Summary

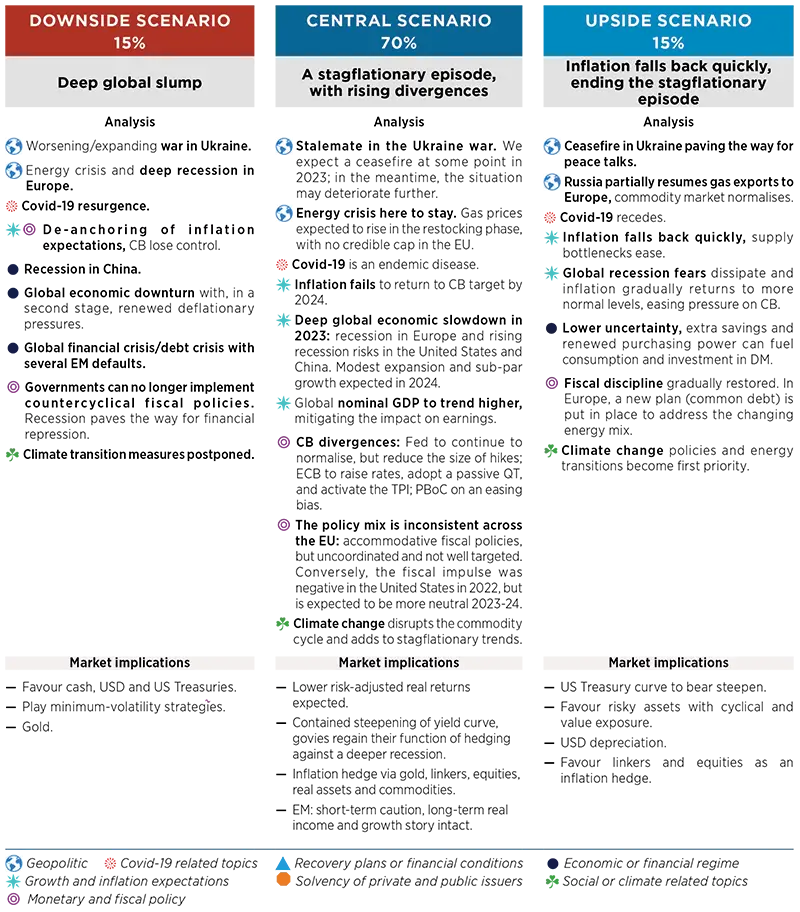

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We maintain the probabilities of our scenarios unchanged. Some of the risk factors we identify may occur in our central scenario, which is probably not yet fully priced-in by markets. Risks remain skewed to the downside in the short term, but it would take a combination of several risk factors to trigger the downside scenario at the 12-18 month horizon. At this horizon, we believe that the downside is counterbalanced by an upside scenario, that of a rapid decline in inflation due to an easing of gas prices, a ceasefire in Ukraine, and/or to the combined tightening of global monetary policies, the impact of which can be underestimated.

