Summary

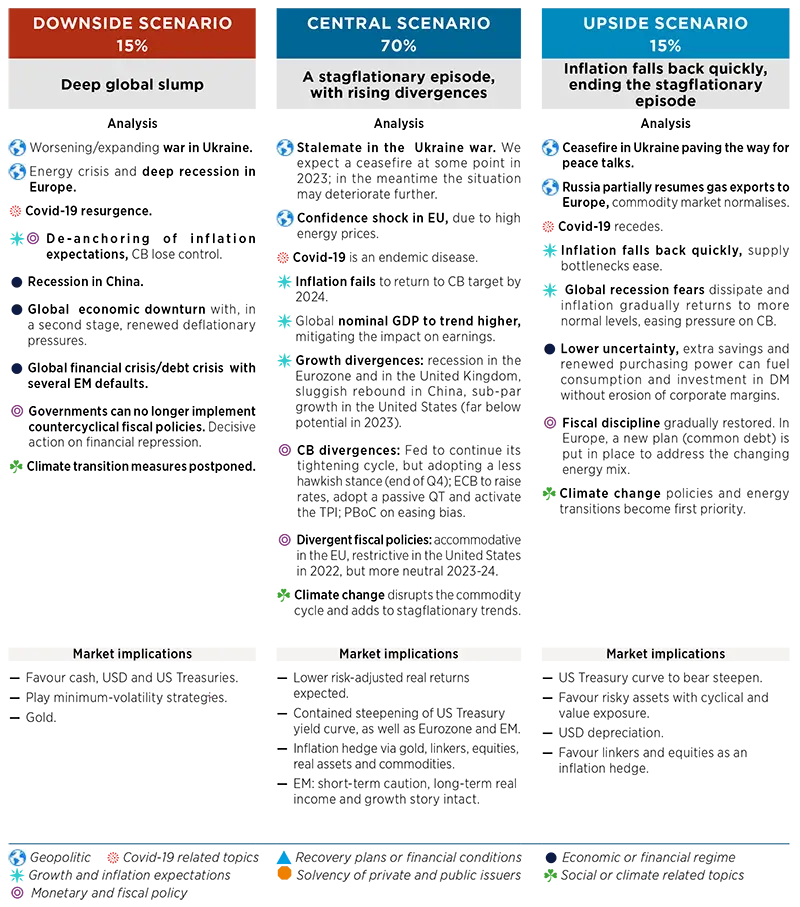

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We maintain the probabilities of our scenarios unchanged. Some of the risk factors we identify may occur in our central scenario, which is probably not yet fully priced-in by markets. Risks remain skewed to the downside in the short term, but it would take a combination of several risk factors to trigger the downside scenario at the 12-18 month horizon. At this horizon, we believe that the downside is counterbalanced by an upside scenario, that of a rapid decline in inflation due to an easing of gas prices, a ceasefire in Ukraine, and/or to the combined tightening of global monetary policies, the impact of which can be underestimated.

