Summary

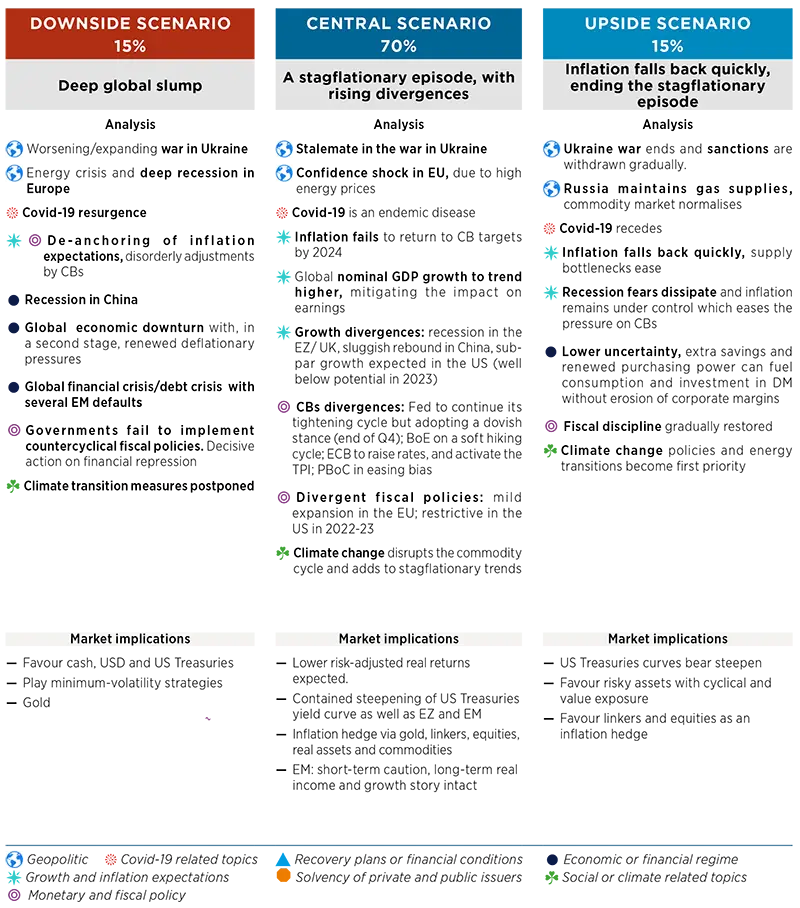

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We maintain the content and probabilities of our scenarios. Note that some of the risk factors we identify may occur in our central scenario, which is probably not yet fully priced-in by markets. It would take a combination of risk factors for the downside scenario to materialise. The downside is counterbalanced by an upside scenario, that of a rapid decline in inflation due to an easing of gas prices and/or to the combined tightening of global monetary policies, the impact of which can be underestimated.

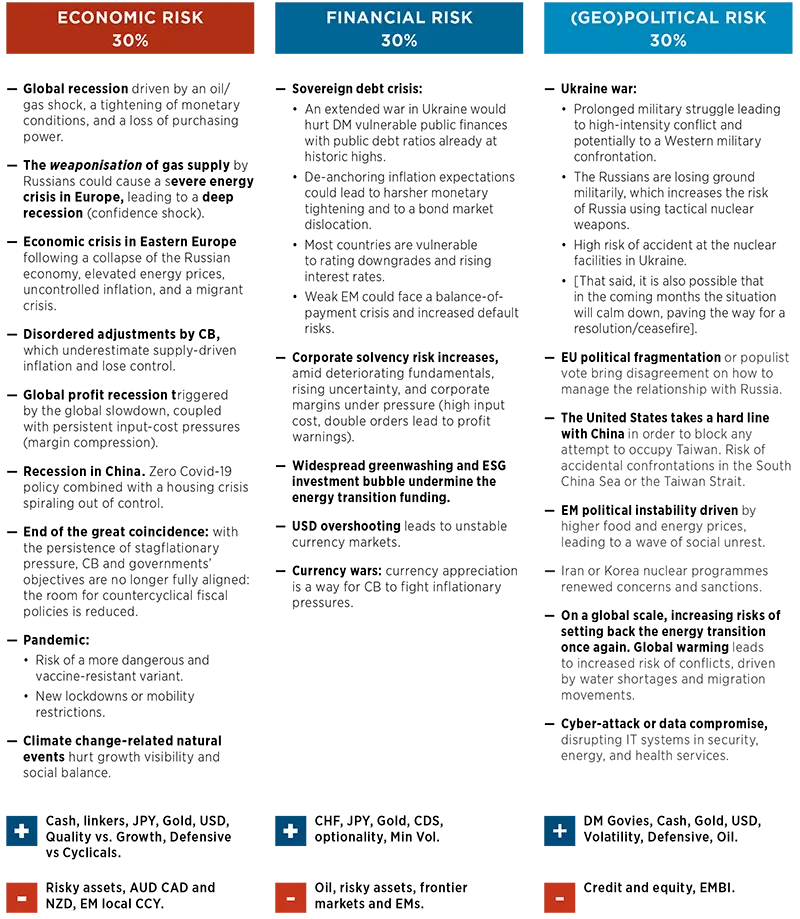

TOP RISKS

Monthly update

We keep the same probabilities for the three families of risks. We see risks growing on all fronts, closely linked to each other. Economic fundamentals are deteriorating globally (which is reflected in the central scenario). The course of the war in Ukraine and its potential implications can tip the scenario in either direction. We consider Covid-related risks (including lockdowns in China) as part of the economic risks.

