Summary

- Superpower competition will continue to drive divergences in EM, favouring countries that will be at the centre of new supply chain routes.

- India will benefit as domestic demand and investments pick up and also because of enduring trends like demographics.

- A pause in US monetary policy tightening and the rate cuts that the Fed is expected to deliver in 2024 should support EM assets ahead.

US and China’s bilateral relationship was under the spotlight on 15 November, when Joe Biden and Xi Jinping held their first meeting in a year (in Xi’s first visit to the US since 2017). In a week full of economic data and with significant market movements, this event reminds us that beyond the cyclical outlook, geopolitics and structural themes are also important drivers of investment opportunities.

Global competition between economic superpowers is driving supply chain re-design benefitting some EM, in particular in Asia, as visible also in the increase in Foreign Direct Investment inflows towards this region.

In our view, India is a promising country supported also by domestic demand. Looking into 2024, EM assets will likely be favoured also by the expected shift in Fed policy and a weaker US dollar.

Actionable ideas

- Seek long-term opportunities in EM and Indian equities Investors willing to capture EM opportunities could consider the overall EM universe or single countries such as India (favoured by supply chains relocation).

- Look at EM debt in search for income EM debt continues to be attractive from an income perspective. Expectations of a Fed pivot in 2024 and a weaker US dollar should further support this asset class.

This week at a glance

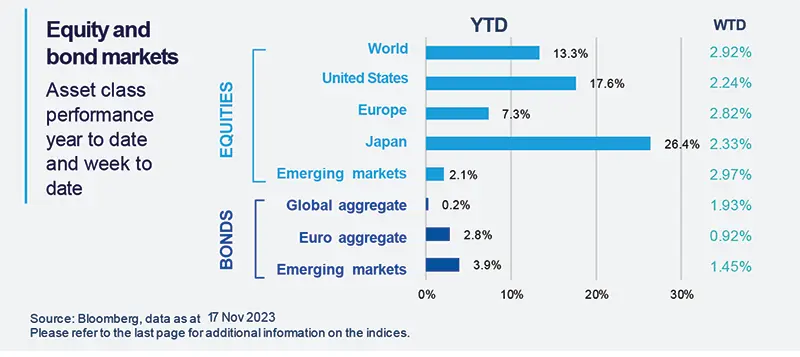

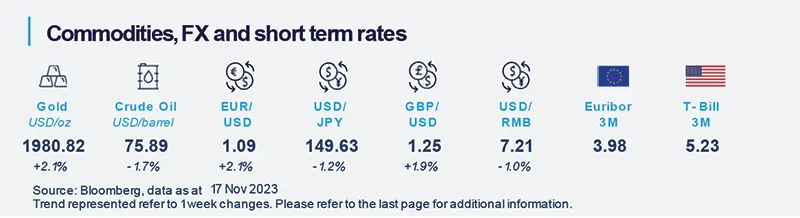

Global markets rallied, supported by slightly lower than expected US inflation readings and signals of cooling labor markets, which strengthened the view that the Fed may be done with raising rates. Bond yields edged lower across the board, the dollar weakened while oil has fallen to its lowest since last July.

Amundi Investment Institute Macro Focus

Americas

US inflation slowdown and the Fed pause

Inflation data in the United States came in below market expectations, raising market confidence in a prolonged Fed pause. US inflation moved from 3.7% year over year in September to 3.2% in October, remaining flat on the month after and increase of 0.4% in September. The disinflationary trend is going on with clear signs of cooling, although more markedly across goods than services where the rental inflation remains still hotter than normal.

Europe

Eurozone employment expanded in Q3, while GDP shrunk

While Eurostat confirmed its estimates for a mild contraction in the Euro Area in Q3 of about -0.1%, employment in the euro zone rose 0.3% in the same period, up 1.4% on a year over year basis. However, business surveys in November started to signal lower propensity to hire from companies, which may anticipate some slowing employment dynamics entering 2024.

Asia

China’s economic data came in mixed in October

China’s industrial production recovered moderately from Q3, while nominal retail sales barely grew month over month. Although Beijing has stepped up its fiscal and monetary policy supports, we hold a cautious view that these policies will have limited impacts on growth against the broad context of slower credit to local government financing vehicles (LGFV) and Real Estate sectors.

Key Dates

|

21 Nov FOMC Meeting Minutes |

23 Nov EZ PMI |

24 Nov Japan CPI, Global S&P PMI |