Summary

Foreword

Catering key climate change mitigation into our asset allocation process

The third year of the Covid crisis began with renewed concerns over the interplay between surging inflation and an economic recovery contingent on concerns over policy tightening, a trend further accelerated by the Russian-Ukrainian conflict. While we collectively gather ourselves to implement preventive measures to build sturdier economies and markets against further tail events, ominous signs loom on the horizon in the form of climate risk. Weather-related events have historically demonstrated financial and physical ramifications against which ex-post remedial measures have proven to be ineffective.

Quantifying and qualifying ex-ante climate risk is and will continue to be a daunting task. Much like Covid, the impact of climate change is undoubtedly global but at a scale severalfold greater due to its dual dimension of granularity and time horizon. Any one of the extreme weather-related events, from storms to droughts and temperature swings between seasons in any part of the world, will not only have an immediate impact on the affected region, but will reverberate across regions in a cascading fashion for years if not decades.

In the previous edition of our annual Medium- and Long-Term Forecast, we initiated a discussion of the importance of incorporating climate risk into our future analysis. Back then, we were convinced that the transition to a low carbon economy would be a key driving force of growth potential and global activity altering financial market dynamics, which would in turn alter cross-asset expected returns on a medium- to long-term horizon.

In the 2022 edition, our outlook for the multi-asset universe explicitly accounts for both the near-term post-Covid landscape and the possible long-term repercussions of climate change. As a starting point, we rely on the reference scenarios established by a consortium of climate scientists, economists and central banks (Network of Central Banks and Supervisors for Greening the Financial System or NGFS), representing a milestone effort offering a flexible framework exploring risks present in a number of distinct possible futures.

Integrating these scenarios with our current methodology allows us to offer a coherent picture of how each possible climate scenario and mitigating factors result in different “what-if” consequences for Amundi’s multi-asset universe. As such, the results portrayed here span several dimensions in terms of severity, likelihood and time horizon of the structural change in monetary and fiscal policy affecting the financial system.

The findings enable us to understand and get a clearer view of the scale of the challenges that will unfold, identifying factors that allow us to pave a path forward. Further developments are in the pipeline as data and methodologies become standardised, regulations are set and additional institutions foray into the climate change arena. Amundi is taking a protective stance in order to lead a discussion of best-practice pathways to improve portfolio outcome opportunities and risk-management practices.

The improvement of understanding is for two ends: first, our own increase of knowledge; secondly, to enable us to deliver that knowledge to others

We assess the Net Zero transition primarily along the geographical dimension combining the transition pathways created by NGFS/SSP/MESSAGEix-GLOBIOM to blend coherent energy/land used systems with various degrees of mitigation policies and eventually nesting them to the financial market impact. We drill down into this evidence and cover the US, Eurozone, UK, Japan, China and EM aggregate.

We proceed by calculating projections of some macro- and micro-fundamental variables (GDP, inflation, investments, productivity, debt). Where possible, we use region specific assumptions (i.e. on the production function).

Limitations of our approach

- All analysis was performed before the Russian military escalation in Ukraine.

- We focused on introducing ESG considerations into our macro-financial projection and financial market pricing equations. In this essay, the focus is on transition pathways and their impact on the financial markets. We are not including economic and/or profit recessions driven by events outside this framework to contain the number of control variables.

- We have not explicitly incorporated physical risk.

- Our analysis largely relies on first order effects. As a result, debt sustainability might increase the probability of default to higher levels than the estimate provided.

- NGFS/SSP/ MESSAGEix-GLOBIOM Limitations

The military escalation will likely reset starting levels, alter transition pathways and create additional costs and effects, including those of physical climate risks which could trigger higher macro-financial impacts than those described here. - We consider an alternative scenario as a pessimistic conception of the central scenario.

Important, uncertain initial steps

Recent unprecedented events leave no doubt that the climb out ahead of us will be more onerous than ever, in a possibly bleak future of deteriorating growth and persistent inflation. Today more than ever, current and forthcoming policy decisions will be crucial as we come face to face with the upcoming challenges.

To put it mildly, 2021 has been eventful. Inflation worldwide took a sharp upward shift and is set to continue rising in 2022 due to persistent supply chain bottlenecks and energy price hikes. As wages have not kept pace, the increasing risk of disposable income erosion remains an impediment to monetary policy normalisation for the foreseeable future. In the midst of such opposing dynamics, inflation has evolved into a political issue insofar as it slows down the normalisation process.

