Summary

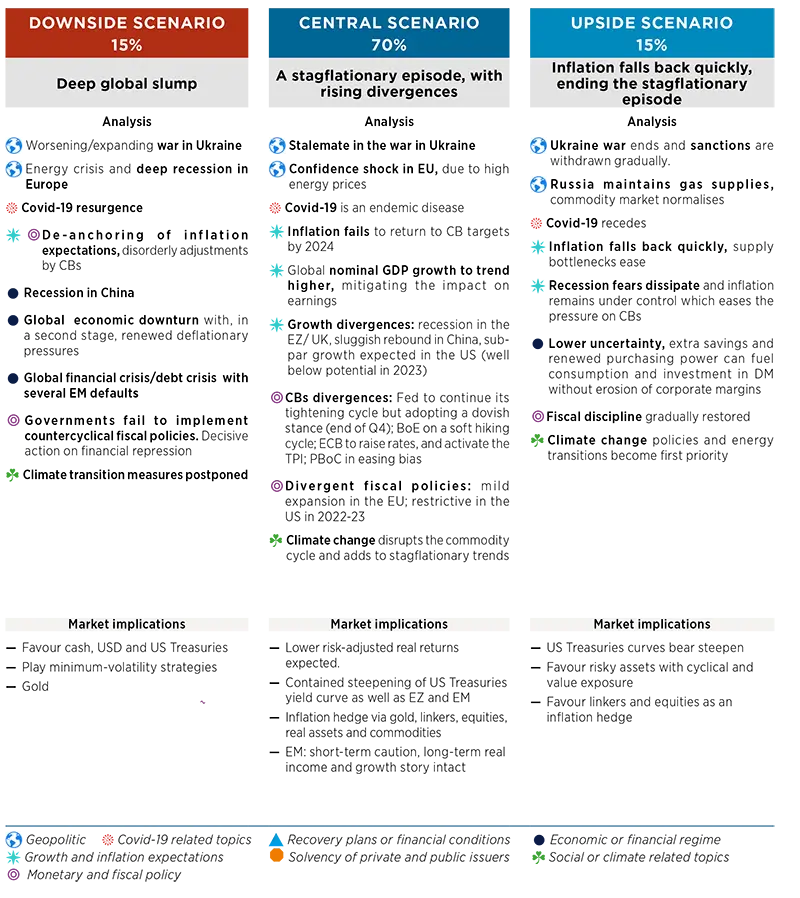

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We have reviewed the content and probabilities of our scenarios. First of all, we have included in our central scenario some of the risks that are materialising (e.g. stagflation in Europe) and that were previously included in our downside scenario. Against this backdrop, the probability of this scenario increases (from 60 to 70%). The downside scenario is also becoming much darker (global recession /debt crisis). And it is now counterbalanced by a new upside scenario, that of a rapid decline in inflation due to an easing of gas prices.

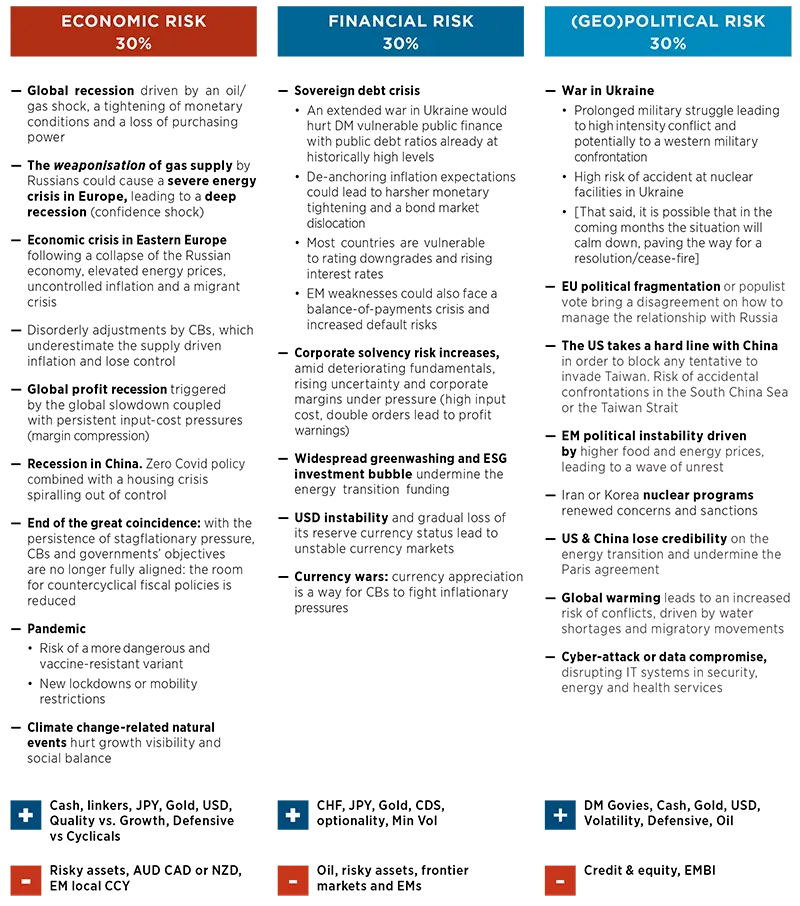

TOP RISKS

Monthly update

We keep the same probabilities for the three families of risks. We see risks growing on all fronts, closely linked to each other. Economic fundamentals are deteriorating globally (which is reflected in the central scenario). The course of the war in Ukraine and its potential implications can tip the scenario in either direction. We consider Covid-related risks (including lockdowns in China) as part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously related.

