Summary

Developed Countries

- United States: in 2022, the US economy will face a progressive deceleration in economic activity, hovering above trend first and eventually converging to potential in 2023. Activity indicators are pointing to a notable deceleration at the end of Q4 and start of Q1 (in part Covid-related), which we expect to be short-lived. Progressively less fiscal and monetary policy accommodation will drive the normalisation we expect. Inflation will gradually retrace lower from recent highs while remaining above 3% for most of the year, as transitory drivers fade, leaving more structural drivers supporting inflation.

- Eurozone: peak growth is now past and the impact of Omicron and some new restrictions translated into a deceleration in activity between the end of 2021 and the beginning of 2022, deferring the recovery in sectors of the economy affected by social distancing restrictions, and already put under stress by higher energy prices and supply bottlenecks. On the persistence of such factors, we project Eurozone inflation to decline from recent peaks but to remain above the ECB’s target for most of the year.

- United Kingdom: after the 2021 rebound, growth will slow sequentially in 2022, on headwinds from inflation, tighter policy, Brexit adjustments and political risks, yet growth will remain above trend. The Omicron variant added some downside in Q4 and entering into 2022. While the year started on a weak footing, we continue to see growth supported by domestic demand, with consumption supported by a strong labour market and investments underpinned by tax credits. Inflation will stage a slow decline from 2021 peaks, as commodities and bottlenecks will only progressively reduce their upside pressure on prices.

- Japan: Domestic demand saw decent rebounds in Q4, as the chip shortage eased and social distancing rules were lifted. However, the increase of Omicron cases in the new year and the return to soft social distancing rules brings uncertainties to Japan’s economic recovery outlook, likely further delaying the “catch-up” in consumption. We maintain a belowconsensus GDP growth forecast of 2.4% for 2022, which would imply a strengthening in growth momentum from an estimated 1.7% in 2021. Inflation rates will accelerate but peak in Q2 at around 1% YoY.

- Fed: The Fed has no choice but to act quickly: the labour market is historically tight and inflation is well above target. The Fed has some catching up to do. It is determined to move quickly and steadily away from its highly accommodative monetary policy. The priority is to address the risk of more persistent inflation with the strong rise in wages. The Fed will raise rates quickly until it is comfortable with the outlook for inflation. This cycle is very different. We expect four rate hikes this year and a shrinking in the Fed’s balance sheet starting in June or July.

- ECB: Though more hawkish than expected, the ECB confirmed its much more dovish stance than the Fed’s and the BoE’s, keeping open-ended QE running for all of 2022, calibrating its size to cover most of next year’s net debt issuance, with additional support through PEPP flexible reinvestments, prolonged to end-2024 and acting as a backstop. The stable outlook for rates has been confirmed, consistent with ECB’s inflation projection below target in the long run, while no decision on TLTROs was actually taken, though the ECB will “monitor bank funding conditions”.

- BoJ: Monetary policy was left unchanged at the January meeting. Responding to a Reuters report on 14 January stating that the BoJ is discussing a potential rate hike, Governor Kuroda pushed back hard on the possibility of early policy normalisation, indicating a hold in 2022. In its latest outlook, BoJ raised its FY2022/2023 inflation forecasts, expecting core CPI to strengthen to just above 1%. In our view, the increase in CPI will be transitory this year, which is mainly driven by one-off positive base effects. This will be insufficient for the BoJ to justify a hike.

- BoE: The BoE surprised the consensus again at its last meeting with an unexpected hike of 15bp, taking the base rate to 25bp. The almost unanimous 8-1 vote showed that the decision was largely consensual within the MPC, and that the improving labour market and high inflation prints prevailed over uncertainties linked to pandemic newsflow in the decision. We expect the BoE to take rates to 75bp by the end of 2022, and then pause in the rate hiking cycle, consistent with the need to keep flexibility in managing QT; the latter is planned to start when the base rate has reached 1%.

Emerging Countries

- China: GDP came in better than expected in Q4, fully reversing the dip in Q3. Exports continued to expand at a solid pace, but domestic demand weakened. The renewed Covid-19 outbreak has complicated China’s recovery path. Holding to the zero tolerance policy, local governments started to tighten social distancing rules just ahead of the Chinese New Year, exerting downward pressures on growth in Q1. We are revising our full-year growth forecast down to 4.5% from 4.7%. Inflation numbers have surprised on the downside lately, due to unusual declines in food prices.

- Indonesia: The Covid outbreak is so far proving much more moderate than in other countries in the region, and Indonesia remains on a gradual recovery path. Despite increasing, inflation is unlikely to pose a serious threat to the inflation target and to push BI to hike. That said, for the first time the Fed shift of stance properly entered the latest MP meeting statement. While Policy Rates stayed unchanged, BI has started to normalise liquidity policy, announcing an incremental increase in the Rupiah Statutory Reserves at banks. In light of the earlier Fed hike (March), we have moved ahead the first hike by BI to Q2 2022.

