Summary

Gold prices should remain supported by demand for safe-haven assets, amid a threat of trade war, tariffs and their economic fallout.

- President Trump’s announcements of tariffs on Liberation day has initiated a sort of a trade war. China has responded with its own tariffs on US goods.

- Tariffs on imports into the US are likely to hit the country’s growth and inflame inflationary pressures in the near term.

- The ensuing uncertainty around economic activity implies that the demand for the metal will stay supported, although it may not be linear.

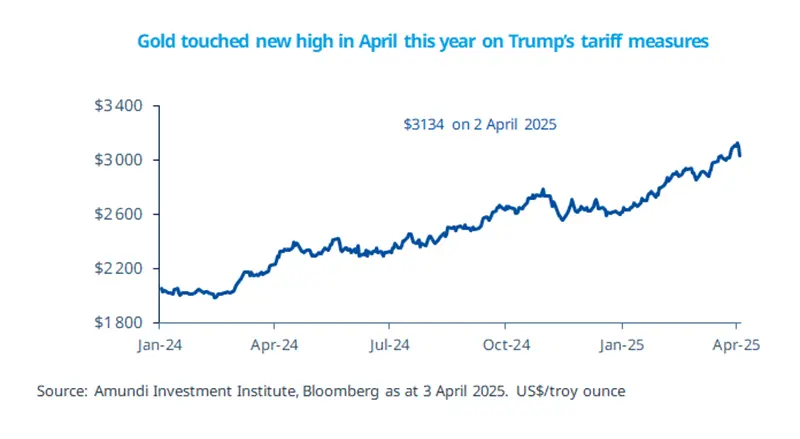

President Trump pushed the US tariffs rate to the highest in over a century and has triggered retaliation by China. In this uncertain backdrop, gold stands out as one of the few stable assets. Recently gold prices hit new highs at $3134/ounce on 2 April as Trump announced new tariffs on its major trading partners. He outlined a 10% baseline tariff on all imports, with higher rates on countries running trade surpluses (excess of exports over imports) with the US. These regions include the EU, China, and most Asian countries. Over the past few years, gold price moved up due to geopolitical tensions, high government debt, monetary policy actions and inflation concerns. While the price has moved below the peak reached in the month earlier, gold is still appealing amid ongoing uncertainty.

Actionable ideas

- Gold

Uncertainty around economic prospects and high geopolitical tensions support the case for safe-haven assets such as gold.

- Multi-asset investing

Risks to economic growth and inflation concerns in the near term call for a balanced and diversified approach that could include bonds, gold, and quality risky assets.*

This week at a glance

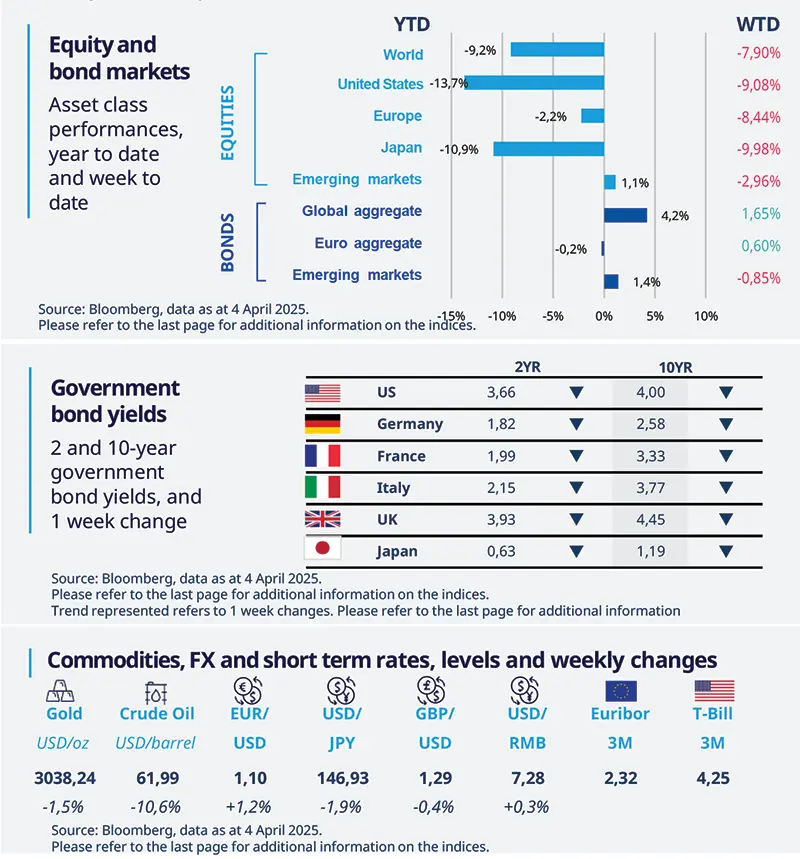

Equities suffered from the impact of President Trump’s tariffs announcements, causing a decline in all major indices. Amid concerns over the fallout of these tariffs on economic growth, bond yields fell. In commodities, oil prices fell following the OPEC+ decision to raise output, but the yen was up for the week.

Amundi Investment Institute Macro Focus

Americas

US ISM surveys show signs of weakness

The US economy is slowing sharply but with upward pressure on prices. The ISM Manufacturing purchasing managers’ index (PMI) fell to 49 in March, indicating a contraction. Most of the subcomponents such as new orders and production declined, while prices rose sharply. The non-manufacturing PMI also fell in March, indicating slower but resilient growth in the services sector

Europe

Eurozone (EZ) inflation slowed in March

In March 2025, annual inflation (CPI) in the eurozone slowed to 2.2%, down from 2.3% in February, This decline is primarily attributed to falling energy prices and a moderation in services inflation. Core inflation (CPI excluding food and energy) also eased to 2.4% in March. But these annual numbers hide some worrying monthly changes. Nonetheless, we expect, the ECB to cut rates later in the month.

Asia

Asia hit hard by steep US tariffs

The Trump administration announced reciprocal tariffs on Asian economies across the board (Japan, China, South Korea, Vietnam, Taiwan, India, Indonesia among others. The region was disproportionately hit with high tariff rates. We believe the small and open economies are the most exposed to these tariffs, given their relatively higher reliance on US demand. In response, China also imposed tariffs on US exports to the country.

Key dates

7 Apr EZ retail sales, EZ | 9 Apr FOMC minutes, Reserve Bank | 10 Apr US and China CPI, |