Why are we addressing these issues while talking about the capital market assumptions for the next 10/20/30 years? Because policy decisions today will affect the starting point of the next climate change mitigation policies, interest rate dynamics and the risk of a monetary policy mistake should central banks move too fast and too far in the normalisation process. Volatility is likely to remain high and persistent. We are not ruling out the possibility of a policy mistake that moves DM economies into a recession due to financial market instability and a deep contraction of risky assets.

However, such a downside risk scenario is most relevant in the short- to medium-term outlook and is not included here. The rationale for this decision is that the primary goal of this document is to analyse the implications of climate mitigation and Net Zero transition policies explicitly introduced for the first time in the definition of Amundi’s capital market assumptions and climate risk aware portfolio allocation and to compare our conclusions with what we have seen so far.

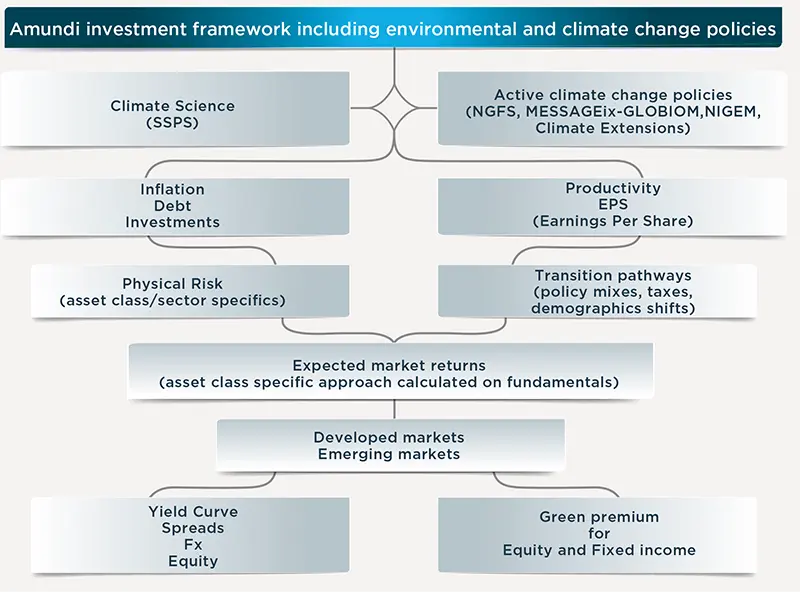

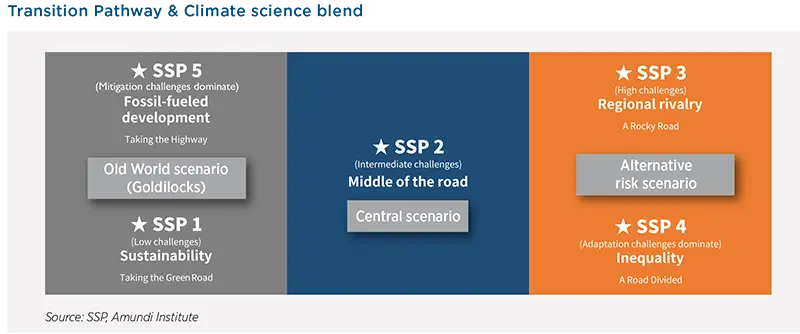

In this context, we have adapted our in-house macro fundamental model and cross-asset returns simulations to take account of different assumptions in the conduct of active Net Zero transition policies. As a reference framework for environmental transition narratives, we combined and aligned the climate-related scenarios as specified by the NGFS1 and the Shared Socioeconomic Pathways2 (SSP) to plug in active policy mixes contemplating specific patterns for socio-economic developments, inequalities, demographic trends, regional rivalries and fossil fuelled developments. The NGFS uses a suite of IAMs (integrated assessment models) with a proven track record of providing mitigation information to policy and decision makers as well as climate scientists. Within these models, we decided to blend our input with findings from MESSAGEix-GLOBIOM and NiGEM3 models, incorporating the integrated transition pathways impact of climate change, biodiversity and macro-finance to assess their impact on our economic analysis and the adaptation required to connect the economic landscape to the financial market simulations. Our objective is not to pass judgement on the precision or validity of the climate scenarios provided by MESSAGEix-GLOBIOM and NiGEM and their consequences but to provide a set of hypothetical shifts in economies and markets needed to curb global warming to 2°C.

