Summary

Developed Countries

-

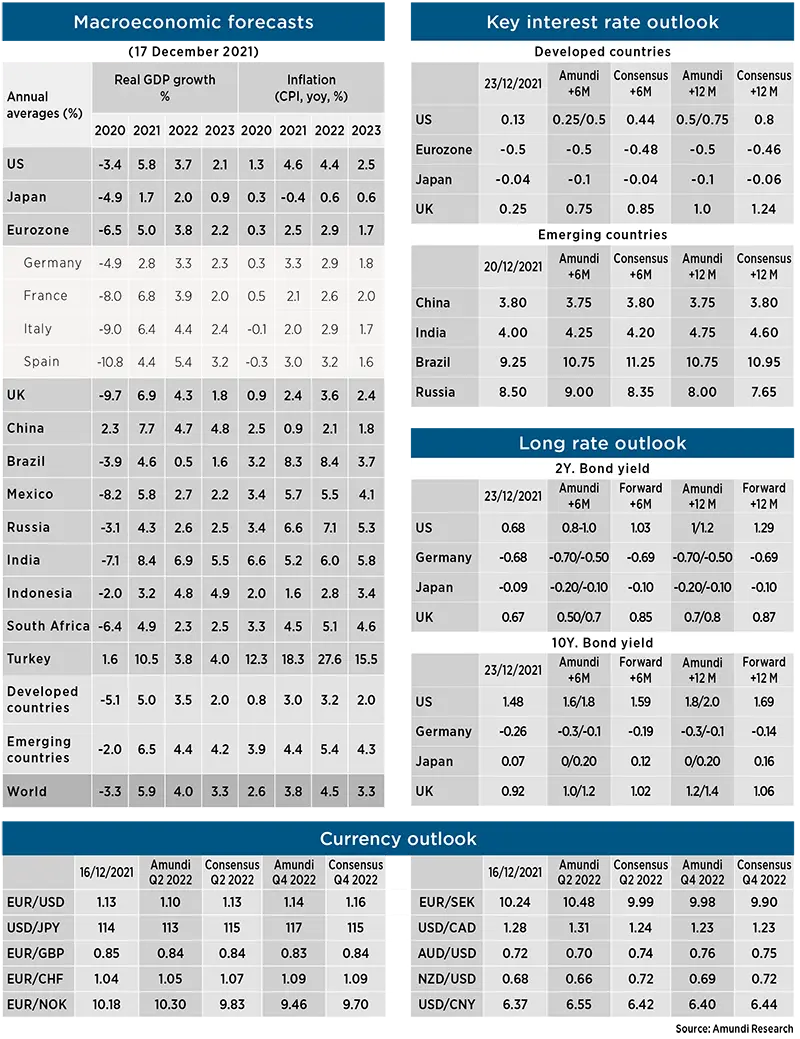

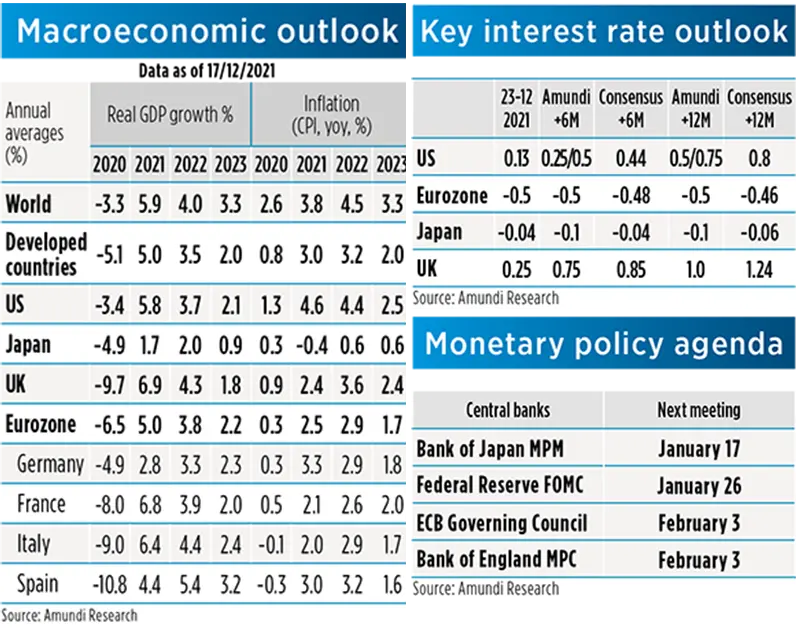

United States: after the sharper-than-expected deceleration in Q3 and a pickup in Q4, we expect real GDP growth to progressively decelerate in 2022 in sequential terms, stabilising above trend first and eventually converging to potential in 2023. Progressively less fiscal and monetary policy accommodation will drive this normalisation. Inflation is also expected to abate, although only gradually, while remaining above 3% until summer. As transitory drivers fade, still resilient demand, rents and wage growth will help supporting core inflation at higher than pre-crisis levels.