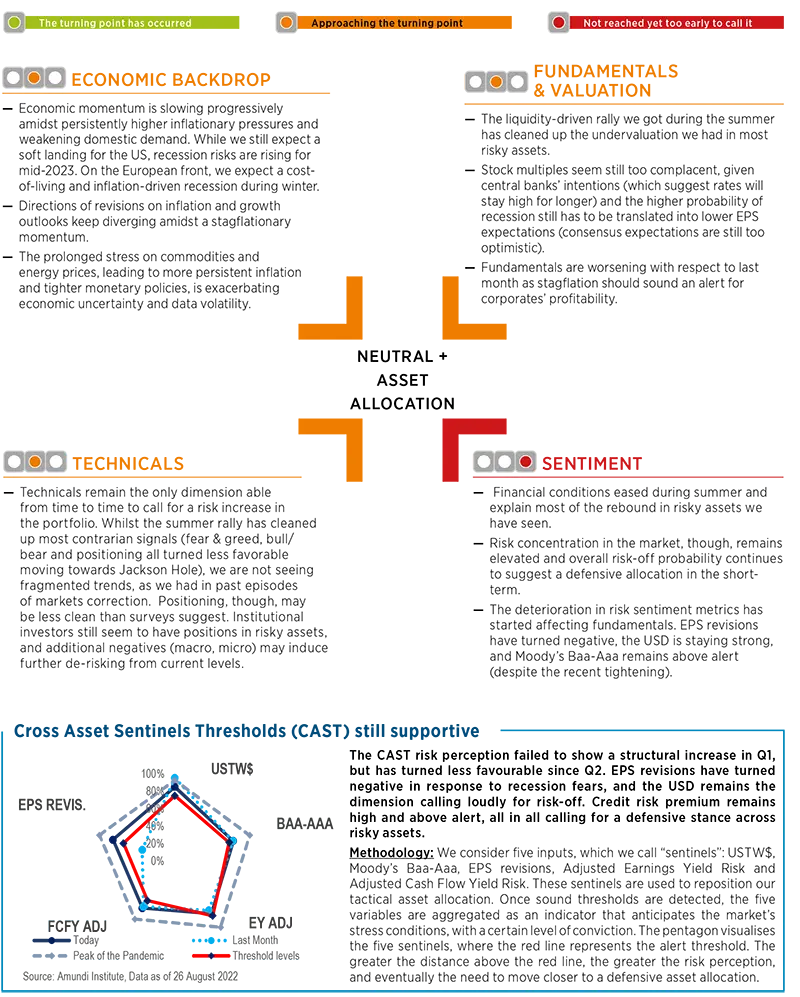

CROSS ASSET DISPATCH: Detecting markets turning points

GLOBAL RESEARCH CLIPS

1| US macro forecasts revision: ongoing growth deceleration

- Growth deceleration is not yet due to the Fed’s tightening policy. Yet a soft landing is possible and the risk of a full-blown recession in mid-2023 is non-negligible.

- US growth forecasts lowered on weaker consumption and investment (2022 GDP growth to 1.6% from 2.2%, and 2023 GDP to 1.0% from 1.5%).

- The labour market remains strong, but cracks are surfacing.

- High inflation is here to stay, notwithstanding loosening bottlenecks and easing pricing pressures.

- The Fed remains committed to hiking rates, by 75bp in September, followed by three consecutive 25bp hikes, leading to a terminal rate of 4.0% by February 2023.

Investment consequences

- Maintain an underweight on global equities due to further deterioration of the economic backdrop in 2022-23.

- Tilt towards high-quality credit and inflation-sensitive asset classes such as inflation-linked and commodities.

- Long USD vs. most G10 FX, potential for the EUR/USD cross exchange rate to move to 0.94 in the short term.

2| Europe: recession led by cost of living crisis is expected in 4Q22 / 1Q23

- Inflation in Europe is expected to peak over the forthcoming winter season to near double digits (due in part to Russia’s weaponisation of gas).

- Eurozone countries will suffer a direct impact from gas supply, inflation and second-round effects from Germany’s recession.

- The stagflationary shock will be extended, amid limited fiscal room, weaker global growth, and globally tighter financial conditions, leading to a recession in autumn-winter.

- We now expect the Eurozone’s real GDP growth at 2.9% in 2022 and 0.3% in 2023.

- Germany and Italy are expected to be hit the most, with France suffering relatively less. Spain is the least exposed but still not immune.

