Summary

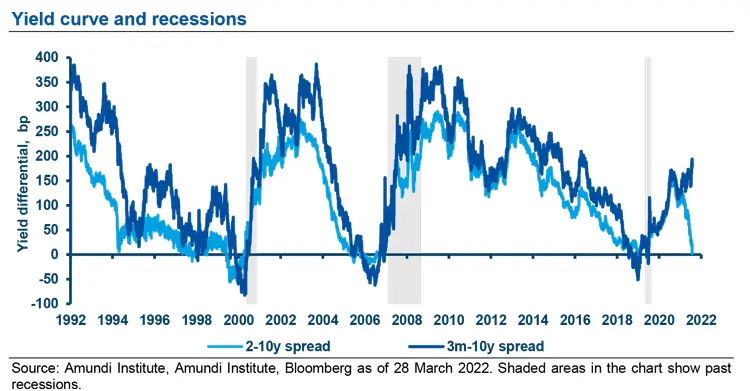

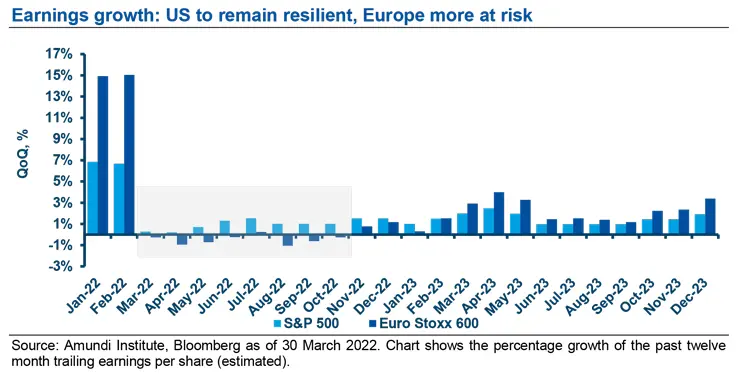

- Market assessment: After an initial negative reaction to the Russia-Ukrainian conflict, US equities markets are now above their pre-war levels. US equity volatility has proven much lower compared to Europe, which is more exposed to the crisis and to the economic downturn. On government bonds, the repricing has been very fast across the US yield curve. Its inversion in the 2-10 year segment shouldn’t be taken as a recessionary signal, in our view, and the 3 month-10 year interest rate differential, that we consider a more reliable indicator, remains broadly positive.

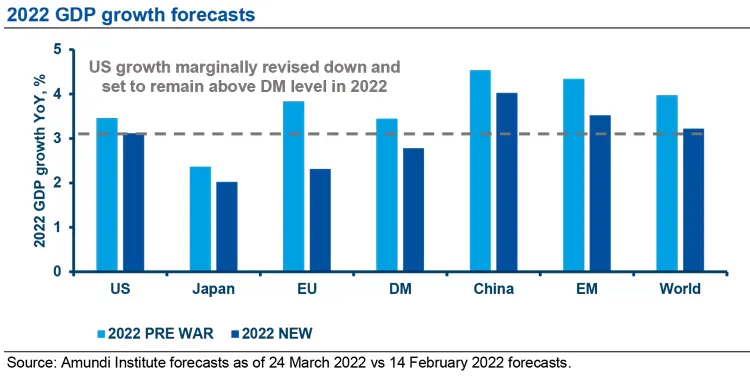

- Economic outlook: the US has exhibited exceptional resilience to the crisis, and a strong labour market continues to drive economic growth this year, despite building inflationary pressures. Europe on the other hand has been fully impacted by the conflict and faces a significant growth deceleration in 2022. Likewise in China, where the pandemic continues to proliferate despite a ‘Zero Covid’ policy, our growth forecast for 2022 has been revisited downwards.

- Monetary policy: both the European Central Bank (ECB) and the Federal Reserve (Fed) were late to react to mounting inflation, the former more so than the latter, and the war has complicated the path toward policy normalisation. We expect rate hikes and quantitative tightening to continue, although at a slower pace in Europe compared to the US.

- Main convictions: inflation continues to be the key theme driving portfolio construction. Equities remain in favour, particularly in the US where earnings growth should stay positive amid a more resilient economy. Here, investors should however avoid the names most exposed to higher rates, and look at value and quality segments in the search for opportunities. The ability to preserve margins will be critical especially in H2 and 2023, and company pricing power will be key in this respect. Strong and fast movements in the bond market calls for a tactical approach to duration, now not as short as a few weeks ago. The short part of the curve now seems particularly appealing as it has already priced in most of the Fed hiking cycle, while the long end will likely reprice further. US housing related securitised markets may be particularly attractive in light of a strong housing marke

Over a month has passed since the start of the conflict in Ukraine and, following the initial volatility swings across all segments, markets have been more constructive in the past few weeks. Rates have drifted higher, reaching 2.5% for US 10 year Treasuries, amid expectations of more aggressive monetary action. Equities are returning to pre-conflict levels, while commodities are still volatile but running cooler overall.

