Summary

DEVELOPED COUNTRIES

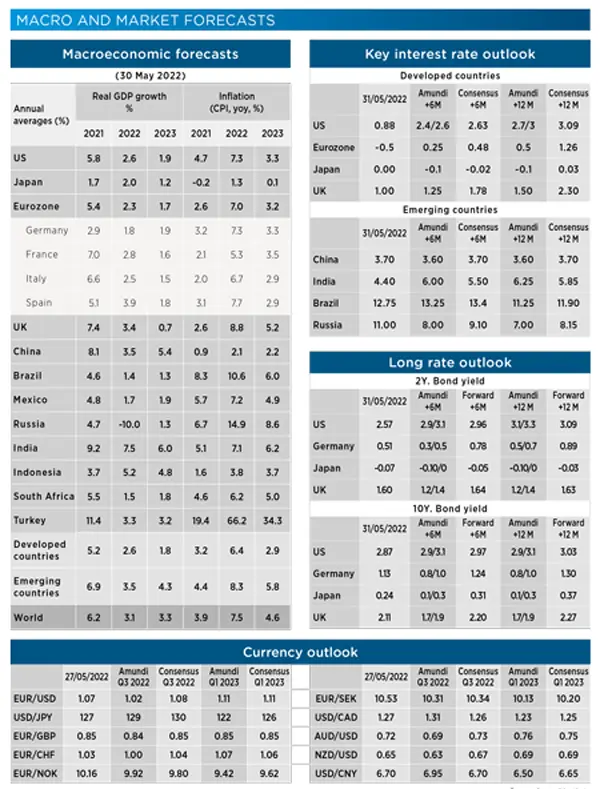

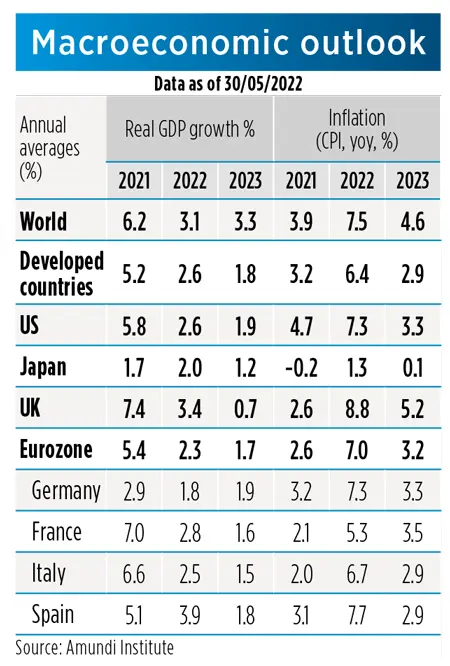

- United States: After the contraction in Q1 (resulting from an outsized detraction from net exports and a payback from the surge in inventories in Q4, not from weak demand) we expect sequential growth to pick up from Q2 and stabilise around moderate rates of growth consistent with reaching 1.6% in Q4/Q4 22 and 1.5% in Q4/Q4 23. Domestic demand will significantly slow on tightening financial conditions, bringing growth below potential sooner than expected. Inflationary pressures remain elevated from both headline volatile components (energy and food inflation) and stickier core drivers, remaining above 6% till year end.

- Eurozone: The Eurozone looks set for a year of stagnating growth amid high and persistent inflation. We expect the economy to post very limited sequential gains for much of the year; high inflation and low confidence are dampening consumption while uncertainty weighs on investments; domestic demand is weak, and foreign demand isn’t much better, thus reducing the contribution of exports. Inflation has become progressively more broad-based; looking ahead, we continue to expect inflation to remain significantly above the ECB target, as pressures on the core will remain high.

- United Kingdom: Against a backdrop of high and persistent inflation, we expect the economy to quickly lose steam as higher prices and taxes squeeze households real disposable incomes. A technical recession is a material possibility, although for now we expect the economy to avoid posting two consecutive quarters of negative growth. Sequentially, we see GDP remaining on a tightrope between contraction and mild expansion. Inflation momentum is still high as producer pricing pressures continue to increase and survey data remain consistent with inflationary pressures staying higher for a prolonged time.

