Summary

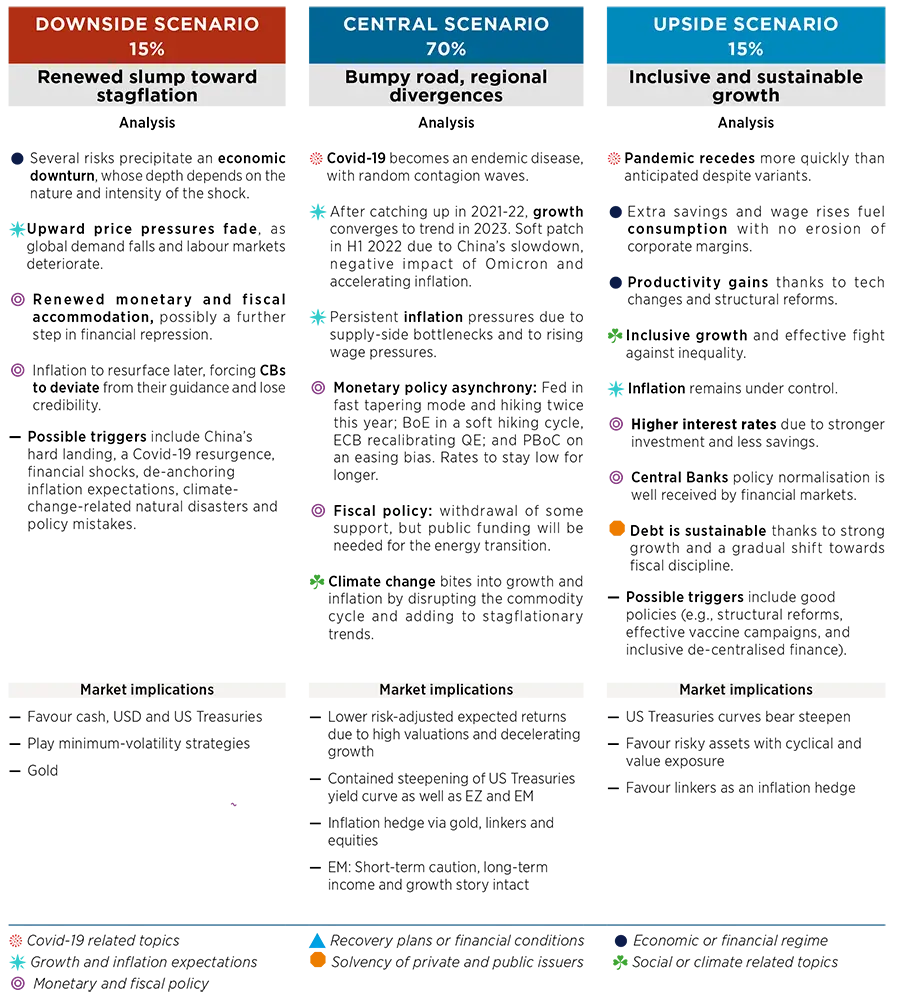

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We are making no change to the narrative and the probabilities of the scenarios. The central scenario assumes that Covid will become endemic with multiple, albeit manageable waves, that fiscal levers will remain significant and tied to monetary policy, and that growth will come back to potential in 2023. We assume the Omicron variant will temporarily impact the recovery in Europe.