While negotiations between the parties involved in the conflict may have reached a stalemate, market attention has shifted toward issues concerning the current inflationary environment and how central banks are expected to react. The Euro area annual inflation rate in March reached 7.5%, up from 5.1% in January. Likewise US inflation almost skimmed 8% in February, its highest level in 40 years, albeit within a sturdier economic environment than in Europe.

Macro: US growth continues to hold steadfast

The US economy has proven to be exceptionally resilient. We’ve witnessed strong GDP growth in the fourth quarter, mainly stemming from inventory accumulation, with consumption running a little weaker

The US economy has proven to be exceptionally resilient in the current context. We’ve witnessed strong GDP growth in the fourth quarter, mainly stemming from inventory accumulation, with consumption running a little weaker. Due to material inflationary pressures we can expect some softening in consumption. Energy prices are up significantly YoY, likewise housing, and these hikes are likely to dampen consumption.

On the other hand, US consumers are in better shape than they were prior to the pandemic. High savings rates are complemented by a very strong labour market characterised by worker shortages, 11 million job openings and less than half that number unemployed. There may be some deceleration in growth, but in our view there will not be a recession in 2022. Manufacturing is also expected to perform well for the rest of the year, particularly in view of inventory shortages in the auto sector. Likewise governments are in a strong position, having tremendous leftover spending power from the fiscal stimulus last year, and the coffers at local state level are in surplus. The combination of manufacturing, residual consumer spending, government spending and inventory accumulation ensures the US economy is on the right track this year. Overall we are anticipating US growth in the region of 3% for 2022, with minor downward revisions compared to the start of the year.

One of the defining elements for this year has been the positive shift in the evolution of the Covid 19 pandemic, as contagion numbers have started to wane. Today, the main cause for concern is the lingering inflationary environment, which the Fed expected to be trending lower by now. Except for some day-in, day-out volatility, markets have by and large priced in the impacts from the war in Ukraine, although we remain watchful for tail events (such as a ceasefire or further escalation into Nato territory). To date, there has been little progress in the evolution of the conflict one way or another, and markets have factored in the stalemate.

One of the defining elements for this year has been the positive shift in the evolution of the Covid pandemic, as contagion numbers have started to wane. Today, the main cause for concern is the lingering inflationary environment

We expect US GDP growth to be around 3% this year, with minor downward revisions compared to our forecast at the beginning of the year

Turning to Europe, the outlook is not as bright. We have revised our growth forecast for the Eurozone to 2.3% for 2022, down almost 1.5% from a month ago, as we anticipate faster growth deceleration than before the war. In parallel we are witnessing inflationary pressures driven by commodity shortages as well as supply chain disruptions. Our CPI expectations for the Eurozone this year have been revisited upwards to 6.3% YoY, compared to 6.9% in the US. The big question that remains is whether Europe is entering a stagflationary phase, and whether this would be a transitory phenomenon or the beginning of a new regime. Ultimately this will steer the ECB’s behaviour. Another question relates to whether there will be increased fiscal spending, particularly concerning the energy transition and defence, and at what rate the latter can be financed. We must wait and see what rate environment will prevail and how much room will be left for government spending. Overall, Europe is in a much more fragile position compared to the US.

We have also revised growth in China down to 4% for the year, mainly due to the evolution of the Covid pandemic in this region. Until a new and efficient vaccination campaign is implemented, China will continue to adopt a ‘Zero Covid’ policy, which will impact on growth and the supply of goods and commodities.

Markets: attention is turning to inflation and monetary policy

The yield adjustment has briefly caused the 2-10 year yield curve to invert at the end of March. While some commentators have interpreted this move as a rising recessionary risk, we believe this reaction is premature

The start of this year has been characterised by the first hike from the Fed in March and most importantly by the fast reassessment of Fed hike expectations. Although the same terminal Fed funds rate (between 2-2.25%) is built into markets, we expect increases will be more front-loaded, with fewer occurring later on in the year. Markets are pricing in less than 200 bp total hikes for the rest of the year and this yield adjustment has briefly caused the 2-10 year yield curve to invert at the end of March. While some commentators have interpreted this move as a rising recessionary risk, we believe that this reaction is premature. Unless the Fed funds rate is brought well above the 2 year rate, a material slowdown or even a recession should not materialise in the US. We prefer to keep an eye on 3 month T-bills to 10 year notes, which has steepened in 2022 as the Fed has fallen further behind, as possible indicators of recession.

