Summary

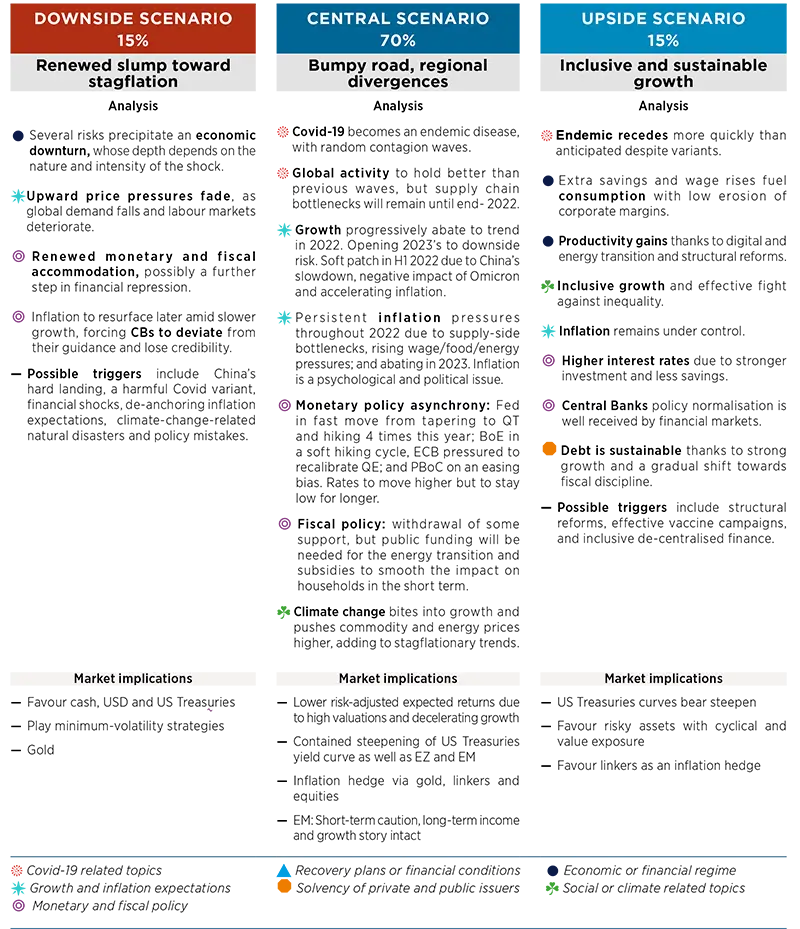

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We are marginally adjusting the narrative to take into account the recent economic news flow and the impact of the Omicron variant, but are keeping the probabilities of the scenarios unchanged. The central scenario assumes that Covid-19 will become endemic with multiple, albeit manageable waves, that fiscal levers will remain significant and tied to monetary policy, that inflation will remain elevated throughout 2022, and that growth will come back to potential in 2023.