-

Eurozone: we believe peak growth is now past and that the impact of Omicron and some new restrictions will translate into a deceleration of sequential growth entering into 2022, further delaying the recovery in consumer spending and in the service sector, as consumers and businesses already had to face the headwinds of higher energy prices and supply bottlenecks. Inflation is also acting as a drag on domestic demand and consumption and is not yet being compensated by higher wage growth. Once the transitory factors supporting the 2021 Q4 peak in inflation are over, from mid-2022 we expect the current gap between core and headline inflation to narrow with inflation stabilising to somewhat higher than pre-crisis levels, yet within target in 2023.

-

United Kingdom: After the 2021 rebound, we expect growth to slow sequentially in 2022 on headwinds from inflation, tighter policy, Brexit adjustments and political risks. The Omicron variant will add further downside, as the steep surge in cases drags activity lower, as mobility and high frequency data start to show. While 2022 will likely start on a weaker footing than previously expected, we continue to expect resilience in domestic demand, with consumption supported by a strong labour market and investments underpinned by tax credits. Inflation will stage a slow decline from 2021 peaks, as commodities and bottlenecks will only progressively reduce their upside pressure on prices.

-

Japan: December PMI, although weaker than expected, rounds off the best quarter since Q4 2018. Despite recent Omicron uncertainties, we continue to expect a rebound in private consumption in Q4 and Q1 to drive the overall economic recovery. In addition, supply constraints continued to ease, leading to a sharp jump in auto exports in November. In 2022, one-off factors (mobile phone charge reduction and rebasing) will wear off, laying the ground for consumer inflation to return to the positive territory. That said, we expect the prints to stay below 1%.

-

Fed: The Fed will accelerate tapering in light of elevated inflation pressures and the strengthening labour market. The pace of tapering will be doubled to $30bn per month in January, to end in March. The new rate projections indicate three hikes in 2022, three in 2023 and two in 2024, while in September the committee was evenly split between one hike in 2022 and no hike. Any reference to transitory factors of inflation has been removed, and instead the FOMC underlined that supply and demand imbalances related to the pandemic and the reopening of the economy have continued to contribute to elevated levels of inflation.

-

ECB: Though more hawkish than expected, the ECB confirmed its much more dovish stance than the Fed and BoE, keeping open-ended QE running for all of 2022, calibrating its size to cover for most of next year’s net debt issuance, with an additional support through PEPP flexible reinvestments, prolonged to end-2024 and acting as a backstop. The stable outlook for rates has been confirmed, consistent with ECB’s inflation projection below target in the long run, while no decision on TLTROs was actually taken, though the ECB will “monitor bank funding conditions”.

-

BoJ: The BoJ decided to partially extend Covid supports. It will end purchases of corporate bonds and commercial paper at the end of March, but will continue to provide interest-free loans to banks aiding pandemic-hit SMEs by another six months till the end of September. It will take six months to reduce the purchases of commercial paper to pre-Covid levels and five years for bond buying. Governor Kuroda firmly ruled out policy tightening, seeing no possibility of consumer inflation reaching or exceeding 2%. Policy rates will be kept at their rock bottom.

-

BoE: : BoE surprised the consensus again at its last meeting with an unexpected hike of 15bp, taking the base rate to 25bp. The almost unanimous 8-1 vote showed that the decision was largely consensual within the MPC, and that improving labour market and high inflation prints prevailed on uncertainties linked to pandemic newsflow in the decision. We expect the BoE to take rates to 75bp by the end of 2022, and then pause in rate hiking cycle, consistent with the need to keep flexibility in managing QT, the latter planned to start when base rate have reached 1%.

