Summary

Amundi’s research takeaways:

- Social inequality plays a critical part in determining an inclusive pathway towards decarbonisation.

- Intraregional social transfers can reduce the burden of climate damage on low-income vulnerable groups while interregional transfers fail to do so.

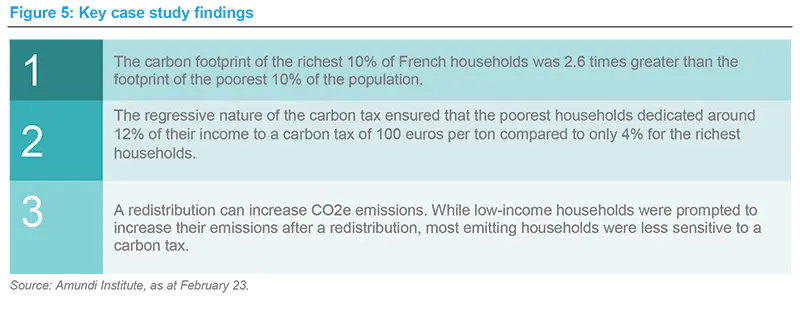

- A case study showed that the greenhouse gas (GHG) emissions of high-income households in France were 2.6 times higher than that of low-income households. Yet, the latter devoted 12% of their income to pay a tax of 100 euros per ton of CO2 emitted compared to only 4% for the richest households.

- Post a transfer of carbon tax revenues, the case study highlighted that low-income households were likely to increase their GHG emissions while the highest emitting households were less sensitive to price changes.

Summary of key messaging:

The research study stressed that considering social inequalities and properly accounting for the distribution of consumption and damage within regions in climate modelling is of paramount importance. Without doubt, there is a trade-off between social and environmental objectives. On the environmental side, a carbon tax stimulates a reduction in GHG emissions by dissuading households from consuming carbon-intensive products. On the social side, price increases can push vulnerable households into poverty. Furthermore, the redistribution of tax revenue aimed at reducing income inequality could drive up emissions, if it leads to an increase in demand for carbon intensive products.

However, the urgency surrounding climate change is forcing practitioners to prioritise the environmental benefits of the energy transition, while underestimating the induced social costs. Yet, the current level of income inequality within and between countries is still ominous. We believe that a future with growing inequality within or between regions could put the energy transient at risk because the public would not accept the kind of policies that are needed to address a fairer distribution of climate damage. Also, without the supply of green alternatives, any effort to reduce the vulnerability of the most affected by the transition could be a wasted effort. Overall, the trade-off between social and environmental aspects seems to be a key factor in the transition risk given that net zero targets imply a notably reduction in emissions and social inequality issues are not being sufficiently considered in climate policies to date.

This paper highlights Amundi’s research findings, including a case study focused on French households’ GHG emissions, and case studies from both the fixed income and equity investment teams.

Lower income groups suffer disproportionally from climate damages, so considering social inequalities in climate policy is of paramount importance and will lead to substantial changes in our journey towards decarbonisation.

Climate change is interwoven with social inequality

Climate change is expected to hurt the poorest regions the hardest. Their populations face challenges, such as floods, crop damage, water shortages, forest fires and extreme temperatures. However, these challenges are not just limited to physical damages, but also can potentially increase social inequalities within poor regions relative to other countries1.

The problem for policymakers is that reducing social inequality and protecting the environment are two distinct objectives that can both complement and contradict each other. For example, one climate policy approach used by countries to curb GHG emissions is carbon pricing. This places a fee on emitting emissions and/or offers an incentive for emitting less. These types of policies can create shifts in consumption and investment, making economic development compatible with climate protection. However, they may not always deliver the targeted results. For example, the aim of a carbon tax on GHG emissions, or fossil fuels’ carbon content, may be to reduce GHG emissions, but the redistribution of the tax receipts could push emissions back on track, sometimes referred as the backfire effect2.

Furthermore, the policies aimed at reducing GHG emissions can be regressive, hurting low-income groups and countries the most. For example, the introduction of a carbon tax can increase the prices of fossil fuel, electricity and food, all of which already constitute a high share of poorer people’s income. Finally, there are intergenerational aspects to consider in the sharing of the burden of climate change. If current generations are not willing to reduce GHG emissions, they could leave future generations with a depleted endowment of natural capital and some groups with a lower standard of living.

Accounting for social inequality in the pathway to decarbonsation

We reviewed the inclusion of social inequality in the economic modeling of climate change. In particular, we focused on the interactions between climate risks (i.e. physical and transition) and social inequality within and across regions. Using a leading Integrated Assessment Model (IAM), the Nested Inequalities Climate-Economy model (NICE) of Dennig et al. (2015)3, we incorporated income quintiles in each region. By doing so, we were able to consider the level of current inequalities within regions and their implications for an optimal climate policy.

