

Physical climate risks are multi-dimensional and typically viewed as an interaction of three core dimensions: hazard, vulnerability and exposure, as well as reflecting the interdependencies of climate, socioeconomic impacts, and biodiversity and natural ecosystems.

b) Why physical climate change impacts matter for investors

For investors, climate impacts that materialize through both chronic and acute physical risks have a direct and indirect influence on investments. Loss and damage to an investee company’s assets will increase CAPEX costs and operational disruptions will affect margin and/or sales. Combined, these effects can significantly increase downside risk. Conversely, the increasing linkage of adaptation and resilience with investment needs and opportunities means that businesses will face stiffer competition to innovate and explore new opportunities.

According to the World Economic Forum, climate risks could hit around 10% of annual turnover, or 4% of the market value for businesses3, and potentially have wider impacts across value chains and global economies. Tackling this issue will require companies to change their corporate strategy, develop new partnerships, and venture into new markets.

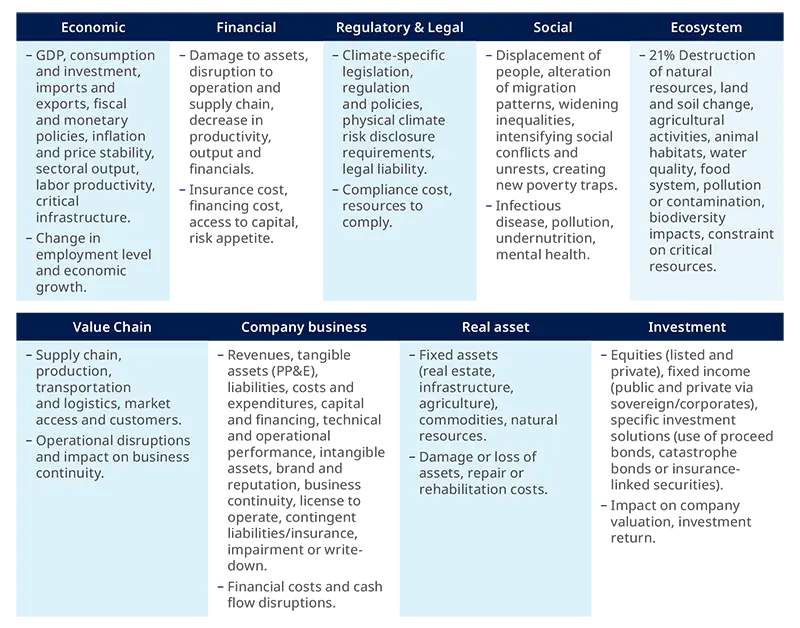

It is vital for investors to thoroughly assess the impacts of climate change on investment portfolios in granular detail, i.e., down to the investee company and asset-level (see Table 1 below). For example, this includes climate hazards that were once considered less material (e.g., the financial impact of extreme heat) as effects further intensify and become more impactful.

Amundi Investment Institute's working paper titled 'Investor Concerns and the Pricing of Physical Climate Risk' examined firms’ physical assets exposure to tropical cyclone risk to study its pricing in the global equity market. In this paper, we use a forward-looking risk assessment model (CLIMADA), which simulates tropical cyclone tracks to project wind speeds at the location of each asset in the year 2050 and estimates the expected damage to about 14,000 facilities owned by 790 companies worldwide. This projection also takes into account the impact of climate change on cyclone activity under different climate scenarios (RCP 2.6, 4.5, and 6.0). The projected damages at the asset level are then aggregated to the company level. This analysis shows that 70% of the companies in the sample have some exposure to tropical cyclone risk. Companies located in East and South Est Asia, the US, and Central America, are projected to be particularly affected. When investor concerns about cyclones are low, a one-standard-deviation higher exposure to cyclone risk is associated with 1.5% to 2.2% higher annual stock returns (RCP4.5 scenario). But during periods of high concerns, a one-standard-deviation higher exposure is associated with a 0.8% to 1.7% lower annual returns. This suggests that investors began to price climate physical risks and that investors’ perception of the risks plays a crucial role.4

Besides assessing companies at the entity level, it is critical for investors to evaluate the impact that physical climate risk pose to entire supply chains. Investors need to assess both the upstream and downstream physical risk exposures of their investee companies as climate hazards can exert a knock-on effect throughout the supply chain which creates volatility in the market and additional downside risk for investors.

