Summary

DEVELOPED COUNTRIES

- United States: Growth. We are still calling a soft landing in the US, with an extended period of sub-par growth for 2023 and 2024. We expect the US economy to grow by 0.9% in 2023 (1.1% Q4/Q4) and 1.3% in 2024 (1.3% Q4/Q4). Inflation. Headline inflation has peaked in the US and is now set to slow progressively as the economy runs below potential. Core inflation will peak slightly later, between Q3 and Q4 22, and then gradually decline, although remaining above target. The Fed will stick to its tightening cycle until current and leading inflation indicators point clearly in the desired direction.

- Eurozone: Growth. We now see a somewhat deeper recession in autumn-winter 22-23, followed by a shallower recovery than before. We expect the Eurozone economy to contract by -0.5% in 2023 and to slowly recover to 1.3% in 2024. Inflation. We confirm our call for inflation to peak little below 10% in Q4 22 and to decelerate towards 4% by Q4 23. The outlook remains highly uncertain as highlighted by recent geopolitical events related to gas supply and gas prices. The ECB remains is in a tough position, needing to calibrate policy tightening in a stagflationary context.

- United Kingdom: Growth. We still see a mild recession for the UK. We expect the economy to contract to around -0.5% in 2023 and then to recover, growing by 1.3% in 2024. Inflation. We have lowered our peak inflation projections for 2022 and 2023, but raised our core inflation forecast for 2024, as we expect the new budget to produce more persistent inflationary pressures in the medium term. The recently announced fiscal package will stimulate demand in a supply-constrained economy, putting a floor on growth but also supporting inflationary pressures, likely forcing the BoE to bolder actions.

- Japan: The government relaxed inbound travel further in September. Mainland Chinese – who accounted for 30% of visitors to Japan before the pandemic – will still be missing. Nevertheless, the reopening of the borders, along with resumed domestic travel subsidies and an ultra-weak yen, will lend support to services consumption in the coming months. Household inflation expectations remain at a historic high. We expect core inflation to climb further, and overshoot the BoJ’s 2% target in Q4 2022-Q1 2023. The BoJ is likely to downplay this overshoot and repeat that it is not sustainable.

|

|

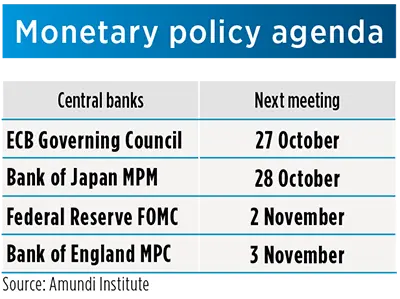

- Fed: As widely expected, the FOMC delivered in September a third consecutive 75 bps hike, bringing the Fed Funds rate to 3.25%. The incremental hawkishness came via the Summary of Economic Projections, which showed a surprisingly sharp increase in Fed funds rate projections. Indeed, the FOMC is committed to hiking aggressively amidst sustained inflationary pressures from an economy that is being supported by a very resilient and robust labour market. In light of the resilience of the US economy, persistent inflation and the Fed’s willingness to go into highly restrictive territory, we now see a high probability that Fed will hike rates until a terminal policy rate in the 4.75% to 5% range.

- ECB: At its September meeting, the ECB decided unanimously to hike its three key interest rates by 75bp. The decision was driven by concerns about the risk of inflation expectations getting de-anchored. Given very high inflation, we expect the ECB to maintain a hawkish stance in the coming months, as the central bank is determined to front-load rate hikes and normalise policy rates rapidly. The ECB baseline scenario is for stagnation in Q4 2022/Q1 2023 rather than for a recession. We expect the ECB to keep a hawkish stance and raise rates further at its next meetings.

- BoJ: The BoJ left its policies and forward guidance unchanged in September, resisting pressure from aggressive tightening overseas and a sharply depreciating yen. Shortly thereafter, the MoF spent 2.8 trillion yen intervening on the FX market. The BoJ continued to buy JGBs after the FX intervention, sending a strong signal to markets that it wants to defend the YCC and its ultra-loose monetary policy stance. We don’t expect any change in the foreseeable future, as the BoJ appears to be buying time, waiting for US rates to peak and reduce the policy gap for it automatically.

- BoE: No hawkish surprise came from the last BoE meeting, as markets had implied the significant probability of a higher 75bps hike than the 50bp delivered. At the same time, the MPC unanimously backed the launch of its QT. However, the stronger-than-expected fiscal package announced after the meeting means that the central bank will be forced to react with hikes that are stronger than previously expected, ultimately leading to a higher terminal rate. At the same time the, BoE intervened announcing temporary long-end gilt buying operations in order to stabilise the market.

