Summary

DEVELOPED COUNTRIES

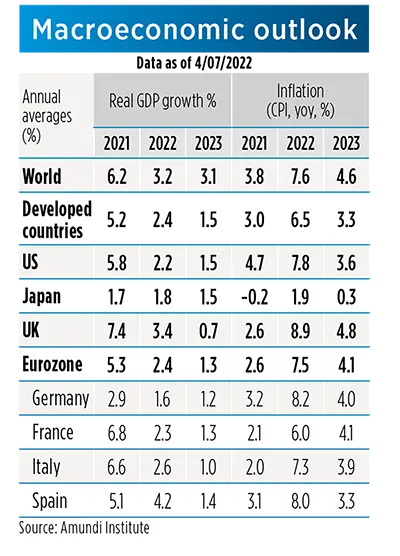

- United States: signs of decelerating growth are increasing as high inflation bites into consumers’ disposable income and companies’ margins. While we do not see activity contracting in Q2, risks to our projections remain on the downside. We do expect the US economy to grow below potential between now and yearend and to remain on a similar sub-par growth trajectory into 2023, as tighter monetary policy impacts the most interest-rate-sensitive sectors of the economy. Inflation should begin moderating by yearend but remain significantly above target as inflationary pressures continue to broaden.

- Eurozone: The upside revision to the Q1 GDP figure (from 0.3% to 0.6%) masks weak domestic demand, especially on the consumption side, and does not bode well for the rest of the year. Higher realised and projected inflation will translate into weaker domestic demand dynamics, making us expect broadly flat growth this year, with contraction risks concentrated in Q2 and Q4. 2023 growth expectations have also been marked down significantly on much weaker momentum entering the new year. Inflation is being revised higher on higher oil price dynamics, unabated pipeline pressures and broadening and accelerating inflationary pressures.

- United Kingdom: High and persistent inflation will translate into a squeeze in households’ real disposable incomes and companies’ margins, making a technical recession a material possibility, in line with recent monthly GDP data. Although for now we expect the economy to avoid posting two consecutive quarters of negative growth, risks remain tilted to the downside as inflationary pressures remain strong and as the hit to consumer and business confidence may not have materialised fully yet. Sequentially, we see GDP remaining on a tightrope between contraction and weak expansion, while inflation momentum remains strong, consistent with inflationary pressures staying higher for a prolonged period of time.

- Japan: Inflation rates have been trending up in the country but remain comfortably low. Optimism on an economic reopening is triumphing over inflation concerns for now, driving the services PMI to multi-year high in May. On the contrary, manufacturing PMI eased for the second consecutive month, reflecting the cooling global expansion and weakening external demand. On net, we expect Japan’s economic recovery to gain momentum from the rebound in private consumption. Its cycle is some distance away from maturing and is still playing a post-pandemic catch-up.

|

|

|

|

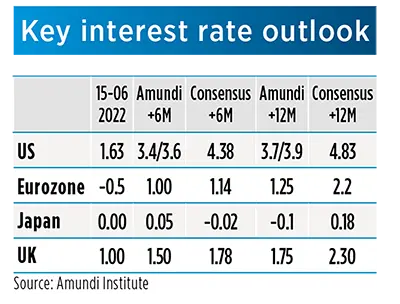

- Fed: The FOMC decided to raise its policy rates by 75 bps – its biggest hike since 1994 – with a target range now at 1.5%-1.75%. We expect the Fed will raise rates by 75bp again in July. Beyond that, we expect a 50bp increase in September and a return to 25bp increases in November before peaking at 3.75% in early 2023. Overall, the FOMC announced a sharper tightening of the policy rate through 2023 and the likely need for policy to be more restrictive next year in order to tackle inflation. With the recent developments on inflation, the FOMC wants to pursue a more aggressive front-loading of rate increases. The path to a soft landing is getting narrower.

- ECB: The ECB remained hawkish at its last regular meeting and will start its rate hikes with a 25bp move in July, followed by a likely 50bp in September, if the inflation picture does not improve. This should be followed by “a gradual but sustained path of further increases”. At the 15th ad hoc meeting following the regular one, the ECB committed to the design of a dedicated anti-fragmentation tool and to the use of flexible PEPP reinvestments: more clarity on the new tool in terms of size and functioning is expected to come by the July meeting.