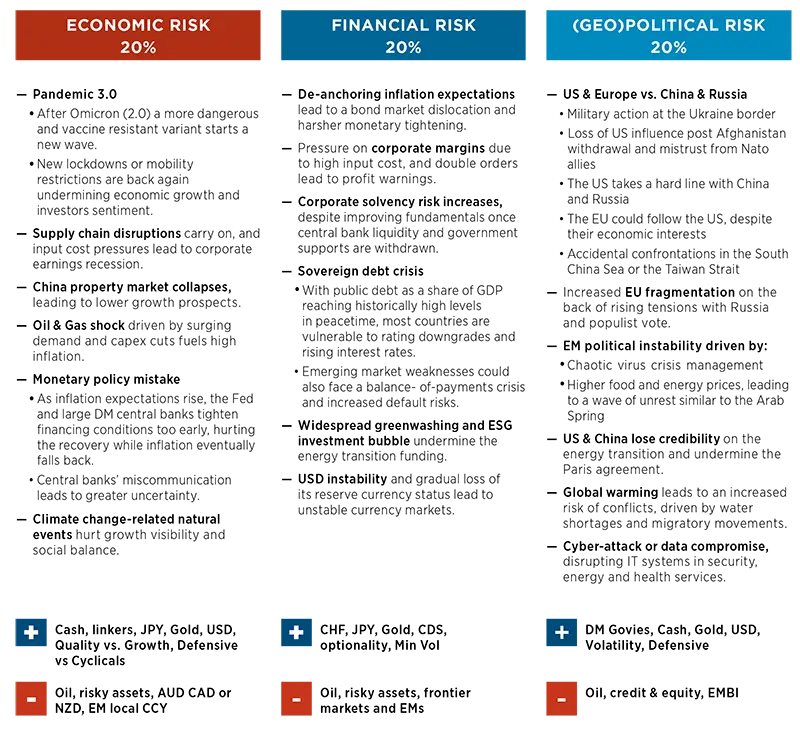

TOP RISKS

Monthly update

We make no change to the top risks to our 2022 central scenario this month since the Omicron wave was already part of Pandemic 2.0

We consider Covid-19-related risks to be part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

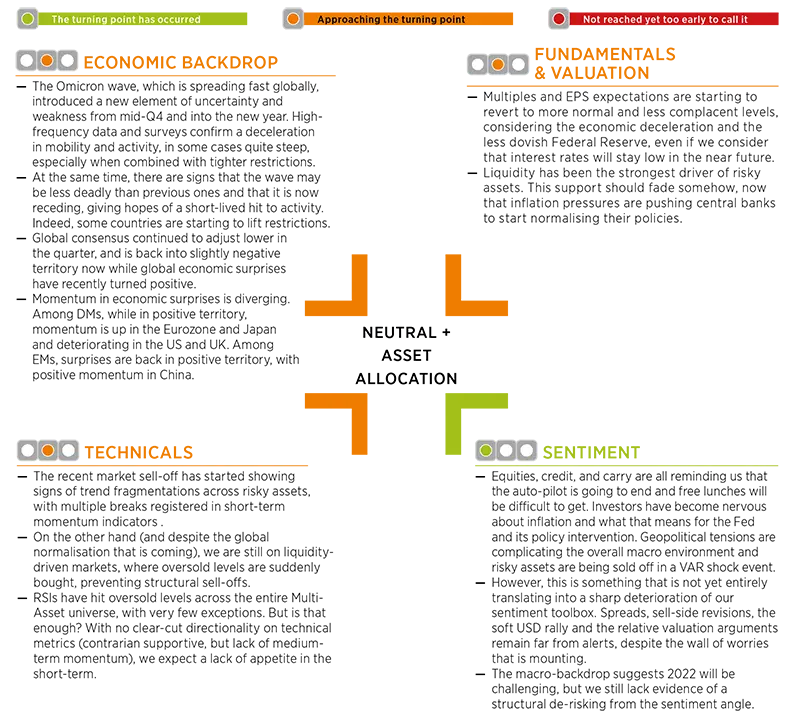

CROSS ASSET DISPATCH: Detecting markets turning points

Monthly update: The traffic light on fundamentals and valuations has turned from red to orange

Cross Asset Sentinels Thresholds (CAST) still supportive

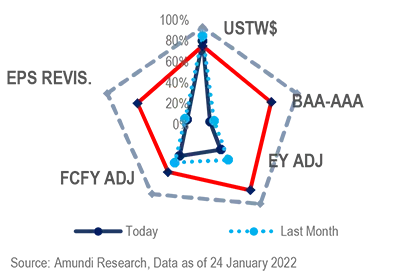

Methodology: We consider five inputs, which we call “sentinels”: USTW$, Moody’s Baa-Aaa, EPS revisions, Adjusted Earnings Yield Risk and Adjusted Cash Flow Yield Risk. These sentinels are used to reposition our tactical asset allocation. Once sound thresholds are detected, the five variables are aggregated as an indicator that anticipates the market’s stress conditions, with a certain level of conviction. The pentagon visualises the five sentinels where the red line represents the alert threshold. The greater the distance above the red line, the higher the risk perception, and eventually the need to move closer to a defensive asset allocation. |

GLOBAL RESEARCH CLIPS

1. Omicron wave impacting growth

- While global activity has taken a hit, it has held up better than in previous waves; supply chains are likely to continue to be affected (→inflation).