Investment consequences

- The ECB’s terminal rate is seen at 1.00-1.25% by year-end thanks to two consecutive 50bp hikes (September and October 2022), followed by one 25bp hike in Dec 2022.

- We remain cautious on peripheral debt and euro credit, as current valuations do not price in a long-lasting deterioration in the Eurozone energy sector.

3| Q2 earnings season update: strong Q2 EPS supports countertrend rally, but results are of ‘low quality’

- Q2 EPS came even stronger than the market’s high expectations, but margins are narrowing.

- EU results are largely driven by the energy sector, inflation, and currency weakness.

- US Q2 EPS YoY growth is expected to turn negative, excluding the energy sector.

Investment consequences

- Resilient earnings are not a sufficient reason to turn more bullish on equities at this stage. We are maintaining a cautious stance on equities.

- We favour US equities over the Eurozone.

4| Private equity and real estate: illiquidity risk premium should help

- Real estate prices are vulnerable to higher interest rates. However, this is unlikely to lead to a 2008-09-style meltdown.

- Monetary policy tightening and nominal GDP deceleration will drain liquidity in 2023, paving the way for de-risking and a focus on illiquid defensive assets such as private debt.

- The illiquidity risk premium has historically paid off in this environment.

Investment consequences

- The liquidity drain expected in 2023 should favour illiquid and defensive assets, such as private debt, replacing HY credit allocations.

5| China: factor in a greater housing slowdown

Recovery still the central case and a recession is not in sight:

- The economy recovered further in July and August, albeit with momentum slowing notably from the jump in June.

- Domestic demand indicators were sluggish across the board, reflecting an overall lack of confidence in the private sector.

- The housing downturn, complicated by sporadic Covid-19 restrictions, is weighing on China’s economic recovery, dampening fiscal and monetary easing efforts.

Housing: too late and too reserved

- Housing sales have remained on a sharp downtrend and the central government has stepped up its support.

- Yet measures to boost demand have already entered an ultra-loose era (governments already relaxed purchase restrictions months ago and mortgage rates are at multi-year lows).

- We expect a bigger housing contraction from August to December, at -20% YoY vs -8% YoY expected in July.

We are downgrading our 2022 annual growth target to 2.9% from 3.2% and to 5.2% from 5.5% for 2023

Investment consequences

- Maintain long MSCI China, HSCEI and HIS.

- Neutral on Credit and long on China.

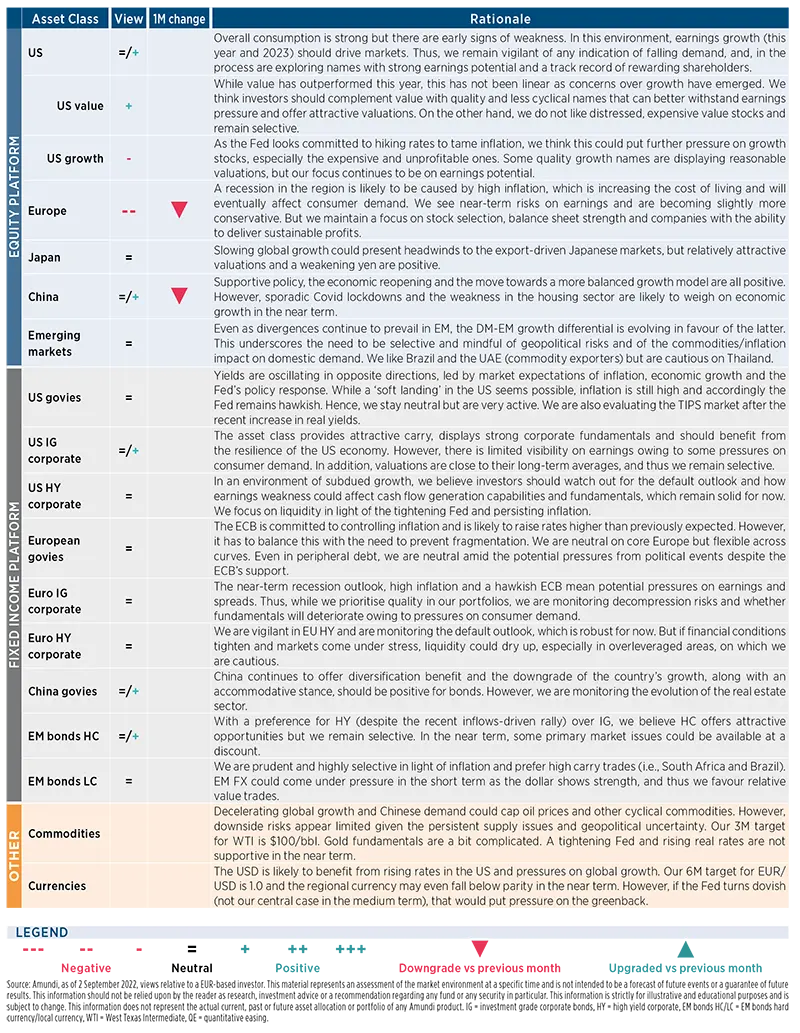

AMUNDI ASSET CLASS VIEWS