Summary

With tariff uncertainty affecting market expectations and consumer confidence, bonds are back as a key diversification* engine for global investors.

- The high uncertainty on the new US administration’s policies is starting to harm consumer confidence in the US.

- We expect the US Fed to cut rates again in 2025, while the possibility of a rate hike remains low despite persistent inflation.

- Bonds are back as a key diversification* engine at a time of economic uncertainty.

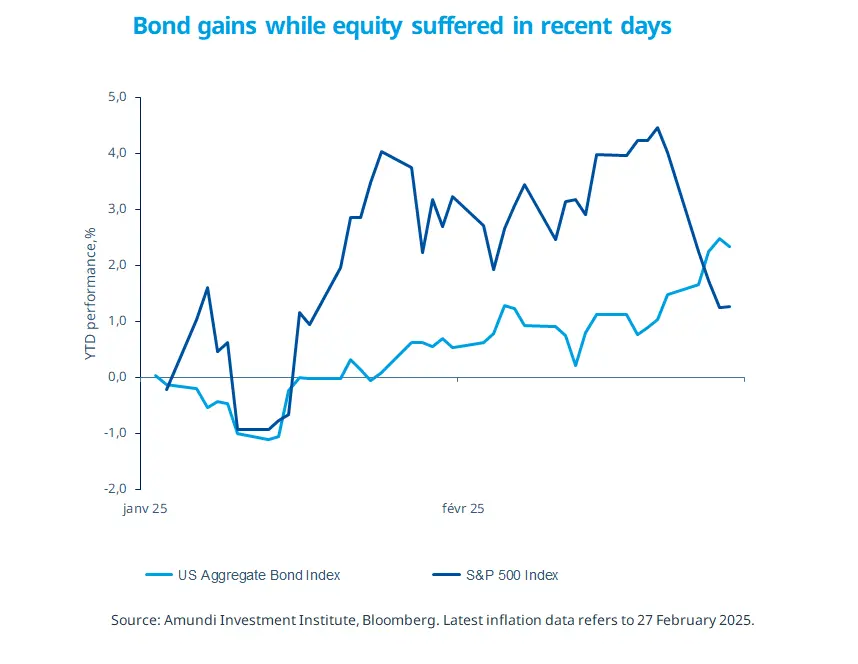

As the new US administration announced tariffs on imports from selected countries and sectors, markets began to question the potential impact on growth beyond the initial fallout on inflation. A few weak US economic data points compounded these concerns, leading to a rapid reassessment of market expectations regarding the Fed’s trajectory, with yields on the 10-year Treasury hitting their lowest levels since the start of the year. This has benefitted the bond markets, which have enjoyed positive returns year-to-date, while equities have struggled over the past week. We believe global bonds will continue to provide income and diversification* opportunities in an uncertain environment.

*Diversification does not guarantee a profit or protect against a loss.

Actionable ideas

- Global bonds

When investing in fixed-income markets, a global approach allows investors to benefit from opportunities arising from de-synchronised monetary policies.

- Global credit

An overall positive global economic picture is supportive for credit markets, where yields remain appealing for income-seeking investors.

This week at a glance

This week, markets faced a global selloff in equities due to President Trump's new tariffs on Canada, Mexico, and China. Asian shares declined sharply and the S&P 500 erased most of its year-to-date gains. The dollar strengthened while Treasury yields fell amid concerns about the tariffs' impact on US growth and inflation.

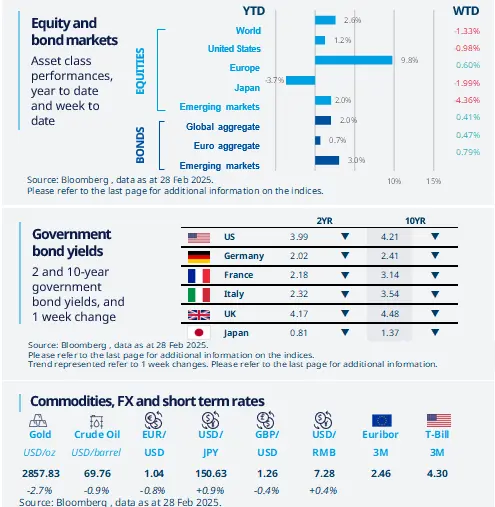

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 28 February 2025. The chart shows the US 10-year Treasury yield.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US consumer confidence plunges in February

February US consumer confidence dropped 7 points to 98.3 in February, the third consecutive monthly decline. Consumers were concerned about the outlook for the broader economy, as uncertainty over the new administration’s policies is weighing on households. The drop was driven by the expectations component, which was the highest fall in three and a half years. Inflation expectations over the coming year increased to the highest level since May 2023.

Europe

CDU/CSU wins German election

The CDU/CSU won the German elections on 23 February with 28.6% of the votes, putting CDU leader Friedrich Merz on track to be the next Chancellor. His first job will be to form a coalition government. Negotiations with the Social Democrats, which came third with 16.4% of the vote, will focus on bridging differences on issues such as fiscal reform and domestic policies. A change in the fiscal stance is likely, with more spending on defence, but may not result in a major stimulus.

Asia

Bank of Thailand (BoT) cut the policy rates

Bank of Thailand cut the policy rates by 25 bps to 2%, against the consensus expectations of unchanged policy rates. The accommodative policy stance aims to support the weak economic performance, in particular in the manufacturing sector and to ease the high cost of debt for households. Depending on next economic performance, BoT could ease further over the year; however, the room for easing remains limited.

Key dates

3 Mar China Caixin manufacturing PMI, US ISM manufacturing | 5 Mar National People's Congress (NPC), China Caixin services PMI, US ISM services | 6 Mar ECB interest rate decision and press conference, US trade balance |