To date, the interaction between climate impacts and social inequality has been largely studied by looking at inequality between regions, using a regional averaging of economic variables. This is an important shortcoming, as high levels of vulnerability can be masked in IAMs by using such data. By considering inequalities within regions, the model permits a more accurate estimate of an optimal climate policy.

Furthermore, different assumptions were made about the distributional effects of climate damage and mitigation costs. It is assumed that within regions, lower income groups will be disproportionately affected by climate damages, to reflect the view that the damage burden is not equally distributed between income groups. By including a climate justice dimension, the pathway to decarbonisation is substantially different from the pathways derived from the leading cost–benefit IAMs (to date). Many of these have assumed that regional average consumption levels will continue to grow.

Turning to the discount rate used in climate modelling, this is a pivotal factor for including social considerations. It determines the extent to which resources should be allocated to the current generation's interests now in preference to the interests of future generations. It can be considered as a “welfare cursor” that moves across time to give more or less weight to one specific generation. The higher the “social” discount rate used, the less would be spent on protecting the interests of future generations. Governments use the discount rate in creating climate policy, as it is a key variable in determining the social cost of carbon (SCC) (i.e., the cost of emitting one extra ton of carbon in terms of current consumption). Given that climate risks are a greater burden for vulnerable groups or regions, the current SCC should be high to limit emissions and temperatures in the future.

In the research, the issue of social inequality was addressed on three different levels (i.e., intraregional, interregional and intergenerational) (see Box 1).

Box 1: Three dimensions of social inequality

- Intergenerational: Delaying climate action will transfer the damage burden onto future generations.

- Interregional: Developed countries can mitigate GHG emissions whereas developing countries can only adapt. There is a negative relationship between economic development and exposure to climate change.

- Intraregional: Since vulnerable households suffer more than others from mitigation costs and damages, the interaction between climate risks and economic inequality needs to be tested within regions.

What type of social transfers reduce the burden of damages?

Using the NICE model, we examined which social transfers can mitigate the inequality issue between and within regions in order to reach a conventional pathway to decarbonisation without inequality considerations. The U.S. and OECD (EU) were used to portray the effect of transfers in high-income regions, while China and Africa were considered to represent regions with higher exposures to climate damage and lower average income levels. Two types of transfers were simulated:

- Intraregional transfers: The tax rate was the same in all regions and the social transfers occurred between the high and low quintiles income groups.

- Interregional transfers: The richest four regions transferred resources to the eight poorest regions by distributing in equal quantity a share of the tax receipts collected.

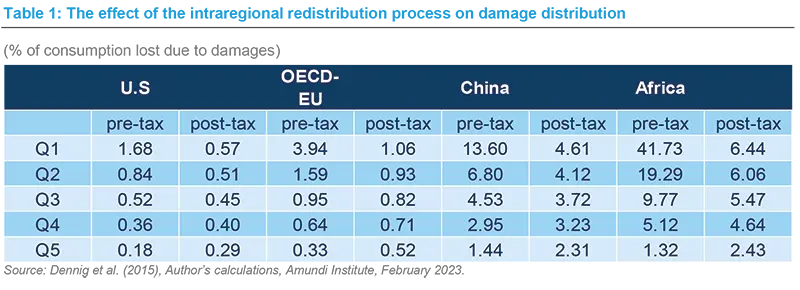

In the case of the intraregional transfers, we illustrated the impact of the redistribution process in Table 1. The impact was expressed as the percentage of consumption lost by each quintile due to climate damage, given a tax rate of 65%. The tax revenue was distributed equally as a lump sum and the same amount of damages was assumed in both the pre- and post-tax scenarios.

The results showed that before any redistribution, the first quintile in the U.S. lost 1.68% of consumption due to damages. However, post a redistribution, the damages represented a loss of 0.57% of consumption for the group. In relative terms, the effect of the redistribution was greater for the higher exposed regions, suggesting that intraregional redistributions could significantly reduce the vulnerability of low-income groups.

