Summary

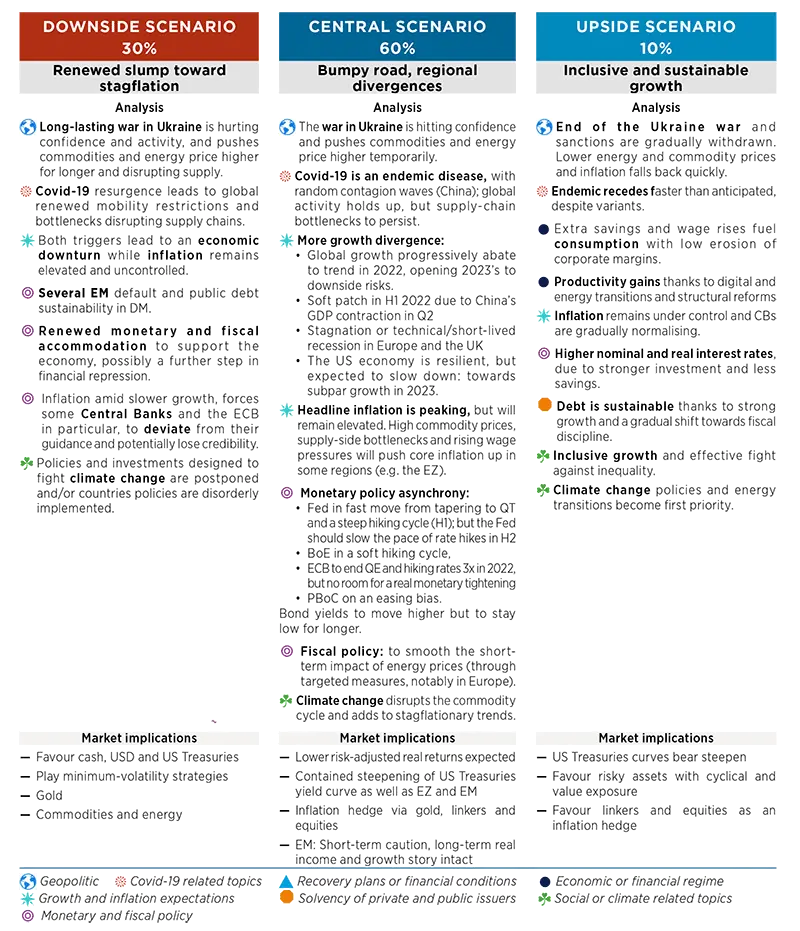

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

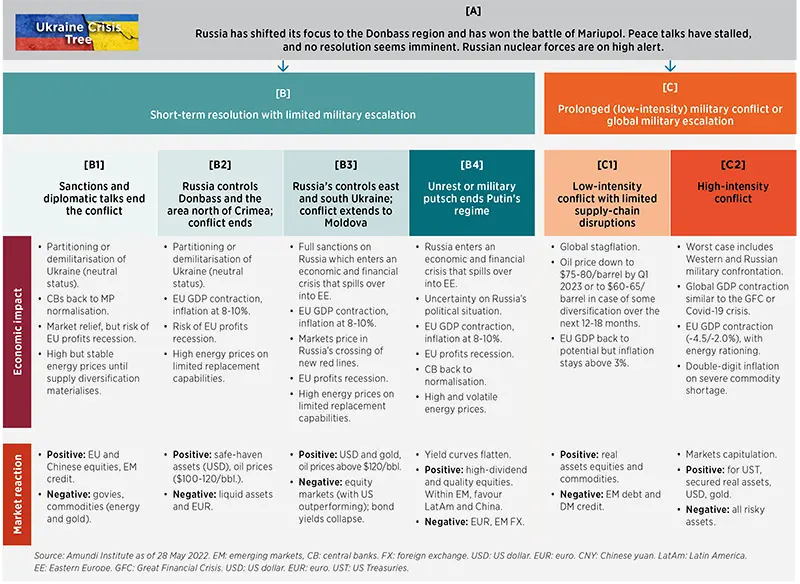

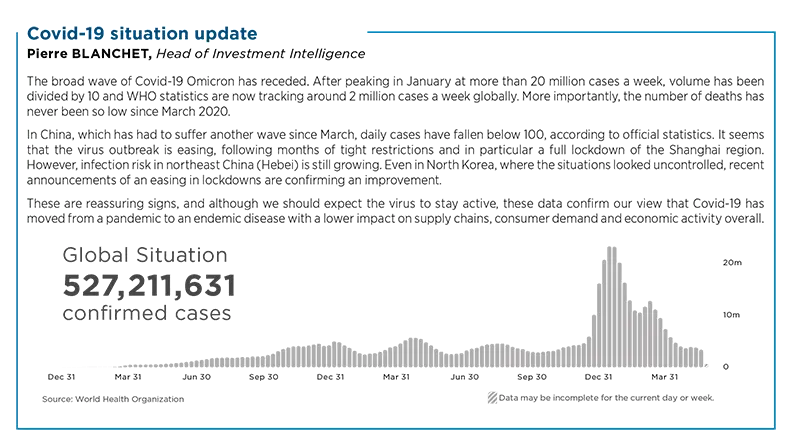

We keep the probabilities of our central and alternative scenario unchanged versus last month but amend the narrative to take into account the evolving geopolitical situation (see Ukraine crisis tree).The new wave of Covid-19 in China and stagnation in the Euro-area are adding growth uncertainty over the short-term.

