Summary

With US equities at record high prices, it’s time to explore the equity market beyond the mega caps.

- Resilient economic growth in the US so far has been driving equity markets, but some areas of the market now look stretched.

- However, weakening US consumption and subdued economic activity in Europe reflect some key risks for corporate profitability.

- Thus companies beyond mega caps or in other regions (Japan for example) could offer opportunities

Equities were buoyed by expectations of interest rate cuts by central banks this year. Sentiment was boosted by resilient US economic growth and consumption, leading the US equity benchmark to touch its all-time high in January.

Looking ahead, the situation is not so straightforward. Some corners of the markets are extremely expensive in an environment where economic growth in US and Europe also looks weaker in the near term.

On inflation, the progress continues and the Fed and ECB are likely to start their policy rate cuts around May/June. However, they will monitor geopolitical tensions in the Red Sea and any potential supply shocks.

All these elements will affect company’s profitability outlooks. Companies beyond the mega cap, with strong brand and pricing power could offer resilience.

Actionable ideas

- Look beyond the mega caps in US market

US mega cap and technology stocks appear overvalued. But if we look beyond this universe, in areas such as equal-weighted and US value, we may identify attractively-priced businesses. - Global equities

Regions such as Asia are showing a divergence from the weak global growth narrative. Global investors may enlarge their opportunity set, including Europe and Japan.

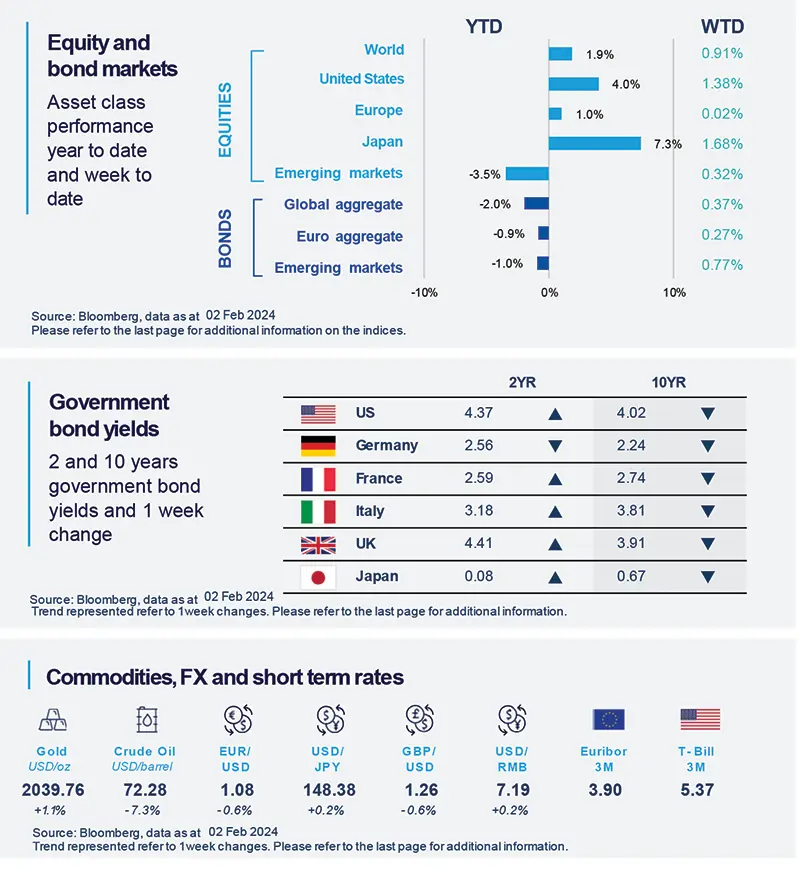

This week at a glance

Most equities rose over the week, which saw many US companies report their earnings. Long-term bond yields fell, after continued progress on inflation indicated central banks would remain on track to cut their policy rates. Oil prices fell on news flow around potential easing of tensions in the Middle East.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as at 2 February 2024.

Amundi Investment Institute Macro Focus

Americas

US worker productivity grew faster than expected in Q4 2023, keeping unit labour costs contained at 0.5%

In addition, first-time applications for unemployment benefits rose to a two-month high last week, while continuing jobless claims was also the highest reported in two months. Signs of labour market progressively cooling could help to curb wage inflation while higher productivity dynamics, if extended, could give a further positive boost to the disinflationary trend.

Europe

Eurozone inflation eased in January as expected, but still showing some areas of stickiness

Consumer inflation moved to 2.8% in January from 2.9% in December, in line with expectations, as unprocessed food, energy and industrial goods inflation all slowed. Yet, core inflation (less food, energy, alcohol and tobacco) only dipped to 3.3% from 3.4%, less than expected, as services inflation held steady at 4.0%, pointing to some price pressures still unabated. The reading may support the ECB's argument that rate cuts should not be rushed.

Asia

India budget: focus on growth and fiscal consolidation

The Finance Minister has announced the next Fiscal Year Budget. On a steep uptrend since 2021, Capital Expenditure continues to rise (+16.9% budgeted in FY25 on FY24): highways, electrification, ports traffic and airports. On the other side, in line with the commitment made last year, there is a strong commitment to a large fiscal consolidation.

Key Dates

|

5 Feb EZ PMI, US PMI, |

8 Feb |

9 Feb China money supply, Italy |