EMERGING COUNTRIES

- China: High-frequency data, including housing sales and mobility, improved towards the end of September, thanks to the partial relaxation of Covid restrictions. We expect the restrictions to remain tight in October, as local governments are doubling down on measures before the 20th Party Congress (16-22 October). But most of this extra tightening will likely be reversed in November, paving the way for a soft recovery beyond that. CPI has stayed subdued below 3%, as pork and energy prices plateaued, and the repeated disruptions in services sector from Covid controls have contained underlying inflation.

- Indonesia: In September, the BI hiked its rates by 50bps (vs. consensus and our expectations at 25bps). While the surprise was on the size of the hike, it’s fair to highlight that the headline inflation figure for September, at 5.9% YoY from 4.7% YoY, has proven to incorporate the subsidies reduction implemented in early September. Based on these measures, we expect inflation to trend higher in Q4 2023, more around 7.0%, calling for further hiking by the BI and at the margin higher than what we were expecting before: 100bps in the pipeline with some easing possibly by the end of next year.

- CEE4: The inflationary effects of the energy crisis have started to affect growth and are expected to intensify. These countries will find it difficult to escape at least a technical recession. Moreover, those countries most economically and/or politically vulnerable vis-à-vis Europe and the availability of European funds (i.e., Hungary and Poland) are facing and will continue to face, major pressures on their currencies, which will penalise them further. Even though CBs have reached, or are closed to, the end of their hiking cycle, we cannot expect any rate cut soon, given the high level of inflation, uncertainties on inflation expectations, and the tightening of the main CBs, i.e., the Fed and the ECB.

- Turkey: While inflation is reaching peaks (nearly 85% YoY) and most central banks are tightening their monetary policies, the CBRT again lowered its rate by 100bps to 12%, causing the currency to fall again. We think that the CBRT could go even further, as it doesn’t seem to be much concerned by the TRY depreciation, 20TRY/USD will likely mark a threshold to stop easing. While expectations are for a recession in the Eurozone, Turkey may grow by 3% YoY in 2023 thanks to credit growth and extra-loose fiscal policy, especially ahead of next elections.

|

|

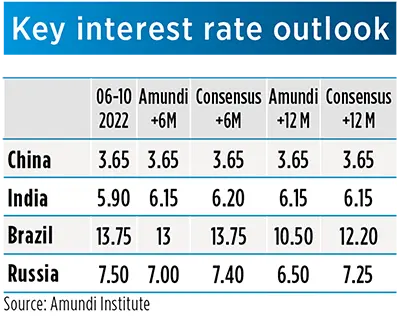

- PBoC (China): the PBoC kept policy rates unchanged in September after the surprising cuts of the previous month. It stepped up support to the faltering housing sector, reducing the mortgage rate for the housing provident fund by 15bps for first-home buyers and allowing banks in qualified regions to reduce mortgage rate floors. With the zero-Covid policy and a slowing housing market weighing on the economy, we expect the central bank to continue with its accommodative monetary policy. Further rate cuts will depend on whether housing sales manage to stabilise.

- RBI (India): As expected, the RBI hiked again its policy rates by 50bp in September, to 5.9%. Since May 2022, the RBI has pursued its front-loading actions in order to keep inflation expectations under control as well as intervening to limit the INR’s depreciation in reaction to deteriorating external conditions. Indeed, in Q2 2022, the current account deficit reached almost 3.0% of GDP. We expect inflation to remain above 6% until the end of Q1 2023 and then slowly moderate below the upper range band of 6.0%. RBI is expected to hike its rates by 25bps more, taking the repo rate to 6.15%.

- BCB (Brazil): 1st EM hiking finisher. While the Fed is still front-loading rate hikes to try to deflate the economy and the labour market, the BCB appears to be done now with its diesel hiking cycle that lasted for 1.5 years and raised rates by nearly 12pp to 13.75%. But the decision that brought about the end was far from a standard one. It was the first split decision (7-2) since 2016, while the statement was full of hawkish remarks. In fact, COPOM made it sound more like a pause by saying it would “not hesitate to resume the tightening cycle” if necessary and otherwise employ the wait-and-see strategy “for sufficiently long.”

- CBR (Russia): The CBR cut its policy rate again by 50bp to 7.5% on 16 September. The magnitude of the cut was in line with market expectations. The main reasons for the cut were declining inflation and subdued consumer demand. CBR’s message was rather balanced (less cutting bias), referring to risks from the potential direction of fiscal policy and the reaction of external markets. We expect another 50bp cut from the CBR over the next six months and possibly an additional 50bp after that, bringing the policy rate to around 6.5% over the twelve-month horizon.

MACRO AND MARKET FORECASTS