Summary

Key takeaways

A critical challenge: climate change represents a major challenge for insurers, driven by the increasing frequency of natural disasters and the need to manage risks associated with the transition to a low-carbon economy

Regulatory initiatives:

Solvency 2 revision: climate risks are gradually being integrated into the Solvency 2 prudential framework for insurers

Climate stress tests: These are proving useful in assessing insurers’ resilience to both physical and transition risks.

Implications for European insurers:

the latest EIOPA recommendations are expected to have limited impact on the solvency of European insurers

however, stress tests reveal significant vulnerabilities, including investment portfolio devaluation, rising climate-related claims, and declining solvency ratios.

Strategic levers for insurers: engaging with companies and reallocating asset portfolios using innovative indicators and tools.

Introduction

Climate change has become a key issue for the financial sector, particularly for insurers. The increasing frequency and intensity of natural disasters, combined with the challenges of transitioning to a low-carbon economy, are reshaping the risks insurers face.

In response, regulators are progressively strengthening the integration of climate risks into the prudential framework, particularly through the revision of the Solvency 2 directive, which governs insurance activities across the European Union.

At the same time, several recent climate stress tests conducted by European supervisory authorities provide concrete insights into the sector’s resilience to both physical and transition risks.

In this article, we explore the ongoing updates of Solvency 2, their potential impact on insurers, key finding from climate stress tests, and the strategic actions insurers can take to adapt to these changes.

1. Regulation that progressively includes climate risks

In Europe, the prudential framework for insurance activities is based on the Solvency 2 directive, in effect since 2016.

This regulation aims to ensure that insurers hold capital to meet their commitments in the event of crisis while reinforcing the stability of the sector. It is stru tured around 3 key pillars:

Pillar 1: assessment of assets and liabilities, along with capital requirements to ensure insurers’ solvency

Pillar 2: : Governance and risk management requirements, including the Own Risk and Solvency Assessment (ORSA)

Pillar 3: transparency and reporting to enable regulators and investors to assess the financial strength of insurance companies

Initially focused on traditional financial criteria, this framework is gradually evolving to incorporate climate and sustainability risks.

The Amendment to Solvency 2 Directive strengthens climate risk management and sustainability obligations

Amendment of Solvency 2 Pillar 1: EIOPA’s recommendations for incorporating climate risks into capital requirements

As part of the Solvency 2 revision, the European Insurance and Occupational Pensions Authority (EIOPA) was mandated by the European Commission to propose amendments to Pillar 1, aiming for more precise integration of climate risks into insurers’ capital requirements.

This includes assessing the potential for specific prudential treatment of assets exposed to climate risks, particularly those linked to fossil fuel industries or to activities deemed by the European Platform on Sustainable Finance as having no potential for transition or as ‘always significantly harmful’ under any climate scenario.

Following multiple public and institutional consultations, as well as retrospective, prospective and stress test analyses on climate transition risks – conducted between 2018 and 2022 by various supervisory authorities (ACPR in 2020, DBN in 2018, ESBR in 2022 and IAIS in 2021) – EIOPA published its final report at the end of 2024.

In this report, as illustrated in the table below, EIOPA recommended new adjustments to the calculation of capital requirements to better integrate transition risks identified in its analyses.

The implementation of these recommendations falls under the responsibility of the European Commission, which will decide whether to apply them.