To incorporate the impacts of climate change into our capital markets assumptions we specified certain critical assumptions as a stylised representation of factors and their dynamics while adding some qualitative descriptions and interpretations of development patterns to maintain consistency over time and across scenarios.

- Our capital markets assumptions have a 30-year time horizon, therefore they include the Net Zero 2050 deadline for most countries. For China and India, which have formally committed to a later deadline, we allowed a longer convergence.

- We assume a “business-as-usual” mindset for macro financial dynamics at the 1-3yr horizon with more aggressive policy action starting from 2025 onward. This implies that the trends between now and 2025 will coincide with the patterns we have been identifying and presenting so far. In fact, we take these as being part of the “old-world” updated as of January 2022 in preparation for the definition of our central and alternative scenarios. With the “old-world” as a backdrop, we can compare our traditional capital markets assumptions with our new findings, where we allow significant heterogeneities across and within countries, with some making good progress and others falling short of expectations in the effort to minimise climate risk.

- We maintain our modular approach, providing a cascade architecture that compartmentalises the numerous modelling challenges while spotting the logical nodes relating elements of the narrative to each other.

- The macro scenarios we simulated are coherent with different active climate policies. These will define the patterns for macro fundamentals (incorporating therefore climate transition) and will eventually be used to derive expected returns.

- We calculate dynamic “green premiums” on asset classes as a primary source of return, at least initially. While there is still uncertainty about the future of climate policies, we expect macro and micro fundamentals to move to lower levels in the long term, therefore affecting risky asset returns in particular. As such, we expect that demand /supply mismatches for green assets will allow regional differences in expected returns and drive asset allocation decisions, at least initially.

While maintaining consistency, we formulate our hypotheses to emphasise differences in transition among scenario outcomes.

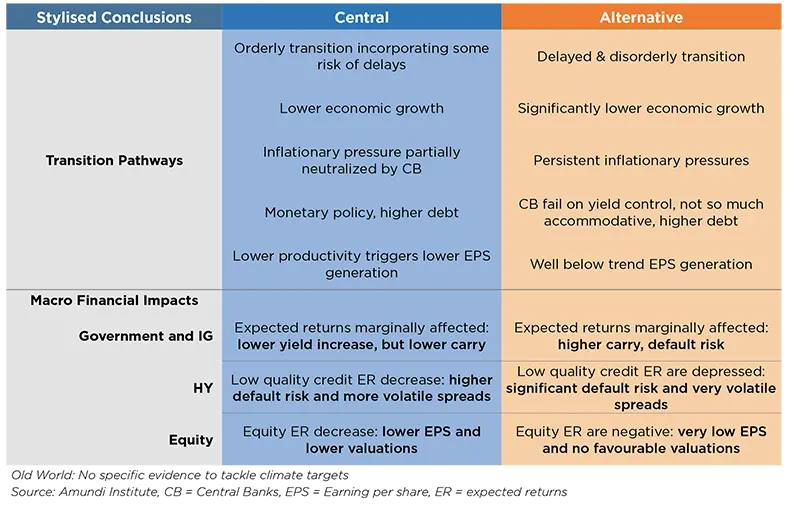

Central scenario anatomy: Muddling through

The goldilocks scenario, where the recovery is smooth and follows the path of the past, driven by productivity gains and a progressive catch-up at regional level, is not feasible anymore. Our central scenario deviates from this in that we argue that climate policies will be slowly introduced starting from 2025 but will proceed in a muddled fashion. There are some limited improvements but these are not sufficient to meet climate goals, i.e. there’s more of a chance of limiting global warming to below 2%, but 1.5% is no longer attainable. Transition and physical risks are on the rise due to ambiguous policy ambition/timing, coordination and technology challenges.

Under our scenario, there are significant heterogeneities across and within countries and the world follows a path in which social, economic, and technological trends do not shift markedly from historical patterns. Development and income growth proceed unevenly, with some countries making relatively good progress while others fall short of expectations.

With all the known differences in terms of economic cycles, the emerging economies have been growing relatively quickly. As income reaches higher levels, economic growth stabilises and then slows down: the demographic transition occurs at average rates as societies develop and technological progress continues without major slowdowns or accelerations. Within this group, Asia leads the way with China moderating/ pausing its productivity deceleration in the medium term as part of its economic transition and India taking the lead on GDP growth, with a still high demographic dividend and productivity. However, overall growth in EM and persistent income inequality will continue to make it difficult to reduce the societal and environmental vulnerability that is restricting any significant advances in sustainable development.