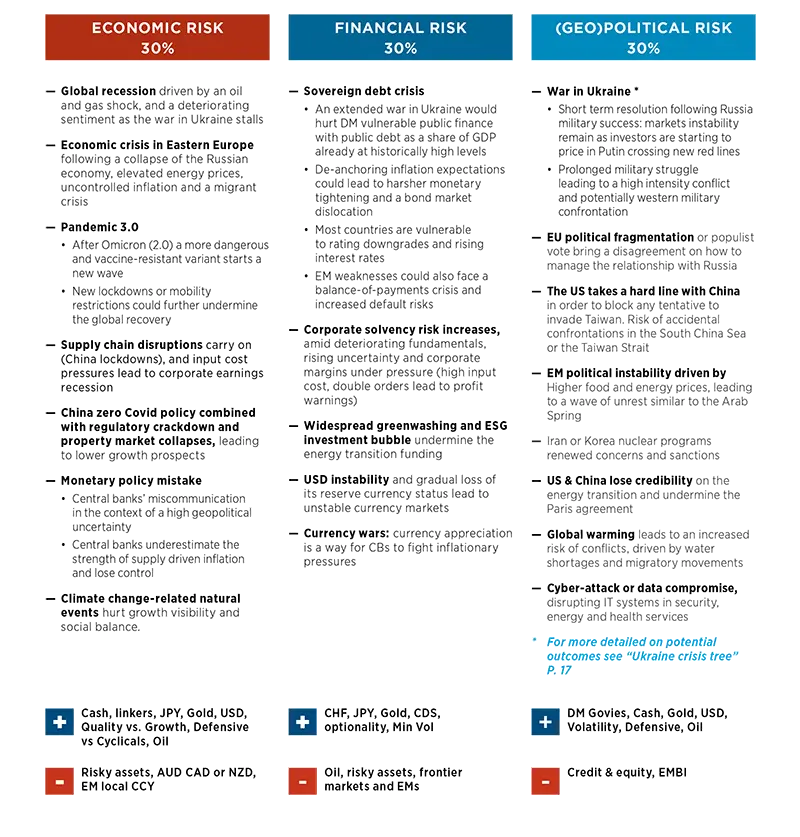

TOP RISKS

Monthly update

We increase the probability of financial risks to 30% from 20% as economic fundamentals are deteriorating. We keep the probability of economic and geopolitical risks to 30% to take into account the war in Ukraine and its potential implications on the economic. We consider Covid-19-related risks (including lockdowns in China) to be part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