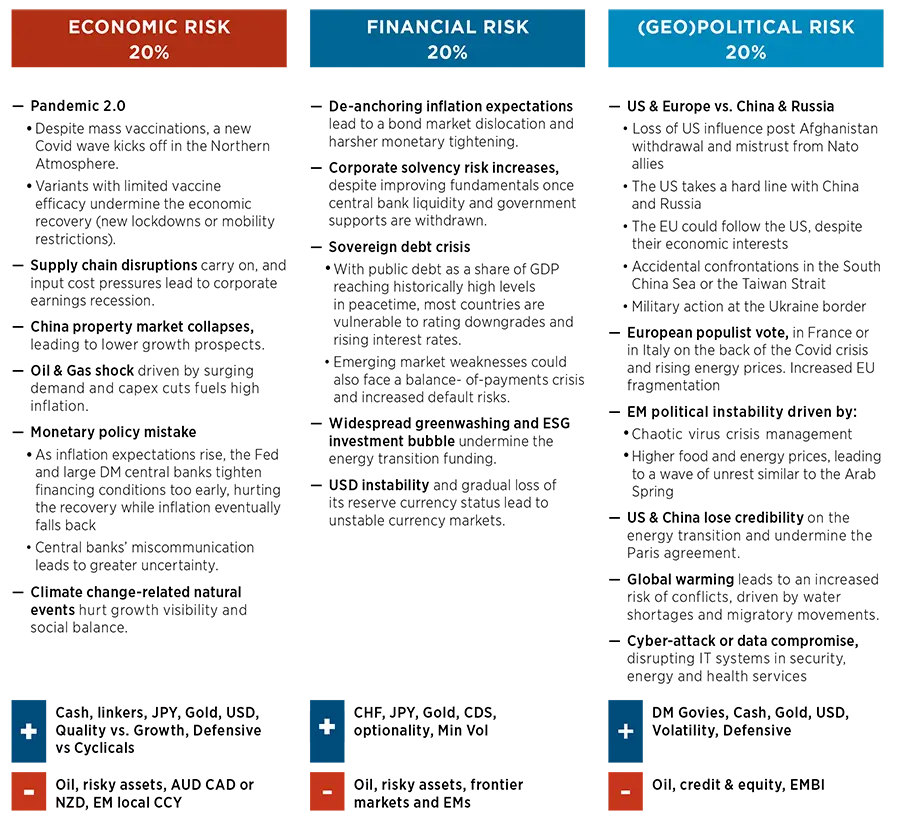

TOP RISKS

Monthly update

We make no change to the top risks to our 2022 central scenario this month since the Omicron wave was already part of Pandemic 2.0

We consider Covid-19-related risks to be part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