- Japan: Unlike its DM peers, Japan’s post-pandemic recovery has remained sluggish. GDP contracted again in Q1, and the overall economic output stayed at a same level as in Q4 2020. Business investments were a particular concern, while the recent slide in sentiment doesn’t bode well for a rebound, considering new supply constraints and the continuous deterioration in terms of trade. Inflation, on the other hand, has become increasingly sticky as expectations hit record high. Core inflation will rise further throughout the year, but stay comfortably below BoJ’s 2% target.

|

|

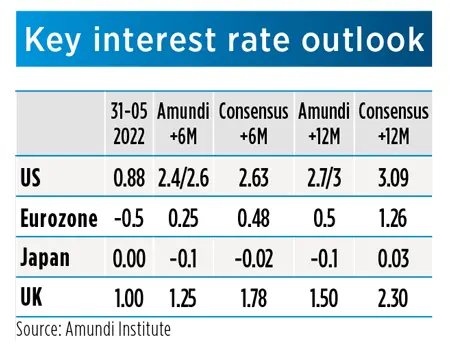

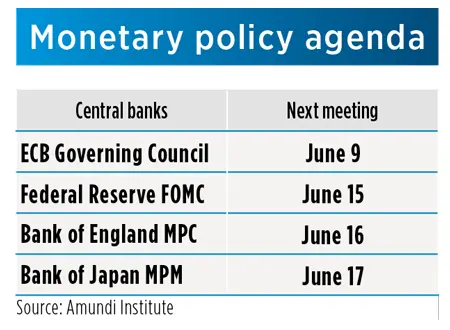

- Fed: At its latest FOMC meeting, the Fed hiked by 50bp and announced that the balance sheet runoff would start in June at a pace in line with market expectations. The meeting confirmed the Fed’s hawkish stance and focus on inflation, pointing to additional hikes likely to remain in the 50bps area at the next two meetings, followed by a possible slowdown to 25bps hikes in the remaining part of the year. This path remains in line with our baseline scenario on US Fed fund rates, pointing to the 2.5% area by year-end, and to a move close to 3/3.25% in one year.

- ECB: President Lagarde confirmed that QE net purchases are likely to end very early in the third quarter, allowing a rate lift-off in July, in line with forward guidance. She added that “based on the current outlook, we are likely to be in a position to exit negative rates by the end of the third quarter”, meaning that a second hike may come in September. The normalisation path in following quarters look more data-dependent, but we expect a third hike in Q4 and a fourth in Q1-23. ECB is also likely to revise down March projections on growth in June meeting

- BoJ: There are good reasons for BoJ to stay dovish. Japan’s economic recovery has lagged behind, with a deep output gap that is not expected to close before 2024. Consumer inflation, albeit strengthening, has stayed contained. Against this backdrop, BoJ has repeatedly stated that the cost-driven increase in inflation is not sustainable. It has maintained its ultra-loose monetary policy and defended its YCC target range by committing to buy unlimited amount of JGBs. Leaving the JPY mostly to MoF, BoJ will continue to prioritise the domestic economy and stay accommodative.

- BoE: The Bank of England hiked rates by 25bp at its last meeting but failed to introduce an announcement on active QT, postponing it to August. New forecasts show a grim picture for the UK economy, with inflation likely to hit above 10% and GDP to contract in 2023 and expected close to stagnation in 2024. The statement had dovish elements, as well, with two members questioning whether the guidance of further hikes was appropriate. Consistent with this outcome, we still expect the BoE to proceed with a more limited rate hike path than still priced in by the markets

EMERGING COUNTRIES

- China: High-frequency economic data, including truck flows and logistics throughput, have been gradually recovering since early April but is still below its level of end-March. In YoY terms, the decline has narrowed moderately, and likely rounded up Q2 with a negative growth rate. Despite upgraded easing efforts, we see the zero-Covid policy as the major catalyst on China’s growth outlook. We expect GDP to contract by 15.9% QoQ annualised (-0.6% YoY)

- CEE4: Inflation continues to rise (ranging from 9.5% YoY in Hungary to 14.2% in the Czech Republic in April). In this context of persistent global and domestic inflationary pressures, central banks have revised up their inflation forecasts and hiked again at their last meetings, by 75bp at CNB, NBP, NBR and 100bp for NBH to, respectively, at 5.45%, 5.25%, 3.75%, 5.4%. CNB is expected to become more dovish due to a change of governor and to end its hiking cycle soon. The other CBs are likely to extend their hiking cycle, with NBH remaining on a firming path and NBR still behind the curve.