Regarding policy normalisation, the Fed only gave hints about its balance sheet plans at its latest press conference and has yet to provide any details. In general we expect an acceleration in quantitative tightening through a roll-off of existing maturities, as well as cash flows and pre-payments on mortgages, to reduce the balance sheet without active selling. Together these may effectively add up to another 25 bp rate hike for the year.

The ECB on the other hand is faced with the complicated task of balancing weaker economic activity in the region with an inflationary environment which is almost as severe as the one in the US. For the time being short rates remain negative. This was a tool devised to combat deflation and is therefore no longer viable in the current environment. President Lagarde has anticipated two hikes later this year, which would still only bring rates to zero and is considered a fairly accommodative level. In terms of tightening, the ECB is still torn regarding its balance sheet. It will start to wind down its holdings but at a slower pace. In fact, today, European states are not able to absorb higher rates due to their deficits and the piles of debt accumulated during the pandemic, as well as the fiscal spending agenda that will take place during a time when growth is flattening. Moreover some inflation (around 4-5%) can be useful in reducing debt levels. Ultimately, this is becoming a political issue and President Lagarde will have a tough job ahead.

Overall we concede that the inflation environment is more difficult today than it has been for the past 15-20 years. Supply constraint issues will take far longer to resolve given the conflict in Europe and due to the shortages in commodities and energy in particular. We can expect inflation to return to more reasonable levels in the next 12-18 months. The rise of populism in the Western world, as well as the pandemic, catalysed nationalistic policies to protect important sectors and have caused a period of de-globalisation which should continue to keep inflation higher than in the previous decade.

Overall we concede that the inflation environment is more difficult today that it has been for the past 15-20 years

Our convictions for US assets

From a cross asset perspective, equities continue to be more attractive than fixed income. Given inflation is here to stay for some time, it is important to reason in terms of real returns rather than nominal returns and to identify the most resilient sectors

- From a cross asset perspective, equities continue to be more attractive than fixed income. Given inflation is here to stay for some time, it is important to reason in terms of real returns rather than nominal returns, and to identify the most resilient sectors. Equities have no real alternatives in today’s portfolios (the so-called TINA effect “There Is No Alternative”) and we continue to look for opportunities in quality and high-dividend names, diversified firms and companies with pricing power that can pass inflation on to consumers.

- US equities are favoured in comparison to other developed markets. After a weak start to the year, US equities have experienced a rapid recovery in the last few weeks, as markets continue to assess a benign earnings outlook. The recovery has been particularly strong in growth areas, while high quality value stocks look particularly attractive at this stage. US energy and materials looked promising, given how cheap they were before the run up in commodity prices, but that has since been priced in. Some more traditional asset classes, such as utilities and real estate, should also be monitored factoring in rising dividends to defend against increasing rates. In the developed world, equities in the US are favoured on the back of its strong nominal GDP, while earnings should also be resilient, as many companies are able to pass through their cost increases.

- Still cautious on credit. US housing-related securitised markets may be particularly attractive. Credit market behaviour has followed a similar trajectory to equity. High yield (HY) spreads started out weak this year and widened a lot but have since tightened significantly. Currently HY spreads are only slightly wider for the year which, coupled with relatively robust economic growth and low default rates, is not indicative of a serious credit problem. Interestingly corporate credits on the IG side have widened more than HY reflecting a much longer duration. Although it is less expensive today than it was a few months ago, credit must be selected carefully, while better opportunities can be found in the US housing-related securitised markets.

- In terms of duration, it no longer makes sense to remain as short as we have been in the recent past given the latest market movements, and therefore we are tactically adjusting our duration stance. The short end of the yield curve is starting to look attractive, with most of the repricing having already occurred.

Definitions

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Drawdown: The peak-to-trough decline during a specific record period of an investment, fund or commodity, usually quoted as the percentage between the peak and the trough.

- Quality investing: It aims at capturing the performance of quality growth stocks by identifying stocks with high return on equity (ROE), stable year-over- year earnings growth, and low financial leverage.

- Value style: It refers to purchasing stocks at relatively low prices, as indicated by low price-to- earnings, price-to-book, and price-to-sales ratios, and high dividend yields. Sectors with dominance of value style: energy, financials, telecom, utilities, real estate.