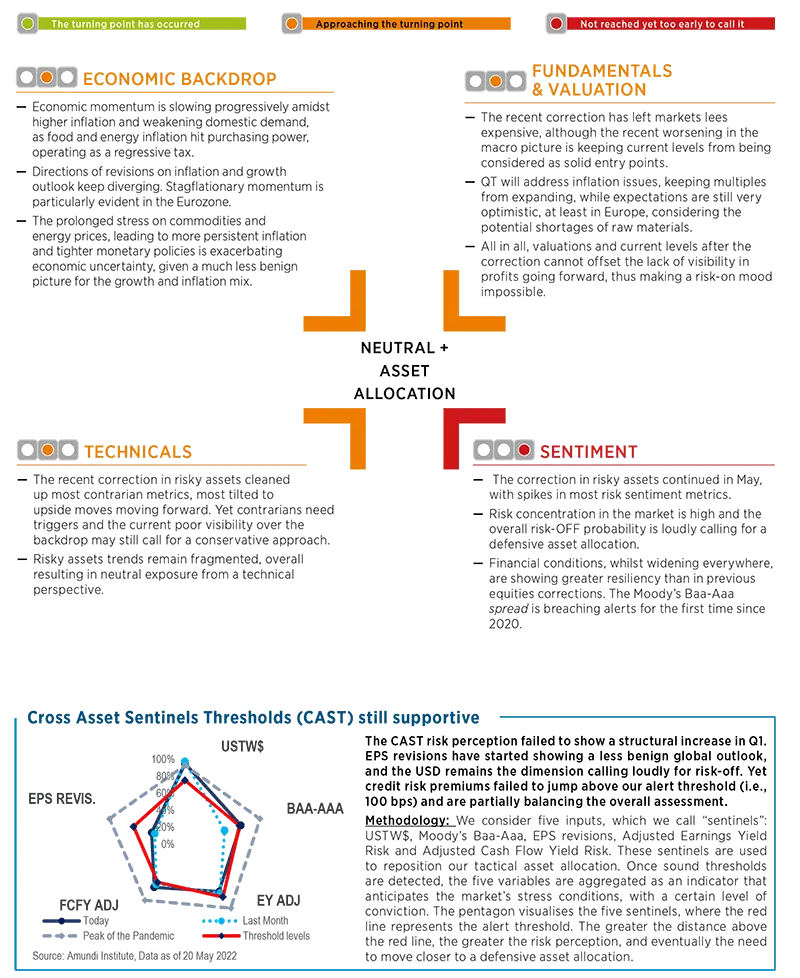

CROSS ASSET DISPATCH: Detecting markets turning points

Monthly update: The traffic light on sentiment has turned from orange to red.

GLOBAL RESEARCH CLIPS

Mounting recession risks

- We expect Eurozone stagnation amidst high inflation and potentially a recession in 1H22, whilst, in the US, a soft landing is possible (recession risks: 20% 12M ahead and 40% 18M ahead).

- We expect the Fed to deliver hikes as the markets expect in the next 12M, but the ECB and the BoE will manage to tighten less than expected by the consensus.

- Eurozone consumers are facing a new shock with fewer tools to offset it, due to weaker wage growth and a severe loss of confidence. For companies are witnessing renewed stress on input prices and more uncertain prospects on demand. After flattish to negative growth in Q1, the Eurozone G4 is flirting with contraction again.

- The US has relatively strong fundamentals (recovery completed under many fronts) to withstand the storm of high inflation. Eurozone fundamentals are more fragile and more vulnerable to the new shock (with an incomplete recovery under many fronts).

Investment consequences

- Central banks’ terminal rates:

- US @ 3.25% (in line with market forecasts),

- ECB @ 0.5%

- BOE @ 1.5% (both dovish vs markets)We remain cautious on Eurozone peripheral bonds, long on 5y5y inflation in the US and Eurozone.

Italian debt sustainability in light of higher yields?

- Debt/GDP will increase if the average yield on 7y maturities moves persistently above 3.4%.

- Yet ECB interventions will ultimately depend on the degree of fragmentation, i.e., elevated and persistent increase in the spread.

- Nominal growth and cost of financing are crucial for debt sustainability:

- Long-term nominal GDP at 3.4% could offset a further increase in cost of debt as long as there is fiscal discipline (with a primary balance at 0%);

- Debt sustainability becomes problematic with a strong, persistent, widespread and greater shift in the yield curve and an idiosyncratic increase in Italian yields;

- Italian fundamentals, however, are in a better position to handle monetary policy tightening than in 2011 or 2018.

Investment consequences

- With average US growth at 2.6% in 2022, US EPS will still manage to deliver low single-digit growth. European earnings should instead prove less resilient than in the US (and at risk of a profits recession).

- We remain neutral on equities and look for relative value strategies.

- Our preferences are for value in the context of rising real interest rates, quality given the maturity of the cycle, high dividends to offset inflation and minimum volatility.

