Summary

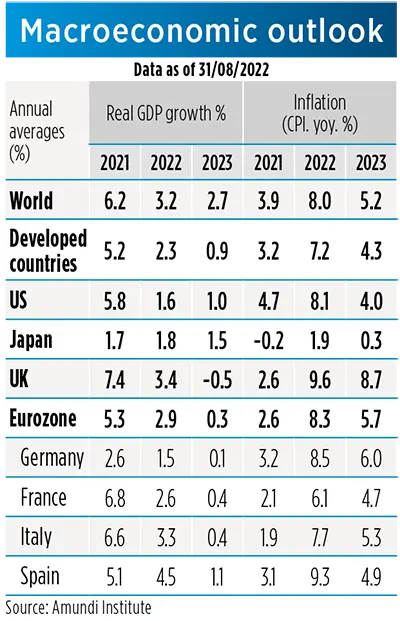

DEVELOPED COUNTRIES

- United States: The H1 contraction will be followed by a protracted period of sub-par growth, but the ongoing deceleration is so far not yet due to Fed tightening; cracks are appearing in an apparently strong labour market, and we expect the lack of productivity to cause a labour market correction. This raises the recession risk for mid-2023, when monetary policy action is expected to take more effect. Easing, but still high, inflation is ahead. Bottlenecks and price pressures are easing, but are staying high. This should push down goods inflation, but lower rent inflation is a 2023 story, meaning inflation will stay significantly above target for several quarters still.

- Eurozone: Extreme weather conditions, compounding with the Russia gas issue, are extending the stagflationary shock, amidst limited fiscal room, weak global growth, and tighter financial conditions, leading to recession in autumn-winter. It will be a cost-of living-driven crisis, as consumers and companies will face further energy cost stress. Fiscal support may help somewhat, but policy room is limited. Inflation is expected to peak in winter near double digits, remaining sustained and broad-based, rising until Q4 and plateauing, and decelerating from 2023.

- United Kingdom: We expect the hit from high energy prices to cause a consumer-led recession in winter, but one that is less severe than predicted by the BoE, as we foresee less aggressive tightening and some fiscal support coming to help. We expect double-digit peak inflation in Q4-Q1 on high energy price pass-throughs, while the new PM is likely to deliver some fiscal support to households for high energy prices.

- Japan: Economic recovery in Q2 came in softer than we expected, as private consumption started to feel the hit from higher food and energy prices. Entering Q3, consumers are caught between stronger inflation and rampant Covid-19 outbreak, while global demand moderates. The economic outlook is dimming, as recovery momentum that stems from a delayed reopening is weakened by plunging export demand, and the latter will likely drag the whole economy into recession in H1 2023. Nevertheless, the input cost pass-through is continuing, which will drive inflation up throughout the rest of 2022.

|

|

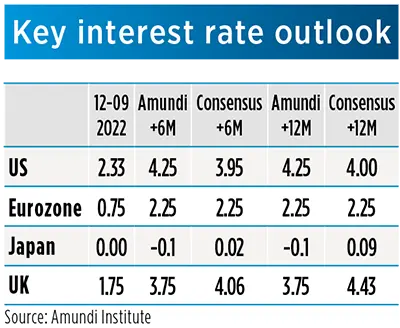

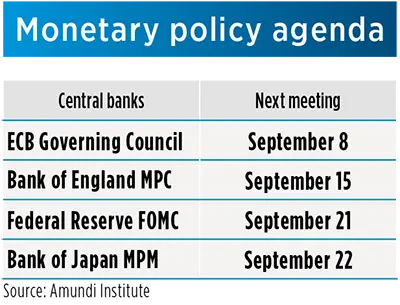

- Fed: In our scenario, the Fed will hike rates by 75bp at its September meeting and will slow its pace of hikes to 25 bp at the following meetings in November and December. In our scenario, the terminal rate for this hiking cycle is 4% and will be reached at the end of the year. Our view of the rate path for 2023 is different from the market’s, which is pricing rate cuts in the summer 2023. There are no rate cuts in our soft-landing scenario. Recent Fed communication has emphasised rates might need to be higher for longer and that restoring price stability will likely require maintaining a restrictive policy stance for some time to come. In a scenario of soft landing, we are comfortable with stable rates (with a modest rise in the unemployment rate and low growth). A hard landing would, of course, trigger rate cuts.