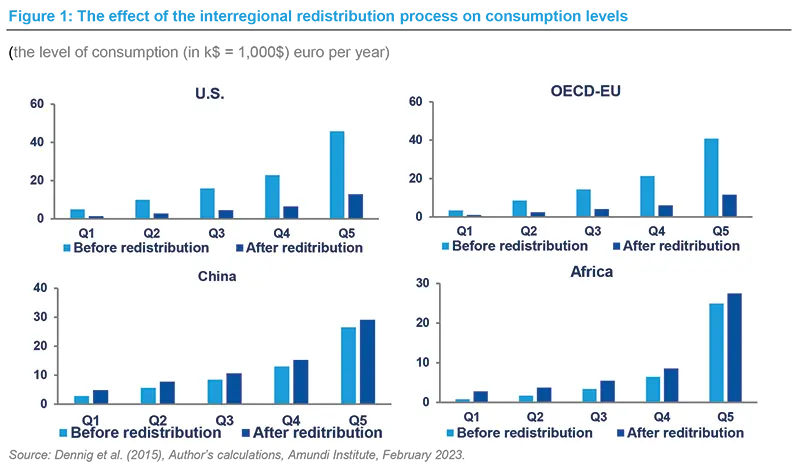

Turning to the interregional social transfer, we used a tax rate of 75% and, again, assumed the same amount of damages in the pre- and post-tax scenarios. In Figure 1, the light blue bars show the consumption level of each quintile before the redistribution, while the dark blue bars depict the consumption levels after the redistribution. Within the donor countries, the tax reduced the impact of damages on consumption in all income quintiles, but such a tax would be too costly for households to be acceptable. Social issues could be triggered within those regions, as all quintiles (except Q5) fell below the national poverty threshold. The level of inequality remained alarming in the lowest income regions, despite the overall reduction in global inequality.

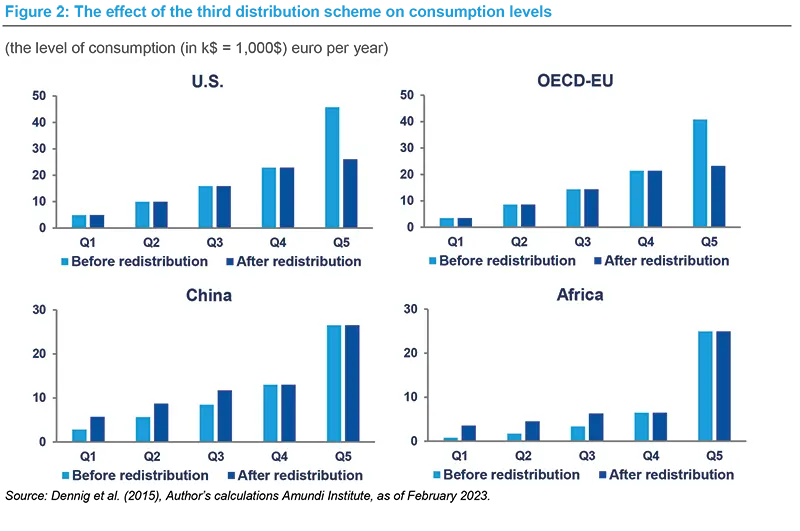

To overcome the drawbacks of the interregional redistribution process, we researched another variant of the scheme. The tax (75%) was limited to the high-income quintiles in the donor regions and the tax receipts were distributed between the low-income quintiles in the receiver regions. In doing so, the regressive effect of the policy on low-income quintiles in the donor regions was controlled in order to keep their consumption levels unchanged. In the receiver regions, the transfers were targeted at the lowest income quintiles, keeping the consumption levels of the fourth and fifth quintiles unchanged. The social transfers were thus targeting the people in need.

The results (Figure 2) showed that the consumption levels of the highest income quintiles in the donor regions were still above those of other income groups after the redistribution. This tax on these groups reduced the level of inequality within the high-income regions and would be expected to prevent social issues that would have been triggered by the regressive tax burden effect on low-income groups. As regards China and Africa, the redistribution benefits were shared between the low-income quintiles, reducing inequality. In this redistribution process, inequality improved across all dimensions.

Overall, the results highlighted the critical need to consider social inequality in determining an inclusive pathway towards decarbonisation. In particular, social transfers should play a key role in climate change policies, as they can lead to a reduction in the size and number of vulnerable groups. However, as suggested by the different variants, the redistribution process must be optimal to produce the expected benefits. If not, transfers can just result in a trade-off between income groups. Redistribution processes cannot resolve the problem on their own but need to be accompanied by a strong climate policy. In fact, an optimal carbon tax should be preceded by social transfers to make carbon policies acceptable.

Box 1: Summary of results derived from the team’s model

- Intraregional social transfers can significantly reduce low-income groups’ vulnerability.

- Interregional transfers cannot solve the issue of climate change by their own, and must be accompanied by strong climate policy to be effective.

