Summary

Emerging markets in a fragmented world

While EM may struggle in a challenging global environment, there are nonetheless advancing structural factors that can benefit some peripheral countries.

In an environment of weak global demand, Emerging Markets (EM) are likely to soon enter a cyclical downturn phase. Despite China’s pronounced deceleration and a tighter policy mix across the board, EM as a whole has displayed remarkable resilience, with GDP growth for 2023 being repeatedly revised upward. This growth has been driven by large countries such as India, Mexico and Brazil. While a broader softening of growth is expected, it is unlikely to spiral into a general recessionary scenario and a mild recovery is anticipated by mid-2024. Next year, EM growth is expected to decelerate to 3.6% on average from around 4% this year. Importantly, the growth premium in favour of Emerging Markets over Developed Markets is projected to continue widening. Asia is set to register the strongest contribution to world GDP once again.

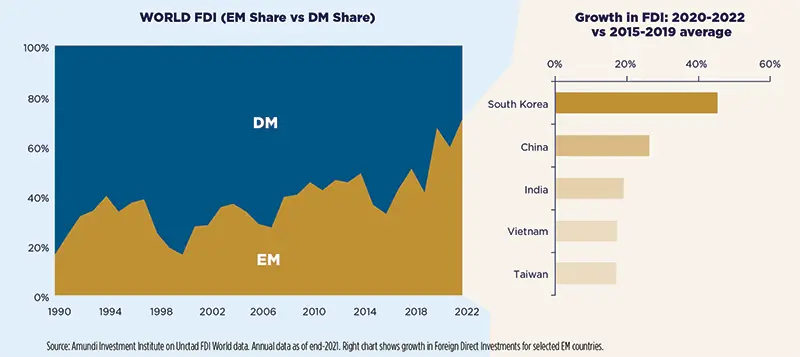

Beyond the cyclical downturn, there are structural factors at play that support EM. These factors include an incrementally higher global fragmentation, involving a great reallocation, near/friend-shoring, supply chain de-risking as well as the need for critical materials for the Net Zero Transition. Critical raw materials exporters sit mostly among EM (e.g. Chile, China).

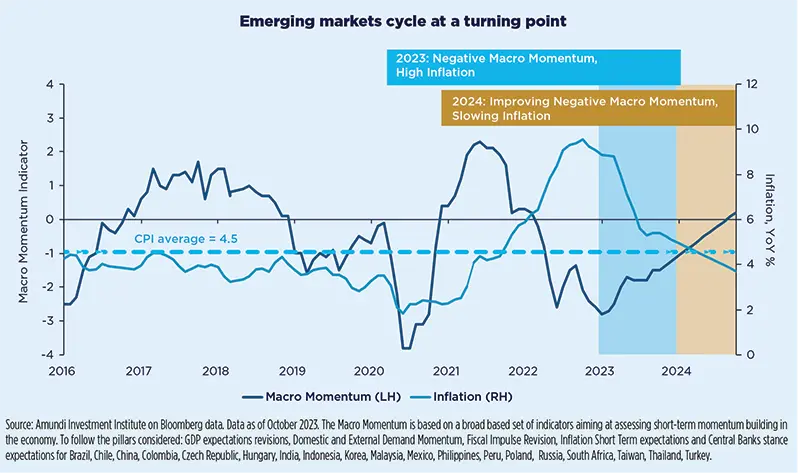

Although fragmentation is costly, the subdued growth backdrop is expected to limit pressure on Inflation. EM Inflation mostly reduced in 2023, with few exceptions where the disinflationary trend is expected to accelerate over the next few months. In 2024, Inflation is projected to land in the upper part of Central Banks’ target ranges or mildly exceed them. However, upside risks to inflation remain, such as supply-side disruptions. Additionally, the current economic downturn, coupled with a tight labour market and worker shortages, is causing core inflation to remain stickier. Hence, complacency on inflation dynamics should be avoided and a prudent policy mix should be continued. Risks of fiscal profligacy or inefficiency need to be monitored, particularly in relation to the electoral cycle. Recent pressure from global financial tightening has prompted unexpected rate hiking. Yet, a reversal of the trend is not expected, and EM Central Banks are likely to continue cutting policy rates in a gradual manner given the present circumstances.

China and India

China: a new growth trajectory

Slower growth with debt discipline

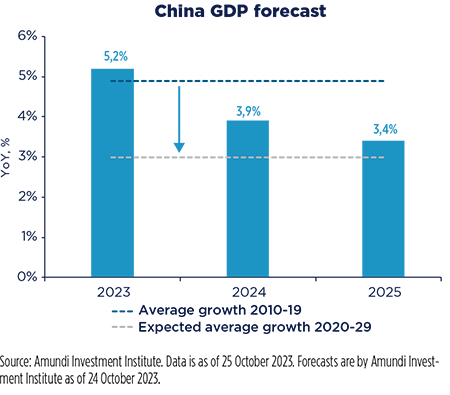

The economy is projected to end 2023 with a growth rate just over 5%. Throughout the year, market expectations for policy stimulus have been realigned in accordance with Beijing's long-term vision, which shifts away from a singular focus on growth and incorporates national security as well as income equality. This shift comes as China grapples with secular challenges including demographic ageing, diminishing capital returns, and geopolitical fragmentation.