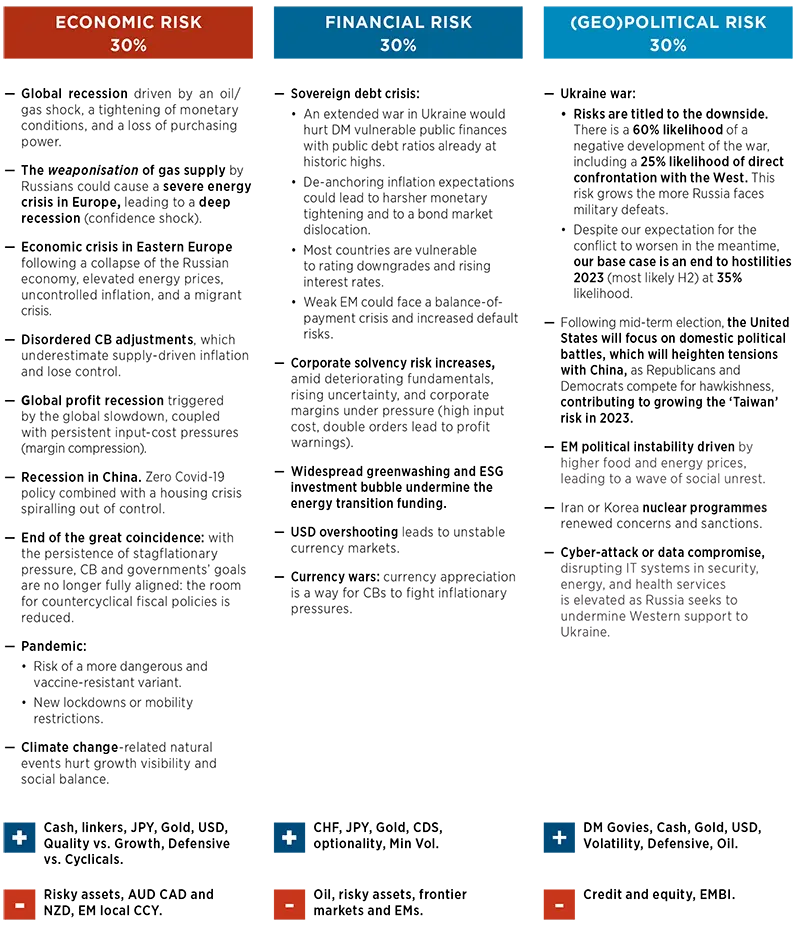

TOP RISKS

Monthly update

We keep the probabilities unchanged for the three families of risks. We see risks growing on all fronts, closely linked to each other. Economic fundamentals are deteriorating globally, which is reflected in the central scenario. The course of the Ukraine war and its potential implications can tip the scenario in either direction, but risks are tilted to the downside in the short term. We consider Covid-19-related risks (including lockdowns in China) as part of the economic risks.

Risks are clustered to ease the detection of hedging strategies, but they are obviously related.

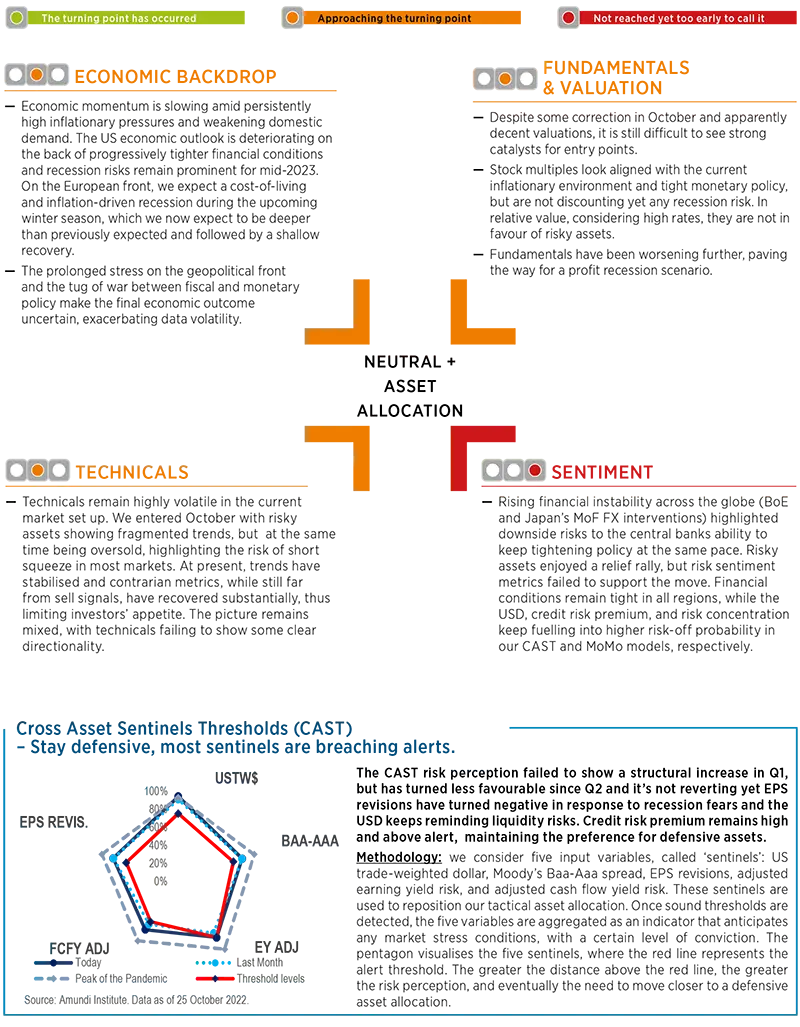

CROSS ASSET DISPATCH: Detecting markets turning points

GLOBAL RESEARCH CLIPS

1| Quantitative tightening prospects for the main central banks

- The Fed is unlikely to accelerate its pace of quantitative tightening (QT) over the next few months; rather, it will be focusing on keeping policy rates in restrictive territory for a prolonged period of time.

- For the ECB, we believe a reduction in the size of its asset purchase programme is unlikely; instead, we expect TLTRO repayments and redemptions to drive passive QT over the next quarters.

- Uncertainty is high on the BoE’s £40bn QT plan, as it will hinge critically on fiscal policy developments.

Investment consequences

- Equity: stay UW.

- Core rates: slight UW/neutral on duration, with rising real yields and the US curve flattening.

- Stay cautious on peripherals.

- Credit: favour IG over HY.

2| US labour market is tight

- We expect the US participation rate to stay lower than its pre-Covid-19 level, as many workers in the 55+ age cohort have left the workforce.

