Summary

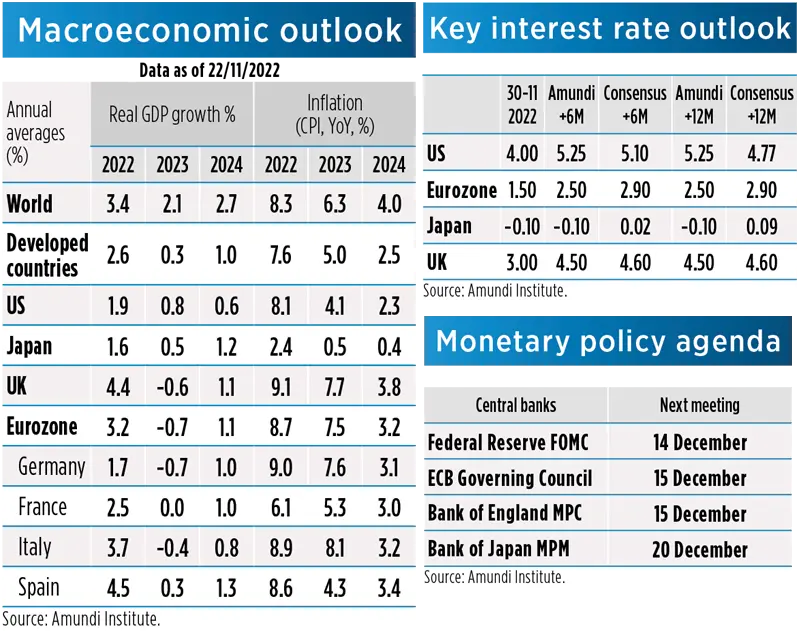

DEVELOPED COUNTRIES

- United States: Q3 GDP surprised to the upside, lifting 2022 average projections. However, our call for 2023-24 forecast has not changed significantly, with restrictive monetary policy dragging growth well below potential. We foresee increased recession risks in H2 2023, when we project the weakest growth trend, weakest composition of domestic demand, and heightened recession risks. While inflation seems to have peaked, stickiness in inflation may remain a key feature in the months to come, with core inflation declining slowly and remaining above target.

- Eurozone: GDP surprised to the upside in Q3, lifting carry-over growth for 2022. Nonetheless, we expect GDP to contract in Q4 2022-Q1 2023, followed by some weak recovery helped by receding inflation providing relief to the consumer (inflation will be the main recession driver). 2023 average dynamics will be weaker than previously expected, feeding into somewhat weaker 2023-24 projected growth. We upgraded our expectations for inflation at end-2022 / early-2023 due to firm momentum and broad-based inflationary pressures. Risks related to the energy component remain prominent for both the inflation and growth outlook.

- United Kingdom: we foresee a recession extending for a few quarters, driven by increased cost of living and tight financial conditions. We expect the economy to contract by -0.6% in 2023 and then recover, expanding by 1.1% in 2024. Risks are tilted to the downside, as our forecasts do not account for recent fiscal announcements. We expect inflation to remain elevated and in double-digit territory until Q1 2023 and peak in Q4 2022, while remaining above target for a considerable time.

- Japan: Q3 GDP growth came in weaker than expected, contracting by 0.3% QoQ seasonally adjusted. After border reopening, visitor arrivals doubled in October and recovered to 18.8% of the 2019 level. However, the reopening boost will not be sufficient to offset fully the external headwinds in 2023. Underlying inflation has risen, on closing output gap and elevated inflation expectation. We expect core inflation (ex fresh food and energy) to stay above 2.0% in Q4 2022 and Q1 2023, before it starts drifting down to below 1.0% in Q4 2023.

- Fed: the door is open to a reduction in the magnitude of rate hikes. The Fed will notably take into consideration: “the cumulative tightening of monetary policy” and “the lags with which monetary policy affects economic activity”. However, for the Fed it is still all about inflation. The Fed does not want the market to interpret the reduction in the size of rate hikes as a dovish pivot or as a sign of lack of commitment to fight inflation. The terminal rate and how long the Fed should keep interest rates in restrictive territory remain the big issues. We have a scenario of a 5.25% Fed Funds terminal rate.

- ECB: at its October meeting, the ECB raised its policy rates by 75bp with the deposit rate now at 1.5% and announced changes to the terms of the targeted long-term refinancing operations. By acknowledging the substantial progress made so far in policy normalisation, the ECB sent an important message through a more dovish tone, mainly on the back of deteriorating economic outlook. Consistently with the reading of the most recent minutes, we expect the ECB to slow the pace of rate hikes and our projection on the terminal deposit rate points to 2.50%.