- We would avoid cyclicals, small caps and momentum strategies

GLOBAL RESEARCH CLIPS

Credit: stay cautious as the global picture is deteriorating

- Corporate credit is facing the challenges of a deteriorating economy, margin pressures and tighter monetary policy:

- A deteriorating global picture, particularly in the Eurozone. Still elevated inflation is keeping CBs in tightening mode, with a risk of triggering a sharp slowdown or recession;

- Increasing divergence among business fundamentals. Margin pressures on: rising wages, costs of materials, energy, and transport. Pricing power will be key;

- Valuations are not pricing in the increased risk of a recession in the Eurozone;

- Technicals are becoming less favourable with the end of ECB’s CSPP.

- In less favourable credit conditions: economic backdrop deteriorating, CBs tightening, increasing divergence in business fundamentals and margin pressures.

- EM HC is cheap in terms of short-term dislocation assuming stabilising US 10y yields, strong oil prices till Q3 2022, and an improving EM-DM gap in 2022.

Investment consequences

- In DM we favour US vs Europe and prefer the short-duration segment.

- In EM we prefer hard currency. We expect spread tightening from current levels mainly in HY

China: growth outlook clouded by zero-Covid policy

- Full-year growth below 4%: Q1 growth came in firmer than we expected at 4.8% YoY, defying strong negative base effects.

- However, the broad slowdown in March economic activities, the extended lockdown in Shanghai and expanded zero-Covid policy in other regions will send China into a transitory recession in Q2.

- High-frequency indicators suggest activities outside of Shanghai herald a gradual recovery in May-June

- We are keeping our growth forecast below the consensus at 3.5% for 2022 (Reuters 5%, Wind 5.2%) and expect a rebound to 5.4% in 2023.

- The PBoC opts for a slow depreciation in currency, so we should expect more RMB weakness ahead.

Investment consequences

- USD/CNY targets increased to 6.95/6.50 for 6m/12m (from 6.5/6.3)

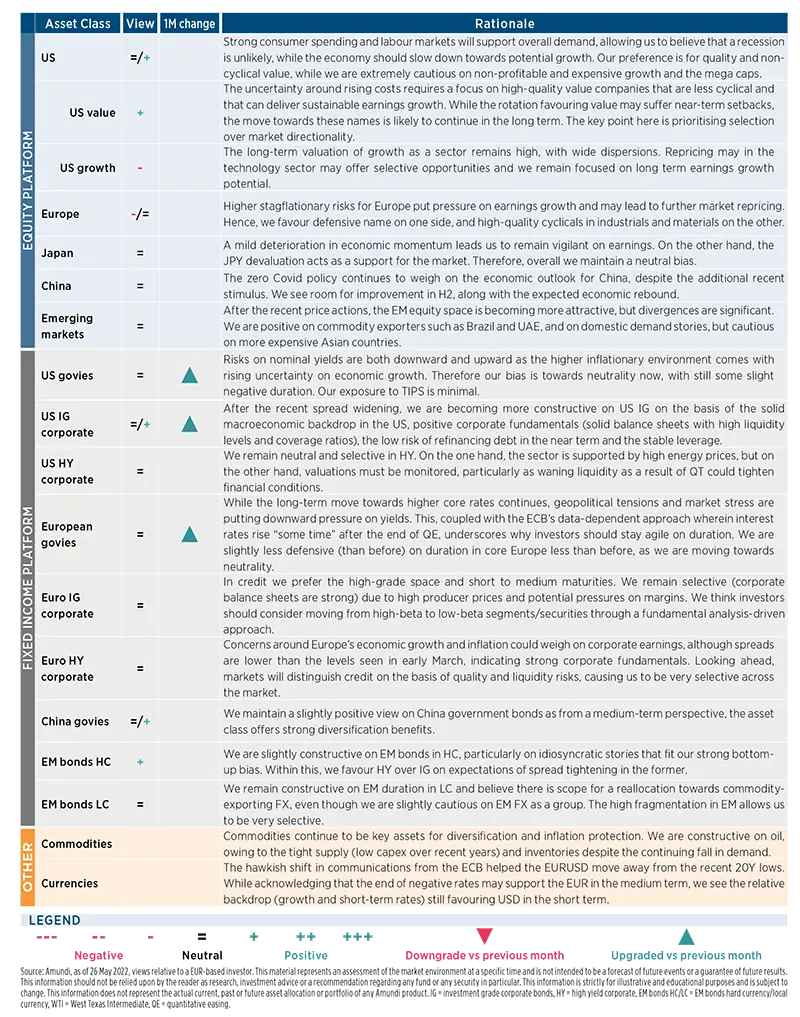

Amundi Asset class views