Summary

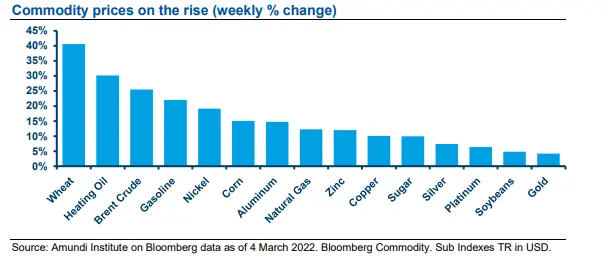

- Markets: At the core of the crisis, Russian assets have become almost un-investible, with dramatic price action as the market attempts to grapple with uncertainty. European equities have suffered, anticipating the negative consequences of the war on corporate earnings, while also commodities trended higher with double digit rise across many commodities. A flight to safety move has benefited government bonds, with the US treasury yield and the Bund yield trending lower.

- Europe in focus: Europe has clearly been the hardest hit by the crisis, due to its commercial ties with Russia. Moving ahead, at the heart of the European agenda will be the need to replace its oil and gas imports with new trading partners and accelerate its energetic transition toward renewables, without causing further inflationary pressures. This should reinforce the European framework.

- China is affirming its role in the new geopolitical order. China official position has shifted from an initial passive role to a more strategically neutral. We believe that China is among the winners in this environment, as Chinese economic cycle is increasingly independent from the US, and Chinese assets and the RMB are seen as diversifier.

- Main convictions: The conflict in Ukraine is likely to have a negative impact on growth, and a certain impact on inflation. Low visibility on the crisis evolution and high volatility means we remain cautious in our asset allocation, with an even higher focus on liquidity amid deteriorating liquidity conditions across the board. Hence we recommend a highly selective approach in bonds and equities with a focus on inflation resilience, which remains the dominant theme.

Market reaction: search for safety as uncertainty is extremely high

The most notable market impact from the crisis is that Russian assets have become almost un-investable. Moscow has kept its stock exchange closed for the fourth consecutive day (for the first time since October 1988), and the rouble has weakened to above 110 on the dollar. Equity markets, particularly in Europe, have been characterized by a spike in volatility and energy prices have likewise been under pressure. We are witnessing a surge in both oil and gas prices with Brent price at $118/b (rising by 25% in one week). Oil is set to remain under pressure as the conflict intensifies. The US start discussing a possible embargo on Russian oil, and possibility to find additional supply. Commodity prices have by and large risen, particularly those for which Russia is a major exporter, such as aluminium and wheat.

Safe-haven moves benefitted the US 10-year Treasury yields back at 1.73% at the close of the week, despite Powell’s reassurance that the prevailing economic uncertainty of war would not destabilize the Fed from its tightening agenda. Ultimately markets are still weighing the sanctions imposed on Russia, notably the exclusion of 7 banks from the SWIFT system, with the exception of the biggest lender Sberbank (which however has exited European markets amid large cash outflows) and the bank part-owned by Gazprom. The prohibition will enter into force on 12 March and will also apply to any legal person, entity, or body established in Russia whose proprietary rights are directly or indirectly owned for more than 50% by the aforementioned banks.

Crisis scenarios: time is not Putin’s ally, as he faces mounting external and internal pressures to find a quick resolution to the conflict.

