Summary

We reiterate the main driver affecting the current and forward-looking macro environments is a combination of sustained inflation, mounting recession fears and geopolitical developments. Price stability has become the paramount goal and even more complicated to reach, therefore CBs will make sure high inflation will not be entrenched in economic agents’ long-term expectations. Different inflation forces are at play in US and Europe. While in the former, labour market tightness and strong demand are the key drivers, the latter is primarily affected by the energy crisis triggered by the conflict in Ukraine. Then, if the Fed has started a fast-paced quantitative tightening to bring inflation to target at any economic cost, ECB and BoE face a more arduous task as they are calibrating restrictive monetary policies in less resilient economies. Our long-term central scenario sees inflation and interest rates stabilising around higher levels than the past decade: we project that systemic shifts to a greener economy and geopolitical events (together with linked supply chains disruptions) will keep risk premiums and long-term volatility elevated. Bondholders are expected to benefit from attractive returns due to increased carry. In the medium-term, high-quality credit instruments are favoured on lower quality assets, as the uncertain outlook might increase default events. On the equity side, last quarter correction has improved starting valuations. Hence, medium-term expectations are improving versus the previous quarter although increased borrowing costs and likelihood of a recession could weigh on performance, while moving to long-term the repricing effect is more diluted.

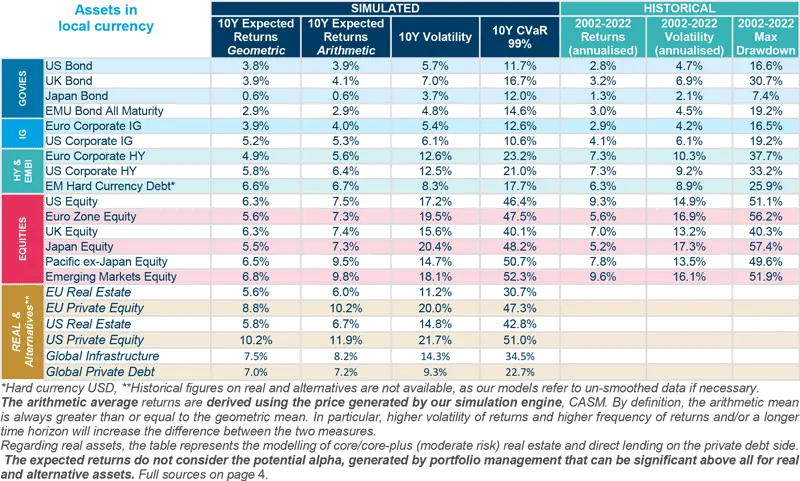

In the table below, we present the simulated forward-looking statistics over a 10-year horizon (expected returns, volatility and CVaR) compared with historical statistics calculated on a 20-year sample. Here, CVaR and max drawdown represent the expected and historical shortfall, respectively. We also provide arithmetic average returns, which is a useful return statistic for portfolio optimisation purposes.

ASSET CLASS RETURN FORECASTS

Expected returns are calculated on Amundi central scenario assumptions, which include climate transition.