- South Asia: During the month of May, the policy makers in several countries have been taking monetary and non-monetary measures to counter an upsurge in inflation trends. Central banks such as RBI (India), BSP (Philippines) and BNM (Malaysia) have begun their monetary policy tightening cycles, while the Indonesian and Indian governments have enforced bans on exports of food items (palm oil and wheat, respectively) aiming at maintaining a good domestic supply and better controlling the prices for these soft commodities. Indonesia has lately lifted the ban due to the poor outcome of attempts to keep cooking oil prices low and increased hoarding.

- Brazil: Stronger 1H economic activity thanks to robust ToT and various stimuli measures – we see GDP expanding by 1.4% in 2022 – will probably give way to softer 2H as high inflation, rates and elections uncertainty weigh on growth (unless offset by further fiscal measures). Inflation has likely peaked in annual terms at 12.1%, but broad-based inflationary pressures are not yet abating sequentially – the diffusion index has not yet shifted from its high levels. The BCB reloaded its leeway by reopening the fine-tuning stage of the tightening cycle likely to end in June at 13.25%.

|

|

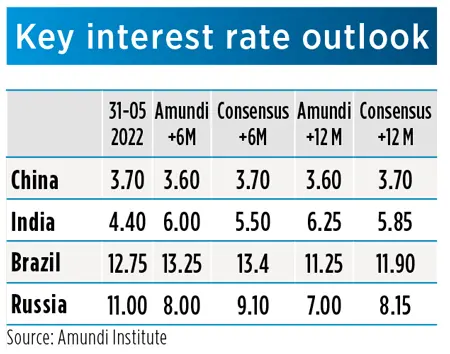

- PBoC (China): As April data genuinely reflected a broad deterioration in the economy, PBoC cut its 5yr LPR by 15bp on 20 May, just five days after it had lowered the mortgage rate floor by 20bp. After this strong move to restore household confidence and boost housing demand, an additional 10bp cut to 1yr LPR is still not completely off the table. However, further rate cuts have become a low-conviction call, since interbank liquidity has already loosened significantly with short rates plunging, and PBoC appears to be focusing more on the transmission side.

- RBI (India): In an inter-meeting decision, in May, the RBI hiked its policy rates by 40bps, from 4% to 4.4% and maintained a dovish stance. While a start of the tightening cycle was broadly expected soon, the decision taken in May surprised on the timing and has triggered a reassessment of the next steps. Moreover, April headline inflation figure of 7.8% YoY, together with stubbornly high core prices and WPI have added pressure for a tighter policy rates path going forward. Based on our inflation expectations of around 7% over 2022, the RBI would have to hike by about 150-200bps to get to a neutral real rate.

- BCB (Brazil): Unlike the Fed, which surprised slightly on the dovish side by taking the 75bps hike of the table, COPOM pre-announced another hike of a smaller magnitude in June (vs 100bps in May) after previously hinting at ending the hiking cycle at 12.75%. The BCB reopened the hiking door, and the fine-tuning stage of its by-now mature tightening cycle, as it could not ignore increased inflationary risks, heightened uncertainty and back then visible FX depreciation. We see the terminal rate of 13.25% being reached in June, though another hike in August is not out of the question.

- CBR (Russia): The CBR cut its policy rate by 300bps to 11% on Thursday 26 May at an unscheduled meeting. The rate cut was motivated by the strength of the RUB and the slight deceleration in inflation momentum. Inflation expectations are also on the decline. CBR thinks that immediate risk to financial stability has abated. The CBR revised its inflation forecasts down to 5-7% for 2023 and to 4% for 2024. We expect more cuts in the coming months as inflation stabilises and economic activity remains weak. We expect the policy rate to be as low as 7% in 12 months. The next scheduled meeting is in June.

MACRO AND MARKET FORECASTS