- Mexico: Growth hit a prolonged soft patch in 2H21 (another Covid wave, supply chain disruptions, rising inflation and rates), and while we expect the recovery to resume this year, we also see GDP expanding at below 2% and below consensus expectations. Capex will stay muted in a subpar business environment under AMLO, while consumers will keep facing above-target inflation and rising interest rates. Banxico will first raise interest rates because of core inflation that is still accelerating and visibly above target headline inflation, and later on account of the Fed’s looking to hike policy rates a few times this year.

- Brazil: The recovery came to a standstill in 2H last year as the triple headwind of rising inflation, rates and uncertainty hit economic activity. The underperformance is set to continue throughout 2022 – we see annual GDP growth at 0% – as hi-flation will need time to recede (more of a 2H22 story than 1H), double-digit policy rates will be reduced only in the late part of the year (if at all, as the BCB will need to see inflation expectations converge with the inflation target before pushing the easing button), and the high level of uncertainty related to the October elections will likely persist, to the detriment of capex. Speaking of the elections, it is Lula’s race to lose at this point, with question marks around his policy stance on many key issues, including the spending cap and the labour market reform passed by the current administration.

- PBoC: Responding to heightened downward pressures on growth, PBoC explicitly signalled additional front-loaded easing. Walking the talk, it cut the 7d repo and 1yr Medium-term Lending Facility rate by 10bp on 17 January, for the first time since March 2020. The 1yr Loan Prime Rate (LPR) was also lowered again by 10bp on 20 January following the 5bp reduction in December, while the 5yr LPR – the rate linked to mortgages – was cut by 5bp. We expect 5-10bp in additional cuts if growth data continues to disappoint on the downside or if the Omicron variant is spotted in more regions.

- RBI (India): As expected, the Headline CPI in December climbed closer to the RBI’s target upper band (at 5.6% YoY vs 6.0%YoY, from 4.9% YoY in November), and we expect inflation to move higher (even above 6%) in early 2022. In December, the RBI remained on the dovish side, claiming the insurgence of the new Omicron wave in the country was raising the downside risks to the economy. WPI are only stabilising at high levels (13.6% YoY), and Core CPI remains stubbornly around 6% YoY. We reiterate our expectations of a policy shift and the first Policy Rates hike in April 2022.

- BCB (Brazil): The steepest hiking cycle in the EM universe continued in December, courtesy of the BCB. The CB hiked the policy rate yet again by 150bp (to 9.25%) and pre-announced another hike of the same magnitude at the next meeting in February, which would land SELIC in double digits. The Committee is pushing rates into highly restrictive territory as a response to surging inflation and medium-term inflation expectations showing some dis-anchoring. But as the economy slows (underway for some time already) and sets in the process of disinflation (inflation peaked in November, it seems), we think the BCB will stop short of market expectations and at a terminal rate of 11.50% in March.

- CBR (Russia): On December 17th the Central Bank of Russia hiked the policy rate by 100bps to 8,5%. The main reason for the hike was persistent supply and demand pressures with further potential upside to inflation and inflationary expectations. The CBR left the door open to further hikes at upcoming meetings. Household inflation expectations reached a new five-year high in December. Inflation accelerated very slightly, to 8.39% YoY in December, from 8.35% in November, well above the 4% target. The CBR’s hawkish stance combined with continued inflationary and geopolitical pressures makes another hike at the February meeting probable.

