Summary

DEVELOPED COUNTRIES

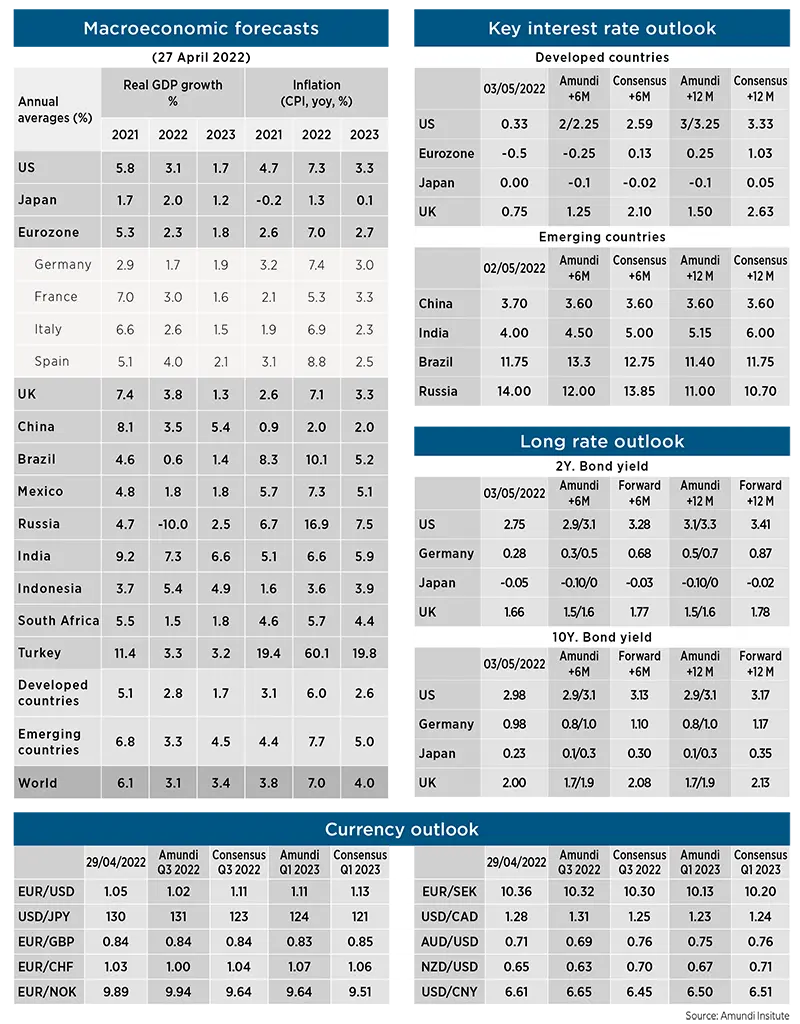

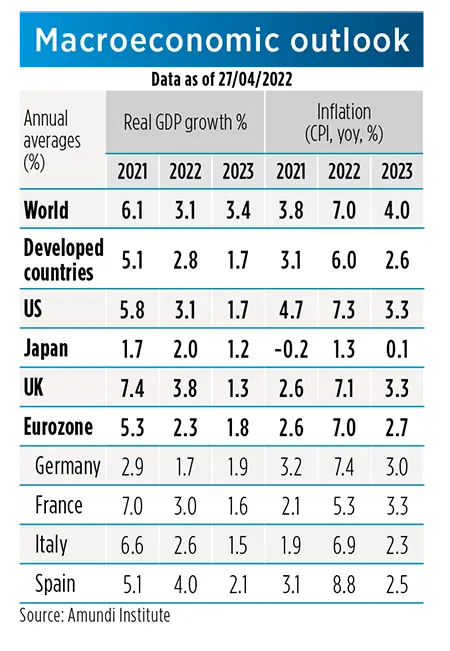

- United States: the surge in inflation to a multi-decade high is compressing real incomes and could negatively impact consumer confidence, spending and saving behaviour, as some surveys seem to expect. At the same time, companies’ capex intentions remain high, suggesting that, while US consumption may be decelerating, capex should remain resilient for the first part of the year at least. We expect GDP to move to potential towards yearend while headline inflation is currently peaking and should start to moderate, while remaining well above the Fed’s target for the entire year .

- Eurozone: the increase in energy and commodity prices continues to weigh on households and businesses as the Ukraine war drags on, putting the recovery of domestic demand on hold and increasing the risks of technical recession in some countries. At the same time, supply-chain disruptions are returning, while risks of gas and energy rationing are exacerbating concerns among producers. Supply and energy-driven inflation will rise further for a few months before starting a progressive deceleration under the assumption of lower energy and commodity prices in the second half of the year.