Risks are clustered to ease the detection of hedging strategies, but they are obviously related.

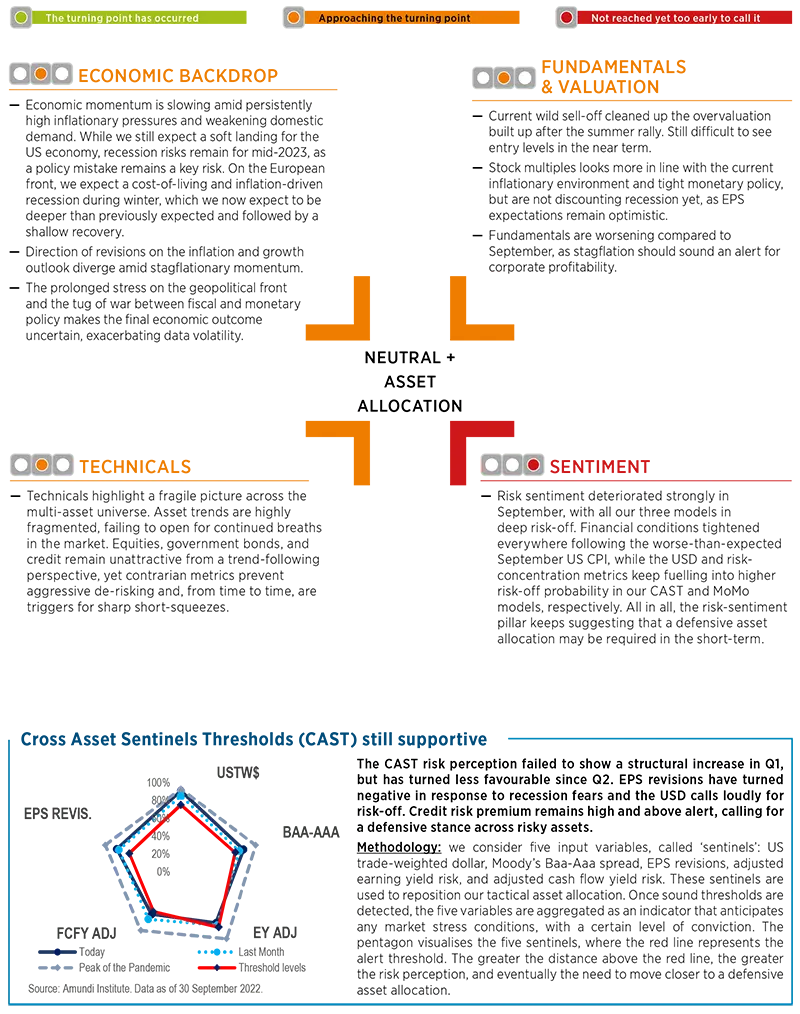

CROSS ASSET DISPATCH: Detecting markets turning points

GLOBAL RESEARCH CLIPS

1| US inflation proved strong, but has probably peaked; Fed to stay hawkish

- US August CPI data surprised on the upside. It may have peaked, and we expect US headline inflation to slow from its 9% high to the 7.5-7.0% range in Q4 2022, but momentum will stay strong in the near term.

- Should the next couple of readings show stronger resilience of core inflation than we expect, then the Fed may adopt an even tighter approach to avoid an inflation resurgence later on, thus increasing the risk of overtightening.

- Against such a backdrop, the Fed will keep its hawkish stance to cool down inflation. We expect it to keep hiking rates aggressively, with a terminal Fed Funds rate seen at 5.0% in March 2023.

- We have raised our US two-year Treasury yield forecast to 4.3-4.5% over a 12-month horizon and our 10-year yield forecast to 3.9-4.1%.

Investment consequences

- Stay cautious on equities.

- Underweight US 10-year inflation-linked bonds and Eurozone nominal bonds.

- Neutral on US breakevens.

- Favour IG over HY credit.

2| Eurozone to enter a recession in late 2022 amid a hawkish ECB

- Our baseline scenario for natural gas prices poses downside risks to the contraction expected in Q3 2022-Q1 2023 and to the recovery foreseen beginning in Q2 2023, making it shallower. We have cut our 2023 real GDP growth forecast to -0.5%.

- The impact of measures put in place by national governments to offset the energy crisis will be limited by tight monetary policy. Fiscal support is unlikely to offset the shock fully.

- With no regulation changes, Eurozone inflation should pick up during the fall-winter season, with the peak still to be reached.

- Consequently, the ECB has turned very hawkish. We expect further rate hikes, with the terminal deposit rate at 2.75% by May 2023 amid discussions of quantitative tightening.

- Sovereign core bond yields should rise further. We have raised our two-year Bund yield target to 1.8-2.0% over a 12-month horizon and our 10-year yield target to 2.3-2.5%.

