Summary

- Political outlook: With the economic situation having deteriorated considerably since the beginning of the year, it is vital for the Conservative Party to agree on a new leader quickly. Boris Johnson has decided to remain in office until the new leader is elected. Leaving without a successor would trigger an early general election, which the Conservative Party does not want due to current unfavourable poll data. A swift transition would be good news for the British economy.

- UK economic outlook: In normal circumstances, political uncertainty is bad news for the economy. But in the current context, the arrival of a new leader with a more predictable and credible economic policy could take the level of uncertainty down a notch. The UK’s economic outlook remains weak, with high inflation persisting. The Bank of England (BoE) may maintain its tightening stance.

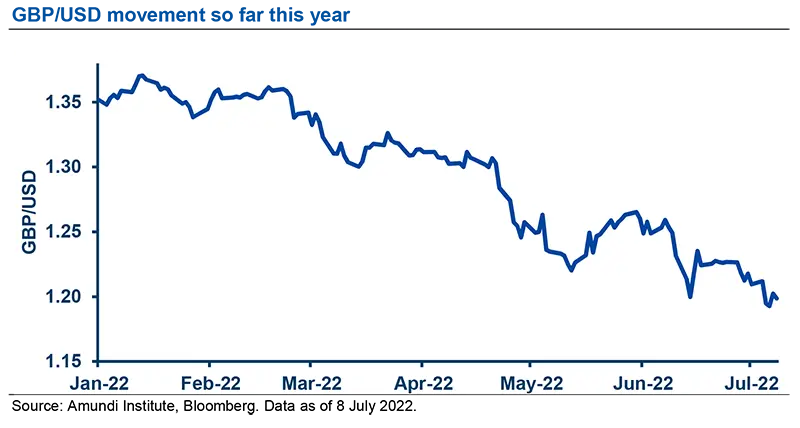

- Market reaction has been muted so far, with a slight movement in GBP lately. But Fed tightening and global recession could weigh on the GBP/USD.

RESIGNATION OF BORIS JOHNSON

After the resignation of Boris Johnson as prime minister, what is your outlook regarding British political development?

With the economic situation having deteriorated considerably since the beginning of the year, it is vital for the Conservative Party to agree on a new leader quickly. A leadership election for the Conservative Party is expected to take place in the coming days/weeks. A more precise timetable should be announced soon by the 1922 Committee, a committee of Conservative elected representatives that oversees the election of the party leader.

Boris Johnson has decided to remain in office until the new leader is elected. Leaving without a successor would trigger an early general election, which the Conservative Party does not want due to unfavourable poll data. The Tories would like to appoint a caretaker PM (eg, the Deputy Prime Minister Dominic Raab) until the Conservative Party finds a successor. But the Conservatives cannot force Johnson out of office until they have elected a new leader. Indeed, a confidence vote was already held in June and the Tories currently have to wait a year to hold another one. Johnson could technically stay in power until September or October, but with no real room for manoeuvre. The Conservatives likely will want to act quickly to avoid this scenario.

Johnson’s succession could pave the way for a candidate that is less confrontational with Europe.

The process of appointing the new leader of the Conservative Party is in two stages. In the first stage, all candidates are considered. Tory MPs vote until only two candidates remain (at each vote the candidate with the fewest votes is eliminated). The final two candidates are then voted on by all party members (currently 180,000), who vote by mail. The winner of this vote becomes both leader of the Conservative Party and Prime Minister.

The most frequently mentioned candidates include: Rishi Sunak (ex-Chancellor of the Exchequer), who resigned this week; Nadhim Zahawi (Sunak’s successor); Liz Truss (Foreign Secretary); Suella Braverman (Attorney General); Ben Wallace (Secretary of State for Defence); Sajid Javid (formerly Secretary of State for Health and Social Care, who also resigned this week); Jeremy Hunt (Chair of the Health and Social Care Select Committee); Penny Mordaunt (Minister of State for Trade Policy); and Tom Tugendhat (Chairman of the Foreign Affairs Committee).