- BoJ: markets are speculating on policy tightening from the BoJ on 28 April 2023, right after Governor Kuroda retires. We assign a 30% likelihood to such an event, holding the view that the BoJ already missed the boat of tightening. It has remained firmly dovish when inflation is rising and growth is ok, resisting all the pressure from peer tightening. We see no reason for it to change in early 2023, when the global economy should turn recessionary. Markets attach too much weight to a single event, and underestimate the prevailing dovishness across government agencies.

- BoE: at its latest meeting, the BoE joined other central banks in raising rates by 75bp. Despite the rate hike was larger than previous ones, the communication was dovish. On forward guidance, the BoE explicitly pushed back on market terminal rate expectations, previously above 5%, while the new set of macro projections is consistent with this message on forward guidance. At the same time, they made it clear that risks remain tilted to the upside. We expect a 50bp hike in December and rates to peak at 4.5%

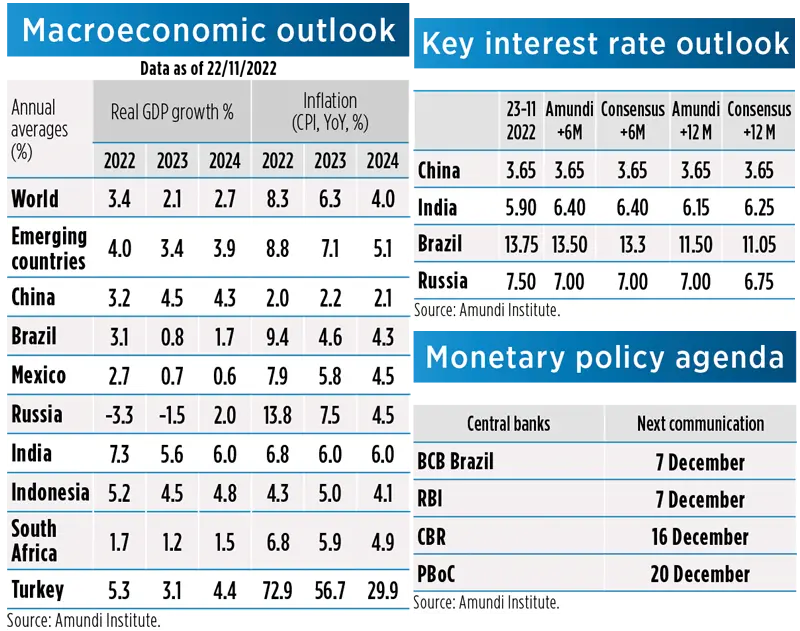

EMERGING COUNTRIES

- China: faced with the largest Covid-19 outbreak since April, local governments are putting in more restrictions to flattern the curve of new cases. The record number of people under medical monitoring (over 1 million), including asymptotic cases and close contacts, points to a likely surge of severe cases. Depressed economic activity in October and November suggests sequential Q4 growth will be close to contraction, challenging our forecasts of a weak recovery. On the inflation side, we hold our view that China’s gradual reopening approach will be most likely disinflationary.

- Indonesia: despite the mild inflection in October inflation (5.7% from 6.0%) and in line with recent meetings, Bank Indonesia (BI) hiked the policy rates by 50bp to 5.25%. Indeed, headline inflation should remain well above target for most 2023, while core inflation (3.3% in October 2022) should move up towards the upper bound of the target range and likely beyond it in early 2023. With that perspective, BI will remain on a relatively hawkish stance, hiking further its policy rates amid inflation concerns, both domestic and external (imported inflation).

- Turkey: Despite the extreme inflation level of 85.5% YoY in October, the Central Bank of Turkey (CBRT) delivered its fourth consecutive rate cut, lowering the key rate by 150bp from 10.5% to 9.0%, which caused the Lira to depreciate further temporarily. In their statement, the committee evaluated “that the current policy rate is adequate and decided to end the rate cut cycle that started in August”. Despite expectations of a global growth slowdown, Turkey may grow by a decent 3.1% in 2023, supported by its unorthodox policy mix.

- Brazil: economic activity has been softening after a robust YTD performance, as tight monetary policy is starting to weigh on credit dynamics and the low-hanging reopening fruits that benefited the services sector are no longer available. Still, the economy will grow by around 3% this year, slowing to under 1% in 2023. Inflation peaked in April, while the BCB wrapped up in diesel hiking cycle in August on a hawkish note. The presidential election brought no surprises, with Lula winning as expected, though by a much tighter margin. The transition itself has surprised on the benign side, but Lula’s initial fiscal proposal has been far from constructive.

- PBoC (China): following the policy pivots on housing and zero-Covid-19, PBoC attempted to tone down its easing bias by warning against inflation risks. This, together with two continuous weeks of liquidity withdrawal, led to a sharp rise in money market rates and a panic redemption of wealth management products. To contain the interest rate increases, the PBoC quickly reverted back to liquidity injection and rates have come down. However, this incident points to a smaller probability of blanket rate cuts. Selective easing and credit forbearance will continue.