Investment consequences

- Stay cautious on Eurozone assets; on equities and credit, we prefer the United States to the Eurozone.

- We are cautious on sovereign core bonds.

- On the forex market, we believe the USD could appreciate further against the EUR, possibly to 0.94 in the short term.

3| Italy election outcome is mildly positive for markets

- The centre-right coalition won with some 44% of votes. It will have enough seats to form a stable government but not enough to vote for constitutional amendments, which require a two-thirds majority.

- Italy’s new prime minister should be Brothers of Italy’s leader Giorgia Meloni. Mario Draghi’s caretaker government will address some of the work on the budget law.

- The new government may make adjustments to public finance figures and try to negotiate a revision to the NRRP. It is likely to stick to EU fiscal targets and avoid clashes with EU institutions on economic policy.

- The recent widening in spreads looks to be driven by external factors, such as the strong repricing of ECB terminal rates and the rise in core yields. Technicals have improved and could help offset the hawkish ECB stance.

- On equities, we expect some short-term relief. To see a structural rally, we need more clarity on government appointments, on the approval of the 2023 budget law, and on possible changes to the NGEU plan.

Investment consequences

- Stay cautious on Italian debt, as volatility may stay high.

- In Italian equities, focus on companies that have visibility on future growth, along with some protection from strong inflation, and keep a balanced exposure to sectors.

4| FX market: risk of technical short squeeze rally and high volatility

- The USD is a long position that both speculative and institutional investors have held since mid-2021.

- USD longs are widespread, while EUR, GBP, and JPY are at their lowest levels in two to five years, yet we are still far from historic lows.

- Despite the stretched positioning on G4 FX, we should not factor in yet a shift in the strategic view.

Investment consequences

- Exploit any rebound of short-positioning currencies to add to USD long positions, especially against EUR, GBP, CAD, SEK, and NZD.

- JPY is the only currency that we would not short and where we see upside risks by end-2022.

- CNY could depreciate further, as moderating China export growth, negative interest rate differentials against the United States, and Taiwan tensions could outweigh positive factors, including expected positive growth differentials and stabilising portfolio flows.

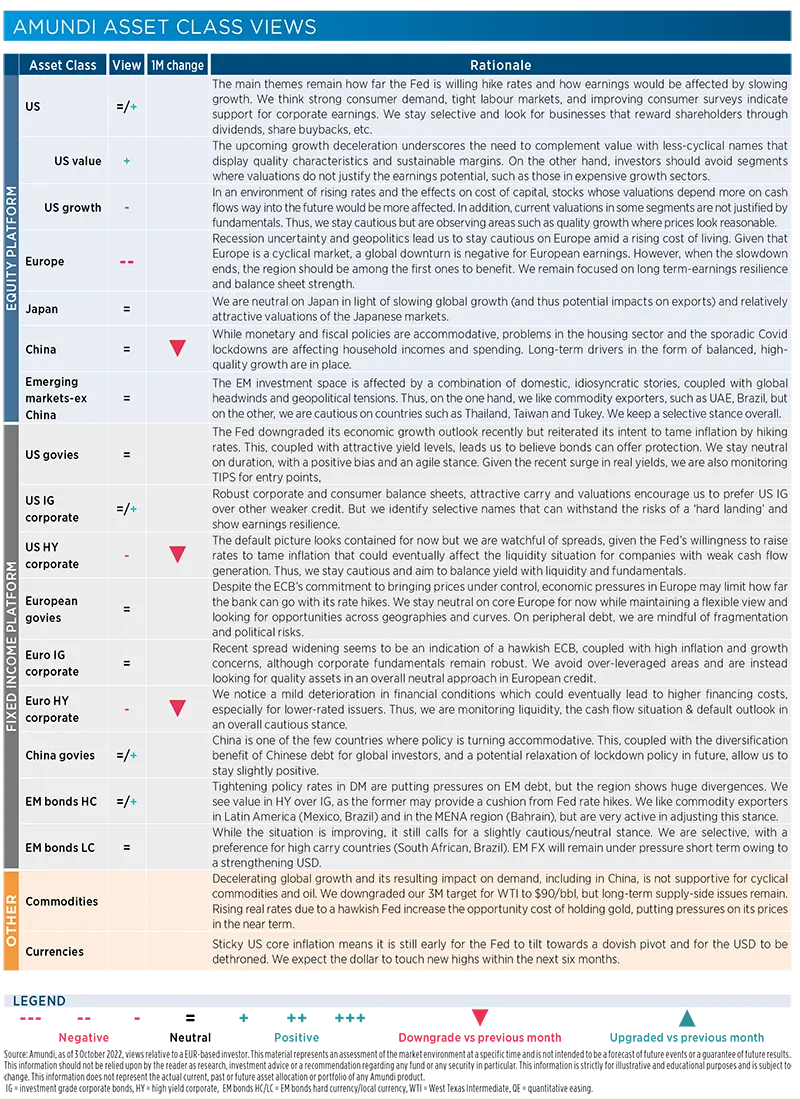

AMUNDI ASSET CLASS VIEWS