Figure 1: Prudential adjustments to capital requirements for climate-exposed investments

A limited impact but a need to adapt

The impact of these new capital requirements on insurers’ solvency is expected to remain moderate for European insurers, for several reasons:

Many European insurers have already started divesting from fossil fuel-related assets

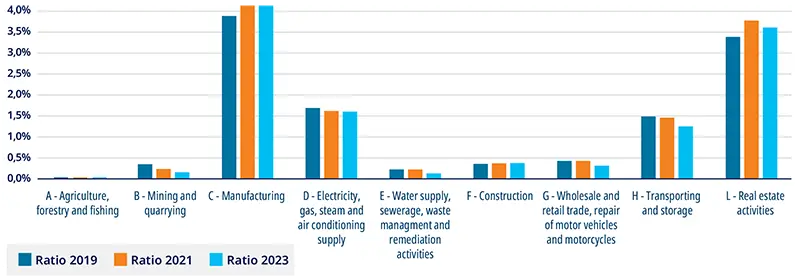

The additional capital requirements apply to a limited share of assets: exposure to assets linked to fossil fuel extraction is generally low relative to total portfolio. For instance, an analysis of EIOPA statistics (Figure 2) on the composition of assets held by EEA insurers shows that:

Direct investment in extraction activities outside the financial sector (B - NACE code) account for less than 0.2% of portfolios

This share has halved between the end of 2019 and the end of 2023.

Figure 2: Breakdown of assets held by EEA insurers outside the financial sector and public administrations, by NACE code as a % of total investment by EEA insurers

Sources: EIOPA - excluding unit-linked investments - Amundi calculations

Furthermore, we believe that EIOPA’s recommendations present several structural shortcomings:

underestimation of indirect climate risks: EIOPA’s assessment focuses solely the fossil fuel sector, without accounting to broader indirect repercussions on other industries.

lack of incentives for climate transition financing: unlike other international regulators, EIOPA does not propose any measures encouraging insurers to shift investments toward “green” assets.

a rigid sectoral approach misaligned with corporate realities: the reliance on NACE codes to classify high-risk sectors fails to account for individual corporate pathways. It does not distinguish between companies with ambitious and credible transition plans and those without, thus failing to encourage financing for the transition of high-emitting companies committed to Net Zero.

failure to consider social risks and preventive measures due to insufficient data availability.

Amendment of Solvency 2 Pillar 2: Strengthening climate risk governance and management, amendments adopted for transposition by January 2027

The Solvency 2 Directive has been amended to explicitly integrate climate and sustainability risks into Pillar 2, embedding them directly into insurers’ risk management frameworks.

Adopted by the European Parliament in 2024, this amendment must be transposed into national legislation by January 2027.

The key objectives are to:

Account for the impacts of climate change and energy transition policies

Align risk management strategies with the EU’s carbon neutrality targets for 2050

Ensure consistency between risk management policies and the Sustainability reports to enhance transparency.

New obligations for insurers:

Assessment of exposure to climate risks at least once every 3 years

Mandatory integration of two climate scenarios into the ORSA:

- a scenario where global temperature rise remains below 2°C

- a scenario where global temperature rise significantly exceeds 2°CImpact analysis across 3-time horizons:

- Short-term: identifying of immediate risks

- Medium term: managing gradual sectoral transitions and adaptation

- Long-term: Assessing structural market transformationsDefinition and justification of materiality thresholds, with no predefined reference imposed by the directive.

2. Key insights from recent climate stress tests: identifying vulnerabilities

The Solvency 2 revision marks progress in integrating climate risks into insurers’ frameworks, with evolving capital requirements and a phased implementation approach. However, this regulatory development alone is not sufficient to fully gauge the magnitude of the challenges ahead.

Recent climate stress tests, such as those conducted across Europe by supervisory authorities and in France by ACPR in France, provide a broader and more forward-looking perspective on insurers’ exposure to climate risks.

They reveal three major vulnerabilities:

Loss of investment portfolio value

Increased in the frequency and cost of climate-related claims

Decline in solvency levels

Recent climate stress tests, such as those carried out in Europe by the European supervisory authorities and in France by the ACPR, provide a broader, forward-looking view of insurers’ exposure to climate risks.