Emerging Countries

-

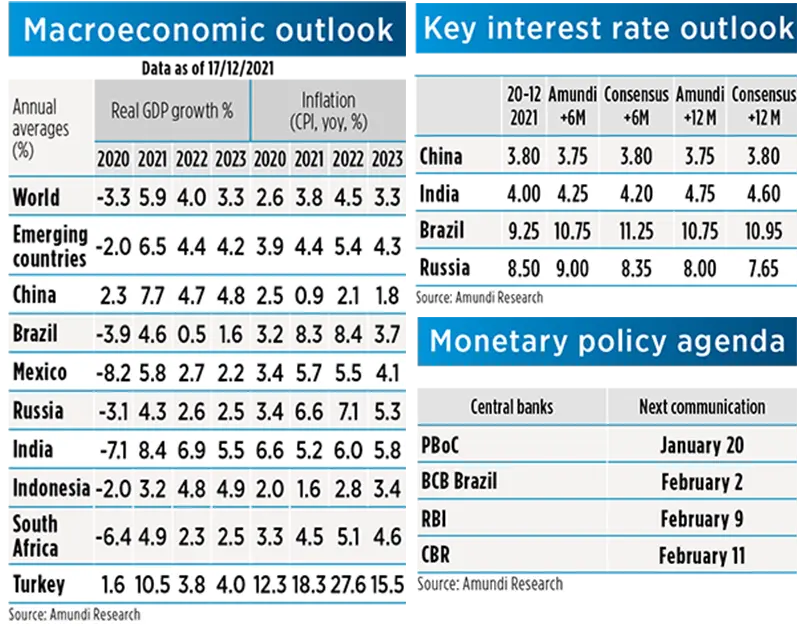

China: The Chinese economy continued to suffer from its self-imposed policy constraints at the beginning of Q4, registering a weak recovery. The broad weakness in the economy has caught policymakers’ attention, and we expect an easing of the policy constraints. However, housing sector deleveraging is most likely to continue, and we don’t expect another round of big credit stimulus. We maintain our view that economic growth will rebound sequentially in Q4 from its dip in Q3 and then stay slightly below trend in 2022. Inflation will remain comfortably below 3%.

-

Indonesia: Indonesia’s momentum is improving on the back of the recent reopening and continuous vaccination rollout. After being very subdued in 2021, inflation dynamics should trend higher in 2022, moving towards the upper part of the BI target. Domestic macro conditions, together with a changing global financial landscape (Fed), will trigger the first rates hike by BI by mid-2022 (or Q3 2022). Policy support is expected to remain in place, through a gradual tightening of monetary policy and the slow fiscal consolidation expected. The fiscal deficit target by 3% in 2023 should be achieved via the recently passed tax reform.

-

Turkey: Despite surging inflation (21.3% YoY in Nov.), with a peak forecasted at more than 30% in the coming months, the central bank once again lowered its interest rates by 100bp to 14%. Although the central bank’s communiqué pointed to a pause, the market reacted immediately. The lira dropped, reaching an all-time low. Several days later, following some measures announced on monetary and financial sides by Erdogan, the lira recovered some ground. In such high level of domestic and global uncertainties, it is hard to make any forecasts, but we do expect growth to remain positive in 2022, driven by an expansionist fiscal policy.

-

CEE-3: Inflation figures once again came out higher for the month of November. No doubt, central banks will stick to their monetary tightening cycle amidst serious domestic and global inflationary pressures and in which the Fed is flagging the normalisation of its monetary policy and, hence, a possible strengthening in the dollar vs. other currencies. However, if the Omicron variant were to lead to new restrictions, the extent of rate hikes expected in 2022 could be lower than expected.

-

PBoC (China): The Politburo meeting and the Central Economic Work Conference confirm China is moving into monetary easing and will step up policy supports at the turn of the year. Broad monetary easing is already underway with the 50bp RRR cut in mid-December and a 5bp Loan Prime Rate cut on 20 December. We expect another 5bp rate cut in January. On the FX side, the PBoC has increased its verbal intervention, embedded a depreciation bias in daily fixing and hiked the FX RRR by 2ppt, to discourage RMB appreciation.

-

RBI (India): In early December, the RBI kept unanimously on hold the Policy Rate at 4% and left its accommodative stance unchanged. Contrary to our expectations, the Reverse Repo Rates remained at 3.35%, without any increase (by 40bps) to make the corridor around the Policy Rate symmetric. The RBI reiterated the need to keep the policy support ongoing even more in consideration of new risks such as the Omicron virus variant. While expected to increase in the short term, Headline Inflation outlook remains benign and not in contrast with a continuous accommodative stance.

-

BCB (Brazil): The BCB again hiked its rates by 150bps (to 9.25%) and again pre-announced another hike of similar magnitude in February. The Committee will persist in its strategy of tightening into restrictive territory until the disinflationary process and expectations anchoring around its target have consolidated. Headline Inflation in November printed at 10.7%, the same level as in October. At the same time, the Copom acknowledged the weakening economic conditions. We see the BCB taking SELIC into double digits in the new year and a terminal rate around 11%, a nearly five-year high.

-

CBR (Russia): On December 17th the Central Bank of Russia hiked the policy rate by 100bps to 8.5%. The main reason for the hike was the persistent supply and demand pressures, with further potential upside to inflation and inflationary expectations. Household inflation expectations reached a new five-year high in December. Inflation accelerated 8,4% YoY in November, from 7,4% in October and is expected to be 8.1% in December, well above the 4% target. The CBR left the door open for further hikes at upcoming meetings. The CBR’s hawkish stance, combined with continued inflationary pressures, makes another hike at the February meeting probable.

Macro and Market Forecasts