Summary

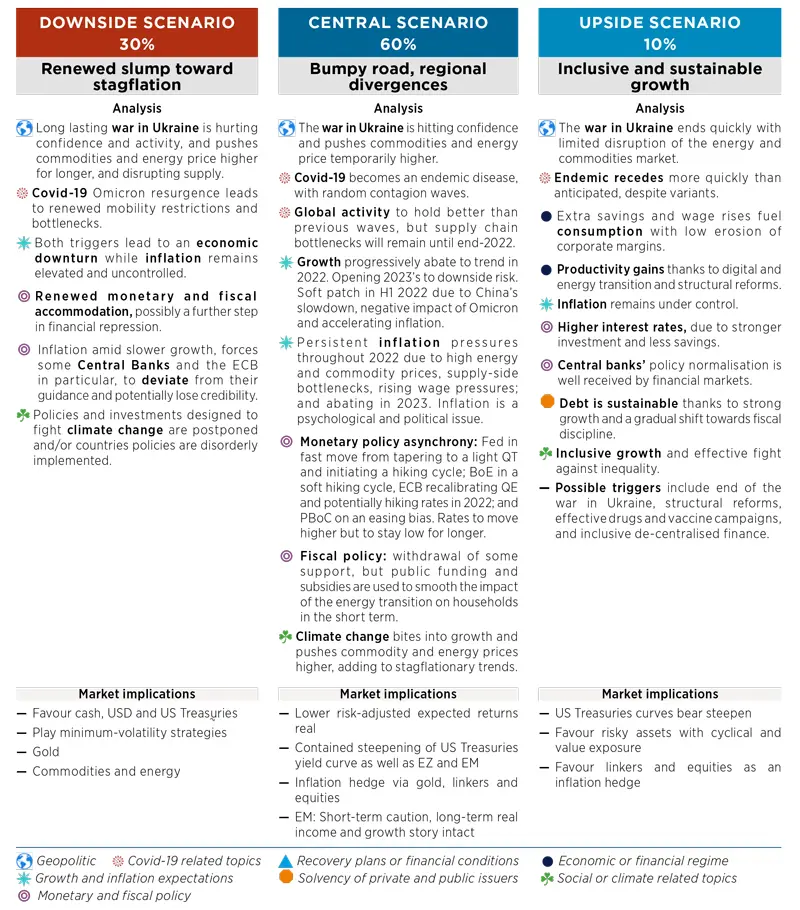

CENTRAL & ALTERNATIVE SCENARIOS (12 TO 18 MONTHS HORIZON)

Monthly update

We keep the narratives and the probabilities of our central and alternative scenario unchanged versus last month. The war in Ukraine could evolve in several ways over the coming weeks (see Ukraine crisis tree) with significant implications on economic and financial markets