The “Fit for 55” stress test (published in November 2024)

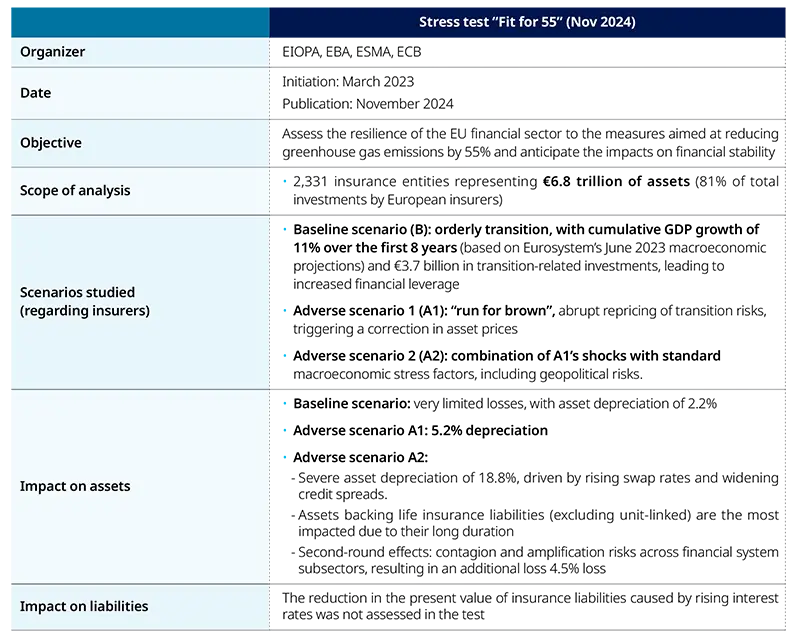

In March 2023, the European Commission requested European supervisory authorities (EBA, EIOPA, ESMA), and the ECB assess the resilience of the European financial sector to the transition risks induced by the “fit for 55” legislative package. This package aims to reduce the European Union’s greenhouse gas emissions by 55% between 1990 and 2030. The scope of analysis was extensive, covering banks, insurers, pension institutions, and investment funds.

As shown in the table below (Figure 3), the results of this “Fit for 55” stress test highlight that while losses remain manageable in an orderly transition scenario, they could escalate significantly under heightened macroeconomic pressures.

Figure 3: characteristics of the “Fit for 55” stress test

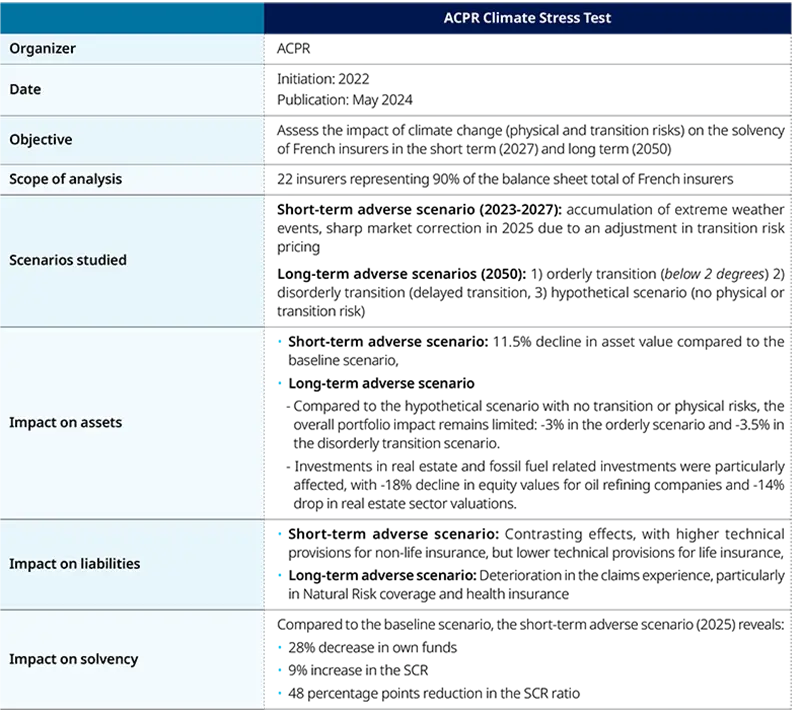

ACPR’s new climate stress test (results published in May 2024)

Separately, ACPR launched a climate stress test in 2022, covering 22 entities and representing 90% of the total balance sheet total of French insurers.