- IAMs that ignore social inequalities are incompatible with an inclusive pathway toward decarbonisation.

Social inequality in the context of a carbon tax: a case study on French households

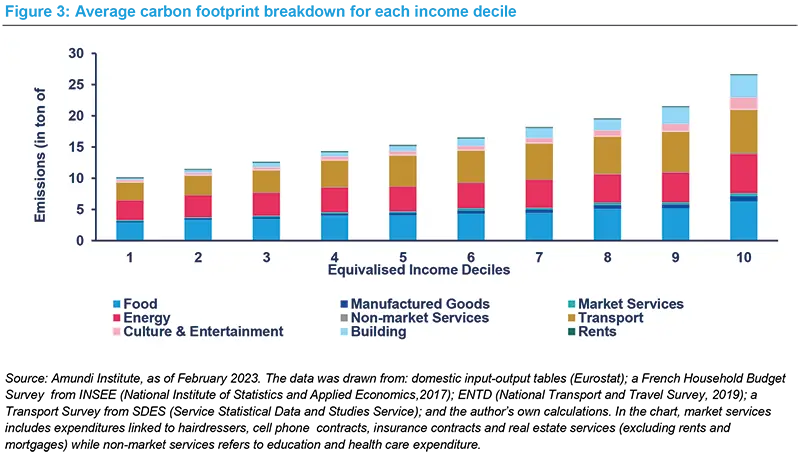

To examine the social risks associated with climate change, we analysed the implications of introducing a carbon tax on French households. Using a bottom-up approach that linked a national domestic input-output model and survey data, we derived the distribution of direct and indirect emissions (caused by consumption) between and within income groups. On analysing this data, the relationship between households’ carbon footprint and their incomes and expenditures became evident (see Figure 3). As living standards rose, households’ GHG emissions increased, with the richest households emitting 2.6 times more than the poorest.

After analysing the carbon footprint distribution, we introduced a carbon tax of 100 euros per ton of CO2e (equivalent) emitted and modelled households’ behavioural responses4. Unsurprisingly, in the absence of any compensation scheme, the research determined that a carbon tax can be regressive, discriminating against the poorest households. Specifically, these dedicated around 12% of their equivalised income5 to the tax compared to only 4% for the richest households.

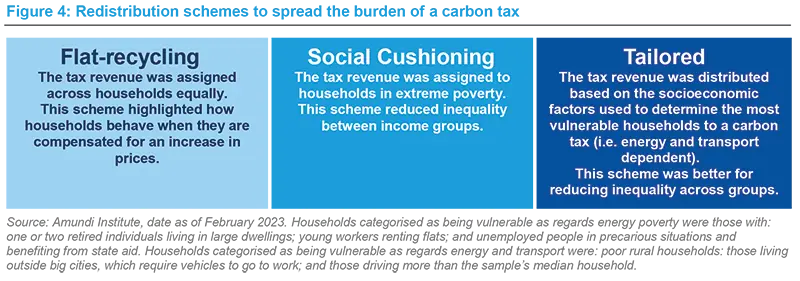

Then we examined whether redistribution schemes can make a carbon tax policy more progressive. Three schemes were considered, each consisting of one lump sum transfer to compensate for the carbon tax (Figure 4).

These schemes targeted either the reduction of vertical inequality, which relates carbon emissions with income, or horizontal inequality, which reflects the differences in emissions between households within the same income group. These differences can have a significant effect on carbon emissions and may arise from different choices. For instance, the carbon footprint can change notably by choosing trains rather than planes, or by consuming locally produced food rather than imported food. In addition, differences in tenancy status (owner-occupiers versus tenants), household size, and household status (retired or worker), can also play a key role in horizontal inequalities.

The research results showed that redistribution schemes made the carbon tax more proportional, but not completely progressive. While each process helped to reduce the initial tax burden, the social cushioning scheme drastically reduced inequality between different income groups (vertical inequality), while the tailored scheme was better for reducing inequality within groups (horizontal inequality).

Unlike many other studies, the potential backfire effect on emissions following lump-sum transfers was also examined. The results suggested that low-income households may increase their emissions (backfire effect), while the highest emitting households were less sensitive to price increases and were unlikely to dampen their consumption. Nevertheless, the tailored scheme was shown to limit the backfire effect and reduce social inequality across households. This enhances the rationale to include horizontal inequality in determining climate policies.

An investment perspective on climate change and social inequality

Views from the Emerging Markets Fixed Income team

Case study: South Africa climate and social challenges

- In our view, the main ESG risks in South Africa are linked to the country’s huge reliance on coal-fired generation and high levels of income inequality. The grid is unreliable and large electricity blackouts take place which have been getting worse over time. These problems reduce the potential to ease poverty and dampen the outlook for sustainable economic growth.

