Summary

Be prepared for a regime shift

Today, most investors are at a loss regarding what to think of the notion of value and valuations and, even most importantly, how to use it in portfolio construction. We are at the start of a sort of crisis in confidence regarding valuations (and therefore also fundamentals, as they are interlinked) because few to no valuation indicators seem to be effectively working and irrational forces are perceived to be taking a prominent role in driving financial markets. There is a great disconnect between financial markets and the real economy.

The temptation is to give up on value/ fundamentals as a founding investment principle or to just consider short-term relative equity/bond valuations instead of more strategic absolute metrics.

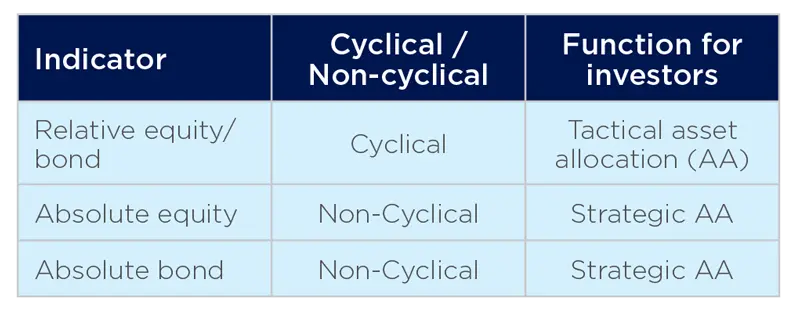

Valuation metrics Indicators

Yet, we argue that long-term absolute valuations are key to building a strategic asset allocation and they are even more relevant in an era of possible regime shifts. What investors need is to further enhance their approach to absolute valuations.

In this respect, we believe they should enrich the traditional approach based on (real) fundamentals (inflation, growth, earnings) with the inclusion of a monetary factor (as a dominant feature of the current transition phase) and narratives as a foundation of long-term expectations. Real fundamental factors, though less prominent in this (monetary oriented) regime, are not less relevant from a valuation perspective if 1) they are approached with a long-term, non-cyclical view in relation to expectations and 2) if they are broken into facts and narratives.

Narratives are adding (or subtracting) to a trend, reinforcing it or pushing it in a different direction. For example, the narrative of low growth/no inflation (secular stagnation) has shaped long-term expectations over the past decade, because it has been public, vocal and visible. Moving forward, the emergence of a ‘back to the ‘70s’ narrative can help modify long-term expectations even before (or beyond) what data shows. This is why it is important to capture the dynamics of narratives and the emergence of new ones as they can help explain a deviation from equilibrium (by equilibrium we mean what is coming from fundamentals as defined by expectations on growth/inflation/earnings). Therefore, we could enlarge the notion of equilibrium to include all the three pillars (monetary factor, real factors and narratives) as explanatory factors. Combining these three pillars can help design scenarios and portfolio actions within a regime and across regimes.

At the same time when there is a deviation from equilibrium and a prevailing narrative signaling a change in regime, this points to an important turning point for investors: this is exactly what we are facing right now.

In the second half of the year, we will likely reach a decisive moment with the acceleration of the vaccine distribution, the reopening of economies and the possible initial effective signals of accelerating growth and some inflation pick-up.

At this point, the current narrative of low growth/no inflation forever will be tested.

This will confirm the dominance of the narrative pointing down the road to the 70s. In fact, today, in the transition phase towards a different regime, for the first time in more than three decades narratives are explicitly expressing a preference for inflation as a way out from the current crisis. In these narratives, inflation has ceased to be a negative. It is a desire. This will likely drive the materialisation of a higher inflationary regime.

When a preference across society and its institutions is being established, experience shows that the prevalent narrative becomes self-fulfilling and this often leads to a new mandate given to central banks. Former Federal Reserve (Fed) chair Paul Volker got his mandate to fight classic inflation when he was appointed in the late 70s. The new generation of central bankers will be asked to address new conflicting challenges, such as absorbing skyrocketing debt while dealing with an asset bubble generated by an excess of liquidity created by central banks themselves. The transition phases unsurprisingly see the co-existence of previous and new mandates. The reassessment of these narratives, and of value, will be a key input when revisiting portfolio construction and it could also offer investments opportunities.