However, it should also be acknowledged that physical risk is a complex subject that poses challenges for investors. Given that physical risk is non-linear, it is difficult to anticipate the exact time and locations where the extreme climate events would occur and their impact. The lack of tools and established methods available for investors to account for physical risk into company or asset valuation further compounds to difficulties in factoring physical risk into investment decisions. Despite the limitations, the following sections will explore current methods that investors may utilize to incorporate physical climate risk into their investment processes.

Table 1: Examples of extended impacts

c) Accounting for physical climate risks in investment portfolios

Cost-benefit analysis

Investors can incorporate physical risk assessment and data to evaluate the resilience of their portfolios in several ways. One important aspect is the cost benefit analysis of resilience options. This analysis involves comparing the proposed expenditure or investment with the expected monetary benefits. It is crucial to consider both financial, and environmental and social parameters, which may need to be translated into economic values.

Financial analyses typically use the discounted cash flow (DCF) methodology, which takes into account adjustments to cashflow forecasts, such as changes in sales, growth or erosion of margin, and increased CAPEX requirements (and thus net debt position). With access to suitable data, investors can consider potential extra costs resulting from physical climate hazards, and adjust discount rates in line with such longer-term risks. This ensures that the DCF methodology can effectively capture the value of resilience options. As such, it is possible to calculate a climate risk-adjusted net present value (NPV) of an asset's cash flows, and compare the costs of doing nothing to those of adapting.

The methodology for adjusting discount rates in relation to climate risks is still subject to debate. One approach is to consider modifying an asset's credit rating by incorporating its level of resilience readiness. The concept of a climate risk scorecard can be used as a measure, similar to the one developed by Ceres that evaluates entities on several physical risk-related dimensions such as whether scenario analysis is conducted, level of transparency over climate-related risk management activities and quality of climate disclosures4. The yields of listed bonds with similar ratings can then be compared to estimate the delta in the cost of debt.

Financial analysis can also be conducted from an equity valuation perspective by considering the cost of equity for companies that are implementing resilience measures. Climate resilience measures reduces the risk-level of cash flows and can lead to reduced cost of equity for resilient-ready companies. However, there is currently no consensus on how to translate this into an adjustment to the CAPM cost of equity formula.

Academic circles are exploring various considerations, such as a climate-risk premium and adjustments to the "beta" used in the weighted average cost of capital of the CAPM. These efforts aim to develop more robust methodologies for incorporating climate risks into investment frameworks and ensuring that private investors can make informed decisions based on accurate physical risk assessments.

Physical climate risk framework

Quantifying physical risks is challenging given that it involves climate modelling, physical asset mapping with geospatial data, value at risk and financial impact calculations. For investors, there are three key areas of focus when assessing and managing physical climate risks.

1. Understand climate scenarios, time horizon, and methodology

There are various climate models and data sources covering selected physical risk hazards, exposure and vulnerability across climate scenarios and time horizons, which quantify such impacts in terms of Value at Risk or financial loss. Investors should still be mindful of the limits associated with uncertainties of these metrics and scenarios. Various climate scenarios are available today, but at times, investors may need to augment them with other drivers for stress testing or with a wider range of plausible hazard outcomes under different pathways. Another key challenge is that many scenarios may not account for the mitigation and adaptation measures the company or the country has already adopted or is planning to adopt.

Common climate scenarios being referenced include the Intergovernmental Panel on Climate Change (IPCC) Representative Concentration Pathway (RCP)5, Shared Socio-Economic Pathways (SSP)6, and the International Energy Agency (IEA) World Energy Outlook Scenarios (which map future global primary energy use to atmospheric CO2 concentration in the atmosphere). Physical risk scenarios often refer to the assumptions of the IPCC RCPs, primarily through a moderate emissions pathway (RCP 4.5) and a high emissions scenario (RCP 8.5). Based on IPCC RCPs and SSPs, the Network for Greening the Financial System (NGFS, a network of central banks a financial supervisors) has also established a number of physical risk scenarios to assist climate risk analysis for the financial sector.