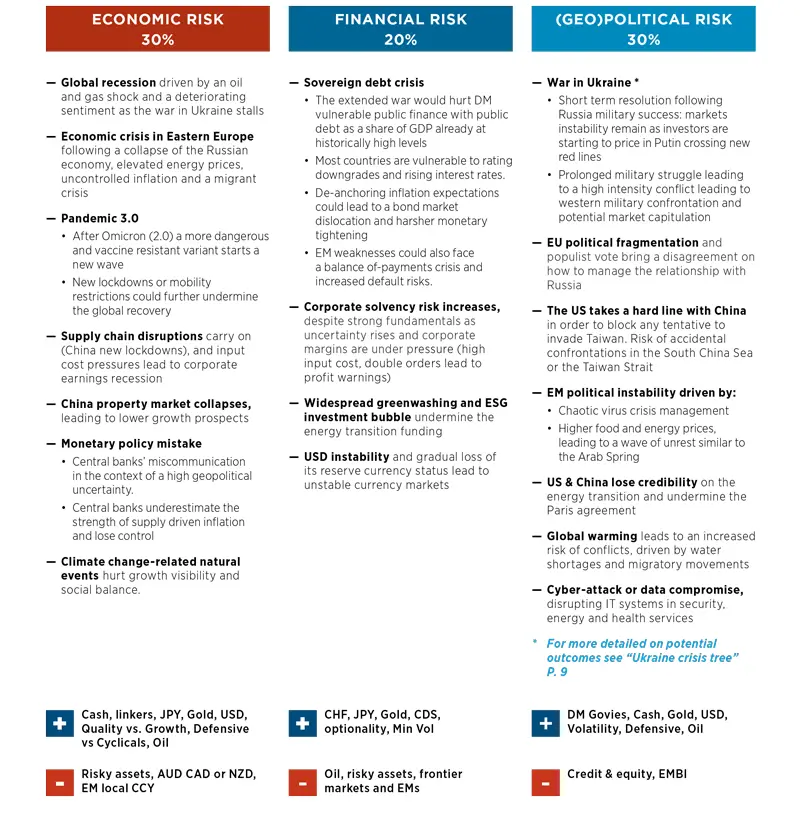

TOP RISKS

Monthly update

We keep the probability of economic and geopolitical risks to 30% to take into account the war in Ukraine and its potential implications on the economic and financial risks. We consider Covid-19-related risks to be part of the economic risks. Risks are clustered to ease the detection of hedging strategies, but they are obviously linked.

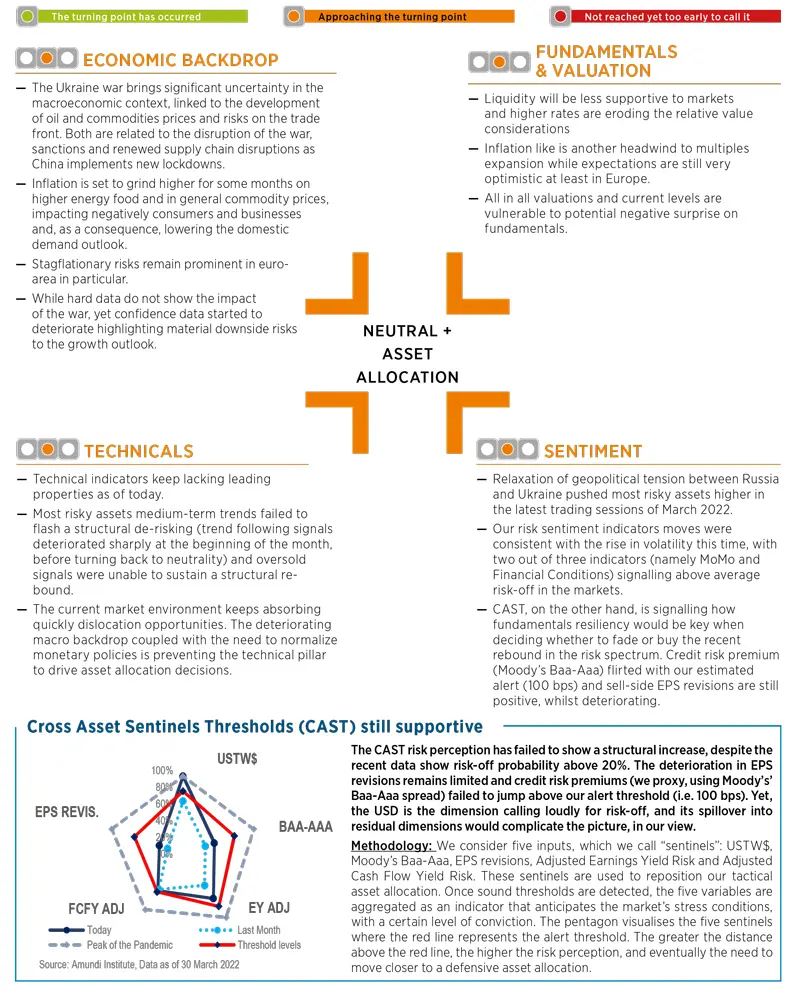

CROSS ASSET DISPATCH: Detecting markets turning points

Monthly update: The traffic light on sentiment has turned from green to orange

GLOBAL RESEARCH CLIPS

1 Growth and inflation macroeconomic forecasts

- US . Growth is revised lower: Q4/Q4 22 from 2.5% to 1.9% , Q4/Q4 2023 from 1.9% to 1.7% , the key message here is that growth goes to potential and below potential sooner than expected.