The great divergence

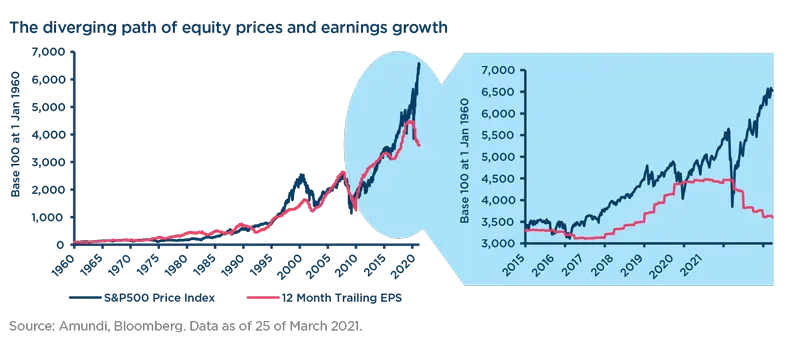

It’s been one year now since the Covid-19 pandemic disrupted the world. It changed our lives, but financial markets seem to have side-lined this dramatic event as a temporary pullback, which was quickly recovered and forgotten as most risk assets achieved new highs. Hopes persist that a “here and now” vaccine will rescue the global economy and overshadow unexciting recent economic data and the uncertainties of the virus cycle. This translates into an unprecedented divergence between markets and the real economy, raising questions about the sustainability of current valuations.

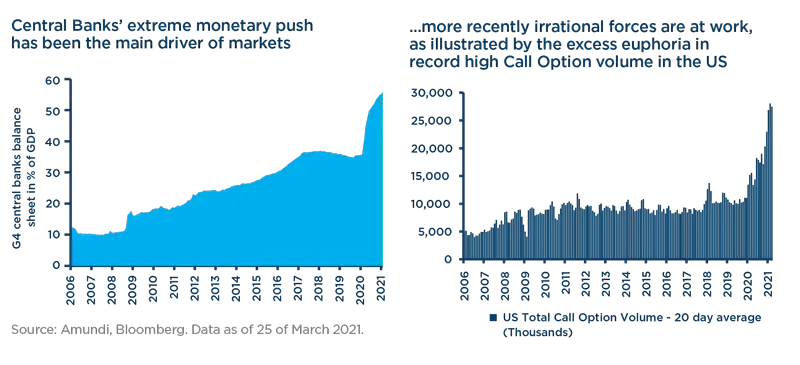

Central banks’ extraordinary monetary reaction to disinflation, and then deflationary tensions, has been the key market driver of the regime that followed the Great Financial Crisis. This has sanctioned the victory of monetary/liquidity factors over real factors. The dominance of the monetary factor and, most recently, the rise of irrational forces in the market, psychological drivers leading to further market exuberance, is resulting in the temptation to give up on traditional valuation metrics or to “adjust” absolute valuation indicators in order to justify the current extremes in the market.

Don’t give up on valuations and fundamentals

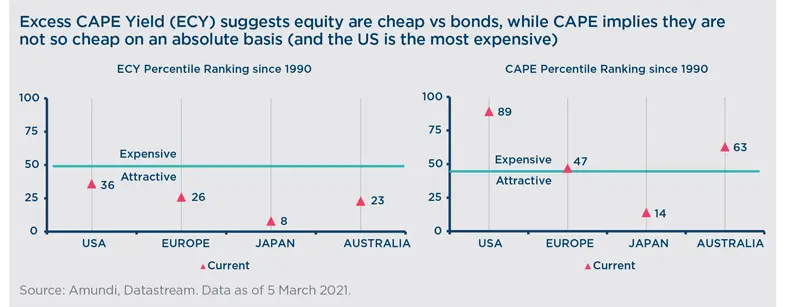

A sign of the times is the fact that even Nobel prize-winning economist Robert Shiller has recently worked on revising his own CAPE indicator to try to make it more accurate and consider interest rates when valuing equities. The new indicator, the Excess CAPE Yield, gives some comfort in the current valuations for equities: no major markets are flashing red in terms of valuations versus bonds. This, however, does not answer the question of whether there is still absolute value in equities, puzzling the most the reading of where markets are today.

