Summary

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We keep the narratives and the probabilities of our central and alternative scenario unchanged versus last month. However, the war in Ukraine could evolve in several ways (see Ukraine crisis tree) with significant implications on economic and financial markets. The new wave of Covid-19 in China is another source of uncertainty over the short-term.

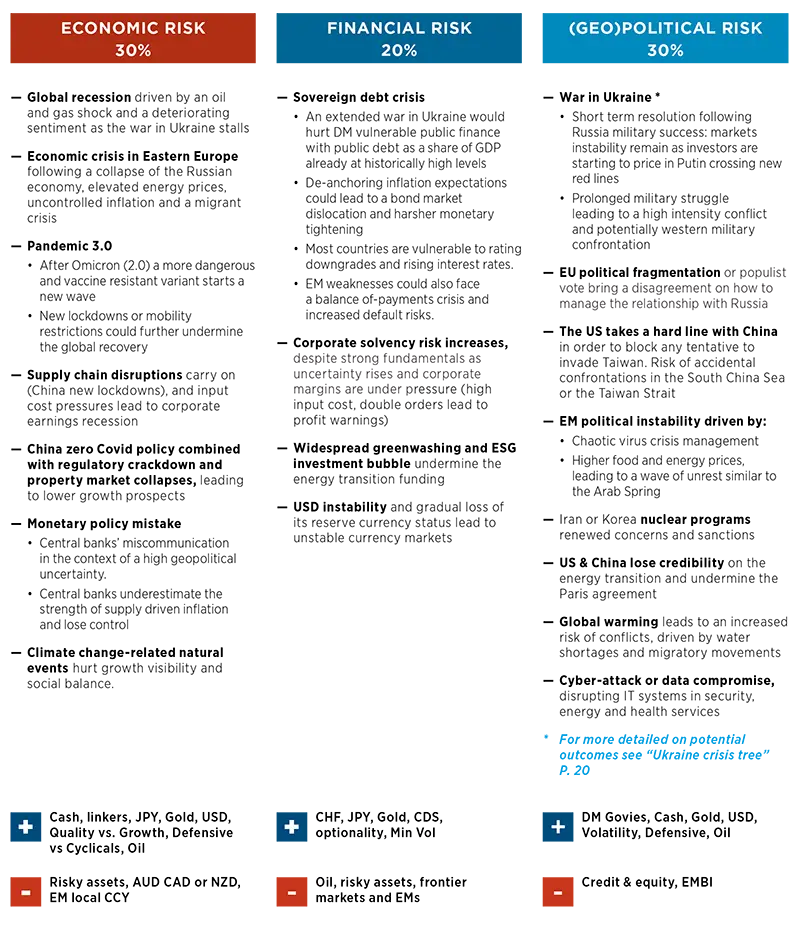

TOP RISKS

Monthly update

We keep the probability of economic and geopolitical risks to 30% to take into account the war in Ukraine and its potential implications on the economic and financial risks. We consider Covid-19-related risks (including lockdowns in China) to be part of the economic risks.

Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

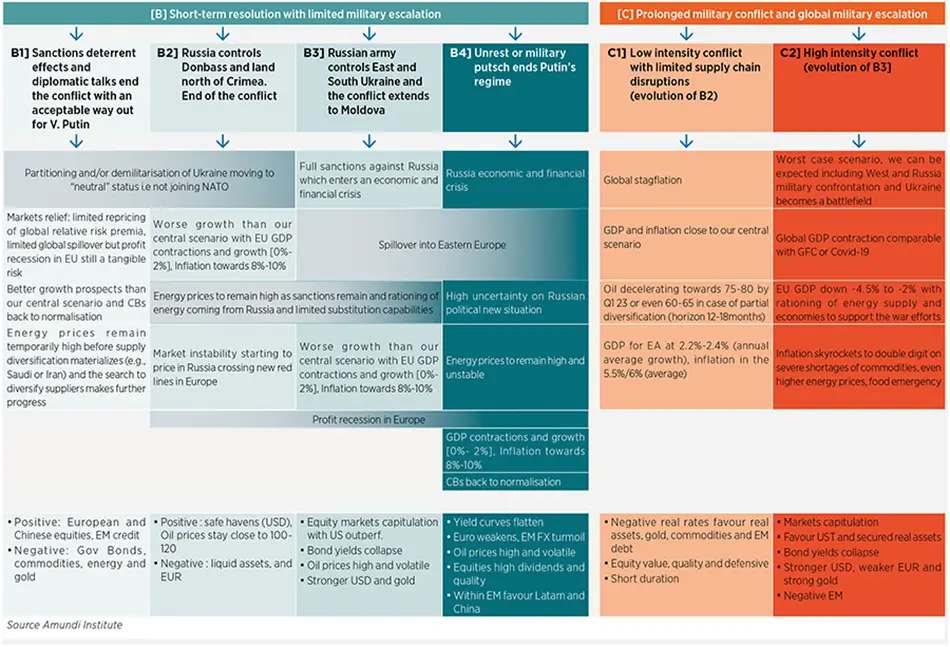

Ukraine Crisis Tree

Russia has partially invaded Ukraine, but is facing resistance and unprecedented economic sanctions. Russia has moved his action to the Donbass region. High level talks have started but no resolution - Russia nuclear forces are placed on high alert

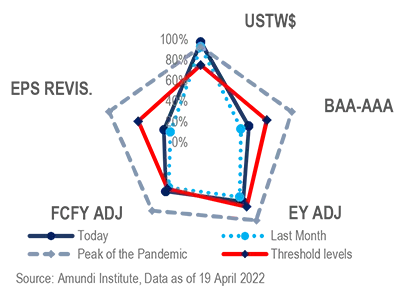

CROSS ASSET DISPATCH: Detecting markets turning points

Cross Asset Sentinels Thresholds (CAST) still supportive

Methodology: We consider five inputs, which we call “sentinels”: USTW$, Moody’s Baa-Aaa, EPS revisions, Adjusted Earnings Yield Risk and Adjusted Cash Flow Yield Risk. These sentinels are used to reposition our tactical asset allocation. Once sound thresholds are detected, the five variables are aggregated as an indicator that anticipates the market’s stress conditions, with a certain level of conviction. The pentagon visualises the five sentinels where the red line represents the alert threshold. The greater the distance above the red line, the higher the risk perception, and eventually the need to move closer to a defensive asset allocation. |

GLOBAL RESEARCH CLIPS

1. Global growth revised lower – inflation revised higher

- Tighter monetary policy ahead to fight inflation: Fed funds rate @ 2.50% by yearend; ECB to exit from negative deposit rates in 2022, amid serious risks of recession in Germany and Italy over the next few quarters

- Higher commodity prices (in energy, industrial metals, and food) for a more protracted period, further exacerbated by the war in Ukraine have severe implications on global inflation and growth:

- negative impact on consumption (through lower real disposable income), and

- higher input costs’ putting a cap on production.

- 12M yield targets revised higher: US 10Y @ 2.90/3.10% (from 2.50/2.70%) and Germany 10Y @ 0.80/1% (from 0.40/0.60%).

Investment consequences

- Reduced risk exposure, slight UW on equities.

- Recalibration in fixed-income from credit to govies and cash.

- Maintain focus on inflation via linkers and commodities.

2. More downside on the euro

- EUR/USD revised six-month target to 1.02 (from 1.09)

- Eurozone’s economic backdrop for 2022 has turned gloomier, due to the commodity shock induced by the Ukrainian war and the related struggles for energy independence from Russia, with Germany and Italy challenged the most.

- Valuation of the FX deteriorates dramatically when correcting its purchasing power parity by the loss in productivity caused by the all-time high gap between PPI and CPI.

Investment consequences

- Short EUR/USD over the next 6M, as we see consensus expectations on EA economy and ECB hawkishness in 2022 as too optimistic.