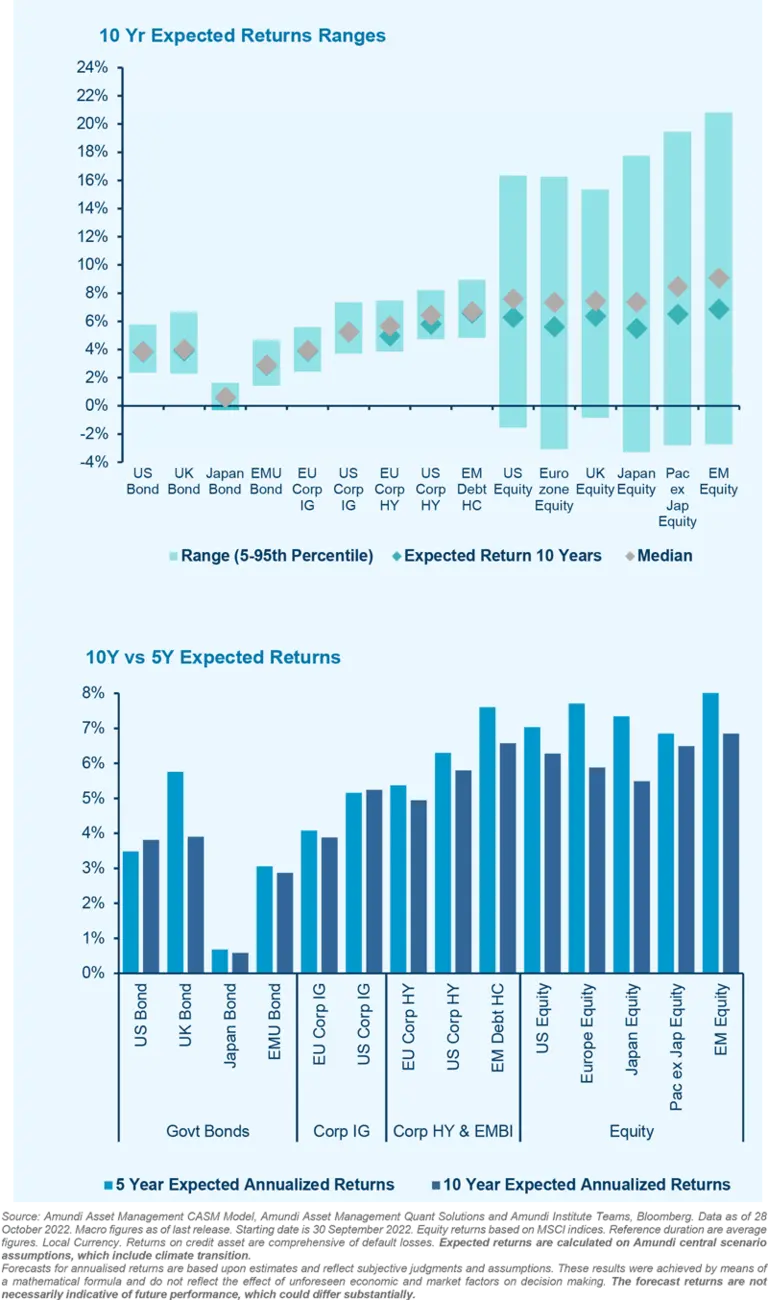

In the chart, we present the ranges for the expected returns where we excluded the tail scenarios.

Fixed income assets are centred on normalised positive average returns: low carry and/or high duration imply returns close to zero on the left side of the distribution for government assets.

Credit returns are supported by the spread component even if enlarging the uncertainly for the low quality ranges.

On the equity side, the upside potential is double-digit for most of the asset classes, but the downside extends into the negative returns as the time can only partially diversify equity risk.

For more detailed information, see: Keeping Up with Climate Change

Government yields have increased across the universe, and now they are hovering around long-term expected levels. We assume monetary policy tightening to halt once economies recede and inflation slows, implying 5-year returns to be close if not higher than long-term ones.

Expectations for credit in the medium term are supported mainly by the high carry as spread are close to long-term equilibrium.

Expected returns for the medium-term have increased amid more attractive starting equity valuations, partially offsetting the risks and uncertainty linked to macro and financial scenarios. In the long-term, equity returns crystallise moderate single-digit expectations.