- United Kingdom: high energy prices, faltering confidence, and an extended war have once again pushed our inflation forecast higher and our growth forecast lower. As inflation dents purchasing power and company margins, growth is expected to remain quite weak for a couple of quarters at least. Given the weaker growth outlook, concerns over a tight labour market becoming tighter may be easing, although labour supply may be structurally lower than before. Inflation is expected to peak in April and then start decelerating, although it is expected to remain significantly high by historical standards.

- Japan: Japan remains the exception that continues to register mild consumer inflation amid rising global food and energy prices. Both temporary technical factors and lacklustre demand are responsible for its missing hi-flation. Technical factors – such as the reduction of mobile phone charges in April 2020 and rebasing in August – will start to recede and add about 1 ppt back to CPI. Meanwhile, the economy has struggled to recover from the double hit from the consumption tax hike (in late 2019) and then Covid. GDP has yet to come back to its pre-Covid level, and the case for a strong recovery ahead is still weak.

|

|

|

|

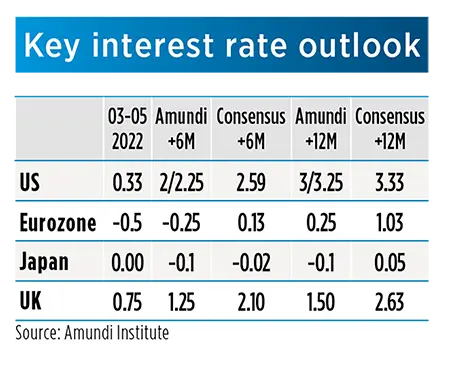

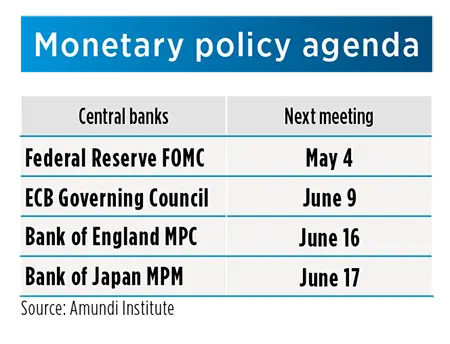

- Fed: The March FOMC minutes revealed some of the key parameters of the balance sheet reduction process: 1) the monthly cap will likely be set at $95bn ($60bn for TSY and -$35bn for MBS); and 2) the caps will be phased in over a period of around three months. The minutes also indicated strong support for 50 bp increases in the policy rate at future meetings if inflationary pressures remain elevated. It supports our view that the FOMC will hike rates by 50 bp in May and June. There is also a high probability that the FOMC continues to hike rates by 50 bp at subsequent meetings, until it reaches the 2.5% level considered as neutral. The Fed should then move into restrictive territory, to reach a terminal rate of 3%-3.25%.

- ECB: In April, the ECB failed to deliver additional hawkish surprises, following the ones delivered in previous meetings. The timing for the end of QE in Q3 was confirmed, while the ECB’s rates guidance and the sequence between the end of QE and rate normalisation were confirmed, too. The ECB is determined to deliver on its price stability mandate, but it acknowledged the high level of uncertainty, and the path of monetary policy will therefore be even more datadependent. Our baseline scenario points to QE likely ending in July, followed by two rate hikes before year end, and by a third in Q1.

- BoJ: In strong contrast to its peers, the BoJ is staying unwaveringly dovish and disregarding the sharp movement in the yen. Speculations had built up before the April meeting that the BoJ could start to fine-tune its communication by adjusting its forward guidance. Instead, it maintained its forward guidance and introduced daily fixed-rate purchases to defend its YCC. The inclusion of a new core inflation forecast in the outlook report suggests that the BoJ expects underlying inflation to stay subdued throughout FY2022-23 and is not in a rush to change its YCC target.

- BoE: By a large majority of 8 to 1 members, the BoE increased its Bank Rate by 25bps to 0.75% in March, its third consecutive policy meeting hike, which brought the policy rate back to prepandemic levels. We expect the BoE to raise rates to 1.0% at the next meeting, in order to begin active QT. At the same time, the recent, more dovish tone suggests that the Monetary Policy Committee expects a more delicate balancing act in the trade-off between high inflation and risks to growth. Thereafter a pause may come after the next hike.

