The flattening of the US yield curve will depend on the persistence of core inflation and on the impact of monetary tightening on growth. The more resilient the US economy proves to interest-rate hikes, the more aggressively the Fed will have to tighten monetary policy, thereby increasing the risk of recession.

We have gone from ‘bad news is good news’ to ‘good news is bad news’.

For the Fed it is still all about inflation. The Fed remains much more concerned about the risk of inflation expectations becoming unanchored than about downside risks to growth. The Fed is determined to act to bring inflation back to target:

- The committee sees resilient underlying growth and persistent inflationary pressures. According to the Fed, “this is a strong, robust economy.” Despite the growth slowdown, the labour market has proved tight, with the unemployment rate near a 50-year low, job vacancies close to historic highs, and wage growth elevated. Inflation is running hot. At their September meeting, FOMC members revised up their median core inflation forecast for 2022 and 2023 by 0.2pp to 4.5% and by 0.4pp to 3.1%, respectively. They left their 2024 forecast unchanged at 2.3%.

- The committee sees a higher terminal rate and a longer hiking cycle and warned that “restoring price stability will likely require maintaining a restrictive policy stance for some time.” As such, no rate cuts are foreseen before 2024. The median dot now shows a Fed Funds target midpoint at 4.375% at end-2022 and 4.625% at end-2023. Almost a third of the committee members see a peak target range of 4.75- 5.0% in 2023 as appropriate.

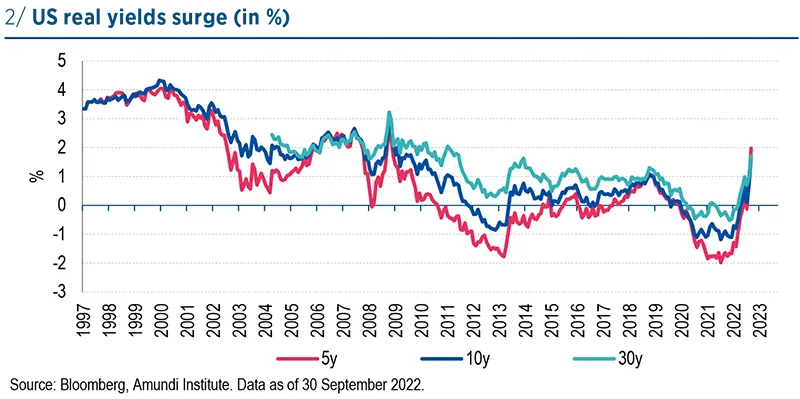

- The Fed wants to continue its restrictive monetary policy. Restrictive territory means positive real rates across the curve, which seems consistent with the Fed’s new willingness to push Fed Funds rates above 4.5% in 2023. “Restrictive means that you will have a positive real Fed Funds rate adjusted for short-term inflation expectations which could be 1 percent or so… it would be significantly positive”.

- Jerome Powell is willing to risk a recession in order to bring inflation back down to 2.0%. Indeed, “the chances of a soft landing are likely to diminish to the extent that policy needs to be more restrictive or restrictive for longer”. The true policy mistake would be to fail to restore price stability, Powell said, but reducing inflation will require “a sustained period of below-trend growth” as well as weaker labour markets, which will cause “some pain” for households and firms. A soft landing scenario implies a rebalancing of supply and demand on the labour market, which does not require an excessive slowdown in economic growth. The soft landing scenario would mean inflation expectations remaining anchored, and a greater supply of labour. “It’s plausible that job openings could come down significantly, and they need to, without as much of an increase in unemployment as has happened in earlier historical episodes”.

We expect the Fed to take further aggressive steps to cool down inflation. “We will keep at it until we are confident the job is done.”

The market expects the Fed to stop hiking rates at 4.5% in early 2023. However, we see upward pressure on this terminal rate assumption, as US core inflation has accelerated further, boosted by a very strong labour market. The US economy is also supported by (1) the recent decline in oil prices, (2) past fiscal policy responses to Covid-19, (3) the past decade of historical low rates, and (4) stricter requirements for granting mortgages after the Lehman crisis.