In 2024-25, we believe that deleveraging will be a central growth determinant. Chinese assets have weathered the storm of real estate consolidation since 2021, with remaining developers grappling to stay afloat. The next step involves Local Government Financing Vehicles that are heavily reliant on financing through land sales. This effort to control contingent public debt will restrain local government easing. We anticipate fiscal policy to stay moderately expansionary, setting the headline deficit at 3.4% and approving a RMB4tn special local government bond quota in 2024. Mini monetary easing will persist, with a 20bp rate cut likely in H2 2024.

This easing, however, is not enough to offset the drag from real estate and the new local debt discipline. We expect China's economy to grow just below 4% in 2024.

India: an emerging power

Investments driving the economy

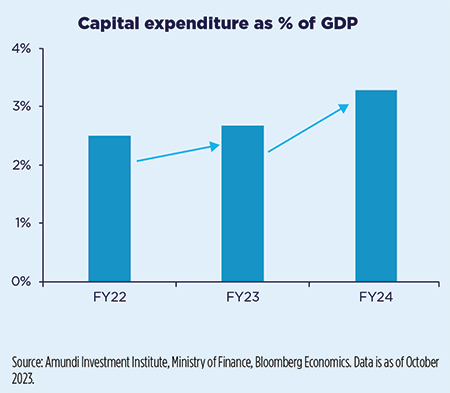

While mildly decelerating, with GDP expected to grow at 6.5% in calendar year (CY) 2023 and at 6.0% in CY2024, India’s economic prospects remain bright and will remain supported by mainly domestic demand over external demand. Signs of deceleration will be more visible on the consumption side than for investments. The government’s efforts to keep prices under control, particularly in an electoral year, will weigh on the rural sector of the economy via more compressed income. In 2024, external demand shouldn’t contribute significantly to GDP growth and that, together with our constructive outlook on oil prices, will prevent a material improvement for India’s current account. While maintaining an erratic path, inflation should stay within the Reserve Bank of India’s upper range and therefore the RBI won’t have meaningful room for its easing cycle, which is not expected to start earlier than H2 2024 and be aimed at neutral or only mildly positive real rates. In addition, the policy mix is expected to remain supportive on the fiscal side. The fiscal consolidation path is expected to advance at a very gradual pace – with the fiscal deficit at 4.5% of GDP by fiscal year (FY) 26 from 5.8% in FY24 – and the expenditure tilt should remain biased to capital expenditure in the context of an unchanged political landscape.

Emerging Market (EM) assets favoured due to tamer inflation and earnings recovery

Room for optimism for EM equity in 2024

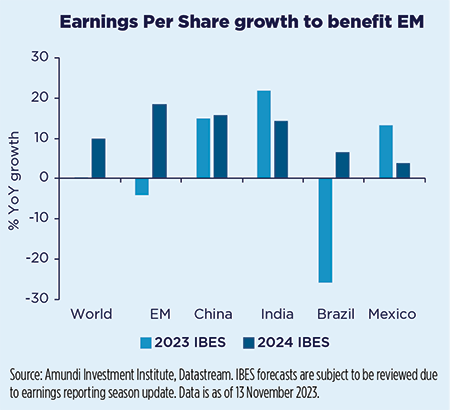

In 2023, EM equity experienced diverse dynamics with China underperforming, while MSCI EM ex China was flat and India equities outperformed. For 2024, we expect to see the appetite for this asset class return as both the capital expenditure cycle and growth premium should be more in favour of EM, but divergences will persist. In the short term, EM growth is expected to remain below the historical average and to decelerate mildly; this phase is still supportive for Quality and Growth styles (mainly EMEA and India). Moving further into 2024, a recovery in EM Growth would favour a shift to valuation styles (LatAm favoured). The tech sector slowdown was exacerbated by a slower global economy and less demand after Covid, and contributed to a series of negative reporting seasons during 2023 and to negative YoY trailing earnings. Yet, with the stabilisation and recovery of the export cycle, we expect GEM earnings to deliver double-digit growth in 2024.