Despite this rising scepticism regarding the traditional investment approach based on long-term horizons and valuations, we believe that a long-term perspective is key for investors, and this is even more relevant when we live in a period of transition towards a possible new regime, such as the one we are facing today. What investors need is to enhance their investment approach to include other elements that go beyond traditional economic variables (such as inflation, growth and earnings). In this respect, they also need to consider the monetary factor (policies at work that can distort market behaviour) which remains highly relevant in the current environment and, in addition, a third element: market narratives that can affect either economic variables or monetary policy. In fact, narratives can confirm the direction of the market, but can also push it in a different one.

What the narratives are telling us

When there is a strong market detachment from the economic reality, as it is the case today, a prevailing narrative can signal a change in regime. This leads to an important turning point for investors.

Currently, there are three narratives driving markets. They are interconnected and dynamic as they evolve over time. The one that prevails will characterise the new financial regime.

The deflationary consequences of the 2008 crisis have strengthened the first narrative, the secular stagnation of forever-low growth and low inflation. The foundations of this narrative rely on the long-term memory of what has been the effective story for developed economies throughout centuries into modern times, if we exclude the inflationary episode of the 70s (and to some extent the two world wars). The inflation pressures from protectionism and post Covid-19 value chain disruption, rising demand for a minimum living wage and the monetisation of debt are the seeds of the shift towards a higher inflationary regime, bringing us back to the 70s.

The second market narrative, that is currently sustaining the high valuations in equity markets, relates to earnings growth being pushed by technological disruption (the creative destruction narrative). However, the assumption that earnings growth will deviate upward from its historical trend, thanks to technological revolution, seems unlikely assuming the current trend in labour force growth, stock of capital and productivity and the high share of profits on value added. If this is the case, as we believe, growth will remain sluggish following the first post-Covid-19 bounce and may end up moving back to the “secular stagnation” environment, in which equity markets should readjust to the downside to absorb the current excess of optimism.

However, we believe that the prevailing narrative will be the third option, the monetary one, from orthodox/anchored to magic/de-anchored central banks. Today, for the first time in more than three decades narratives are explicitly expressing a preference for inflation as a way out from the current pandemic. Inflation has ceased to be a negative; it is a desire, as it can help make the debt burden originated by the crisis sustainable. In 2020, global debt has grown to USD24tn and now stands at 355% of world GDP. New priorities for populations and institutions are emerging. The huge debt pile that will weigh on future generations has to serve to help to fight climate change and make the overall economic model more inclusive, reducing inequalities. This mantra is vocal among politicians and central bankers globally and shared by the wider society. This leads to the dominance of the market narrative that pushes for a continuation of extraordinary monetary policy, with central banks further evolving their roles into new territories including green topics (see recent ECB members talking about decarbonising the ECB balance sheet) or targeting inequality (ie the Fed moving into the full jobs market target).

A change of regime often occurs with a change in the mandate of central banks, as it happened in the late 70s, with the arrival of Mr Volker at the helm of the Fed. The transition phase unsurprisingly sees the coexistence of previous and new mandates. This is exactly what we are starting to see today.

Today, the coexistence of the monetary narrative coupled with the consequences of Covid-19 is creating a fertile ground for a shift towards a higher inflationary regime, a sort of back to the ‘70s scenario.

Key take-aways for investors

Acknowledging the importance of looking at all three pillars (monetary factor, real factors and narratives) when assessing valuations, we can draw four key investment implications.

1. Higher inflation challenges traditional diversification, as correlation between equity and bonds turns positive. To build an inflation-proof portfolio, investors should consider increasing their allocation to pockets of assets such as inflation-linked bonds, real assets (real estate and infrastructure in particular) and commodities.

2. In a world of stretched absolute equity and bond valuations, relative value is the only value left in the markets. Investors should look at relative value “within” and “across” asset classes. Absolute return approaches that seek to extract relative value in markets, with limited directional risk, could enhance diversification.

3. The role of equities will be key both in tactical (attractive valuations vs bond) and strategic asset allocation. Despite their stretched absolute valuations they are the “must own” assets, in a world of lower expected returns (due to the lack of returns on the bond side). Investors will have no choice, but to increase equity allocation.

4. A higher inflationary regime will drive a multi-year rotation from growth to value stocks. Lower interest rates, used to discount future profits, have amplified growth outperformance and therefore growth stocks are now vulnerable to higher rates. Investors should focus on sector allocation with a preference for sectors linked to real assets (commodities, energy and infrastructure).

This is not the time to give up on valuation, but instead stick to value in search of opportunities while carefully following the evolution of market narratives. Be prepared, as this is the time to play opportunities in the market.