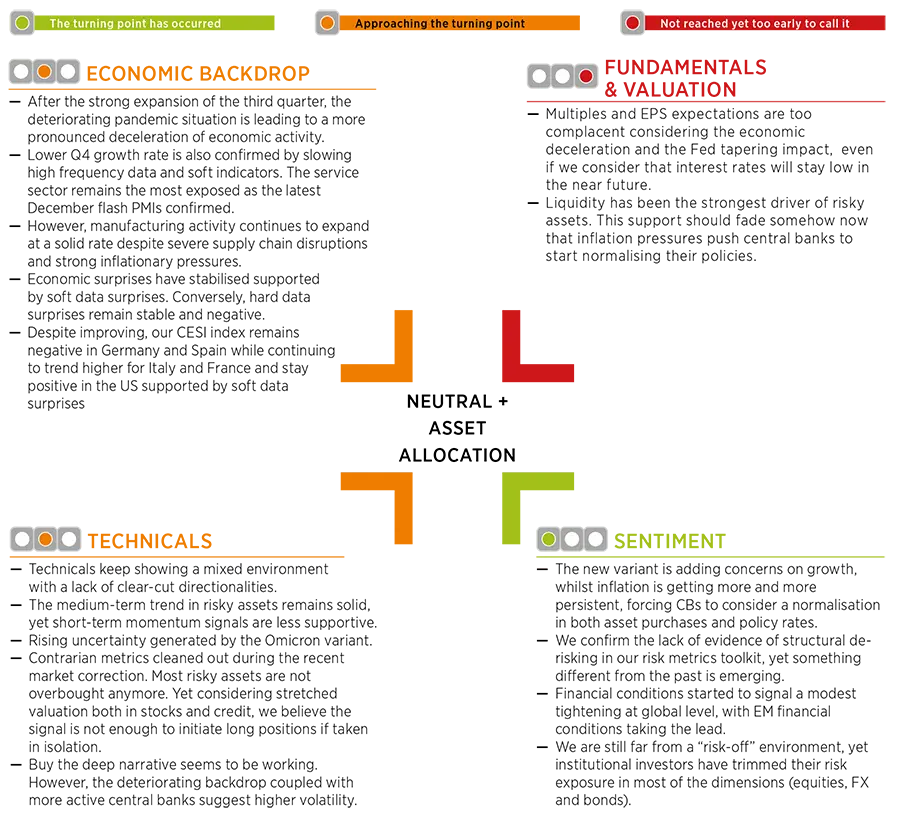

CROSS ASSET DISPATCH: Detecting markets turning points

Cross Asset Sentinels Thresholds (CAST) still supportive

|

||||

GLOBAL RESEARCH CLIPS

1. US inflation revised higher, extending the current regime into 2022 and postponing the convergence to lower levels in 2023

-

2022E CPI @ 4.4% (versus 3.8%, quarterly avg.), on a higher base (Q4) and confirmed persistence

-

Amundi’s CPI forecast is slightly above consensus which stood at 4.2% 2022E. We therefore expect an extension of the current inflationary regime into 2022 and convergence to a “normal” inflation regime (as per Inflation Phazer labelling) to start overtaking in Q4 2022 and prevailing in 2023

-

Worst case scenario: Covid-19 spillovers continue impairing supply (higher costs) and demand (progressive erosion), pushing central banks into a corner

Investment consequences:

-

The inflationary regime is now the central case for 2022, implying: 1) central banks are more under pressure on monetary policy adjustments; 2) there is upward potential on nominal (and real) yields; and 3) there is less support for valuations in risky assets, which markets are not factoring in yet despite the recent pullback.

2. Changing our Fed rate hike forecasts for 2022: we are adding one rate hike in June (25bps), confirming the other one in Q3/Q4.

-

Inflation speeds up the policy tightening via faster tapering (ending March) and therefore opening the door to rate hikes soon thereafter

-

We believe the number of FFR hikes will be linked to the job market participation rate

-

We expect one hike in June, followed by another one in Q3 or Q4

-

The short end of the US curve is more sensitive than the long end. We have revised our 2Y target to 0.80/1% in 6M (wa 0.45/0.60%) and to 1/1.20% in 12M (was 0.70/0.90%), while leaving 10Ys unchanged

-

These FFR hikes are more an opportunistic signal than effective normalisation, as real interest rates will remain negative

-

Omicron is a game changer, which was not included in the Fed’s forecasts

Investment consequences:

- We reiterate our short duration call on UST 5y, as well as on the UST10y as the employment gap closes.

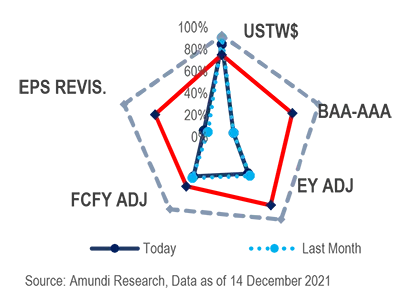

3. Risk sentiment is still “ON” but deteriorating progressively, and is providing less support to risky assets

-

Risk Sentiment is still in “ON” mode, but the last leg of the USD appreciation caused a meaningful tightening to EM financial conditions

-

Emerging markets’ financial conditions have recently been experiencing a broader tightening, due mainly to USD’s strength

-

Risk sentiment is therefore the pillar, which is deteriorating faster despite remaining risk-on

-

The moderation in risk sentiment signals that the early phase of the cycle is approaching its end, and that we are approaching a late-cycle regime

-

Credit and financial conditions are back to October 2020 levels, something consistent with the fact that lower growth is becoming an issue, but liquidity is what matters the most to investors in maintaining their long exposure to markets

-

While preventing a full risk on stance, the current environment is not yet a call for closing all risks