EM bonds hard currency to be favoured

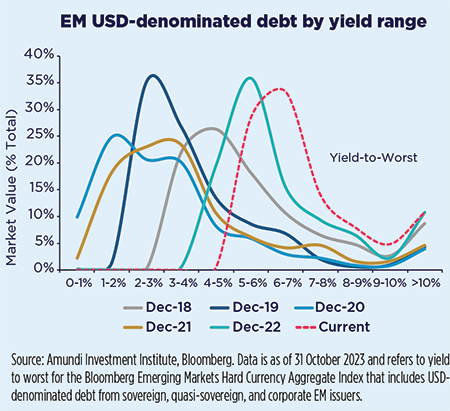

Geopolitical tensions and rising Treasury yields have recently raised concerns about the stability of EM currencies and the sustainability of external debt. On the latter, risks are lower than in the past thanks to pre-emptive hikes and the increased credibility of monetary authorities, while EM currencies are broadly undervalued in our view.

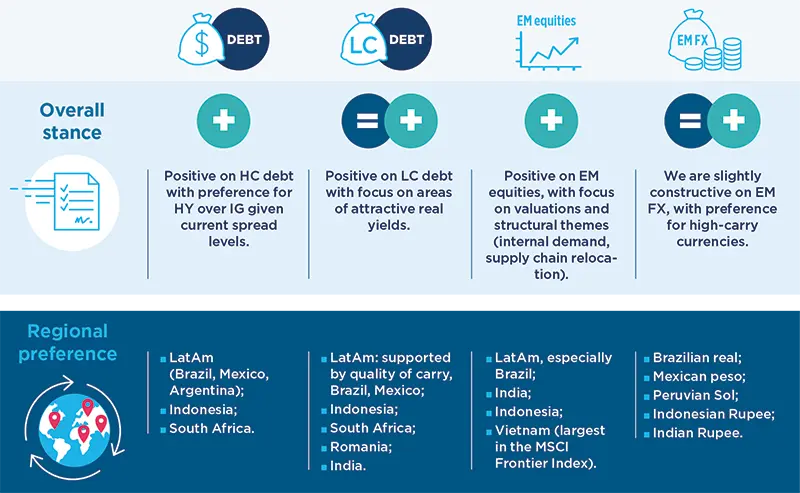

EM bond hard currency (HC) now offers a more attractive yield profile than in the last five years. The EM bond HC spread should be favoured mainly thanks to the high yield space tightening in the context of the improving EM-DM growth gap and less stretched financial conditions amid decreasing inflation, lower policy rates and yields. We are slightly positive on EM bonds in local currency, which we think are currently pricing in too much risk aversion. We favour EMEA and LatAm, which should benefit from a more rapid reduction in inflation and an advanced monetary policy cycle. We remain cautious on EM Asia, where there is less support from monetary policy and the yields are less attractive, with the exception of Indonesia and India.

Emerging markets Convictions

We expect emerging markets to enter a positive backdrop in 2024, as inflation is trending lower allowing for a continuation of the easing cycle by EM Central Banks initiated in 2023. At the same time macro-economic momentum, while remaining low, is improving. In the past, this combination has been supportive for EM assets, particularly equities. Yet, the EM world remains a highly fragmented universe and not all countries are set to benefit to the same degree from this turning point.

EM Convictions

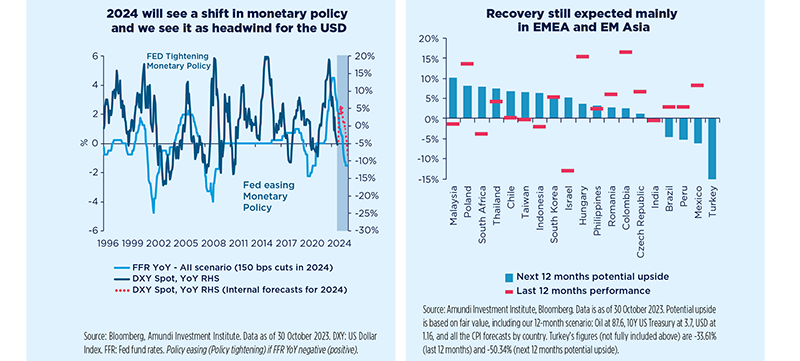

EM currencies to recover

Following several months of correction, EM currencies vs USD seem oversold and are now extremely cheap. In addition, our USD internal expectation for depreciation reinforces our constructive view for the asset class in 2024.

We expect EM Central Banks to continue cutting rates to support the domestic economy, also in line with the sizable price stabilisation. This will result in slightly higher real rates, with CEE countries still enjoying most of this. The region will benefit from its strong undervaluation as well as from its ties to the EUR, which is expected to strengthen during the year.

On the other hand, LatAm currencies have already enjoyed some recovery in 2023 and valuations are now more stretched.

Overall this translates into positive expectations mainly for EMEA and EM Asia currencies.

The main risks to this constructive outlook stem from geopolitical tensions resulting on one side in volatility spikes (detrimental for such a liquid asset class) and, on the other hand, in higher commodity prices (impairing the ability of EM Central Banks to ease as expected because of a stickier or higher inflation).