Summary

Since the 1980's, the electronics industry has grown dramatically and has benefited substantially from the linear economy by regularly offering new and better products, pushing consumers to renew their computer equipment (computers, smartphones, tablets, etc.) at an ever-increasing frequency. The extraction of materials, especially rare earths, the programmed obsolescence and the low recycling rate have become the industry norm.

How can the sector integrate the Circular Economy concept into its business model?

The European Union and France have decided to legislate on the Circular Economy in order to force the sector to review its practices, in particular by integrating "a right to reparability". Companies still need to translate these obligations into their strategy and have, in our opinion, two tools at their disposal: eco-design and product as a service.

The increasing volume of e-waste leads the EU to tightening the legislation

In the context of the 2020 European New Circular Economy Plan, the Electronics & ICT industry has been identified as one of the seven intensive-resources sector that need to implement a Circular Economy given its environmental impact and circularity potential.

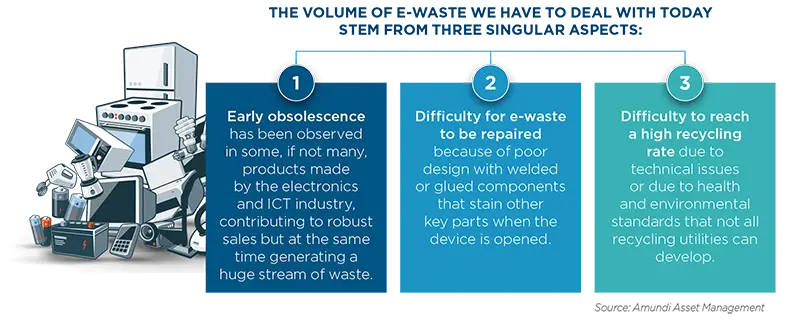

For many years, the sector has been experiencing strong growth resulting into one of the fast growing waste stream, so called e-waste. Compounding the issue is e-waste’s low recycling rate. In 2019, only 17%1 of global e-waste was collected and properly recycled, which means that 44 million metric tonnes of e-waste, was either placed in landfill, burned or illegally traded and treated in a substandard way. Poor treatment of waste has three major consequences: pollution of the environment, health deterioration for the people handling this waste, high CO2 emissions.

E-waste contains many substances that are harmful for the environment if not dealt properly and consequently can pollute water sources and food chains. For instance, circuit boards or cathode ray tubes from old TVs contain lead, chromium or mercury, which, if they are not well decontaminated, could pollute soils heavily.

Besides, in many countries where informal e-waste processing takes place with the aim of recovering valuable metals such as copper and gold, workers –including women and children- are exposed to toxic substances during the melting process which is carried out at dumping grounds.

Last but not least, according to the World Economic Forum, the manufacture of a tonne of laptops could emit 10 tonnes of CO2, mostly during the production process rather the product lifetime. That is why establishing low carbon manufacturing processes by using refurbished or recycled component is so important to limit carbon emissions.

In the European Union, it is estimated that less than 40%2 of electronic waste is recycled and in order to improve the situation, the Commission is set to introduce a ‘Circular Electronics Initiative’ to establish a level-playing field where products sold in the EU are designed in such a way that they contain more recycled materials and have longer lifespans.

Implementing a Circular Economy could help solve these three issues, causing as of today a high quantity of e-waste. Indeed, improving product durability and reparability are at the heart of the Circular Economy process and remains likely the best lever the industry has at its disposal, not only to reduce the amount of e-waste generated by electronics devices but also to reduce the need for newly mined mineral resources and incremental carbon emissions.

This is the reason why the EU is revising its legislation to make it more stringent.

In its New Circular Economy Action Plan, the EU Commission has highlighted 5 research focuses:

- Implementation of an Eco-design Directive so that devices are designed for energy efficiency and durability, reparability, upgradability, maintenance, reuse and recycling.

- Defining the sector as a priority for implementing the “right to repair”;

- Introducing measures on chargers for mobile phones an similar devices (common charger) allowing to decouple the purchase of chargers from the purchase of new devices;

- Improving the collection and treatment of e-waste, including exploring options for an EU-wide take back scheme to return or sell back electronic devices;

- Reviewing EU rules on restrictions of hazardous substances in electrical and electronic equipment.

A key initiative of the European Commission regarding Circular Economy for the electronics industry was taken in Q1 2021 when the New Eco-design regulation entered into force. This new legislation widens the 2009 Eco-design Directive beyond energy-related products, in particular by promoting circularity, which current eco-certification standards have fallen short of. Thus, in the EPEAT label3, upgradeability and reparability are not required criteria to obtain the label while they definitely have a role to play in making products more eco-friendly. As of today, the Eco-design regulation is only applicable for displays (including TVs) and servers but aims to include the broadest possible range of products, such as smartphones and laptops, which are still being discussed.