- Inflation is revised higher: Core PCE, is now moving higher: from 3.2% Q4/Q4 in 2022 to 4.1%, while headline CPI Q4/Q4 upgraded to 5% from 3.5% on a combined effect from oil and commodities.

- EA . GDP Growth: 2.3%Y in 2022 (was 3.4%), 1.8%Y in 2023 (was 2.1%) (annual averages). For 2022, H1 basically flat (0.1% QoQ), H2 small “recovery” as some of the drag from energy and inflation eases, based on our shared oil/commodities scenarios. An outright recession is not excluded at this stage, but more at country level than in EA aggregate.

- Inflation: 6.3% Y in 2022 (was 4.3%) , 2.6% Y in 2023 (was 2.1%). Peak in Q2 22 at 7.1% (quarter average), then slow deceleration (again, quite relevant the role of oil/commodities assumptions here).

- UK . Growth is now revised lower from 4.3% to 3.8% in 2022 (carry over 2.6%), thus implying a very limited quarterly growth during the year, which is concentrated in Q1 ( currently tracking at 1%+), followed by very weak growth in the following quarters as the inflation tax drags on consumption. Growth in 2023 is expected around approx. 1.5% (2% prior).

- Inflation is revised significantly higher, averaging 7.1% (5.7% prior) in 2022 and 3.5% (2.4% prior) in 2023, on stronger energy and food price dynamics. Peak is expected to occur around April, with Ofgem energy price cap increase of+54%. Another round will occur in October, but according to our forecast inflation should continue decelerate from Q2 onwards.

2 EUR/USD poised for more correction as the CPI/PPI ratio is expected to deteriorate further, due to the Ukrainian war

- Relative to international peers, the US is showing greater flexibility in passing higher input costs on to consumers.

- We see the Ukrainian war playing towards the same channel and deteriorating EUR productivity further relative to peers (CHF, USD, GBP are all much better positioned in the current juncture) as Eurozone’s PPI may keep trending higher on the back of Ukraine war’s impact on energy prices.

- EURUSD is also driven by the widening US-EUR yields differential and the increasing portion of the EUR yield curve shifting positive. Yet the net-productivity loss of the Euro area economy versus US is translating into structural deterioration in EUR medium term fundamentals. The currency may keep weakening in the months to come with geopolitics adding further pressure. In this context, CHF looks better positioned.