- ECB: In July the ECB hiked rates by 50bp rather than by the previously announced 25bp, dropped forward guidance and became more data-dependent. The announced TPI was unanimously supported and is unlimited in size, with conditionality linked to already-existing commitments and is flexible in terms of triggering. The TPI announcement indirectly supports our baseline expected scenario on rates, pointing to two further 50bp moves at the next two meetings and to a 25bp move in December. PEPP flexible reinvestments conducted in July confirmed the ECB’s commitment to fighting fragmentation.

- BoJ: Japan’s inflation has strengthened further and the likelihood of core inflation (ex. fresh food and energy) reaching the 2% target in late 2022/early 2023 has increased significantly. This is in contrast to the BoJ’s own benign forecast of a modest increase to 1.5% by FY2024. However, BoJ officials continued to voice up its preference for ultra-loose policy during the August summer recess, citing growth and demand concerns. The BoJ is more likely to brush off a potential overshoot of inflation rates and is maintaining its accommodative stance.

- BoE: The latest meeting delivered a 50bp hike and indicated that active QT is likely to start in October with an expected size within the consensus range. The major news came from the updated set of economic projections, pointing to a much worse growth picture than before, coupled with higher inflation expected this year and next year. New forward guidance underlines significantly increased uncertainty over the path for policy rates over the medium term, with more tightening in the near term likely, but also forecasting a significant growth slowdown and recession.

EMERGING COUNTRIES

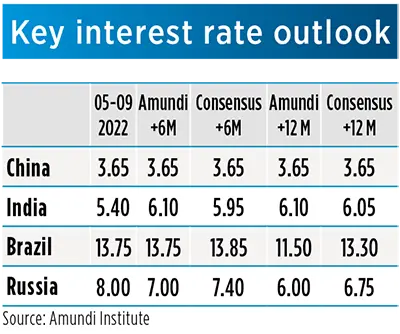

- China: The economy recovered further in July in August, but momentum slowed notably from June. Domestic demand indicators were sluggish across the board, reflecting an overall lack of confidence in the private sector. The housing downturn, complicated by sporadic Covid-19 restrictions, continued to weigh on China’s economic recovery, dampening fiscal and monetary easing efforts. Against the backdrop of a challenging macro backdrop and depressed consumer confidence, we now expect a bigger housing contraction from August to December at -20% YoY and have downgraded H2 growth accordingly.

- Indonesia: On the back of domestic economic conditions and global financial uncertainty, BI has finally decided to raise its Policy Rate by 25bps to 3.75%. While Core Inflation remains subdued (though increasing), Headline Inflation is well above the target driven by volatile components, which are not subsidised. BI sees the risk of Inflation expectations building up. The hiking path should continue at a gradual pace, with about 100-125bps in the pipeline. As announced in August, 2023, the budget reports a fiscal deficit within the legal threshold of 3%, as per the plan announced during the pandemic.

- Thailand: Amid the laggards, BoT raised its Policy Rate in August by 25bps to 0.75%. Still the approach to policy normalisation will be very gradual, in consideration of a still subdued recovery phase. Q2 2022 GDP disappointed economists’ expectations. Despite moderate growth, BoT’s balance of risk has definitely tilted towards inflation, with headline at 14 years high and cost pressure (food) passing on to core inflation. In the meantime, tourism revenues (an important part of the economy) have been gaining pace though are still far away from the pre-pandemic levels.

- Brazil: Sequential growth appears to be peaking now after a robust 1H but is by no means tanking, supported by another round of disinflationary and pre-election policies. We see GDP expanding by over 2% in 2022. Inflation peaked already in April at 12.1% YoY and will close the year below 7% thanks also to tax and fuel price cuts. The BCB is ready to wrap up its diesel tightening cycle after hiking rates to 13.75% though left the door slightly open to another residual hike in September. Most importantly, the presidential election is now just several weeks away, with Lula leading Bolsonaro handsomely, though with a shrinking lead.

|

|

- PBoC (China): After holding policy rates steady for months, the PBoC surprised the markets in August, first lowering its interbank market rates (7d repo and 1y MLF) by 10bp, then cutting 1yr LPR by 5bp and 5yr LPR by 15bp. Against a backdrop of sluggish domestic demand and the sharper-than-expected housing downturn, this nonparallel cut serves as an additional effort to stimulate housing demand and to nip a broader crisis in the bud. Maintaining an easing bias, PBoC will focus on structural easing for most of the time and further broad easing will be data-dependent.