The new Ecodesign rules will be underpinned by new obligations for manufacturers and especially a new “Right to repair”, which consists for companies in:

- making most spare parts and repair manuals available to professional repairers for several years after retiring the product from the market;

- ensuring the delivery of the spare parts within 15 working days. Spare parts can be replaced with the use of commonly available tools and without permanent damage to the product;

- making the latest available version of the firmware available at a ‘fair’ cost;

- ensuring that joining, fastening or sealing techniques do not prevent the disassembly for repair or reuse purposes of a number of components (data storage devices, memory, etc.).

So far, we note that the regulation does not address the pricing of spare parts, often considered as a key barrier for products to be repaired in practice. Notwithstanding the different product categories or markets served, we believe these guidelines serve as a good practice baseline and we have been using them to assess the companies’ current practices around eco-design and communication around product longevity toward customers.

| WHAT IS THE FRENCH REPARABILITY INDEX? | ||

|

France became the first country to use an official reparability index since January 2021. The display of the reparability index is now mandatory at the point of sale for five categories of products : smartphones, laptops, televisions, washing machines and lawnmowers. This reparability index is a score out of 10 that informs the consumer on the level of reparability of the product. Buying a product with a good reparability index means buying a product easy to repair and consequently reducing the risk to buy a new one in case of failure. It also means protecting the environment as reparability prevents from extracting new materials, producing new products, increase CO2 emissions, etc. The reparability index is based on four main criteria:

Interestingly, the index takes into account the price of spare parts, unlike what is done by the EU. |

During our 2020 Circular Economy Engagement Campaign, we interviewed and assessed the Circular Economy practices of seven companies in the sector. These companies, based either in North America or Asia, are operating globally and importantly operate in Europe. Hereafter are developed the main observations and recommendations at the end of this first year of campaign.

Board and Management need to show stronger leadership on Circular Economy

Half of the analyzed companies confirm they do discuss Circular Economy as one of the strategic issues the company needs to handle at Board meetings at least once a year. However, including for these companies, we note that Circular Economy is too often assimilated to sustainability generally rather than being addressed as a strategic topic in itself. This does not enable companies to address the entire spectrum of opportunities offered by the establishment of a circular model. This amalgam is quite common as sustainability is not a subject Boards discuss very often, as it is seen as an add-in and not as a way to rethink the whole business model of the company. Besides, Board members expertise on sustainability – and even more on Circular Economy – is uneven.

If the top level of the company is not completely familiar with the concept of Circular Economy, we praise the fact that all companies under analysis have some type of commitments linked to Circular Economy, including commitments to increase sustainably sourced materials or collection of used products. However, we regret that companies do not have a global approach on Circular Economy that would question more deeply the company business-model. Indeed, companies tend to focus only on some pillars of the Circular Economy and forget the other pillars more complicated to implement. Thus, it is difficult for investors to understand how these commitments add up and how the company’s trajectory toward a circular business model would look like from here.

Typically, when it comes to the development of closed-loop products, which arguably will require technologies not yet operating at scale today, very few of the analyzed companies have managed to make clear commitments at this juncture. We acknowledge that true Circular Economy is not yet possible but stronger commitments on growing a CE compliant product ranges would help the industry to move forward and invest in areas that still require development.

Besides, companies very often lack relevant KPIs to evaluate progress, which does not help to make the subject concrete.

In order to switch from a linear to a circular business model, we first encourage companies to train Board members and top managers to sustainability and more specifically to the potential of Circular Economy. Top managers need to understand that the shift needs to be done as soon as possible in order to comply with new legislations but also to meet consumers’ demand and new behavior and, above all, to address the environmental challenge.

In a second step, we encourage the top management to review its global strategy in light of the circular model. This will include taking into account every single pillar of the Circular Economy, from sustainable procurement to a higher recycling rate, and not only the easiest ones. This new strategy must be expanded to all departments of the company and inspire a new mindset.

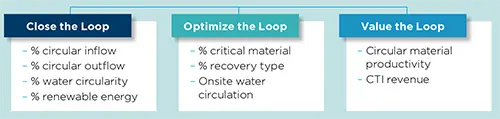

Last but not least, we strongly encourage companies to develop a system of metrics that can guide their decision-making when moving toward Circular Economy and help them communicate with investors on their trajectory and progress over time. For doing so, companies can rely on the Circular Transition Indicators4 developed by 25 companies in one of the World Business Council for Sustainable Development (WBSCD)’s work stream.