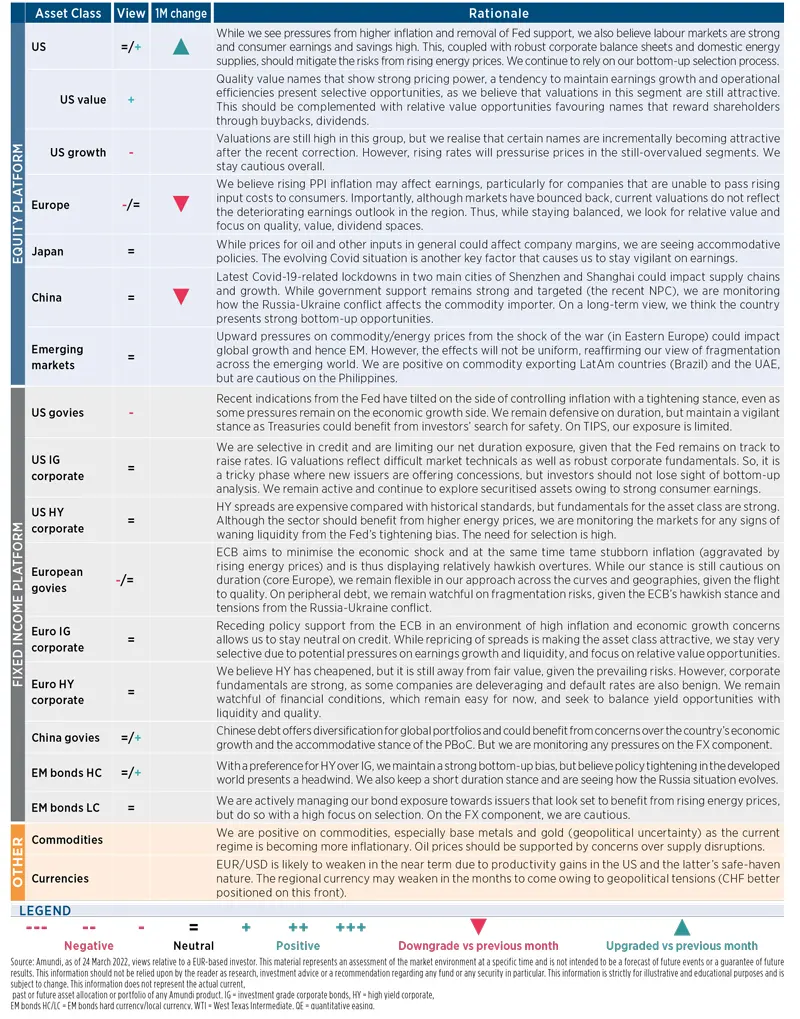

Investment consequences

- EUR/USD will have to absorb the shock, the valuation of the currency is expected to move lower, with, as a consequence, potentially greater weakness on the FX from current levels

3 China policy stance post-NPC meeting

- The recent geopolitical events, influencing global demand and the perseverance of zero covid tolerance are overall growth-negative for China. We revised our 2022 GDP growth forecast down to 4% from (4.2-4.5%).

- While the cost pressure could slowdown the producer prices decline, consumer inflation is expected more muted amid a still subdued recovery in services demand.

- The NPC and other comments by officials confirmed a continuation in policy support to the economy as well as lately to the Equity markets (though short in details).

- Notwithstanding the recent blip, Credit growth should continue on its upward trend, government bond supply is expected to remain stable on the past year levels, and the Monetary policy easing is not over yet (additional LPR cut and RRR cut are expected soon).

Investment consequences

- Maintain long positive stance on China local government debt

Covid-19 situation update |

||

| Pierre Blanchet Chairman, Amundi Institute |

||

|

While the attention of Western leaders is focused mostly on the war in Ukraine, Covid-19 and its Omicron BA.1 and BA.2 variants continue to make headway. In the United Kingdom, the number of reported cases is once again near the record set in late 2021. One out of 16 persons reportedly had the virus in England last week and 1 out of 11 in Scotland. In France, the number of new daily cases is almost 150,000, a level that would have triggered a nationwide lockdown just a few quarters ago. However, the ICU hospitalisation rate is still rather low, and the hospital system is not on the verge of saturation, as it might have been during previous waves. In China, however, the virus’s spread has pushed the authorities into imposing new lockdowns. This was the case at first in the region of Shenzhen, where large electronic component fabs are located, and, more recently, the city of Shanghai. China’s financial capital is currently split in two, with the Huangpu river as the dividing line. Half of its 26 million people are being locked down until 1 April, and the other half of the city is expected to suffer an similar fate next week. The Chinese authorities’ “zero-Covid” strategy is testing its limits, as locking down millions of people in key economic zones may appear, based on the official case numbers, to be disproportionate compared to Europe. The economic repercussions could be very serious for China’s economic partners. |

||

AMUNDI ASSET CLASS VIEWS

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

— Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

— Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.