|

Climate pathways are integral to economic and market expectations, and investors must increasingly focus their attention on the impact of the energy and climate transitions, particularly in Emerging Markets (EM). Last year’s record-breaking temperatures were a stark reminder that the global economic landscape is undergoing profound shifts; 2023 was the hottest year on record, with average temperatures exceeding 1.5°C of warming above pre-industrial levels.

The urgency of climate action disproportionately affects lower-income and emerging countries, which typically bear the brunt of extreme weather events. For many of these countries, the road to net zero carbon emission targets is challenging and will result in material GDP losses and lower growth standards by 2050. Regional dynamics are varied and countries that are rich in the minerals critical for the transition will fare better, leveraging these resources to offset the strains of climate mitigation and adaptation. Chile, for instance, is rich in lithium and copper, while Indonesia is first for the extraction of nickel and second for cobalt.

We expect GDP growth will average 4.3% for these countries over the next decade, compared to 3.3% for other EM. By contrast, we anticipate annual real GDP growth of 1.6% in the US and 0.9% in the Eurozone over the same period. A sustainable mobilisation of capital beyond domestic resources will therefore be imperative to address the challenges and facilitate the transition to a carbon neutral global economy, including multilateral climate funds and private sector contributions.

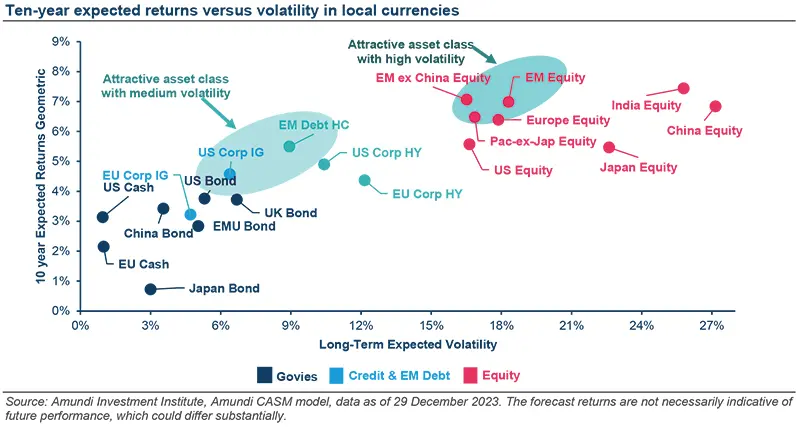

Emerging Markets represent a significant opportunity for investors as well as for the countries themselves. In fact, over the next decade, we expect a shift in investors’ relative preferences, driven by a reordering of expected returns across asset classes. Developed Market (DM) equities, which have outperformed in the recent past, should lose some of their appeal in large part due to tight current valuation levels, notably in the US. This means that the traditional portfolio growth engine will be less powerful, leading investors to look elsewhere for additional sources of return.

For investors who can bear the added volatility, Emerging Market equities can provide access to higher expected returns. India and Emerging Market equities ex-China are poised to offer returns in excess of 7% per annum, ranking them highest in the spectrum of asset class returns. Regarding China equities, we expect a 6.8% annual return, driven by a more cautious view of current fundamentals and macroeconomic assumptions reflecting the long-term inflation environment. While China still represents considerable uncertainty, even a partial recovery from today’s low valuation levels may provide a tailwind, particularly for the onshore market.

Compared to the past decade, we expect higher volatility across the board, requiring investors to enhance diversification. Emerging Market bonds in particular are on the rise. They offer a medium level of volatility within the liquid asset class category and deserve a greater role in strategic asset allocation.

In order to detect the opportunities across emerging markets, investors must develop a comprehensive understanding of the macroeconomic factors that distinguish countries, including their growth patterns, and monetary and fiscal policies. The evolution of the geopolitical scenario, and individual countries’ political and fundamental stability will also play a key role.

In general, investors must adapt their strategies to navigate the climate transition, leveraging the growth potential in countries such as India. Ultimately, a nuanced understanding of regional dynamics and asset allocation strategy will be essential for maximising returns amid an evolving climate and economic landscape.