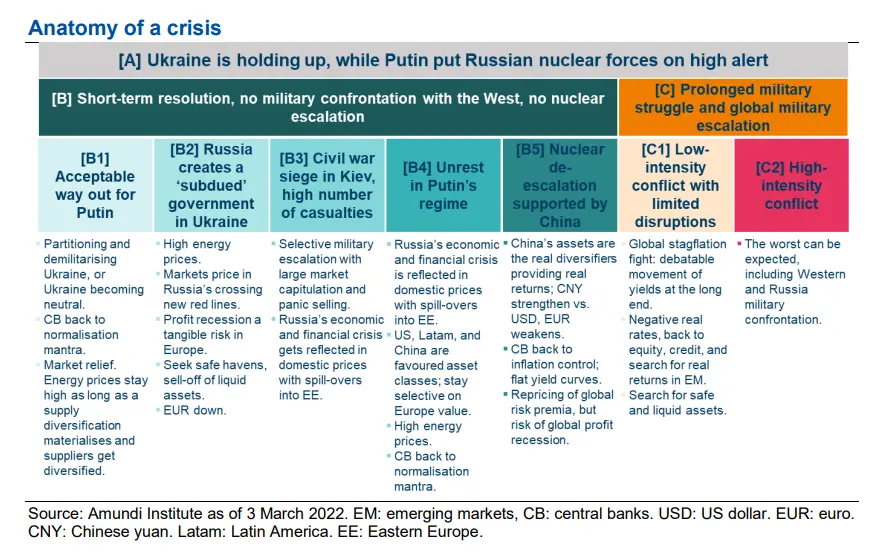

On the internal front Putin faces pressures on three sides: from the Russian population burdened with the prospect of hyperinflation and depleted savings, from the army in view of mounting casualties, and the oligarchs targeted by Western sanctions. As the situation stands we can envision either a short-term resolution or a longer-term path. In both cases there can be several outcomes, with a greater or lesser amount of military involvement and economic disruption, which is difficult to foresee. What is clear is that even a short-term resolution will likely result in a prolonged period of higher volatility and real interest rates persistently in negative territory, though likely to increase again over time.

There are multiple scenarios for the continuation of the crisis. What is certain is that volatility will persist and real interest rates will remain in negative territory for a while.

In the longer term, certain market readjustment themes should also be considered, such as:

- The implication of sanctions freezing dollar and euro transactions. We can expect to see increased diversification, potentially benefitting the Renminbi and gold.

- The energy-independence theme will emerge reinforced from the crisis, benefitting alternative energy demand.

- Oil and gas prices are set to remain higher for the oncoming months, further contributing to the inflationary pressures.

China’s role: in light of evolutions in the Russia-Ukraine confrontation, China sees the opportunity to step up its role.

As the crisis bears on, China’s official position has shifted from restrained and passive side-line observer to more strategically neutral. In response to military escalations, Beijing began advocating for peace talks in favour of a ceasefire, and the first diplomatic meeting held between Chinese Foreign Minister Wang Yi and his Ukrainian counterpart Dmytro Kuleba took place on the 1st of March. We have also seen the first batch of Chinese repatriation from Ukraine as the short-term situation is expected to become worse before it gets better, and accepting a quick resolution is no longer an option on the table. The local public view in China is also changing, focused now on the humanitarian crisis in Ukraine.

We may see China playing a more visible and larger role as it seizes the opportunity to do more in this challenge. Looking ahead, China will want to increase its self-sufficiency in key technologies, and to insulate itself from possible financial sanctions. The country is concerned with global stability and therefore it might play a greater role in the mediation for e ceasefire. Moreover, China’s and Russia’s interests are far from perfectly aligned, and the weakening of the EU (a major trading partner for China) is not in the former’s interests. Overall China is among the global winners. Its economic cycle is increasingly independent from the US, which could prove an important support for the RMB and Chinese assets.

China may play a greater role in the crisis as mediator. China is also going to be among the global winners in a fragmented world.

Looking West: the US has been more insulated from the crisis, whereas Europe is the hardest hit, and is revising its agenda of priorities.

The implications for Europe are broader than for the US. Russia is the EU’s 5th trading partner accounting for 5% of EU trade, while it is only 30th for the US with 1% US trade coming from Russia. Additionally the US benefits from being energy-independent. Commodities are poised to play an especially important role in this regard:

- Oil: Russian exports to Europe are in the region of 4 Mb/d (approximately half of total exports, while total production is around 10 Mb/d). To put this into context, that amounts to almost 30% of Europe’s oil consumption. This will barely be replaced in the near term by OPEC. An Iran agreement is a potential game changer as, prior to sanctions, Persian exports were around 2.5 Mb/d with analysts estimating 1.5 Mb/d in case of an agreement. With a few exceptions there exists today a general reluctance to buy Russian oil, and the global shortage and price pressure will last in the near term.