Amundi Investment Institute’s recent paper on “Modeling Direct and Indirect Climate-related Physical Risks”7 models direct and indirect damages using the example of worldwide tropical cyclones, and illustrates the distribution of future damages across several countries. There are two methods examined in the paper to estimate the costs of physical climate change. The bottom-up approach (direct damage) assesses the geographical locations of all physical assets of the company, identifies hazard sensitivities, and aggregates estimated damages at the portfolio level. Another method is the top-down stochastic approach, which models the damages in terms of GDP loss from extreme events at the country level, which are then disseminated at the sector level.

2. Identify high risk or hotspots by sector, asset type and geographical location

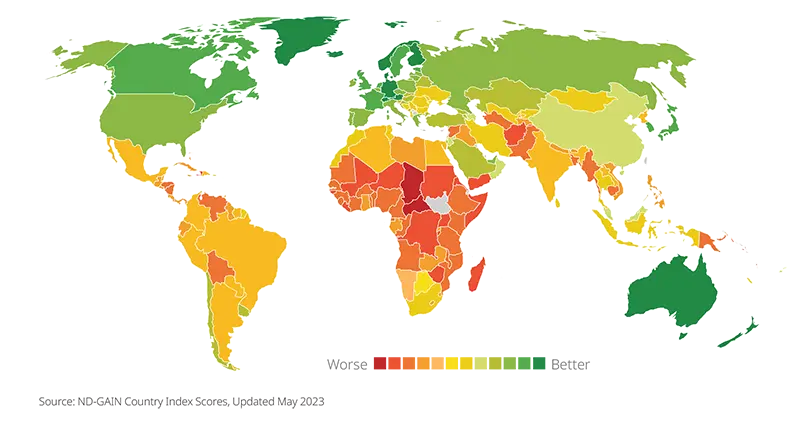

It is important to understand the various types of physical risk and its materiality across locations and sectors. Having access to specific data on the location of the physical asset or infrastructure, as well as on the supply chains of companies, makes it possible to pinpoint hotspots or high-risk companies. In turn, this can allow investors to work out the level of risk exposures and probabilities of damages from climate change and extreme weather events. Taking a sector and geographic location approach, “high-risk” sectors include utilities, energy, materials & industrials, capital goods. For example, at the country level, the ND-GAIN country index8 measures the vulnerability (health, food, ecosystem, habitat, water, and infrastructure) and readiness (social, economic, and governance) of countries. Many data providers also provide climate and geospatial analysis to overlay asset locations on a climate hazard map.

Graph 1 : ND-GAIN Country Index (2023)

3. Assess data output and impacts

We need to develop appropriate evaluation criteria and frameworks to identify specific hazards and physical risk impacts from assets and companies within investment portfolios. Without adequate adaptation and resilience measures, physical risks could have significant direct and indirect business and financial implications for companies stemming from interruptions, damages and costs (including insurance).

While it is important to monitor physical risk change over time, we understand there are certain barriers in the assessment of physical climate risk. Common challenges are data availability especially with regards to asset location, the ability to anticipate the occurrence and intensity of climate hazards, the difficulty to assess adaptation and resilience actions at company, national, and regional level, and last but not least, the secondary effects of physical climate risk and relevant socioeconomic impacts.

However, barriers are expected to reduce over time as models and data providers are improving and enhancing their data and coverage. The climate reporting and disclosure regime already covers the integration of transition and physical risk and opportunities for companies, which should help investors in their assessment. Regardless, investors should still actively seek granular information from companies including assumptions, drivers, and indicators used in climate scenarios and models, and how their physical climate risk and resilience are factored into their strategy and business operations.

3) Concrete solutions to adaptation and resilience

a) Developing a portfolio with adaptation considerations

From a portfolio construction perspective, adaptation and resilience can be integrated into the investment framework and asset selection process. For instance, a screening criterion can be introduced to select companies that are either best-in-class in terms of responding to physical risk across the operations in their value chain, or companies that are deemed to have positive momentum towards adopting adaptation measures in their operations. A concrete example of implementing this approach can be found in the AIIB-Amundi Climate Change Investment Framework (see Case study 1 below)9. Based on this framework, Amundi has been managing a climate bonds portfolio for AIIB that invests in companies that score high in their alignment with the different dimensions of the Paris Agreement objectives, including climate change adaptation. A few years later, Amundi launched a pooled fund for a London-based fiduciary manager that uses for a large part this same investment framework.