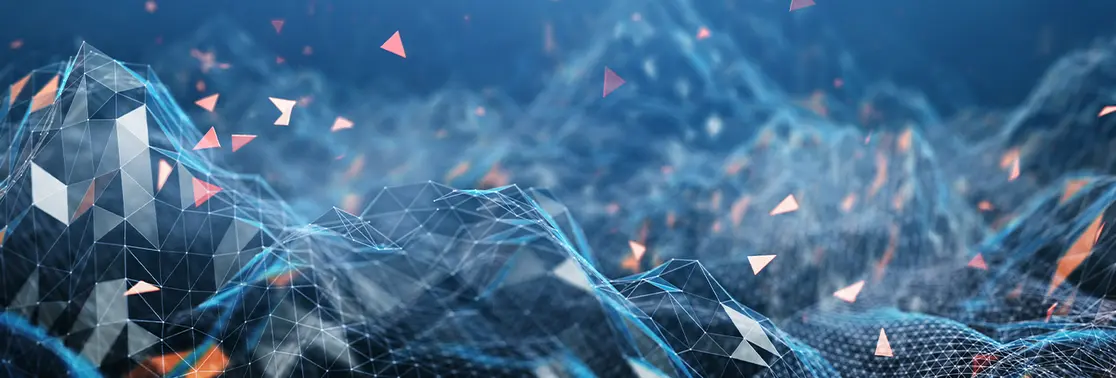

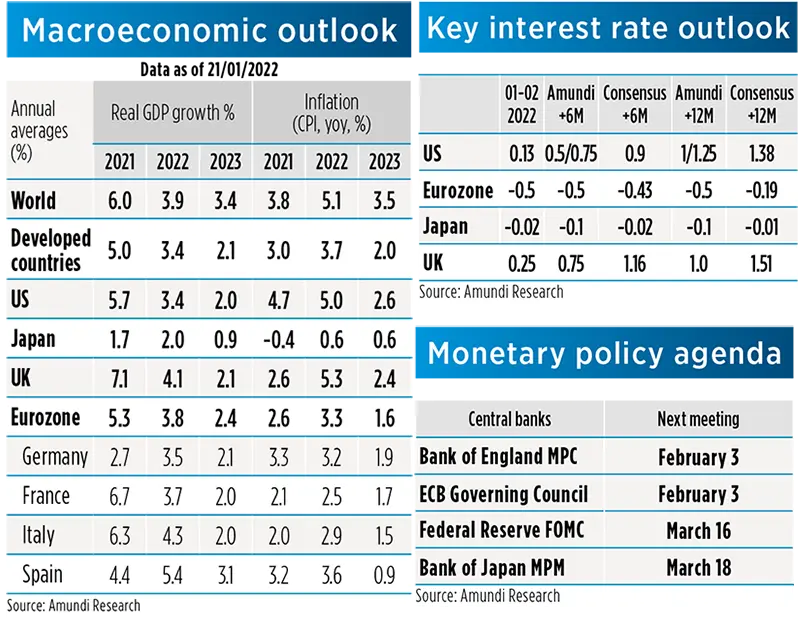

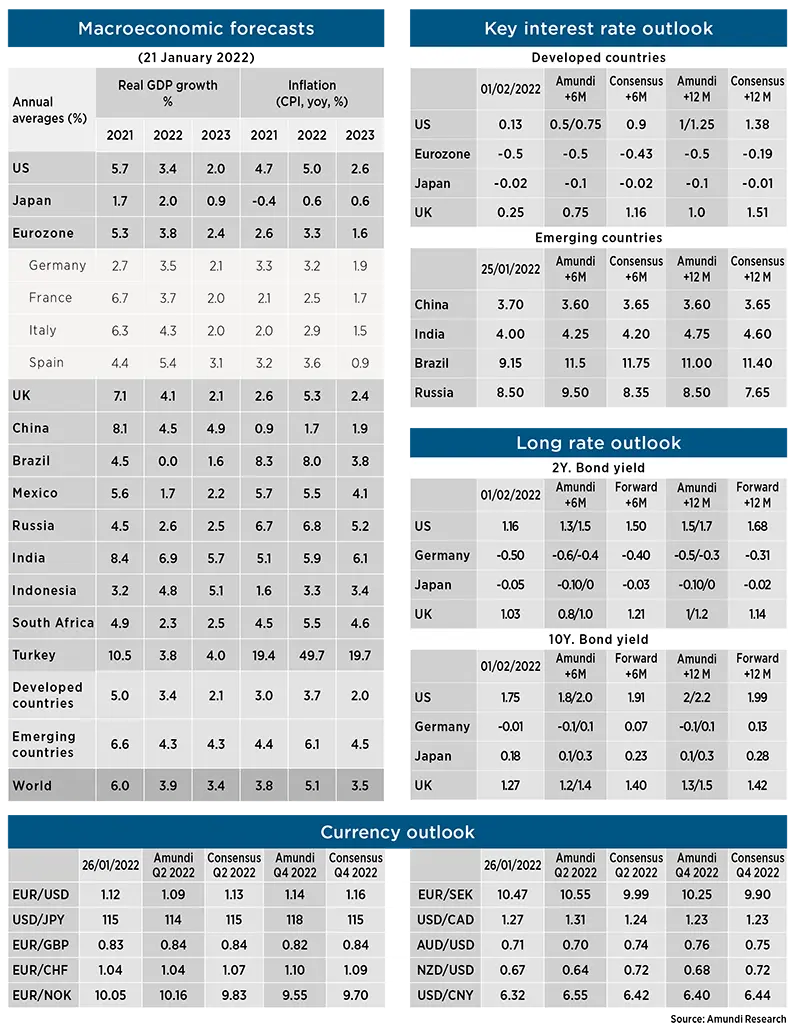

Macro and Market Forecasts

Disclaimer to our forecasts

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

Methodology

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

- Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.