3. Commodities, holding on to our constructive view

- All historical drivers of commodity prices are currently supportive:

- Cyclical and fundamental: undervaluation gap with global growth is now closed thanks to the economic recovery being driven by fundamentals (increasing economic activity, infrastructure, cyclical demand)

- Geopolitical: the most critical factor due to the Ukrainian war, which generated undersupply issues on natural gas and a generalised shortage in a wide spectrum of commodities, from grain to steel (Russia and Ukraine account for 30% of global wheat exports).

- Structural: the green transition and a potential long-lasting demand-supply mismatch in crucial base metals are the bulk of our constructive view. As inventories are still at historical lows, commodities valuations are being adjusted by growth, and inventories look cheap in absolute and relative term.

- The rally seen over the past 24 months (CRB index up 83% since the end of April 20) closed the gap with growth. Nevertheless, valuations are not expensive when adjusted by the level of inventories.

Investment consequences

- Commodities are a key portfolio diversifier and offer opportunities in all phases of the economic cycle when managed proactively.

- Will remain structurally supported as demand in “green” commodities is going to increase due to the electrification transition.

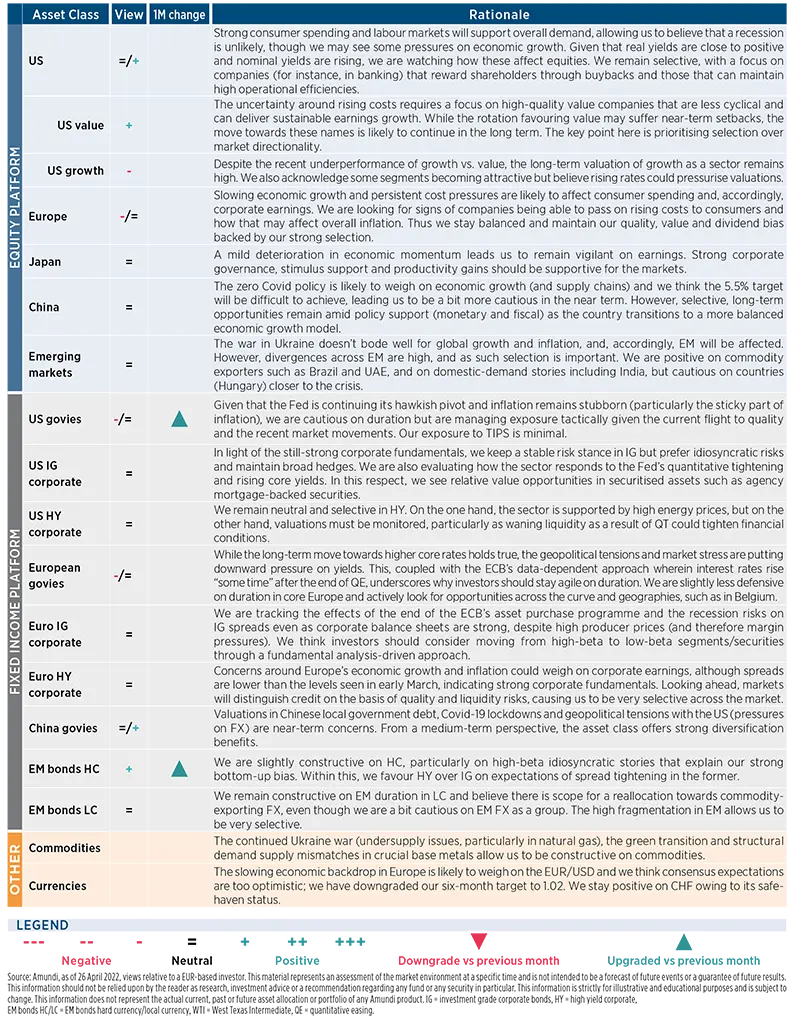

Amundi asset class views

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

- Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.