Summary

- Global markets were not pricing in a war scenario and are now adjusting given the magnitude of this military move. It will take time for the situation to settle down. In the meantime, uncertainty and volatility will persist, with the possibility of seeing some excesses to the downside. This is not a time to try to buy the dip, as the market does not yet fully understand the impact of this geopolitical shock.

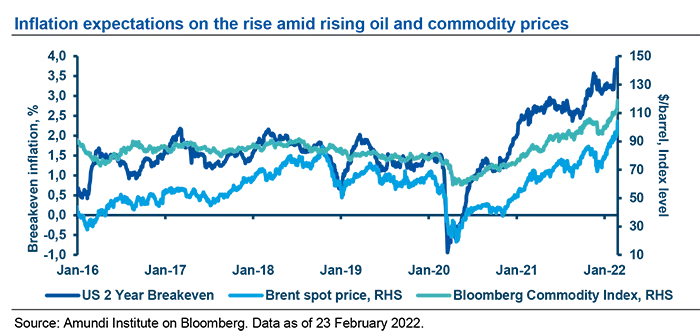

- The escalation in geopolitical tensions between Russia and Ukraine adds uncertainty to the global outlook at a time when central banks are acting to fight inflationary pressures. The impact of the Russia-Ukraine conflict is primarily on confidence and through commodity prices in an already-hot inflationary environment. The risk of stagflation globally is now higher (inflation factor gets reinforced while the growth factor weakens), while China is relatively insulated from this, further reinforcing the role of Chinese assets as diversifier.

- Overall, we believe it is time to keep hedges in place and stay cautious, but not overreact to excesses that we will likely see in the coming days. Some duration, gold and safe-haven currencies can provide a cushion to risk assets. Equities, which have ample liquidity, will be the first target of risk reduction for markets and credit will likely follow. Overall, keeping cash buffers and a high focus on liquidity will be key.

- As we don’t expect a fast resolution of the situation, we see rising probability of further repricing across global risk premia Central banks actions will be even more key. Their agendas could change in case of increasing effects on the growth outlook.

Market reaction: The worst-case scenario of a full blown attack to Ukraine has materialised. It’s risk-off on Russian assets; global risk assets are under severe pressure.

The worst-case scenario of a Russian attack on Ukraine with the aim of demilitarising the country is now a reality. The probability of escalation had clearly risen in recent days, and this explains why we have recently increased the focus on hedges and turned even more bearish on Russian assets in a cautious move.

Yet, global markets were not pricing in a war scenario and are now adjusting to the magnitude of this military move. It will take time for the situation to settle down. In the meantime, uncertainty and volatility will persist, with the possibility of seeing some excesses to the downside. This is not a time to try to buy the dip, as the market does not yet fully understand the impact of this geopolitical shock.

So far, the big risk-off move is on Russian assets declining dramatically, prompting the Russian exchange to halt trading. The Russian Moex equity index is down 50% from the October highs and the ruble has weakened further against the dollar, to 86.

Regarding global markets, we observe high demand for protection, with cost of credit insurance and a flight to safe-haven assets on the rise, in particular gold, which had moved above $1,940/ounce at the time of writing. The US dollar, Swiss franc and the Japanese yen also moved amid strong safe-haven demand. Regarding US Treasuries, considered safe assets, the reaction has been contained so far: yield has fallen below 1.9% as the expectations of a hawkish Fed given high inflation is limiting the fall in yields. Also, Bund yields are retreating, moving back to zero.

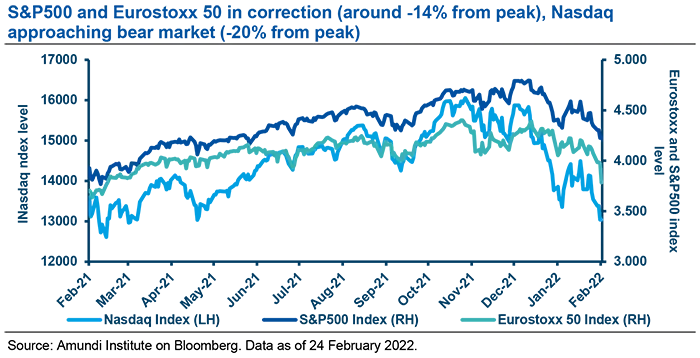

Volatility has increased materially: the VIX spiked this morning, to 36, and global equity markets are down, but we are not yet seeing fire selling. Asian markets closed down (-1.8% Nikkei; -3.20% Hang Seng), and European and US markets are falling at the time of writing.

We believe this is just the first leg of adjustment in a process that could persist in the next weeks, depending on the evolution of the situation. Markets will reassess the situation in particular with regard to:

- Sanctions and their implications. We expect much harsher sanctions to follow from Europe and the US, harming the ability to trade Russian assets, therefore potentially causing further disruption in these markets. We don’t expect to see major retaliation related to energy, as this is not in the interests of either Russia or Europe.