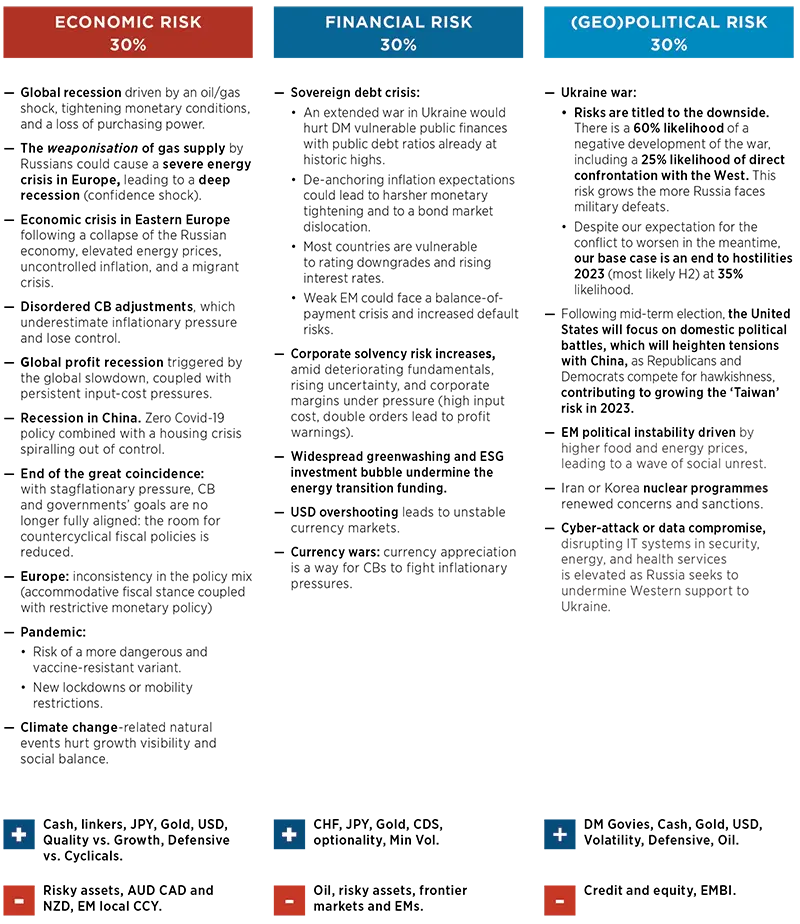

TOP RISKS

Monthly update

We keep the probabilities unchanged for the three families of risks. We see risks growing on all fronts, closely linked to each other. Economic fundamentals are deteriorating globally, which is reflected in the central scenario. The course of the Ukraine war and its potential implications can tip the scenario in either direction, but risks are tilted to the downside in the short term. We consider Covid-19-related risks (including lockdowns in China) as part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously related.

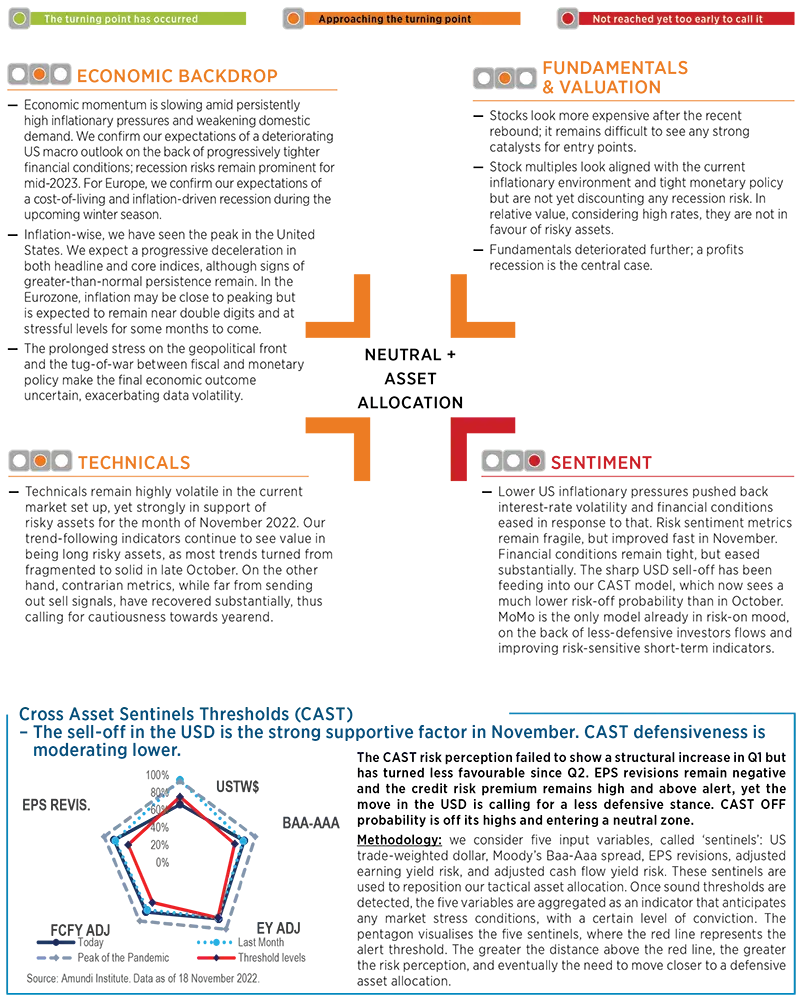

CROSS ASSET DISPATCH: detecting markets turning points

AMUNDI INSTITUTE CLIPS

1| ECB concerned about recession risks

- At its October meeting, the ECB highlighted how the fight against inflation could get difficult as the economy is expected to enter a recession in late 2022, suggesting a less aggressive rate-hike path ahead.