While building debt portfolios with adaptation elements is more common, investors can also consider investing in project-level equity, in order to scale solutions across areas of climate adaptation: water management, resilient food systems, geospatial intelligence, etc.

b) Scaling use-of-proceeds bond investments in adaptation

According to the latest CPI Global Landscape of Climate Finance, adaptation finance is still low, at 9% of total climate finance in 2021-2022, with the vast majority of financing going instead to mitigation purposes10. Moreover, while adaptation finance increased by 29% in 2021-2022 to US$63 billion (from US$49 billion in 2019-2020), the share of total climate finance directed to adaptation almost halved in the same period. This shows there is significant need to scale up adaptation financing, at a time when countries’ climate vulnerabilities are growing.

From a security-level perspective, sustainable bonds can be a concrete way to finance climate resilience projects across sectors. While debt instruments have mostly focused until now on financing climate mitigation efforts, rather than climate adaptation ones, we believe that the sustainable debt market remains a key avenue for tapping private financing on specific adaptation and resilience projects.

Market-rate debt instruments indeed currently dominate adaptation finance, amounting to US$37.5 billion, representing 60% of total adaptation financing in 2021-2022. Most of these instruments are issued by national and multilateral development finance institutions (DFIs) and fund projects across sectors (water treatment, agriculture, forestry, etc.).

While a multitude of adaptation activities can be implemented across sectors, it is important that they are based on existing market standards, to ensure they achieve material impact without causing harm to other environmental and social aspects. Clarity on activities that fall under the definition of adaptation and resilience projects is equally important to avoid green- or impact-washing risks.

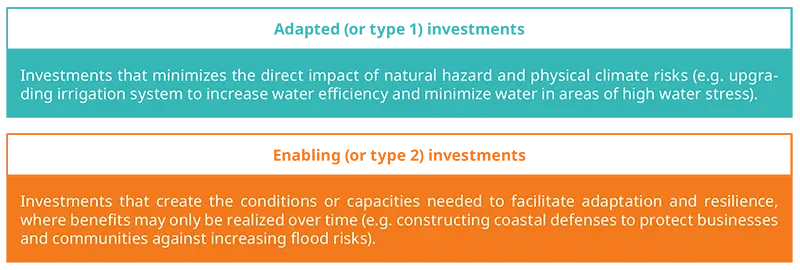

To help develop greater awareness and more guidance on project financing for adaptation and resilience activities, the United Nations Office for Disaster Risk Reduction’s Guide for Adaptation and Resilience Finance11 offers a reference point for investors looking to finance such activities, particularly in emerging markets and developing economies. Broadly speaking, the guidebook categorizes seven Climate Resilience themes12 into two types of investments:

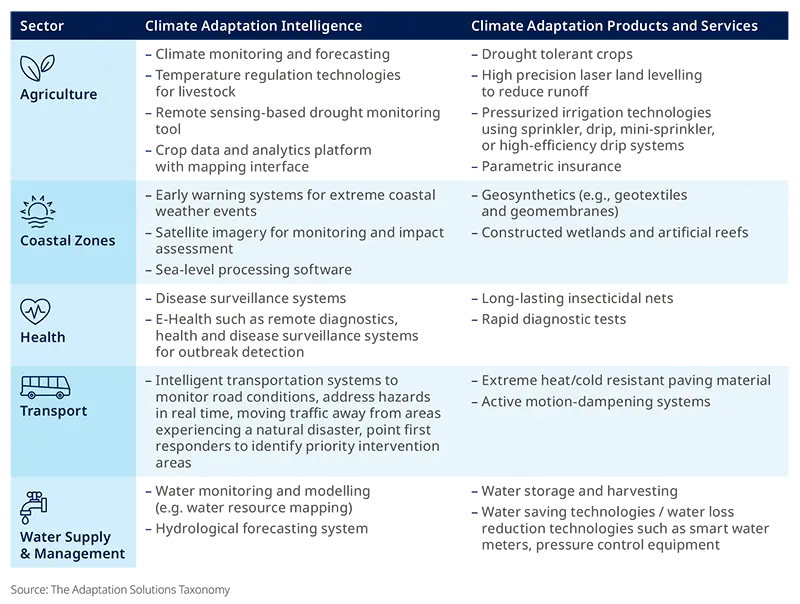

The Adaptation Solutions Taxonomy13 is another investor resource for adaptation financing, which specifically covers a framework for classifying adaptation activities offered by Small and Medium Enterprises (SMEs) in developing countries. Activities can be broadly grouped into those relating to Climate Adaptation Intelligence – activities that aid in identifying and assessing physical climate risks – and Climate Adaptation Products and Services – activities that aid in addressing physical climate risk. Table 2 below provides a non-exhaustive summary of potential adaptation projects as described in the Adaptation Solutions Taxonomy.

Table 2: Adaptation Solutions Taxonomy Project

AIIB’s first Climate Adaptation Bond issued in 2023 is an example of a thematic bond where proceeds are directed towards climate-resilient and adaptive infrastructure investments14. Examples of eligible projects include a municipal services improvement project in India aimed at improving water supply and treatment infrastructure, and another project enhancing the capacity of flood risk management, flood emergency responses and post-disaster rehabilitation of flood-damaged areas for municipalities in China.

When considering investments into adaptation solutions, we can further expand the scope to include Nature-based Solutions (NbS). According to the International Union for Conservation of Nature (IUCN), nature-based solutions can be understood as me thods that leverage nature and healthy ecosystems to address major challenges such as climate change, disaster risk reduction, food and water security, biodiversity loss and human health15. In the context of adaptation, nature-based solutions can involve the conservation of natural resources, habitats and ecosystems that lead to enhanced resilience against climate hazards. For instance, Mexico’s Sustainable Development Goals (SDG) Sovereign Bond issuance in 2022 featured allocations to ecological restoration activities, wildlife conservation and sustainable forestry development, contributing to both climate mitigation and adaptation objective16. Other examples of nature-based solutions for adaptation as described by the European Environment Agency17 are listed below in Table 3.

Table 3: The European Environment Agency’s Nature-based Solutions

c) Impact measurement

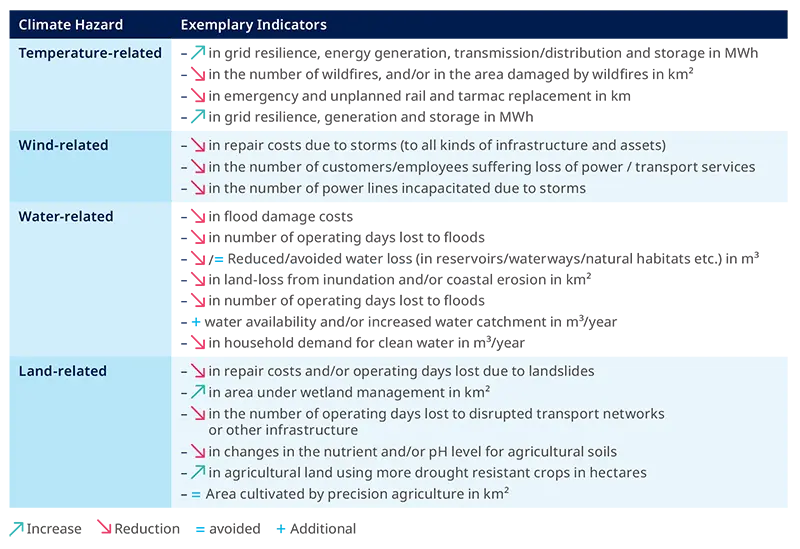

In assessing the positive adaptation and resilience impacts of investments, key outcomes to enhance adaptive capacity for the people (whether individuals, families, or communities in terms of number of beneficiaries), planet (i.e., area of habitat in size under climate adaptation programs), and the economy (i.e., number of businesses adopting climate resilience measures) should be compared to investments with a hypothetical baseline without such adaptation investment. This approach is in line with the International Capital Markets Association’s (ICMA) impact reporting guide for adaptation projects and a list of indicators categorized by climate hazards can be found in Table 4 below18.

