Summary

We are witnessing a rewiring of the global trade system that is negatively impacting sentiment towards US assets, while European and Indian assets may emerge as long-term winners.

Uncertainty on US trade policy and its potential impact on economic activity will keep market volatility high.

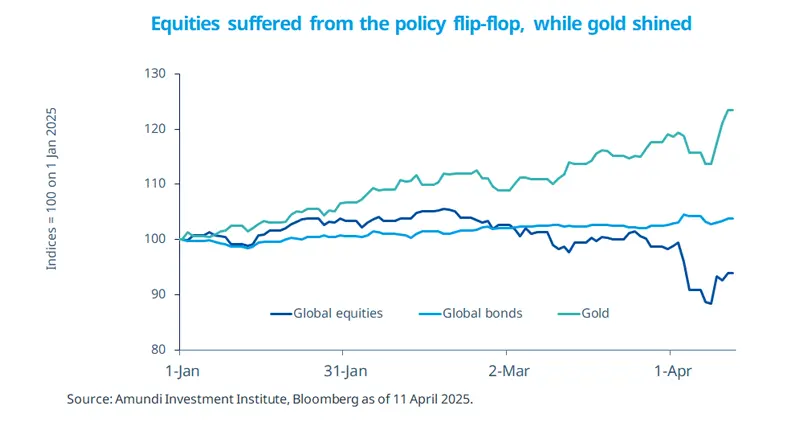

Geographical diversification* is key, while gold is also benefitting in this market environment.

Over the past week, markets have experienced extreme uncertainty caused by US policy gyrations on tariffs. This uncertainty has started to weigh on US assets, including the dollar and US Treasuries. Despite the 90-day pause announced on 9 April, the US average tariff rate remains at a 100-year high, with rising US tariffs on China triggering retaliation from the latter. We are moving towards a rewiring of the global trade system that will have long-lasting implications for financial markets. In the China-US competition, Europe could benefit. Tariffs will affect the global economy through lower growth and higher inflation, ultimately impacting corporate profits. Against this backdrop, we believe investors should remain cautious, diversify* across markets and geographies, and consider gold.

Actionable ideas

European bonds

European government bonds could benefit in an environment of weaker growth and offer diversification* to US assets.

Multi-asset approach

A diversified* conservative allocation to global markets can help investors to navigate this phase of uncertainty.

This week at a glance

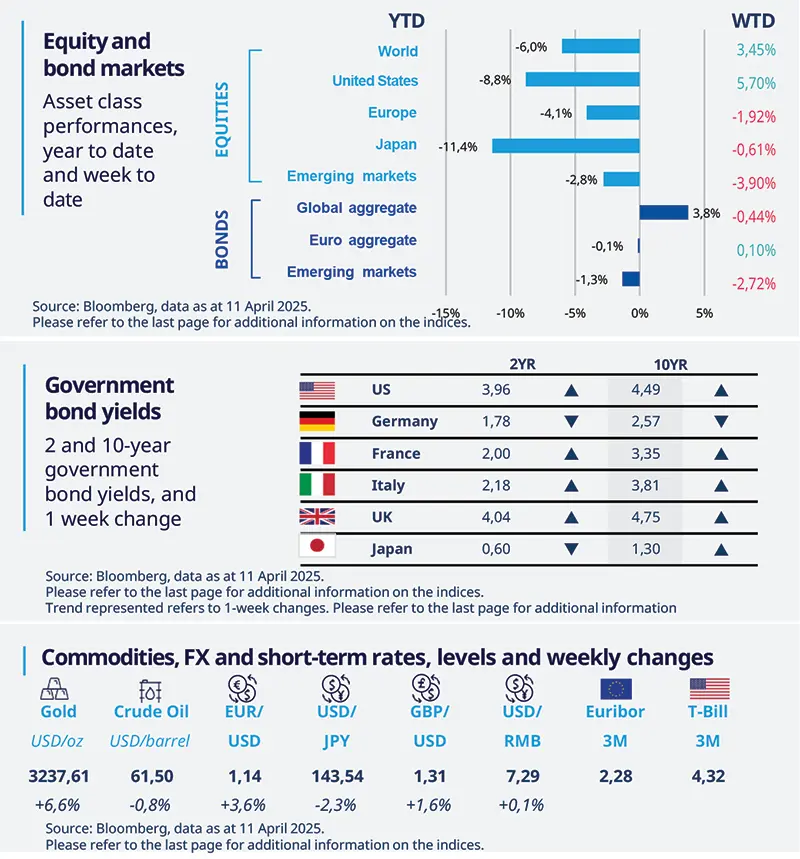

Equity markets were volatile, and were affected by gyrations on US trade policy. A relief rally last Friday led a surge in US equities but European markets declined. Bond yields were also mixed. The dollar fell against most major currencies, whereas gold hit an all-time high above $3,200/ounce on continuing uncertainty on international trade.

Amundi Investment Institute Macro Focus

Americas

US inflation slows more than expected in March

March CPI came in lower than expected, down to 2.4% YoY from 2.8% in February. Gasoline prices helped drive the index down, as well as shelter and used car and truck prices. On the other hand, inflation accelerated for natural gas and food. Core CPI (inflation ex food and energy) eased to 2.8% YoY, its lowest level since March 2021. This data supports the Fed’s patient stance in cutting rates, while more volatile numbers could come soon as US tariffs on Chinese imports kick in.

Europe

EZ retail sales weaker than expected

EZ retail sales were up 0.3% MoM in February following three months of stagnation. Sales of non-food products rebounded after a 0.2% drop in January. Food, drinks, and tobacco sales also rose, as well as fuel sales. Retail sales increased in Spain, Germany, and France, while they declined in Italy. On a YoY basis, sales accelerated to 2.3% from 1.8%.

Asia

Easing monetary policy across Asia

Two Asian CB - Reserve Bank of India and Central Bank of Philippines - cut their policy rates by 25 bp, as expected. While the dovish narrative was already there, in both cases the decisions and the statements reinforced the commitment to ease further, considering the looming strong negative external shock, as rising US tariffs on the region were announced (although currently paused for 90 days for most Asian countries).

Key dates

15 Apr Germany ZEW | 16 Apr China GDP, industrial | 17 Apr ECB policy rates decision, US housing starts and building |

*Diversification does not guarantee a profit or protect against losses.