- Wheat: potential disruptions in Ukraine are more relevant for Europe. Imports are significant in corn (estimated at 2.6B) but also in other vegetables totalizing around 5 Billion. European agricultural imports from Ukraine are almost half of oil imports from Russia in USD.

- Palladium: offers a complex picture. Russian exports are estimated at 6.5 Billion (1/4 of the world total) with 3 Billion estimated toward Europe. Hence Europe’s dependency is huge, with no meaningful potential for import diversification.

- Natural Gas: is the crux of the issue. Europe imports 40% of its gas from Russia. We know from our climate change simulations and active climate policies there exists a need to replace coal with gas, boosting demand for the latter. Even without Russian retaliations the expected environment for 2023-24 will be even more challenging considering the total amount Europe requires to restore inventories for the next winters.

While the US economy is more immune to the shock, Europe faces higher stagflationary pressure.

As the most affected area Europe must quickly revise its agenda, placing greater focus on energetic independence, a common defence, and rising short term economic risk:

- Stagflationary pressures in 2022-23 can result in an earnings recession, clearly affecting companies which are most exposed to Russia.

- We are witnessing a U-turn in European defence policy, heading toward a big increase in military spending in the coming decade, and a reversal in the fiscal doctrine.

- In the short term the ECB is trapped by QE, and is unable to carry out the policies it would like to in the current environment.

- Energy diversification and climate transition imply higher inflation. Although there has been an acceleration in energy transition toward renewables, Germany will rely on coal for many years, and Europe must diversify away from Russia.

- The risk of a migration crisis: numbers are growing significantly day by day and now refugees are just below 1.5 million. The EU expects this will rise to 7 million if the conflict does not end soon.

Longer term the European framework will be boost by rising common priorities (energy diversification and common defence).

Investment convictions: stay cautious as volatility will persists and increase focus on liquidity.

The current geopolitical crisis is likely to get worse before it gets better and therefore we remain cautious in our allocation. We hold a slightly cautious view in equities (amid hedges in places) and a neutral stance in credit where we see strong discrimination among names. Credit has sold-off sufficiently since the beginning of the year to be attractive on a prospective 12-18 month view. The biggest medium term risks relates to the rate path and inflation dynamics, rather than credit quality, which we believe will remain broadly stable.

In HY, markets have recently experienced significant disinvestments by non-dedicated highyield investors, and should see higher credit risk tolerance and price stability going forward. We believe that dedicated high yield investors will create inflow once we get some market stability, while the new issue calendar/new supply should remain restrained. This could offer some selective opportunities in this space. In the IG asset class, the BBB credit area is the sweetest spot for rates resistance and carry. Lower quality investment grade has suffered relative to higher quality credit and offers decent carry. IG subordinated debt has sold off, and is oversold in our view. Again we expect geopolitics to get uglier for the time being, and would therefore look very selectively into this space.

Liquidity has been deteriorating across all main asset classes. In general, futures and other derivatives being more active than underlying instruments. Thinning liquidity has also meant market depth - the ability to absorb large orders without significantly impacting prices - has worsened across the board. Bid/ask spreads are now similar to levels seen in the midst of the Covid shock. This trend affects not only equity and credit, but also rates markets. Signs of stress are beginning to emerge in US rates markets with some indicators of market depth deteriorating. The Bloomberg US Government Securities Liquidity Index, which measures deviations in yields from a fair-value model, remains near yearly highs (see figure below). While there are not yet significant level of stress in trading condition, we believe it’s important to increase the focus on liquidity.

Liquidity has been deteriorating across the board.

Definitions

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Credit Default Swap (CDS): A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event.

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Dividend: A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- High yield: High yield paying bond with a low credit rating due to the high risk of default of the issuer.

- SWIFT payment system: The Society for Worldwide Interbank Financial Telecommunication is a cooperative society that serves as an intermediary and executor of financial transactions between banks worldwide.