- BoJ: The BoJ stood firmly as a dovish outlier in June, resisting pressures from bond and FX markets to make a policy change. Governor Kuroda delivered two clear messages that: 1) BoJ will stick to the YCC in order to support the economic recovery, and an expansion of YCC band is equivalent to a tightening; and 2) a sharp yen depreciation will hurt the economy, especially business investments. His statement gained support from PM Kishida, who believes FX is only one of several factors to consider for monetary policy. We expect no change to the YCC during Kuroda’s term.

- BoE: The BoE delivered an expected 25bp hike in June, at the same 6-3 majority of previous meetings and a minority pointing to a 50bp increase. Despite a weaker than expected growth picture, a tight labour market and persistent inflation have opened the door to a more forceful response at future meetings, sending a hawkish message, contrary to the more dovish tone of the May meeting. We expect the last move to be followed by a 25bps hike in August, and by an additional 25bps in Q4, but risks are tilted to a stronger move in August, depending mainly on coming inflation prints.

EMERGING COUNTRIES

- China: Since the Shanghai reopening, the biggest debate has been how strong the recovery is. We have observed a steady but moderate pick-up in national truck flows, with one distinguishing characteristic – cross-region travel has been much restricted due to local governments’ cautious stance on inbound cases, but mobility in each city has recovered more quickly. It is not a V-shaped rebound, and an economic contraction in Q2 is highly probable. Despite easing efforts, the recovery in H2 will most likely run below trend, considering the housing downturn and zero-Covid policy overhang.

- South Asia: In June, regional central banks didn’t surprise, with RBI (India) and BSP (Philippines) hiking again by 50bps and 25bps, respectively, while BI (Indonesia) and BoT (Thailand) kept policy rates on hold. Due to the increased inflation outlook, BSP will follow through, gradually increasing policy rates. BI has decided to overlook CCY volatility for the time being, triggered by a hawkish Fed and the wait for clearer signals on firming inflation, which will happen quite soon. Finally, the BoT board has started to shift towards a less dovish stance, likely bringing forward the first rates hike (Q3).

- Colombia: Gustavo Petro has become Colombia’s first ever leftist head of state and the Andean’s region third leftist president in this election cycle. Petro ran in an ambitious platform that included tax, pension, land, and healthcare reform, a ban on new oil exploration – which is highly problematic for a twin deficit economy. He sent a message of unity and dialogue in his acceptance speech. Despite signs of moderation, a regime change is likely on its way even if of an orderly nature. Meanwhile, the economy is moderating from a robust starting point, inflation is closing in on double digits and BanRep continues to hike in a gradual but firm way.

- Brazil: 1H economic activity re-accelerated thanks to a robust ToT and various stimuli measures but is likely to give way to softer 2H on the back of moderating but still high inflation, a double digits SELIC, and political noise unless offset by further fiscal measures – we see GDP expanding by 1.7% in 2022. Annual inflation has likely peaked in April at 12.1% YoY with favourable base effects and tax cuts helping inflation close the year at around 8% though sequentially inflation will be moderating more slowly. The BCB has pre-announced yet another fine tuning hike in August and hinted at a high-for-longer SELIC throughout the forecast horizon.

|

|

|

|

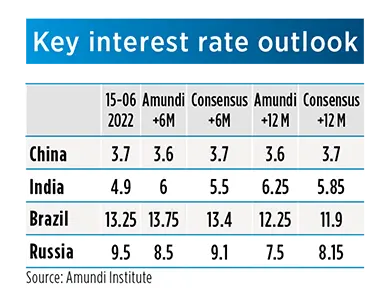

- PBoC (China): Mortgage rates plunged again in June to their lowest level since 2014, and interbank market rates stayed ultra-low. This argues against another policy rate cut from the PBoC, as liquidity and financing conditions have loosened so much in reality. We keep rolling with a 10bp LPR cut with low conviction. Such a cut would be deployed as a sentiment booster if needed on occasion if China has another wide-scale outbreak. Even without further rate cuts, we expect the PBoC to maintain an accommodative stance in the rest of 2022, to assist the recovery and fiscal stimulus.