- RBI (India): In August, the RBI hiked its Policy Rate by 50bps to 5.40% and was perceived as hawkish, as a large part of economists expected a more moderate hiking. Instead, the RBI continued frontloading its normalisation, and we expect the RBI will move forward in October and December at a slower pace, reaching 6.1% as terminal rate. In the meantime, headline inflation (as well as core) declined mildly in July to 6.7% YoY from 7.0%, in our opinion not implying the start of a proper descending trend yet. The RBI is proving to be less accommodative and not really tight at this point.

- BCB (Brazil): Finally there? While the Fed appears to be pivoting towards a slower pace of tightening, the BCB, which had been front-running the Fed from the get-go, is now wrapping up its diesel hiking cycle. At its early August meeting, COPOM hiked again by 50bp to 13.75% but closed the door to another hike of the same magnitude in September. The CB will consider another ‘residual’ hike of 25bps but, given the latest set of minutes and the slightly better than expected July inflation print, the odds are now in favour of no further adjustment. But as in the case of the Fed, BCB will want to see the August inflation print before deciding on the next move.

- CBR (Russia): The CBR cut its policy rate again by 150bps to 8% in July. The magnitude of the cut was larger than expected. The main reasons for the cut were declining inflation and subdued consumer demand. The CBR left the door open for further cuts. July inflation decelerated further to 15.1% YoY, from 15.9% YoY in June and 17.1% in May. We expect inflation to decline further to around 13-14% by yearend. We expect another 100bps cut from CBR over the next six months and an additional 100bps after that, bringing the policy rate to around 6% over a 12-month horizon.onal 100bps after that, bringing the policy rate to around 7.5% over a 12-month horizon.

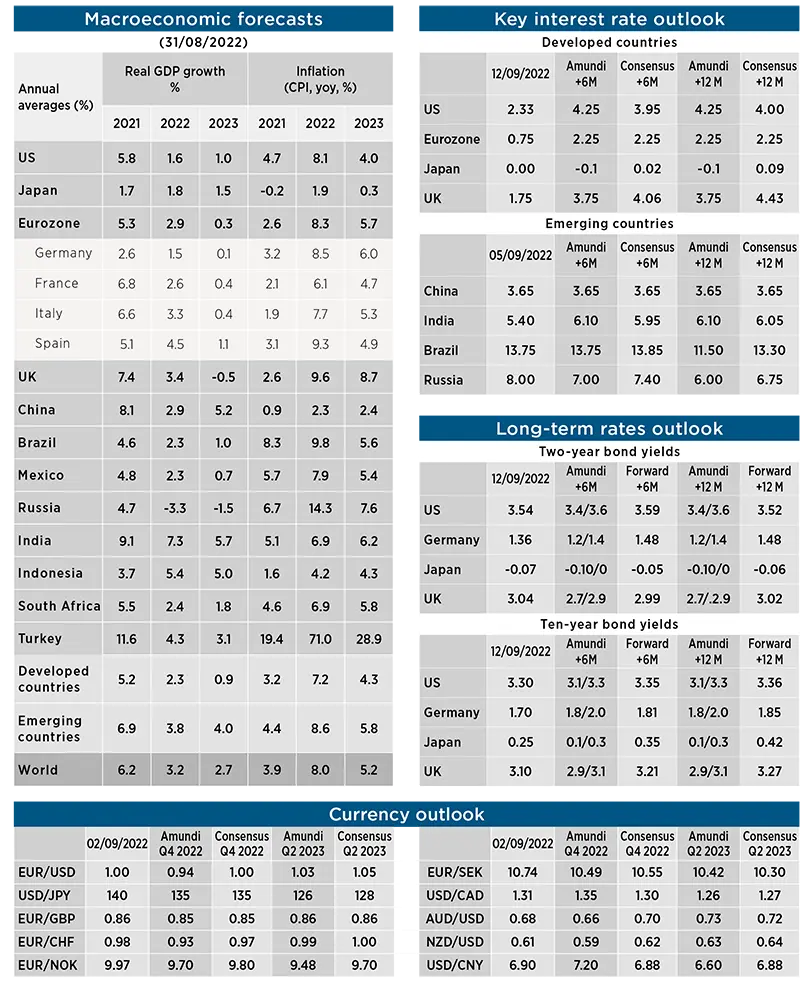

MACRO AND MARKET FORECASTS

UK forecasts are as of 31 August 2022. In light of the recent announcements by the UK Government, but in absence of details enabling to evaluate the final impact at the closing of the document, we leave our projections unchanged, warning our forecasts may be subject to change shortly after publication.