Table 4: ICMA Suggested Metrics for Climate Adaptation Projects

d) The role of investor stewardship in climate adaptation

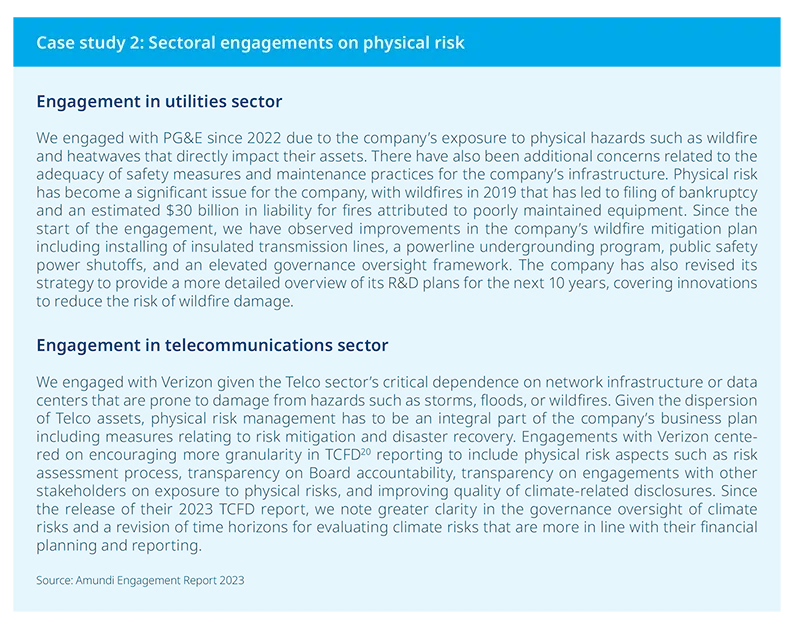

Beyond direct investments, stewardship functions as a proactive approach for investors to drive the adaptation and resilience agenda with investee companies that can lead to tangible improvements in incorporating physical risk topics into a company’s business planning and strategy. As featured in our 2023 Engagement Report19, physical risk is one of the key topics of engagement at Amundi. We focus our engagement on companies that are considered “High Risk” based on their sector exposure to physical risk, particularly for the following sectors: Electric Utilities, Electronic Equipment & Instruments, Semiconductors, Oil & Gas Companies, and Telecommunication.

Table 5: Amundi’s engagements cover several objectives

These are the priority areas required for companies to be considered more ready, resilient or better adapted for physical climate risks. Even so, external factors could still have an impact on the degree of readiness, such as insurability and national efforts in mitigating physical risks.

4) Other market players can play a crucial role in scaling adaptation finance

Apart from private investors, Multilateral Development Banks (MDBs) and development agencies can play a crucial role in financing adaptation and resilience programs by providing financial support to low- and middle-income economies through various instruments. For example, several MDBs and the International Development Finance Club (IDFC) have worked together to improve the harmonization, comparability and transparency of the adaptation finance. The IDFC-MDB Common Principles for Climate Change Adaptation Finance Tracking were established in 2015 to improve reporting on adaptation finance and provide a standardized approach for tracking such financings. These principles serve as the foundation for enhancing transparency and comparability in reporting, and have been updated and adopted by the IDFC and MDBs to improve their operational application.

Development finance institutions can also play a role in scaling the market by providing concessional lending and grants. Over 2021-2022, this type of financing amounted to US$24 billion, according to CPI, representing 38% of tracked adaptation finance21. While this is promising, more work can be done to remove investment barriers and unlock private sector capital, in particular in EMDEs that are traditionally considered as riskier.

The insurance sector also plays a crucial role in adaptation and resilience efforts. The relationship between risk transfer and adaptation investment is complementary, as both practices contribute to the management and pricing of physical climate risks. Insurance solutions can provide additional incentives, such as reduced premiums, for adaptation investments that reduce risk to assets and communities. Insurance-related analytics, particularly catastrophe modelling, can also support adaptation investments in achieving their desired outcomes effectively.

In certain geographical areas, the rising frequency and severity of hazards have rendered certain economic activities uninsurable. In recent years, the insurance industry has seen significant innovation in relation to adaptation investments, particularly through the development of insurance-linked securities (ILS). ILS are financial instruments that are dependent on insurance-related, non-financial events, including natural disasters like hurricanes, earthquakes and pandemics. We indeed observe positive momentum in the ILS market, with a growth rate of 20% in 2023 to US$43.1bn, up from US$35.5 bn in 202222.

