Russia’s recent invasion of Ukraine has focused investors’ minds on the Taiwan issue and the People’s Republic of China’s potential approach to it. We believe that the risk of war remains low.

The People’s Republic of China sees Taiwan as an integral part of its territory. This stance was shared by the Western allies post-WW2 and confirmed by the general global acceptance of the one-China policy over the last 40 years. Hence, it is reasonable to assume that the PRC would like at some point to reunite the governance of Taiwan under Beijing. Xi Jinping himself said in January 2019 that the political division across the Strait “cannot be passed on from generation to generation”. Some observers believe – rightly or wrongly – that the Chinese leader wants to resolve the Taiwanese issue before his rule ends.

This reunification of China nevertheless poses a significant challenge, given that over the years, Taiwan’s governance has evolved to a democratic process. A full integration has been rendered even more complicated by China’s handling of Hong Kong’s integration, which has not been well perceived by Taiwanese people.

Past statements by Xi Jinping, the growing animosity between US and China, and Russia’s recent invasion of Ukraine have focused investors’ minds on the Taiwan issue and the People’s Republic of China’s potential approach to it. The recent visit by Ms Nancy Pelosi was considered by China as a provocation, considering this was a breach of the one-China policy, something the US had formally acknowledged. Fortunately, President Biden apparently made it clear during a 137-minute call with President Xi Jinping on 28 July that he did not approve of the visit and that Washington’s policy towards Taiwan remains unchanged.

We believe that the risk of war in Taiwan remains low, not only for the above reasons but also because:

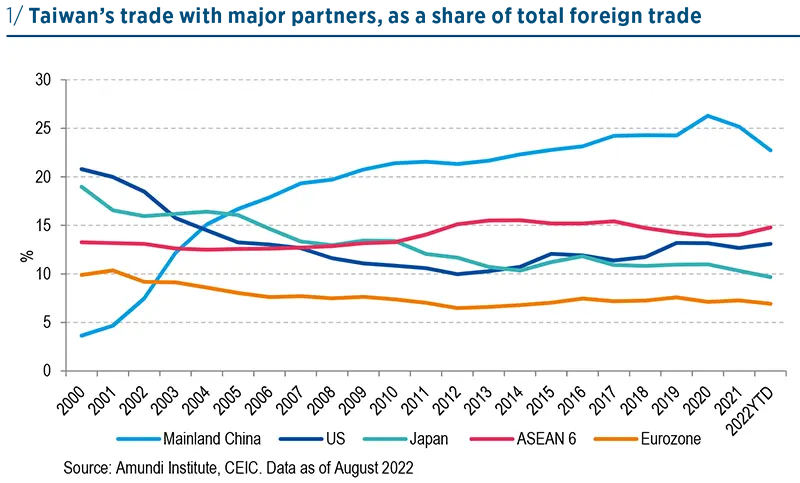

- The economic cost to both China and the developed world would be catastrophic. It would likely bring Europe closer to the US on a global containment strategy, likely triggering co-ordinated sanctions that would lead to a global economic crisis. The Chinese economy would take an immediate direct hit, due to collapse of export demand and production disruptions. For the rest of the world, it would prove to be a huge supply shock of a magnitude much greater than the Ukraine war, pulling down global potential growth. A war would seriously affect as well China’s long-term growth prospects; access to inputs where it is not self-sufficient (such as primary materials and high-tech components for semiconductors) would likely become more difficult, as it would probably lead to a full separation of the Chinese economy from the West.

- Clearly, China’s impressive economic progress over the past 30 years, which has lifted hundreds of millions of people out of poverty to first-world income levels, has been crucially instrumental in the Chinese people’s support of the current regime. In our view, a setback would severely weaken the mandate given by the population, and the nationalist rhetoric will likely do little to make up for a collapse of the standard of living.

- Some military experts believe that China’s military resources are not sufficient to successfully operate landings further than 140 km off its shores (as was the case in Normandy during World War II):

- A war with Taiwan would not result in an appropriation of Taiwanese technology, as material and human expertise would most probably evaporate. More likely, semiconductor factories would be (voluntarily or not) damaged and key people would flee overseas.

- The willingness displayed by Western countries to sanction Russia on every level (individuals, corporates, and FX reserves) is probably a strong deterrent for Chinese authorities, who can only expect a similarly harsh reaction to a Taiwanese invasion.

A war would seriously affect as well China’s long-term growth prospects

We would also assign a low probability to an outright blockade of Taiwan. The main reason is not that it would disrupt traffic in the Taiwan Strait, the world’s busiest container-shipping route, used by 88% of the world’s largest ships, as other routes could be used (even though alternatives are significantly longer and hence much more costly). Our low expectation of a long-lasting blockade of Taiwan is based on the premise that the island is a key part of the global semiconductor supply chain. A blockade would inflict strong economic damages to both China and the West, and hence to the global economy.

However, while we believe there is a low probability from both China and US to willingly start a war, we also think that the risks of potential accidents have risen, as:

- The US is committed to a higher level engagement with Taiwan (ideologically speaking: the democratic world against autocracy, especially after what has happened between Russia and Ukraine);

- Xi’s China is more and more frustrated by the fact that the one-China policy is being interpreted differently by US and its allies;

- The regular communication between China’s PLA and the US military was suspended after Pelosi’s visit.

We believe that the importance of sustainable and high-quality Chinese growth and increasing prosperity has never been more important to the PRC. Indeed, notwithstanding Xi’s recent nationalist comments, there is no ticking clock. It is also true that, notwithstanding the recent more authoritarian direction of the Chinese Communist Party, a regime change or political transformation is not completely inconceivable, given what happened in South Korea, Brazil, Greece,… and Taiwan.

Latest news: the Chinese military said on 10 August that it had completed its exercises around Taiwan but would regularly conduct patrols and drills in the area.