- Since corporates have been experiencing challenges in recruiting skilled workers, now they look more likely to open fewer positions, rather than laying off staff.

- We believe that a structural shift in labour supply and higher labour market frictions may have shifted NAIRU higher, implying that tighter policy is needed to slow the labour market.

- Wage growth has been moderating very mildly.

Investment consequences

- Stay cautious on equity; favour the United States (US) over Europe; on factors, favour Quality, Value, High Dividend, and Min Vol.

- The dollar should strengthen further (EUR/USD cross exchange rate is foreseen at 0.92 and 1.02 in six and twelve months, respectively).

3| Earnings downgrade

- EPS have started experiencing more significant downgrades: 2023 EPS estimates are down 4.2% and 7.6% from their peaks in the US and Europe, respectively.

- The EPS downturn will be mostly driven by margins, as inflation supports top-line and nominal EPS.

- We are using the 1970s and 1980s recessions as a template. Back then, the US peak-to-trough EPS fall was -15% and -19%, respectively. Those EPS downturns lasted 12 and 15 months, respectively.

Investment consequences

- Margins compression, but they remain at high levels, especially in the US.

- Margins are likely to shrink, as the economic downturn accelerates.

4| Lessons from the UK episode: ‘tug-o-war’ between monetary and fiscal policy

- The UK situation remains unresolved, as the crisis started with a lack of fiscal credibility, sending Gilt volatility to the roof and with spillover into global rates. Hence, the ball is still mostly in the fiscal camp.

- The BoE is in a difficult position, preventing financial instability with temporary supportive measures. It may be forced to extend its support and delay active QT.

- Only a strong political U-turn could help restore some fiscal credibility.

Investment consequences

- UK rates should keep underperforming major countries.

- Short GBP against USD.

5| Private assets

- Rising rates and decelerating economy are weighing on private equity value, as happened during past recessions.

Investment consequences

- Private markets are benefitting from the illiquidity premium, but look expensive and should converge gradually to their fair value.

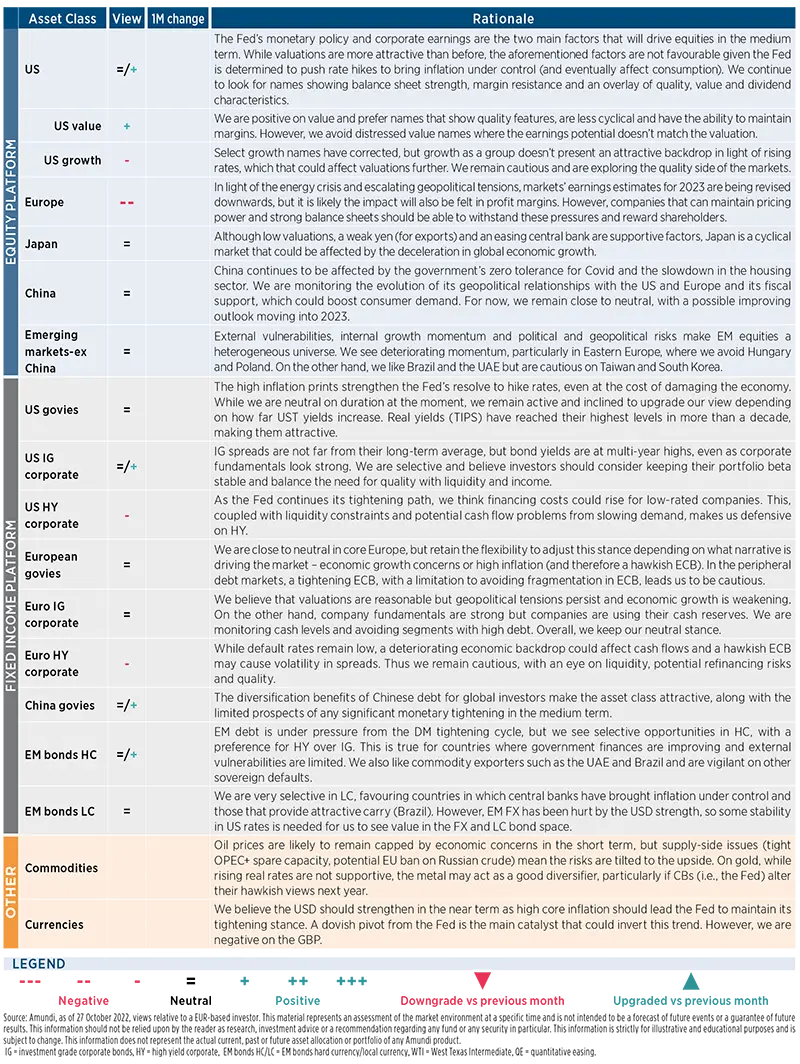

AMUNDI ASSET CLASS VIEWS