We also acknowledge that the lack of economic incentives have prevented further inroads so far. Again, situation seems poised to improve as the European Commission wants to reward products based on their different sustainability performance, including by linking high performance levels to incentives.

Eco-design is key for the sector but unequally addressed: strengths in energy efficiency, work in progress for material cycling

Eco-design is a fast-developing area, where product differences clearly exist. Energy efficiency appears to be have been the key focus of both R&D and communication toward customers up until now. Life Cycle Analysis are usually carried out but not always publicly disclosed.

Use of recycled materials is very often explored and deployed in many products. These materials typically include plastics such as polypropylene (PP), polystyrene (PS) and acrylonitrile butadiene styrene (ABS), as well as metals such as steel, aluminum and copper for some products. They are the materials used in large quantity and for which there exists a value chain that can deliver high quality recycled material.

In the companies analyzed, partnerships with suppliers around eco-design initiatives are interesting but their scope could be extended further notably to build reverse supply chains. Closed-loop is usually still limited in scope to one component made of one material. In a few instances, companies who established a closed-loop component value chain have naturally strong supplier relationships and this correlates with good performance overall.

To tackle efficiently that issue in terms of action and communication toward stakeholders, our recommendation is two-fold : companies need to build up a well-developed closed loop system for some products, like can be found in the multi-function printers industry (see later in this section). In doing so, they can promote some of the product range as being aligned with Circular Economy as waste will be minimized through parts reuse and recycling of old materials into new parts. Another way of demonstrating a company’s actions toward Circular Economy is to calculate and publish the cycled resource percentage of one of its product range, using a methodology such as the WBCSD Circular Transition Indicators (CTI) methodology. Initial figures from companies using the methodology suggest a global average of 8% circularity for electronics products, so any figure above that average can be seen as progressive and reflect positively on the company.

| DIVERSITY OF BUSINESS LINES COMES WITH BOTH CEILINGS AND OPPORTUNITIES | ||

|

Companies with several businesses lines will often find it challenging to achieve a high percentage of revenues dedicated to Circular Economy product lines, given how unique each value chain is and how complex it is to transform them to a circular regime. Nonetheless, large, vertically integrated and diversified companies should not be written off because of the large transformation potential they hold. They can become an enabler towards a circular model shift in the markets where they operate. For these companies, the question of which Circular Economy revenue metric to show to investors remains acute. In their case, we tend to emphasize collaboration with their peers, suppliers and other stakeholders to assess how their commitment can translate into a positive outcome that will benefit all players within a given value chain or ecosystem. |

| CIRCULAR TRANSITION INDICATORS FOR ASSESSMENT AND COMPARABILITY | ||

|

Companies can start by using the Circular Transition Indicators, disclosed by the WBCSD. The indicators developed aim to instore a common language for circularity so that companies can measure their circular performance and understand the associated linear risks and circular opportunities. The 8 indicators are divided in 3 categories: Close the loop, Optimize the loop and Value the loop.

This methodological guide explains how to calculate the indicators and can help companies to better assess circularity in their business lines and put figures on it. |

Product as a Service (PaaS) is a step in the right direction

Three companies in our panel had a well developed PaaS or leasing offer. We found that PaaS was well developed, that is the most usual way of contracting a device, for B2B in Multifunction Printers and Enterprise PCs. Benefits of the PaaS/ leasing model are not only from a pure business perspective but also beneficial to the stakeholders: value can be maximized by relocation of equipment to another organization that has lower specification requirements, while repair, refurbishment or recycling should be ensured. It should also allow better traceability of materials, and help the establishment of closed-loop value chains. LCAs show a 25-30% impact reduction of PaaS vs transactional sales in terms of GHG emissions and resource efficiency. Thus, PaaS is a strong contributor to the much needed reduction of e-waste.

Based on our findings, we recommend companies to explore product ranges that can lend themselves to the PaaS business model. Nonetheless, we acknowledge that to bring this model to the B2C market is likely to be a challenge in light of low barriers (costs) for product change or upgrade and likely preference of consumers to retain ownership of their electronic device.

Conclusion

Companies are timidly starting to integrate the Circular Economy into their business processes and innovations. This integration must intensify and gain speed in order to be extended to all products. The Circular Economy must become a compass for the company in order to radically break with the economic model that is dominant today. For this, the highest management bodies - Board of Directors and Executive Management - must be trained and give a clear line.

Companies in the sector must also develop further eco-design and improve the collection and recycling rate in order to ensure a supply of raw materials while limiting the need to extract virgin materials. Companies must also develop product leasing, thus limiting the number of new products brought to market and thus the environmental footprint, while maintaining revenues through new services.