- Oil price and commodity dynamics are key variables to watch. Oil prices jumped above $100/bbl for the first time since 2014. We will see an increase in negotiations to ensure sufficient supply to avoid an oil shock, with the possibility that Iran and Saudi Arabia open up reserves. An oil rise is a major source of inflationary risk at a time of already-hot global inflation. In addition, Russia is a global producer of other commodities (palladium, platinum and wheat for which Ukraine is also a top producer), where prices also are surging, adding inflationary pressure.

- Rising probability of a stagflationary scenario – in particular, in Europe. Europe is clearly more vulnerable to this geopolitical clash. This raises the risk of stagflation at a time when the ECB appears willing to continue its reduction of Quantitative Easing. Heavy reliance on natural gas from Russia for electricity production could represent a major risk in terms of a further drag on consumer purchasing power and higher input costs for companies. Regarding sector exposure, the most key Russian supplies to Europe are basic metals, chemical products and basic manufactured products, and in the current environment of still-high supply bottlenecks, high commodities prices, and more in general elevated input costs, this situation could represent drags for the EU economy in several sectors, especially those with high energy usage. Inflationary pressures will mechanically intensify with higher commodity prices, increasing the risk of stagflation and challenging ECB action. The need for diversifying the energy supply and gaining autonomy in strategic sectors is now critical within the European political agenda as is the need to increase common military spending for defence.

- Reassessment of central bank policies. A direct effect of the escalation in the Russia-Ukraine crisis is an increase in energy prices, which adds to inflationary pressures. However, a deterioration in the economic scenario will make it more difficult to act boldly.

- Global geopolitical equilibria will be redesigned, as will be the role of Nato.

Central banks will have to deal with higher inflation at a time of rising risks on growth outlooks. The risk of policy mistakes is rising

Investment convictions

While markets readjust to the shock and assess the inflation and growth spillovers, we expect volatility to stay high. It is a time to keep hedges in place and stay cautious, but not overreact to excesses that we will likely see.

At the overall allocation level, it’s time to keep hedges in place, with some tactical readjustments.

Protection is currently working, and as the market moves, we will need to readjust to even possibly lower downsides. Some overshooting in protection costs (for example, on the credit market) may also provide opportunities for some tactical readjustment. Nevertheless, this is not time to underestimate the possible escalation and remove hedges.

Overall, we continue to stay cautious.

- Within EM, we have become even more cautious on Russian and Ukraine, and the ruble amid the risk of sanctions disrupting market liquidity. A critical point to follow is whether the index providers, MSCI and JPMorgan, could decide to kick Russian assets out of the index, forcing further unwinding of positions.

- In global fixed income and EM bonds, we have tactically become more constructive on duration (within a still short duration stance), as they act as safe-havens and help hedge risk assets exposure. In the past few days, we have also put in place protection in credit through CDS.

- In equities, we are monitoring single stocks exposure to Russia and we are continuously focusing on the inflation theme as a core driver.

- We continue to strongly monitor liquidity across the board. Market liquidity conditions appear to be resilient so far, with only small reductions in some EM and credit space, (expect for Russian assets where liquidity is disappearing).

Some duration, gold and safe- haven currencies can provide a cushion to risk assets

Looking ahead: Focus on how the evolution plays out and expect to make some further readjustments.

Is it difficult to see a fast resolution of the situation. This shock adds to the inflationary situation and harms growth outlook – in particular, in Europe. Equity volatility will stay high, as given the high liquidity profile of equities, they will be the first target in case of fast risk adjustment. Central banks actions will be even more key. Their agendas could change in case of increasing effects on the growth outlook.

The inflation theme is even more in focus, further adding to the need to look at portfolio construction through the inflation lens

How broad will the readjustment of risk premia be, beyond Russian assets, is the key question now. We expect to see some further adjustments at least to cope with the fact that the probability of stagflation has increased significantly – in particular, in Europe, the most exposed market. Investors will have to cope with the challenge of building an allocation keeping in mind two scenarios that could materialise. One is more positive, with inflation rising further and growth remaining resilient based on no major disruption from the conflict and still positive momentum from the economic recovery post-Covid. The other is more negative, with a growth and inflation shock. All this points to keeping some positioning for the best (mainly with equity exposure) but preparing for the worst (adjusting hedges to even more unfavourable developments) outcomes. The inflation theme is in any case reinforced, further adding to the need to look at portfolio construction through the inflation lens.

Definitions

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Credit Default Swap (CDS): A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a loan default or other credit event.

- Credit spread: Differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration possible embedded options.

- Dividend: A sum of money paid regularly (typically annually) by a company to its shareholders out of its profits (or reserves).

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- High yield: High yield paying bond with a low credit rating due to the high risk of default of the issuer.

- SWIFT payment system: The Society for Worldwide Interbank Financial Telecommunication is a cooperative society that serves as an intermediary and executor of financial transactions between banks worldwide.