In this scenario, global warming of 2°C is feasible but Net Zero CO2 emission commitments will likely not be met by 2050.

We are convinced it is critical to move beyond GDP figures to production functions, productivity, and EPS: our findings show inflation moving higher and GDP lower. In these conditions, EPS formation will struggle on the basis of an unstable bottom line due to lower productivity, higher unit labour costs and higher PPI due to higher prices for brown energy.

Granular analysis beyond GDP in this manner introduces new multiple dimensions of the causal relationship between climate-related risks and the overall impact on an economy. This, in turn, would allow for a more nuanced interpretation of possible future evolutions of markets and of asset classes which otherwise may be missed when aggregated in a single projection. Of course, our approach in the field of ESG transition, which is at an embryonic stage, is not without its shortcomings. Applying such a magnifying glass, the detailed methodology may result in a myopic vision as the outlook of the granular variables becomes more blurred the further we move into the long-term. Additional data and game-changing technologies not visible in the future could alter the relationships we describe in this report.

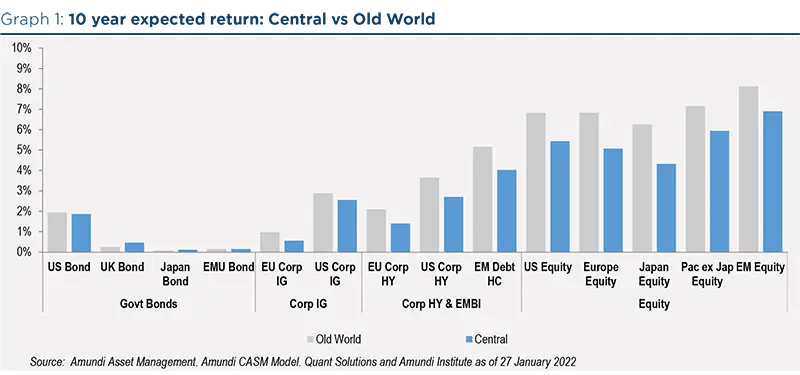

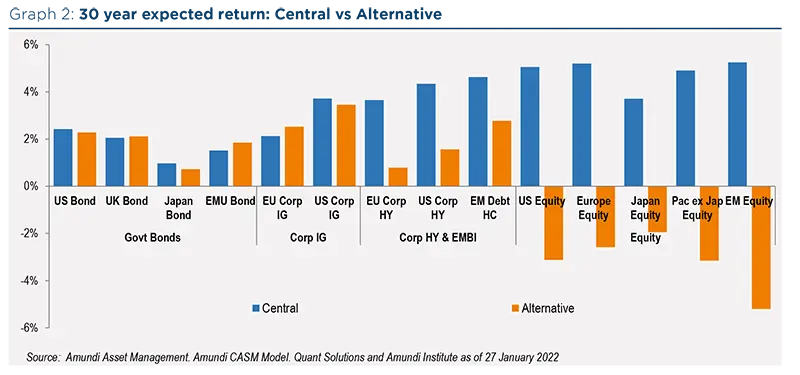

Our central scenario implies a general erosion of risk premiums in the cross-asset spectrum associated with the transition. High-rated fixed income assets will be impacted only marginally, assuming central banks will finance a huge amount of the global debt increase required for transition, while equity assets will be characterised by weaker fundamentals and less favourable total return expectations. The increased fragility of corporate fundamentals will alter low credit ratings, causing higher volatility and default losses.

Asset allocation implications

Concerning strategic asset allocation, the inclusion of climate active policies implied in our central scenario is relevant for two reasons. The strategic asset allocation analysis gives a general quantification of the impact of the risk return trade-off looking at the global cross-asset universe. With respect to a year ago, the frontier has flattened. When we select a portfolio allocation on the frontier targeting a certain expected return, we observe that the most relevant difference is on the portion of equity showing both a higher portion and increased diversification within the equity basket towards efficient allocation calculated last year. Investors looking for higher returns will most likely seek to take advantage of the momentum offered by the equity market as a result of the transition process.

At the same time, the results give some flavour of the preferences for macro asset classes and regions driven by the first step of transition, which we incorporated in our models. In the fixed income space, the preference is for developed market government assets, while high-yield fixed-income assets are less relevant in the efficient allocations vs. last year, as the expected returns price in some downside risk embedded in the transition scenario. On the equity side, supportive expectations translate into higher allocations to Asian equity and emerging markets. Within a well-diversified equity portfolio, European equities remain relevant.

