Summary

Private markets

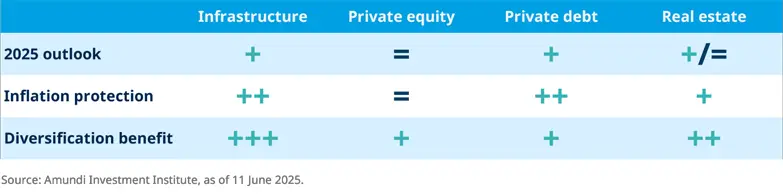

Private markets: infrastructure and private debt will likely continue to attract flows and may deliver performance.

A bottoming process should gain traction for real estate and private equity over H2.

While noise from policy shifts may decrease after the summer, we expect uncertainty to remain high, leading to above-par volatility. Tariffs might become more targeted, potentially denting global growth; however, a recession is likely to be avoided due to the shift toward more business-friendly policies in the US as Trump starts to eye the mid-term elections. Inflation is likely to remain uncertain due to policy changes in trade, fiscal stance, and immigration. This may delay Fed easing, while other central banks should have more flexibility to act.

We thus anticipate increased corporate activity and deal flow, albeit constrained, with a gradual recovery in corporate risk appetite. Liquidity and credit conditions are expected to stay healthy, although US interest rates could remain elevated longer than in other regions. Investors will likely become more selective, with differentiation between segments affected by policy shifts and those that remain insulated. Investors will continue seeking enhanced portfolio diversification, benefiting private assets. We expect the industry to further adapt to growing demand with new means, such as evergreen funds or secondaries, to provide more liquidity and dynamic allocations. Selectivity will be the name of the game amid huge capital flows into these markets.

Private equity remains under pressure from limited deal flow and modest corporate activity, but valuation opportunities may help establish a bottom. Fundraising is constrained by uncertainty, and the trend toward smaller deals is expected to continue, with low exit activity, especially through IPOs. However, secondary markets are likely to further expand as investors seek liquidity. A stabilising corporate risk appetite could lead to increased private transactions in H2.

Private debt is expected to show resilience thanks to declining rates and benign credit conditions, especially in the EU, amid volatile listed bond markets. Fundraising started strongly this year, particularly in EU, driven by direct lending and distressed debt. While the policy environment remains a drag, private credit's floating rates, higher seniority, and stronger protections are likely to continue to attract interest.

In Real Estate, a bottoming process is gradually taking shape, creating valuation opportunities, particularly in the EU. Yields have stabilised in prime locations. The retail segment will likely stay resilient, while the office sector should stabilise for well-located assets. In contrast, logistics is facing challenges due to supply chain and trade stresses. Residential and healthcare sectors, benefiting from demographic trends, continue to show strong fundamentals.

Infrastructure continues to attract investors seeking protection against inflation, driven by trends in energy security, reshoring, and AI. While geopolitical and US policy shifts may affect deal activity, the sector should stay resilient, as private capital is key for critical projects, particularly in Europe.

Private Markets views for H2 2025

Hedge funds

Healthier backdrop in H2

Hedge fund returns have remained nearly flat year-to-date (-0.3% for the HFRI FoHF as of April). CTAs and Special Situations lagged, while Global Macro, L/S Equity Neutral, and EM-focused strategies outperformed. Easing policy uncertainty may facilitate broader themes with more fundamental pricing, but investor caution could limit market directionality. Overall, the alpha backdrop is likely to be better than in H1, albeit constrained. We still favour L/S Equity Neutral, EM FI, and Global Macro, and we now see more appeal for L/S Credit.

L/S Equity: A return to normalcy opens more micro trends, but with limited potential. Stock correlations have reverted to average, indicating more catalysts but also limited dispersion due to investor hesitance. Consequently, stock-picking opportunities have improved, but they still lack depth. We anticipate more sector trading amid shifting US policy focus and favour neutral styles.

Merger Arbitrage: M&A activity has proved resilient, with average deal sizes rebuilding, particularly in tech, but focusing on more conventional operations. Tighter deal spreads point to average conditions in H2.

L/S Credit: Alpha is improving as credit stress reduces cross correlations. Valuation opportunities look modest, but net carry remains supportive. We favour EU managers, who are displaying greater confidence and focusing on safer papers while capitalising on deep value securities.

EM Credit: Provides access to beta at an attractive risk/reward, amid easing trade uncertainty, the prospect of EM rate easing, and a weaker dollar. Net carry also remains appealing. However, we expect mediocre pure alpha potential, as evidenced by flows concentrating on broad indices rather than more targeted EM segments.

Global Macro: We see a more favourable backdrop, with a focus on traditional macro drivers. We see more market timing in FX markets, with plentiful correlation anomalies, as bonds and gold become range-bound. Conservative managers’ positions limit downside risks.

CTA: Improved market directionality and reduced contrarian behaviour should provide more support in H2. However, investor caution may limit full trend-following deployment. A low degree of conviction regarding the quality of market trends in the next few months keeps us neutral.

Hedge fund views for H2 2025

Get the full picture

| A rewiring of the global economy is forcing investors and policymakers to proceed with caution. |

Get more insights

|

|

| ||

India and EM winners of the rerouting shift | Time for Europe | "The Great Diversification" is underway | ||

| Read the article | Read the article | Read the article |