None of these candidates is an obvious choice, although Rishi Sunak seems to be the favourite. Note that the process does not necessarily have to end with a final vote of all party members. In 2016, Theresa May became leader after only two rounds of voting and the process took less than two weeks. In contrast, in 2019, it took almost seven weeks for Boris Johnson to become leader. The Conservative Party will probably try to find a successor before the summer recess of Parliament (on 21 July). If this does not occur, the process will have to resume with the reopening of Parliament (5 September) or even extend till the Tory Party conference in October.

A swift transition would be good news for the British economy. Johnson’s repeated scandals and lies have seriously weakened the reputation and credibility of the Conservative Party. It is therefore very likely that the future leader of the party will seek to move away from the 'Johnson style' to a more traditional approach to governance.

At the end of the day, the PM’s succession could pave way for an improvement in UK-EU relations. Most candidates (even those who were in favour of Brexit) are less confrontational than Johnson on Europe. In particular, it is unlikely that the next PM will want to violate international law, as Johnson did, by proposing legislation to amend the Northern Ireland Protocol of the post-Brexit treaty negotiated with the EU. A normalisation of relations with the EU on this issue would certainly be welcomed by investors.

ECONOMIC OUTLOOK & BoE POLICY

How does this departure affect the economic outlook and BoE policy at a time of rising inflation expectations and increasing recession risks?

In normal circumstances, political uncertainty is bad news for an economy. But in the current context, the arrival of a new leader, with a more predictable and credible economic policy, could take the level of uncertainty down a notch.

The UK’s economic outlook remains weak, with high inflation persisting. The BoE may maintain its tightening stance.

The UK's economic outlook has deteriorated sharply since the start of the year. The risks of recession are further exacerbated by the economic consequences of Brexit. Global inflationary pressures have intensified, driven by soaring energy and other commodity prices. UK inflation is at a 40-year high (9.1% in May) and inflationary pressures will continue to build through to the end of the year with the expected pass-through of higher commodity prices to utility and food prices.

So, monetary tightening is still likely on the cards. This is especially true as the BoE will probably want to demonstrate its independence. However, like the ECB, the BoE will face strong headwinds related to rising inflation and sluggish growth. After ending its QE and raising its main policy rate by 100bp, to 1.25%, the BoE is now looking at not only continuing to raise rates further but also starting to sell Gilts.

Wholesale gas prices in Europe have risen by over 300% year on year. Monetary policy cannot offset a supply shock of this magnitude. However, it must react to combat second-round effects on wages. On the one hand, the compression of real household incomes will weigh on consumption, corporate margins will be squeezed, and the labour market will eventually deteriorate. On the other, however, this economic weakening may not be sufficient to stem inflationary pressures that are at work, which argues for a continued rise in BoE rates in the short term.

Ultimately, we will have to watch for second-round effects. It is the state of the labour market that will best reflect the degree of persistence of inflation for the BoE and dictate its monetary action. If the new government takes compensatory fiscal measures, the BoE will be comforted by its restrictive policy. In summary, increased political stability should emerge despite very-short-term uncertainty. If the new PM succeeds in restoring confidence, the rise in rates could benefit the pound.

INVESTMENT IMPLICATION AND MARKET REACTION

How has the market reacted to the news and what is your view on Gilts and sterling amid rising stagflationary risks?

Market reaction has been muted so far, with a slight movement in the GBP recently. But Fed tightening and global recession could weigh on the GBP/USD.

The leadership contest is causing a surge in political risk, which is increasing the uncertainty around the GBP. While market impact has been minimal so far, sterling rallied slightly on Thursday and Gilt yields declined fractionally. Moves are likely to remain muted till there is more clarity on a new PM.

While the GBP has been on a downward trajectory this year, it didn’t miss the recent opportunity to gain on Thursday amid the potential for a change in political leadership.

Looking ahead, global recession fears and the Fed’s tightening mood are the main factors that could weigh on sterling. We see the GBP/USD rate moving lower in the short term, but expect resiliency vs the euro and higher beta currencies in the G10. However, from a domestic perspective, the UK seems relatively better off than energy importers.

Finally, we think, the BoE is likely to adopt a wait-and-see approach. Rate hikes may continue at the current pace, not speed up, as some monetary policy committee (MPC) members have appeared to favour. Any quantitative tightening would be small and gradual. Gilt yields will continue to be trapped between US and Eurozone yields. However, if a populist candidate looks likely to come to the fore and win the leadership contest, Gilt yields could rise.