- RBI (India): October price indices showed some benign decline. In particular, headline inflation decelerated to 6.8% YoY from 7.4%, while core inflation decline was much smaller, at 6.0% YoY from 6.1%. As a proper decline in the inflation within the RBI target should arrive by the end of Q1 2023, the policy adjustment will continue until early 2023. We expect smaller hikes going forward. With one-two 25bp hikes by February 2023, RBI should complete its hiking cycle, taking the real policy rate at a neutral level.

- BCB (Brazil): high, not higher, for longer. While the Fed seems to be moving towards a slower hiking pace, the BCB is not getting any closer to kick off an easing cycle after wrapping up its diesel hiking cycle worth 12% in August. On the other hand, the recent fiscal developments – aggressive PEC proposal by the new administration -- and the political noise will make COPOM more cautious and even consider further hikes in near future. We think the BCB will have to stay high, though not higher, for longer, as the fiscal anchoring weakens and will start entertaining cuts only in mid-2023.

- CBR (Russia): the CBR left the policy rate unchanged at 7.5% at its 28 October meeting. While the CBR considers short-term pro-inflationary and dis-inflationary risks as balanced, in the medium term the CBR sees pro-inflationary risks dominating. Despite gradually declining inflation, the amplification of the impact of the sanctions, shortages resulting from the partial mobilisation, and potential rouble weakness were cited among the pro inflationary risks, tilting the CBR bias to stay on hold. We see a less dovish and more cautious tone from the CBR. While the outlook remains highly uncertain, we now expect a 50bp cut in the next six months, most likely not before Q2 2023.

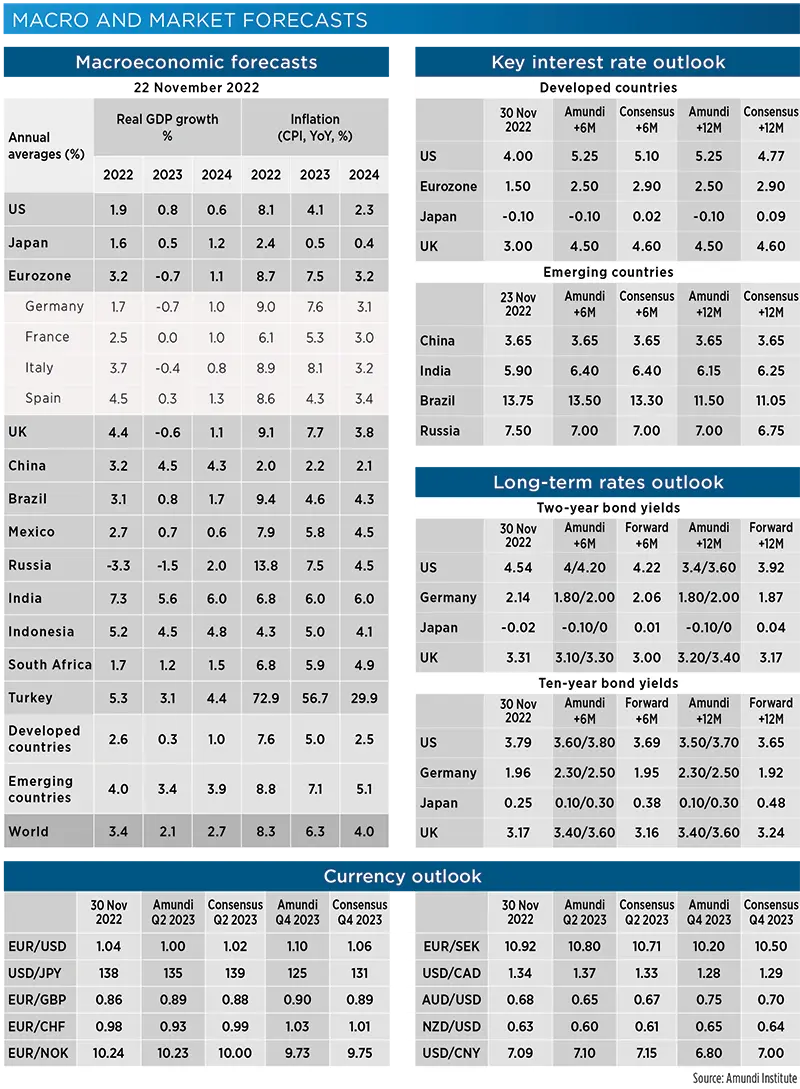

MACRO AND MARKET FORECASTS

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

- Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts. - Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.