This exercise aimed to assess short-term solvency risks under a climate stress scenario and evaluate long-term impacts (by 2050) across multiple transition scenarios.

Figure 4: features of the ACPR climate stress test

3. Two strategic actions for a proactive approach to climate risks

Asset portfolio reallocation: supporting the transition without undermining economic stability

The climate transition requires a reallocation of asset portfolios, but this shift involves a delicate trade-off:

- Reducing exposure to climate risks to protect investment portfolios

- Investing in climate solutions, which often lie within high-emission sectors

Rather than simply minimizing climate risk, we believe it is crucial to enhance our understanding of it and manage it proactively.

Rather than minimising climate risk, we believe it is essential to improve our understanding of it and manage it proactively.

Implement a dynamic climate risk assessment by integrating advanced indicators

Traditional indicators, such as Scope 1 and 2 emissions, provide a starting point but remain insufficient for a comprehensive climate risk assessment. We advocate for a more refined and forward-looking approach, based on two complementary dimensions:

Alignment dimension: Identifies companies actively transitioning their business models to progressively align with a net-zero trajectory.

Contribution dimension: Focuses on investments that accelerate the deployment of solutions directly advancing the global economy toward net-zero by 2050

These dimensions offer both a temporal (alignment) and spatial (contribution) perspective. They are complementary because they provide insights not only into a company’s carbon trajectory and climate ambition (alignment indicators) but also into its direct climate action (contribution indicators).

Contribution indicators, such as taxonomy alignment or green bonds, help identify issuers developing solutions that support net-zero objectives. Alignment indicators complement by assessing the quality of a company’s transition plans.

Additionally, climate stress tests further enhance climate risk analysis by evaluating the vulnerability of financial institutions to climate change impacts. These tests help identify climate risks as systemic risks, enabling better risk management and informed decision-making.

However, the lack of standardized, high-quality data hinders the integration of climate risks into corporate strategies, potentially leading to an underestimation of climate-related risks.

We are convinced that innovation is key to refining climate risk assessment and encouraging smarter capital reallocation.

Develop innovative tools to support the transition

We firmly believe that innovation is key to refining climate risk assessment and driving a more intelligent reallocation of capital.

To illustrate, we have developed several decision-making tools aimed at improving our understanding of climate risk at both the issuer and portfolio level.

For instance, we have designed a transition score, which will be applied to all of our actively managed portfolios by the end of the year. Its objective is to assess the alignment and progress made by companies towards net zero targets.

In addition, we have developed a climate stress test tool based on the scenarios of the MIT EPPA model1 to assess a broad sample of companies. This tool enables the systematic application of climate stress testing across equity and bond portfolios.

Unlike the broad-based regulatory analyses, this model:

Aligns with the NGFS transition pathways

Integrates asset valuation at both the companies’ and investment portfolio levels.

By leveraging this tool, we have refined our assessment of transition impacts by directly linking macroeconomic variables to corporate financial statements. This allows us to estimate the valuation effects on corporate equities and bonds.

Three key strengths of our approach:

1. Dynamic asset valuation aligned with macroeconomic scenarios:

- the model incorporates financial shocks anticipated in regularly updated transition scenarios.

- it quantifies their impact on financial ratios and portfolio profitability.

2. Enhanced granularity:

- the model precisely identifies a portfolio’s exposure to transition risk based on the activities and revenues of the companies within it.

- it considers the diversity of business activities within companies, recognizing that exposure varies even within the same sector, which is crucial for accurate risk measurement.

3. Cross Asset perspective:

- the tool aims to provide institutional investors with a forward-looking view of the opportunities and risks associated with different asset allocation strategies across both equities and bonds.