- RBI (India): In June, as expected, the RBI board voted unanimously to continue its monetary policy normalisation, raising its policy rates by 50bps, from 4.40% to 4.90%. As appeared clear in the minutes as well, the focus shifted decisively towards inflation, as, for the second time in a row, the board raised its headline inflation forecasts for FY23 to 6.7% YoY from 5.7% YoY. Our internal forecasts are still higher at 7.4% YoY for FY23. We do expect policy tightening to continue until a neutral real rate, therefore implying 100-150 bps of more hiking.

- BCB (Brazil): Higher for longer. COPOM raised its policy rate in June by a smaller amount than in May (and less than the Fed) 50bps to 13.25% and hinted at yet another hike of the same or smaller magnitude in August. In a slightly hawkish twist, the committee also pointed out that, in order to bring inflation to around the target interest rates needed to remain in contractionary territory for longer/over the forecast horizon. We see the hiking cycle wrapping up in August at 13.75%, when the political cycle kicks off for good, and the policy U-turn taking place only in 2Q’23.

- CBR (Russia): The CBR cut its policy rate again by 150bps to 9.5% in June. May inflation decelerated to 17.1% YoY from 17.8% in April. The main factors behind this drop was the strengthening of the rouble and deceleration in domestic demand. The decline in the CPI came mainly from non-food items, but food and services also decelerated. Both household and business inflation expectations also are on the decline. We expect another 100bps cut from CBR over the next six months and an additional 100bps after that, bringing the policy rate to around 7.5% over a 12-month horizon.

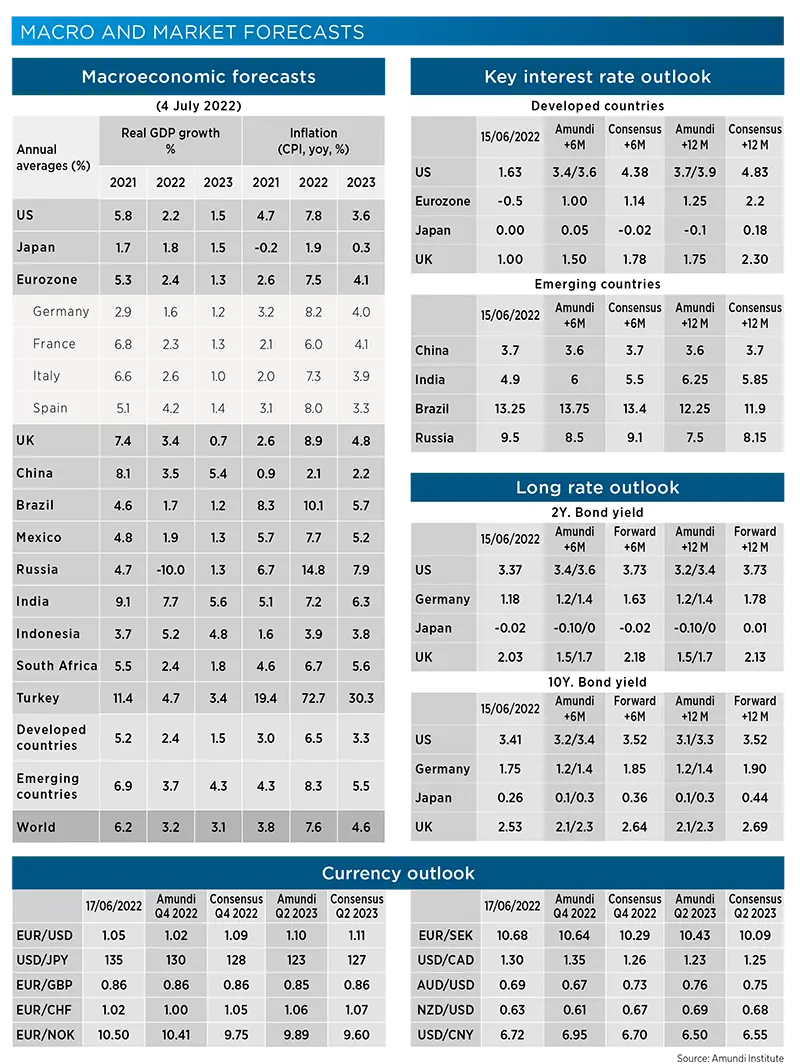

MACRO AND MARKET FORECASTS

DISCLAIMER TO OUR FORECASTS

the uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.