Opportunities lie beyond precarious path to growth

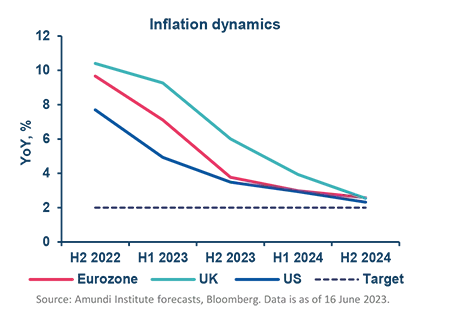

Global economic resilience and a reorganisation of supply chains mean we are upgrading our growth projections for the rest of the year. Annual global GDP growth in 2023 is set to improve despite a slowdown in developed economies, thanks to higher growth in emerging markets. Persistent inflation and a deteriorating geopolitical environment continue to pose a challenge.

While monetary tightening is nearing its peak, we expect developed market central banks will maintain a restrictive policy stance in the near term. In emerging markets, the overall economic momentum is fragile but resilient, particularly thanks to fiscal measures in place to shield consumers from higher living costs.

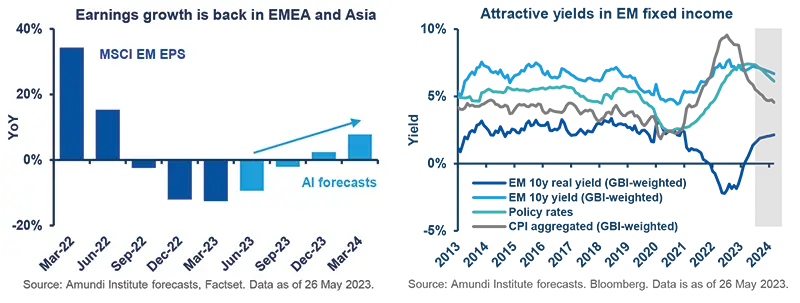

In the second half of the year, EM equities should benefit from more attractive valuations, the end of the Fed’s interest rate tightening cycle, and expected dollar depreciation. A return to positive earnings growth in EMEA and EM Asia should sustain the recovery in corporate margins.

EM fixed income offers good yields and spreads, helped by a weaker dollar. High yield bonds in emerging markets offer more appealing valuations. Overall, conditions in EM corporate bonds are improving, thanks to lower debt levels, and corporate defaults having passed their peak.

Investors are likely to face an environment of further deceleration in global economic activity in the second half of the year The uncertain macroeconomic outlook and weak corporate earnings growth call for a cautious allocation, as the upside is uncertain and downside risks persist, while risky assets are expensive on a valuation basis. Low visibility on the economic outlook means that quality – for both equity and bonds – is the compass with which to navigate this uncertain phase.