Engagement: a key lever to accelerate corporate transition

Active engagement is a critical tool for accelerating the climate transition of financed companies and, consequently, reducing exposure to climate risks.

Among the four pillars of the NZAOA2, engagement stands out as the only mandatory pillars. This reflects its central role as a driver of real economy change.

For an engagement strategy to be effective, it must be supported by adequate resources, strong governance, and a clear roadmap that outlines expectations and key action levers.

Mobilizing internal resources to structure effective engagement

Establishing an engagement strategy focused on priority themes, and setting quantifiable targets based on specific indicators are essential steps. However, these efforts require dedicated resources which not all insurers possess.

This is why analyzing investors‘ engagement and voting practices is crucial.

Since the publication of the latest Target Setting Protocol in 2024, members of the NZAOA, who delegate asset management are now required to question their asset managers about their engagement and voting strategies.

For example, we rely on a team of 40-person team dedicated to ESG research, engagement and voting. Thanks to this commitment, we had engaged with over 2,800 companies had been engaged by the end of 2024. Climate-related issues remain a core component of our engagement strategy and are among the 10 key objectives of our ESG Ambition 2025 plan, with a goal of engaging an additional 1,000 issuers on climate challenges.

Targeting high-emitting sectors that are essential to the transition

According to the Energy Transition Commission, achieving net-zero by 2050 will require $3,5 trillion in annual investments. Today, only $1 trillion is invested per year, with 70% of this amount needed for low-carbon electricity production, transmission, and distribution.

The primary challenge is the decarbonization of business models, starting with high-impact sectors.

For example, we have developed an internal engagement framework to support the transition to a low-carbon economy. This framework covers multiple sub-themes, with sector-specific criteria and tailored expectations for the most carbon-intensive industries, such as oil and gas, utilities, automotive and transport, real estate and construction, as well as steel, cement and chemicals.

Developing a thematic engagement framework to enhance transparency and ambition

Our internal engagement framework is designed with two primary objectives: promote transparency in corporate climate commitments and increase the level of ambition among issuers.

This approach enables us to deepens our understanding of climate risks while encouraging companies to decarbonize their business models and reduce exposure to climate-related risks.

This internal commitment framework has two objectives: to promote transparency and to raise the level of ambition of issuers.

While the climate transition requires significant investments, the cost of inaction will be far higher. A disorderly transition would result in substantial economic costs, driven by the increasing frequency and severity of physical risks.

For instance, using NGFS climate scenarios3, the Banque de France estimates that the most economically damaging climate events for France would be droughts (-3.2% of GDP), heat waves (-2.1% of GDP), and floods (-0.3% of GDP).4

Given these challenges, our climate engagement campaign is focused on raising awareness among issuers about the consequences of physical climate risks, which could lead to asset devaluation or rising insurance premiums.

Additionally, other sub-themes, such as Scope 3 emissions and methane reduction, complement our engagement strategy.

Escalation mechanisms and long-term monitoring of commitments

An engagement process typically lasts between 3 to 5 years. It is therefore essential to clearly define escalation mechanisms, which can range from voting against the re-election of board members to downgrading the issuer ESG rating and ultimately excluding the issuer from investment portfolios if progress remains insufficient.

Additionally, with over 2,800 companies engaged across various sub-themes, implementing an ambitious engagement policy requires the development of effective monitoring tools.

These tools contribute to:

- Enhance transparency to promote engagement actions,

- Meet regulatory requirements,

- Ensure effective monitoring of commitments at both the issuer and portfolio levels.

By structuring engagement with clear escalation steps and robust monitoring, we can drive meaningful corporate change whole ensuring that investments remain aligned with long-term sustainability objectives.

1. Emissions Prediction and Policy Analysis.

2. Net Zero Asset Owner Alliance.

3. Network for Greening the Financial System.

4. https://www.banque-france.fr/en/publications-and-statistics/publication…