- However, a dovish turn is not a given, as inflation remains uncomfortably high.

- We have cut our projection for the ECB terminal deposit rate to 2.50% from 2.75%.

- For all central banks, the challenge next year will be to maintain their credibility: any dovish surprise should be coupled with satisfactory progress in inflation towards target.

Investment consequences

- Twelve-month target for 10-year Bund yield unchanged at 2.3-2.5%.

- EUR/USD target also unchanged, at 0.92 in six months and 1.02 in 12 months.

2| Fed remains committed to fighting inflation

- The November Fed statement was dovish, but Chair Powell’s press conference was hawkish, as the Fed did not want the market to interpret a possible reduction in the size of rate hikes as a dovish pivot or as a lack of commitment to fight inflation.

- We believe the Fed will find better risk-reward in overtightening, as it has the tools to support economic activity strongly if needed, as it showed during the pandemic.

- Focus should be on terminal rate and how long interest rates should stay in restrictive territory.

- We confirm our projection for the terminal Fed Funds rate at 5.25%.

Investment consequences

- Twelve-month target for ten-year US Treasury yield unchanged at 3.9-4.1%.

3| Inflation trends across DM

- US core inflation has been proving sticky, while headline inflation should weaken over the next few months, as gasoline prices should drop.

- US PPI dynamics have peaked and the CPI-PPI gap has been narrowing, although still above average; the transmission from lower PPI to lower CPI may be delayed, but signals are pointing in the right direction.

- Eurozone inflation – both headline and core – should peak in Q4 2022, but the upcoming wage negotiation rounds will be crucial, as they may reinforce inflation persistence.

- Eurozone inflation pressures remain strong and not completely passed through yet. PPI is sending out limited signals of moderation, and the CPI-PPI gap remains wide.

Investment consequences

- Confirm UW in equity.

- Core rates: confirm UW/neutral positioning on duration, rising real rates, flattening US yield curve.

- Peripheral rates: keep a cautious approach.

- Credit markets: US IG favoured over US HY.

4| Political and geopolitical update

- US mid-term election: Democrats performed better than expected, retaining control of the Senate, but losing the House. No big bills are likely to be passed over the next two years, while US-China tensions are likely to remain; more scrutiny is likely over funding to Ukraine.

- UK fiscal budget: It is aimed at regaining market trust, while supporting the key conservative voter base. However, more spending for ‘levelling up’ and increasing taxes on high income earners also highlights that the Conservatives are still targeting former Labour ‘red wall’ seats in left-behind areas that switched to the Tories at the last election, but have since been increasingly disgruntled with the party.

- Brazil presidential election: Lula won the second round. He appears keen to spend freely but may moderate his stance under further market pressure.

Investment consequences

- Markets enjoy divided governments, as populist policies get prevented.

5| China’s structural slowdown already showing up

- Two sources are contributing to slower potential growth: a fast-ageing population and declining return on capital.

- Full relaxation of Covid-19 curbs is unlikely until 2024.

- Housing market drag should recede in 2023.

- We have upgraded our 2022 growth outlook to 3.2% from 2.9%, due to better-than-expected Q3 data, but while cutting our 2023 projection to 4.5% from 5.2% on a dimmer Covid-19 policy outlook. 4.0% growth is achievable in the next three years, with a convergence then expected down to 3.0%.

Investment consequences

- Long HSCEI, add MSCI China and CSI 300 dividend.

- Credit: stay neutral, six-month/two-year HY is relatively cheap.

- Rates: move to neutral from short.

- Commodity: stay neutral.

6| Q3 earnings season: more negative, but not a collapse

- EPS downgrades and results were ahead of expectations. Despite beats, companies are reducing forward guidance.

- The growth slowdown and inflation impact show up in strong energy sector growth, which remains the key EPS driver. Exenergy, US’s Q3 EPS is -3.4% and Europe’s is 9.6%.

- A few consumer sectors have been struggling and, especially in Europe, the real estate sector, as well.

Investment consequences

- Stay cautious on equity, while favouring the United States over Europe.

- Focus on quality, value, high dividend, and min vol.

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts. - Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.