-

Moody’s spread widening weighted on HY already

Investment consequences

- Decreasing growth, USD’s strength, credit widening and wage increasing pose a clear risk of severe downward revisions to EPS in H1 2022, which is not yet factored in

4. EM macro momentum: Asia mildly picking up versus Latam and CEEMEA

-

While EM macro momentum is still negative, for the first time in a while we see a shift across the regions, favouring Asia vs Latam and CEE/MEA

-

Overall, softening domestic and mainly external demand will result in lower growth projections

-

We expect China’s GDP growth to stay close to, but below, 5% over the next two years. EM growth should be above 4% in 2022 and 2023, while inflation should be above 4% on average

5. Chinese policies have shifted more quickly to the easing side: broadly positive for Chinese assets and for global growth

-

With the latest 50bp RRR cut, the PBoC policy stance has decisively shifted the focus back to growth stability and domestic demand

-

As the policy stance is much more constructive in 2022 vs 2021, a rate cut now looks possible

-

Politburo’s policy stance for 2022 is much more constructive than last year. The leadership might have decided that supplyside reforms were over-done, shifting their focus back to growth stability and domestic demand. On housing, it is asking the sector to “better meet proper housing demand”

Investment consequences:

-

RMB weaker in the ST at 6.55 (6M) and 6.4 in 12M

-

Stable govies targets 2.8%-2.9% (lower yields by few basis points in case of rate cut)

-

Even more constructive than anticipated on Equity (particularly on the CSI 300 Dividend)

6. The EU sweet spot

-

The Capital Market Union (CMU) is moving forward as the European Commissions announced a package of measures to improve the ability of companies to raise capital across the EU

-

More political cohesion in the EZ with convergence of interests Germany (Scholtz), France (Macron) and Italy (Draghi)

-

More reforms to come on fiscal rules, investments spending with the NGEU and new proposals from Germany on Banking Union

Investment consequences:

-

Positive foreign investors sentiment towards the Euro area (peripheral bonds and equities),

-

Resilience and internationalisation of the euro

-

Financing the green & digital transformation

7. Eurozone 2022 GDP forecast revised down in light of the impact of Covid-19 Omicron

-

Containment measures introduced and new lockdowns announced in some EA countries were not embedded in our forecasts with the November update

-

We have reduced our growth forecasts by a cumulative 0.4 percentage point over 4Q21 and 1Q22

-

Average growth rate expected: 2021@ 5.0%, 2022@ 3.8%, and 2023 @ 2.2%

-

In light of the November inflation reading and PPI, we are also revising up our inflation projections for Q4 2021 and for the 2022 year average

-

Average CPI headline annual rate expected: 2021@ 2.5%, 2022@ 2.9% , 2023@ 1.7%

Covid-19 situation updateThe Covid-19 sanitary crisis has moved to another phase, with the Omicron variant spreading quickly throughout the world. According to recent studies, Omicron cases are doubling in 1.5 to 3 days according to the WHO and are now rising in 64 out of 240 countries. Europe, which already had a growing share of global cases since September, is so far the epicentre of this new wave. Most European countries have seen a surge of cases, while the UK is facing a record high level of infections (with a daily rate above 1k per million people1). At the time of this writing, Omicron was spreading across the US, accounting for three quarters of new cases. Although the Omicron variant is far more contagious than the Delta variant, existing studies confirm it is not more dangerous and that, thanks to vaccines, the hospitalisation rate is not increasing as fast. According to the WHO, preliminary evidence suggests that there may be a reduction in vaccine efficacy and effectiveness against infection and transmission associated with Omicron. However, several vaccine producers have confirmed the efficacy of their jabs against the variant. In advanced economies, governments are urging people to take a booster jab in order to increase immunity and reduce the number of severe cases. However, scientific advisory panels have said that data are showing that boosters alone will not be enough to contain Omicron. Mobility restrictions are now being implemented across Europe where most yearend public events have been cancelled. The Netherlands has reimposed a strict nationwide lockdown. Germany and France are setting new entry rules for travellers outside the EU. A strange feeling of “déjà vu” and Covid fatigue is noticeable across Europe. Pierre BLANCHET, Head of Investment Intelligence __________________________ |