- In order to encourage a transient towards renewable energy, the government has barred the major state-owned power generation company from investing in new coal-fired capacity and has provided large tax breaks to encourage businesses and households to install renewable capacity. From a social perspective, a more secure power supply is essential to provide access to services and improve the quality of life among low-income groups.

Case study: An African sustainability-linked bond focused on ensuring access to clean water and sanitation

- The largest water utility in Africa has a key role in helping the South African government achieve the United Nations sustainable development goal (SDG) 6 which calls for access to clean water and sanitation for all. The latter is a challenge given South Africa’s population growth and increasing urbanisation.

- The utility’s sustainability-linked bond has a number of performance targets. For example, one target is to increase the number of people with access to safe and clean water by 8.75% by 2025. Other targets are linked to the SDGs 5 and 7 (gender equality and clean energy). In particular, these include a focus on installing both solar and hydroelectric power capacity, and empowering women.

Investment Focus: Robust standards for sustainable business practices are vital to promote climate-friendly investments.

- A large African corporate, business and retail bank has developed a green finance framework which identifies projects and assets that are supportive of its mission to set robust standards for sustainable business practices.

- The Bank has aligned its strategy with the SDGs, the Nigerian Sustainable Banking Principles (NSBPs) and the Paris Climate Agreement. It became the first commercial African bank to attain the sustainability certification under the Sustainability Standards and Certification Initiative of the European Organisation for Sustainable Development.

Looking forward: SDGs are gaining traction in the emerging markets

- A number of sovereigns and corporates have issued labelled ESG bonds to help fund a sustainable energy transition and address social inequalities. Some examples include: a Latin American Telecoms company issuing a social bond to improve connectivity in impoverished areas in Chile; and a large Nigerian bank recently issuing a Green Private Placement Bond. Looking forward, we expect social sustainable green finance to gain traction which hopefully will help in reducing inequalities.

Views from the European Equity team

A case study: A global reinsurer viewed as an ESG winner thanks to both climate and social focus

- Being a substantial underwriter of assets vulnerable to climate change, this reinsurance company has extensive knowledge and skills in analysing climate damage. Furthermore, the company adopts robust business ethics practices which compare favourably to its global market peers.

- The company supports initiatives that promote social cohesion. For example, it is a partner of Save the Children and Team Rubicon, international groups that help communities after natural disasters. Also, improving access to healthcare through various initiatives worldwide is a key focus of the group.

- As regards its climate change initiatives, the business sponsors start-ups focused on carbon removal solutions and mangrove afforestation programmes. A good example of the former is the company’s support for the EU public-private climate initiative, EIT Climate-KIC (Knowledge & Innovation Community), and the new Carbon Removal ClimAccelerator, a program dedicated to assisting European teams working on carbon removal. Furthermore, we note the company’s involvement in other projects such as the reforestation of mangroves in the Mekong Delta (Vietnam) and the strengthening of forest ecosystems in Cuba, Mexico, Guatemala and the Dominican Republic.

- Finally, the company contributes to industry knowledge by conducting research into climate risk, both through setting up internal working groups and gathering together panels of external experts.

Sources:

- Stakeholders in the Just Transition - N°3 Territories and local communities Amundi Institute.

- Ravigné, E., & Nadaud, F. (2023), “Can a carbon tax increase emissions? The backfire effect of carbon tax recycling”, https://www.centre-cired.fr/en/wp-2023-89-can-a-carbon-tax-increase-emissions-the-backfire-effect-of-carbon-tax-recycling-2.

- Dennig, F., Budolfson, M.B., Fleurbaey, M., Siebert, A., and Socolow, R.H. (2015),”Inequality, Climate Impacts on the Future Poor, and Carbon Prices”, Proceedings of the National Academy of Sciences, 112(52), pp. 15827-15832. Integrated Assessment models simultaneous use more than one model to: simulate and quantify the relationship over time of the social and economic factors that drive the emission of greenhouse gases; the biochemical cycles and atmospheric chemistry; and the resultant effect of greenhouse gas emissions on climate and human welfare.

- We modelled households’ behavioral responses to price increases by constructing Engel curves with the QAIDS model (Banks et al., 1997). Banks, J., Blundell, R., and Lewbel, A. (1997), ”Quadratic Engel Curves and Consumer Demand”, Review of Economics and Statistics, 79(4), pp. 527-539.

- Equivalised income is a measure of household income that takes account of the differences in a household’s size and compositions.

Read more on this subject