EMERGING COUNTRIES

- China: Growth came in firmer than we expected, at 4.8% YoY in Q1, defying strong negative base effects. However, the broad slowdown in economic activities since March, the extended lockdown in Shanghai, and expanded restrictions into other regions are expected to send China into a transitory recession in Q2. We are keeping our growth forecast below consensus at 3.5% for 2022, and expect a rebound in 2023 to 5.4%. CPI inflation is expected to hold below 3%, considering the drag from stringent Covid policies on the labour market and consumer demand.

- Mexico: While still below the pre-pandemic levels, economic activity gained some momentum in 1Q, thanks to stronger external demand but also domestic consumption. Inflationary pressures, meanwhile, are not abating and, together with a more expeditious Fed, are forcing Banxico into more forceful action – we think it will mimic the Fed, despite lesser external and financial exposure. On the political front, AMLO’s electricity (anti)reform did not pass, and the Supreme Court voted against the electricity bill (though did not strike it down as unconstitutional), suggesting checks and balances are more or less working.

- Indonesia: In late April, President Jokowi enforced a palm oil products ban in order to meet domestic demand (amid soaring cooking oil prices) over exports. The ban should remain in place until unpackaged cooking oil price reaches IDR14,000/ltr, therefore moderating the inflation pressure. Beyond the domestic impact, a demand surge for substitute products (soybean oil) could contribute to raising inflation globally. Beyond a mild positive impact on inflation, the acceleration of a current account negative trend (due to the prominence of palm oil in exports) will challenge BI’s pro-growth stance and possibly IDR stability.

- Brazil: The geopolitical shock will likely have a less damaging impact on Brazil (and LatAm in general) thanks to its geographical location, lesser trade and financial exposure to the region and its net commodity producer status. But while growth is more protected, inflation is being hit hard despite policy makers’ efforts to cushion the blow and its impact on disposal income. The BCB will, in turn, be under pressure to extend the hiking cycle for a bit longer. The crisis, however, presents long-term opportunities for both Brazil and the region as food and energy security and near-shoring become strategically important.

|

|

|

|

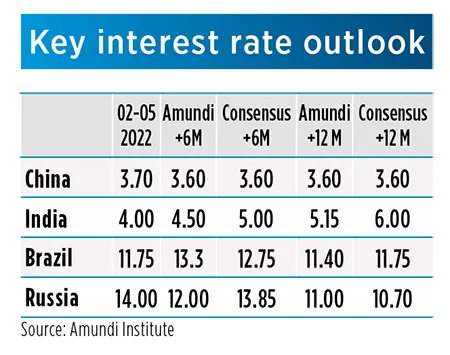

- PBoC (China): The central bank disappointed again in April, leaving policy rates unchanged and cutting the RRR less than expected. Interbank liquidity conditions have loosened further, with front-end rates plunging. The Bank turned its focus to transmission, talking about the structural supports to SMEs and credit growth stabilisation. With mounting downward pressures on growth, additional rate cuts are still needed and we expect another 10bp rate cut in coming months. We expect credit impulse to turn positive in April and to improve further.

- RBI (India): Following a long period of very dovish monetary policy, the RBI’s stance turned de facto more neutral at its latest meeting in early April, introducing a new instrument (SDF) to recalibrate the symmetric corridor around the Policy Rates at 4.0% with the MSF at 4.25% and the SDF at 3.75%. Some pressures from higher-than-expected inflation are rising (7% YoY in March above the RBI target). We confirm our expectations of the first policy rate hike in June by 25bps (50bps is not a negligible probability) and a more sizable tightening path on a one-year horizon (150bps-200bps).

- BCB (Brazil): ‘Structurally’ data-dependent now. COPOM slowed down the pace of tightening and raised SELIC by 100bps in March (to 11.75%) as pre-announced. The BCB wants to hike again by the same magnitude in May but also hinted that this is where the hiking cycle might end (at 12.75%), due to the advanced stage of the tightening cycle, unless proven otherwise by inflation. But even though the Ukraine crisis supply shock is hitting price dynamics hard, Gov. Campos wants to assess the damage from a structural standpoint and via second-round effects mainly. Either way, the terminal rate is just around the corner.

- CBR (Russia): The CBR cut the policy rate again on April 29th, from 17% to 14% following the April 8th surprise rate cut by 3%. These cuts follow the surprise hike of February 28th, to 20% from 9,5%. The latest rate cuts were motivated by the slowdown in economic activity and the appreciation of the rouble, coupled with high inflation -- albeit expected to abate. The CBR left the door open for more cuts. In March, inflation jumped to 16,7% yoy from 9,2% in February. Inflationary pressures are expected to ease towards the end of the year, with inflation, however, remaining above the 4% target. Milder inflation dynamics may allow the CBR more cuts in the coming months

MACRO AND MARKET FORECASTS