Catastrophe bonds, a sub-type of ILS that transfer risks from issuers to investors by raising money for companies in the insurance industry in the event of a natural disaster, have also seen growing traction: issuances have reached record highs in 2023, at US$15bn. Overall, the market has grown at about 4% annually for the past six years, which is roughly in line with the growth of global natural catastrophe exposures23.

Beyond financial instruments, initiatives like CCRI (Climate Change Resilience Initiative) have also emerged to blend risk transfer and credit solutions, aiming to enhance cash-flow predictability and the net present value (NPV) of investments24. Overall, the insurance sector plays a vital role in supporting adaptation and resilience efforts by providing risk transfer solutions, incentives for adaptation investments, and valuable analytics.

5) Conclusion: Financing climate adaptation cannot wait

Climate adaptation is an essential objective alongside climate mitigation efforts to meet the goals of the Paris Agreement. Still, it continues to be a highly underfinanced area. Considering the intensity and frequency of extreme weather events, financing climate adaptation cannot wait further. Moreover, acting now will reduce the overall cost from rebuilding as a result of climate-related disasters.

Despite the current limitations related to physical risk methods and data, investors need to understand the importance of assessing both the upstream and downstream physical risk exposures of their investee companies. Investors already have the opportunity to start incorporating physical risk factors into their financial modelling and investment decision process. They can also drive capital towards adaptation solutions through methods such as adequate assessment of physical climate risk, dedicated investment framework and stewardship activities.

Finally, a wide range of stakeholders is required from both public and private areas to work together and complement adaptation financing efforts through blended finance, partnerships, and innovative solutions. The entire financial community needs to make climate adaptation a priority item on their agenda, considering the knock-on effects that climate hazards can have on the economy and the downside risk they represent for investors.

Sources and References

- UNEP – Adaptation Gap Report 2023f

- World Economic Forum - Global Risks Report 2024

- World Economic Forum’s White Paper - Accelerating Business Action on Climate Change Adaptation

- Investor Concerns and the Pricing of Physical Climate Risk | Amundi Research Center

- https://www.ceres.org/resources/assessments/climate-risk-scorecard

- RCPs describe different pathways of GHG emissions and atmospheric concentrations, air pollutant emissions and land use.

- SSPs model how socioeconomic factors such as population, economic growth, education, urbanization and the rate of technological development may change over the next century.

- https://research-center.amundi.com/article/modeling-direct-and-indirect…

- https://gain.nd.edu/our-work/country-index/

- https://www.aiib.org/en/policies-strategies/framework-agreements/climate-change-investment-framework/.content/index/AIIB-Amundi-Climate-Change-Investment-Framework-FINAL-VERSION.pdf

- CPI (2023). Global Landscape of Climate Finance in 2023

- https://www.undrr.org/publication/guide-adaptation-and-resilience-finance

- The seven climate resilience themes are: resilient agri-food systems, cities, health, industry and commerce, infrastructure, nature and biodiversity naturebased solutions, and societies

- https://publications.iadb.org/en/adaptation-solutions-taxonomy

- https://www.aiib.org/en/news-events/news/2023/AIIB-Issues-First-Climate-Adaptation-Bond-Targeting-Resilient-Infrastructure.html

- International Union for Conservation of Nature (IUCN) https://www.iucn.org/

- https://www.finanzaspublicas.hacienda.gob.mx/work/models/Finanzas_Publi…

- https://www.eea.europa.eu/publications/nature-based-solutions-in-europe

- https://www.icmagroup.org/assets/documents/Regulatory/Green-Bonds/Sugge…

- https://about.amundi.com/files/nuxeo/dl/5994803c-6af1-4d7e-89e0-f1134f6…

- Task Force on Climate-related Financial Disclosures (TCFD)

- https://www.climatepolicyinitiative.org/wp-content/uploads/2023/11/Glob…

- https://www.swissre.com/dam/jcr:bb189e59-a15f-49df-a250-07b2c6b2d9bd/20…

- https://www.swissre.com/institute/research/sigma-research/Economic-Insi…

- See more at: Coalition for Climate Resilient Investment (CCRI). Available at: https://climateaction.unfccc.int/Initiatives?id=Coalition_for_Climate_R…