- While the impact of Omicron on mobility looks similar across countries, policy reaction has not been uniform, which has led to regional disparities.

- Lockdown severity and mobility data point to softer growth in the eurozone, where GDP will be impacted the most (in Q4 2021 and Q1 2022) by both Omicron and rising energy prices.

- In the US, the initial Omicron wave appeared to have only a modest impact. However, December’s very weak retail sales figure adds downside risks to our growth forecasts for both Q4 2021 and, more importantly, Q1 2022 due to lower consumption.

- In China, despite some signs of supply chain normalisation, the zero tolerance Covid policy might potentially extend the disruption. Rising input costs have not yet been passed through to prices, resulting in a downside risk to corporate margins.

Investment consequences:

- Higher growth volatility confirms the neutral exposure to equity and cautious approach to credit.

2. DM Central Banks more hawkish than expected, driving volatility higher

- The US Federal Reserve (Fed) is concerned about inflationary pressures with an already tight labour market. This tightening cycle will be very compressed and unusual.

- Amundi’s path of rate hikes is in line with the Fed’s forecasts, but we foresee a slightly lower terminal rate (2.25-2.5% vs. the Fed’s 2.5%).

- We expect four rate hikes in 2022 and a terminal rate of 2.25%

- Quantitative Tightening is expected to start in H2, with a balance sheet reduction for the year of $250-300bn in Treasury securities and $200bn in Mortgage-Backed Securities. The Fed could start gradually and then increase redemption caps to a pace of $100bn per month: $60bn in TSY and $40bn in MBS. The balance sheet could be reduced by $250-300bn in TSY and $200bn in MBS this year.

- The euro market mirrored the trends in the US. We are more dovish than the market, which expects the ECB to correct excessively. The approaches from different CBs will remain asynchronous.

- We are increasing our US 10Y yield year-end target to 2/2.2% (from 1.8/2%)

- We are increasing our Germany 10Y yield year-end target to -0.1/0.1% (from -0.3/-0.1%)

Investment consequences:

- Short duration (5, 10Y), long US 5Y5Y inflation swaps, long EU peripherals

3. Global commodities update

- We are confirming our preference for base metals on the back of inventories and valuation considerations. Base metals are being driven by bottlenecks and low inventories in the green transition related metals, rather than growth or recovery considerations.

- In green commodities, the super cycle can last assuming there is strong demand for global electrification as the cheap valuation adjusted for inventories offsets the normalisation of the economic cycle. Such a scenario would likely call for close to a double-digit upside.

- We believe US Liquid Natural Gas (LNG) and Oil are fairly priced.

- LNG: the energy sector is being driven up by heterogeneous factors: structural, tactical, fundamental and geopolitical. All four have supported LNG prices in the EU.

- Oil: OPEC should maintain its promise to gradually increase production while demand is expected to decelerate in H2 2022, generating a potential oil surplus. As a consequence, our WTI short term target is $80, and we expect a $65-$75 range by the end of 2022.

- Gold is undervalued but is likely to remain under pressure as interest rates rise in H1 2022.

Investment consequences:

Long base metals throughout 2022 combined with a preference for LNG in H1 and then a rotation to Gold in H2

4. China: revising down our 2022 GDP growth forecast

- China’s zero tolerance COVID policy and real estate sector rebalancing continue to affect the country’s GDP.

- Omicron has introduced new downside risks to our China growth forecasts in 2022.

- If more cities step up restrictions ahead of the Lunar New Year, sinking mobility to last year’s level, then this will lower full year GDP growth from our current estimate of 4.7% to around 4%.

- National property sector data is still on the weak side.

- The PBoC is being more accommodative to temper RMB appreciation and help SMEs.