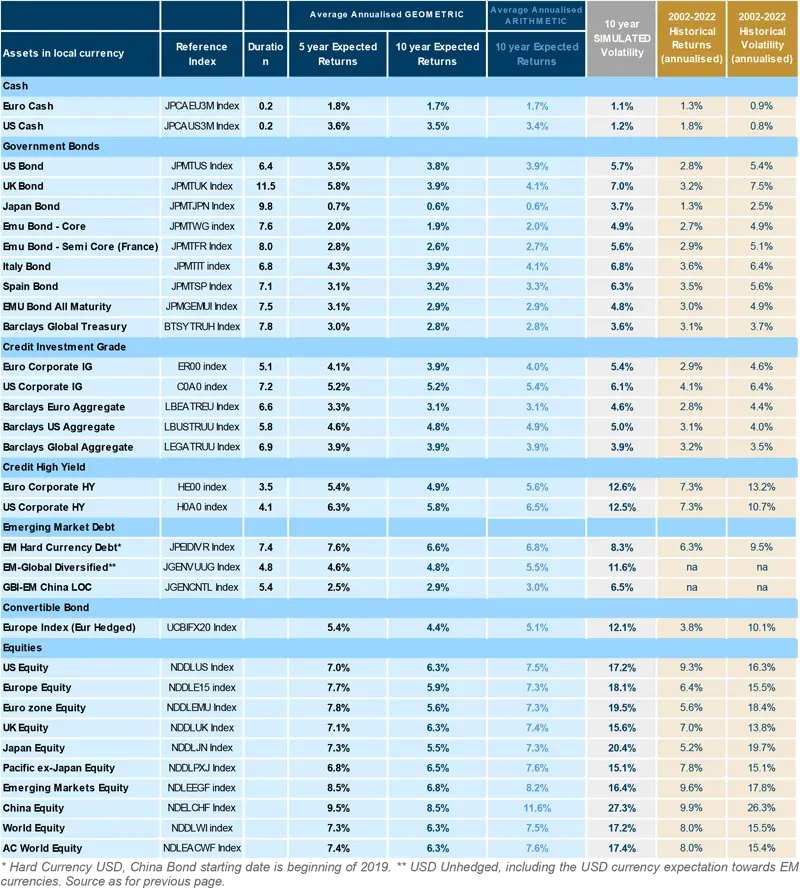

In the following table, we present our annualised return forecasts across different asset classes, calculated as the average of simulated returns on different forward-looking horizons (at five and 10 years). We also report historical figures for annualised returns and volatility calculated on the last 20 years, a sample that includes the two big crises (GFC and Covid-19).

CASCADE ASSET SIMULATION MODEL (CASM)

This medium- and long-term return forecast report is intended to provide some guidance for investor expectations. The time horizon under consideration is 10 years, a timeframe deemed to be appropriate and during which long-term trend factors and issues can reasonably be expected to play out and, therefore, market returns should accurately reflect this information. We use a Monte Carlo methodology in order to generate possible changes in different risk factors for the time horizon considered, representing the future states of these factors under objective measures.The model is then used to price the instruments in line with these factor scenarios.

In order to determine possible interest rate scenarios, we analysed the changes in the major economic DM regions, China and EM aggregate[We used a cascade-style modelling technique to simulate the different term structures, using risk factors such as the GDP cycle, inflation, real rates, debt pattern and CB guidance for each of the economic regions in question. Moving into spread-related assets (EM and corporate bonds), we focused on implied volatility, quality, default and recovery rates, together with economic cycles, yields, commodity prices, EPS and private investments (both specific for credit spreads) to estimate a forward-looking path for EM bonds (hard currency), EU

corporate (IG and HY), and US corporate (IG and HY).

Our framework for equity focuses on earnings growth, economic growth variables, interest rates and inflation as determinants of capital gains and dividend yields to represent the income effect. EPS forecasts are derived considering both top and bottom lines, so including the cost side of the equation.

Our medium-/long-term model, known as CASM, is updated on a quarterly basis to incorporate new starting points, changes in our short-term outlook and medium-term expectations, along with long-term trends, the significance of which is verified on an annual basis. Amundi assumptions include our central scenario on climate transition which

impacts expected returns via macro and financial variables.

Our CASM model focuses on key factors that drive this change over the medium to long term. The resulting forecasts look at the comparison between current and medium- to long-term readings for the key factors included in the model.

Note that these are simulated figures only and may not represent actual asset class returns. Actual returns are based on many factors and may vary substantially from modelled ones.