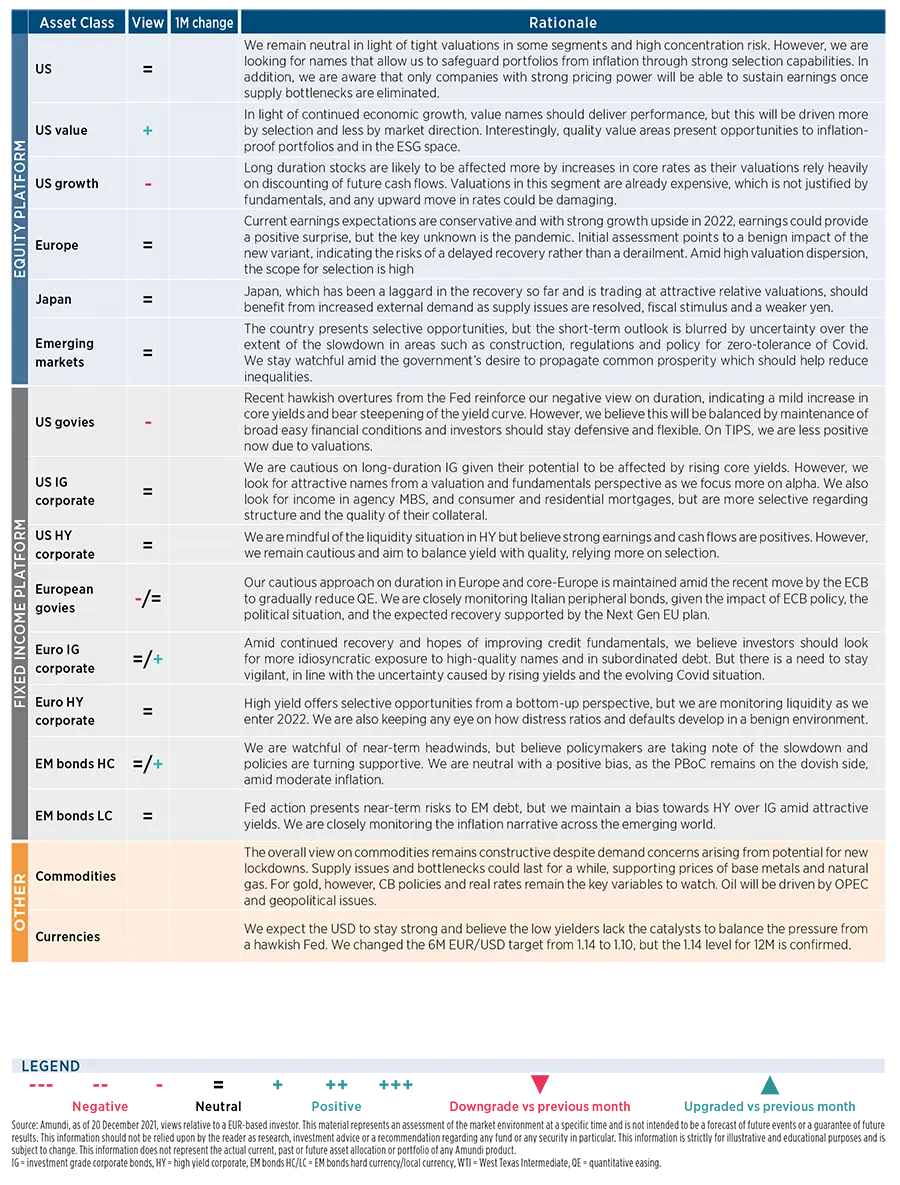

AMUNDI ASSET CLASS VIEWS

Disclaimer to our forecasts

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

- Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.