Investment consequences:

- We prefer Chinese govies and wait for an entry point on equities

Covid-19 situation updateThe number of registered Covid-19 cases keeps rising fast as the Omicron variant spreads across the globe. Europe and the US are seeing the highest volumes in the northern hemisphere, and the rate of cases is three to five times higher than at the same period last year, with more than 20 million infections officially registered per week in mid-January. However, the number of cases is now rising faster in the Eastern Mediterranean region and Southeast Asia. Like Japan last year, China has implemented strict rules ahead of the Winter Olympics, with strict measures in order to avoid transmissions during the games. The first “good” news is that the death rate keeps falling. However, the volume of casualty is rising because of the large number of cases. The second is that this wave is very steep but seem to fall very quickly, as the UK has shown, which means that its impact on the economy should be short-lived. The third is that in regions like Europe, 60% of the population will have had the disease by the end of March, a level that could trigger herd immunity according to the WHO. So far nine vaccines have been granted the WHO Emergency Use Listing. Several studies have shown that existing mNRA vaccines provide high level of protection against severe disease and hospitalisation. Yet, Pfizer and BioNTech have enrolled the first participants in a clinical trial of a vaccine tailored to the Omicron variant, to assess the benefits of new vaccination campaigns targeting Omicron. Pierre BLANCHET, Head of Investment Intelligence |

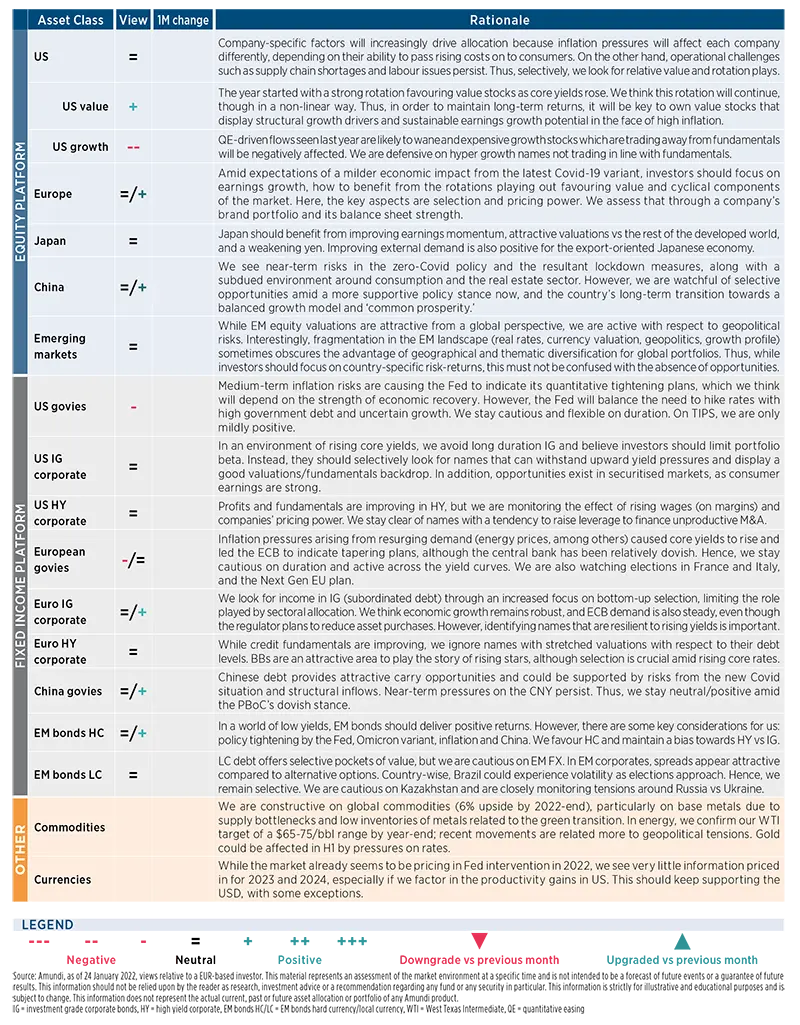

AMUNDI ASSET CLASS VIEWS

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

- Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.