We are aware of the change in business model that this requires for companies based on the principle of “always more, always faster” but we are convinced that the companies that will integrate Circular Economy into their strategy will be the winners of tomorrow's economy.

CASE STUDY

Ricoh illustrates how a company can build new business opportunities while extending the life of its products.

What is the benefit of having a refurbished product line in Ricoh’s offer?

Ricoh corporate clients are increasingly willing to minimize their carbon emissions, both for their direct and indirect operations. Since 2012, Ricoh's GreenLine offer has been providing refurbished copiers: an environmentally responsible service by significantly reducing CO2 emissions through the reuse or recycling of parts and components. On some models, more than 95% of the existing parts and components by weight on the original model are reused or recycled.

How comes Ricoh, headquartered in Japan, had to set up a refurbishment center in France?

In Japan, Ricoh has established reverse supply chains and industrial processes since three decades. The company deployed similar supply chains close to its European end market. Relying on local procurement, logistics and workforce allows better efficiency (i.e.: reduced transportation time and lower associated carbon emissions).

Ricoh transformed its French factory, initially dedicated to the assembly of new photocopiers, to a European recycling center. This factory produces the Greenline range - that consists in refurbished products. Since 2012, more than 25,000 devices have been produced and more than 600 people are employed, a large third of whom (225 people) is directly involved in the repair, recycling and refurbishment of office products (multifunction printers, cartridges, spare parts, etc.), thus contributing fully to a Circular Economy.

How can Circular Economy deliver both an environmental and a social positive impact?

Standardization and industrialization of the processes and the recycling methods throughout Europe was the groundwork that allowed refurbished product range to become economically viable. Today, the GreenLine offering and its production process meet the most demanding environmental management and remanufacturing standards (ISO 9001, ISO 14 001, ISO 50001, etc.).

Besides, since January 2021, Ricoh Industrie France became the first French company officially certified “Service France Garanti” for a refurbishment service. This new certificate guarantees that at least 90% of the people involved in the realization of a service are subject to an employment contract under French law hence showing a contribution to local economy.

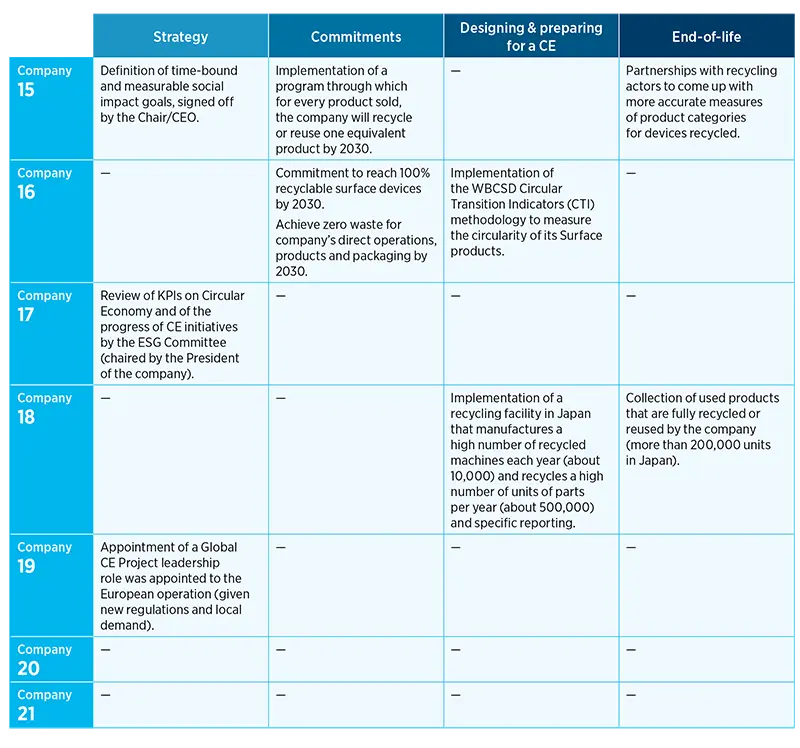

Table of best practices

The electronics and ICT sector

______________________

1. https://weee-forum.org/publications-papers/

2. https://ec.europa.eu/eurostat/tgm/table.do?tab=table&init=1&language=en&pcode=t2020_rt130&plugin=1

3. The EPEAT ecolabel is a leading global ecolabel covering products and services from the technology sector

4. https://www.wbcsd.org/Programs/Circular-Economy/Factor-10/Metrics-Measurement/Circular-transition-indicators