- The US labour market is extremely tight. The impact of rate hikes on the unemployment rate will be mitigated by the labour shortage. The labour market is clearly out of balance, with demand for workers substantially exceeding the supply of available workers. The gap between available jobs and workers stands at 5.2mn workers, down from a peak of 5.9mn,

but still close to the most overheated level in post-war history. Indeed, early retirement and the aging of the population have shrunk the workforce, while the share of population over 55 has increased. Moreover, people in their early twenties are 3% less likely to be in the workforce now than they were when the pandemic began. Employment levels remain well below pre-Covid-19 levels in the leisure & hospitality, healthcare, and government sectors.

A soft landing scenario implies a rebalancing of supply and demand on the labour market, which does not require an excessive slowdown in economic growth

- The US housing downturn is nothing like the one in 2008. The housing market has cooled in recent months, as US mortgage rates have climbed to 6.7%, their highest level in 15 years. The housing affordability index has dropped to its lowest rate since 1989. New home sales and prices have begun to decline. However, the impact of the doubling of mortgage rates will be partly offset by:

- Low inventories. The United States has been underbuilding housing over the past decade. The lack of new and available residences has been amplified by delays caused by the Covid-19 crisis. The inventory of newly finished homes is 40% below pre-pandemic levels.

- Solid US household balance sheets and accumulated savings.

- High credit quality. Over the past decade, mortgages have been granted only to households with high credit scores.

- A decade of low interest rates helped lower the average cost and increase the duration of corporate debt. The recent rate hike will take some time to negatively impact the average cost of corporate debt. We need to monitor access to the financial bond market.

The flattening of the US yield curve will depend on the persistence of underlying inflation and on the coming impact of monetary tightening on growth. We have moved from ‘bad news is good news’ to ‘good news is bad news’. The Fed is committed to hiking aggressively amidst sustained inflationary pressures and resilient growth.

Its firm rhetoric “to keep at it until the job is done” and its willingness to accept recession risks argue for flatter curves. The two-ten yield curve at -40bp has now reached its peak inversion of the last three cycles.

Nevertheless, we see room for further inversion:

- The two-year yield will remain under upward pressure until we have more visibility on the terminal rate which could continue to drift higher until the economy reaches these three challenging outcomes: 1) much slower growth, 2) labour market showing better supply-demand balance, and 3) clear evidence that inflation is moving back to 2%. In light of the resilience of the US economy, the persistence of inflation and the Fed’s willingness to go into highly restrictive territory, our base case is now for a Fed Funds terminal rate at 5%, above current market expectations of 4.5%. Nevertheless, we see further upside risks to this level.

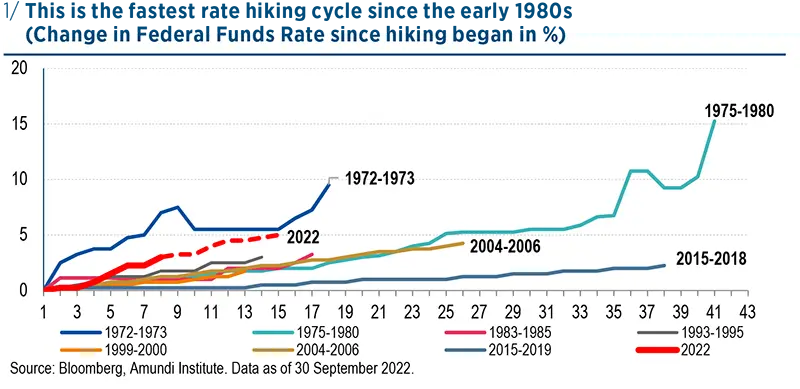

- On the other hand, the Fed is engineering the fastest tightening cycle in history, financing conditions are tightening sharply, and the growth outlook is weaker for 2023, which will at some point put downward pressure on long-term yields.

We are moving from “bad news is good news” to “good news is bad news”