Alternative scenario anatomy: Armageddon

Alternative scenario anatomy: Armageddon In these discussions, we cannot lose sight of the non-trivial possibility of the onset of the worst-case sequence of events. Such conditions would presumably arise from a chain of events: non-concordance of climate risk estimates/ effects leading to a limited global decrease of CO2 emissions after 2030, with strong emphasis on national policies. Divergent schemes are introduced across sectors leading to a quicker phase-out of brown energy commodities use but at a higher cost. A significant lack of coordination among global institutions running mitigation policies makes difficult to limit global warming to below 2%. Ultimately, the transition to a Net Zero world is delayed and the macroeconomic scenario worsens on multiple fronts as the transition/physical risks increase significantly.

The deterioration will be similarly reflected on the financial front. Delayed and uncoordinated transition financing will weigh heavily on central banks’ efforts to maintain control of the monetary narrative. As rates move higher, the cost of debt servicing becomes unsustainable, leading to an unprecedented rise in default risk for even the safest sovereign debts.

While the advent of such a gloomy outlook is remote, we prefer to maintain a “devil-you-know” approach, keeping in mind the implications for the financial markets and the value of anticipating adversities. Historical studies of past hardships show this scenario would be unprecedented. Thus, this report does not look at a reset or normalisation of the economy and financial markets.

The repricing of expectations on the downside is more pronounced in the alternative scenario, as expected. The downgrade is substantial in risky assets (low grade credit and equity), where expectations are depressed by weak macro and financial fundamentals, inflationary pressure and default risks. Only an orderly climate transition would make climate-related supply shifts predictable and spread them over a long period, thus limiting the inflation impact.

In particular, credit spreads will widen and remain high, causing an increase in default risk. The risk of default is significant also in high grade asset classes (including government bonds), while for low grade credit, the default risk is really consistent. Equity returns will be affected by weak fundamentals as a result of the macroeconomic picture showing low and decreasing economic growth associated with persistently high inflation (and PPI) and significantly lower valuations.

Conclusion

The inevitability of climate change has fast become a reality, with the accelerating frequency and severity of weather-related events in the last few years convincing even the most sceptic. Stakeholders are starting to grasp the scale and complexity of the problem and the need to maintain a united front to combat it. The recent outbreak of the Russian-Ukraine conflict will surely have further ramifications on the transition process, heaping on additional pressure across commodities, energy markets, and supply chains. Remedial efforts on multiple fronts will require thoughtful planning, decisive implementation, and correction as new data surfaces and technologies develop, not least due to the asynchronous nature of the dichotomy between the required short-term investments and the long-term benefits. Even if the task seems Sisyphean, humans have a demonstrated track-record of overcoming such obstacles when working in the spirit of collaboration, as most recently seen with the record-breaking timeline of Covid vaccinations. After all, as John Donne put it aptly, “no man is an island”

______________________

1 The Network for Greening the Financial System (NGFS) is a network of 83 central banks and financial supervisors that aims to accelerate the scaling up of green finance and develop recommendations for the role of central banks in combating climate change. https://www.ngfs.net/ngfs-scenarios-portal/

2 Shared Socioeconomic Pathways (SSPs) are scenarios of projected global socioeconomic changes up to 2100. They are used to derive greenhouse gas emission scenarios with different climate policies. The SSPs provide narratives describing alternative socio-economic developments in different GHG scenarios and related climate policies. https://climatescenarios.org/primer/socioeconomic-development

3 MESSAGEix-GLOBIOM (Global Biosphere Management Model) is a bottom-up IAM designed by IIASA (International Institute for Applied Systems Analysis) to set a relationship between land use (bioenergy, deforestation, climate change and agricultural policies) and economies around the world. For details see https://previous.iiasa.ac.at/web/home/research/GLOBIOM/GLOBIOM.html. The NiGEM (National Institute Global Econometric Model) is a large-scale macro-econometric that takes MESSAGEix-GLOBIOM as an input while accounting for further fiscal and monetary policies to generate corresponding financial market scenarios.

Table of Contents

- Keeking up with Climate Change

- Asset Class Returns: Drivers and Assumptions

- ESG Thematics

- Methodology & Appendix

To find out more, download the full paper.

Discover the main findings from our annual asset class views