Summary

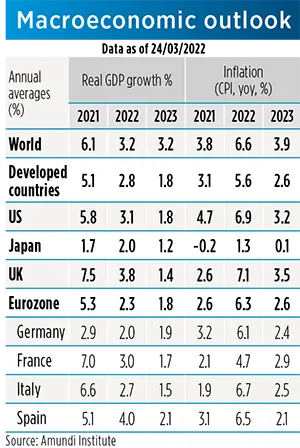

DEVELOPED COUNTRIES

- United States: the increase in energy and commodity prices, which is pushing inflation higher, is negatively impacting the US consumer, both in terms of confidence and spending. At the same time, companies’ capex intentions remain high, suggesting that while US consumption may be decelerating, capex should remain resilient to the Ukraine war confidence hit. We expect GDP to keep decelerating towards potential, while headline inflation will grind higher for the next few months before resuming a downward path, while remaining well above the Fed target in terms of both headline and core for the year on the whole.

- Eurozone: as the increase in energy and commodity prices, which already took place in autumn and winter, continues to impact European households and businesses as the Ukraine war continues, we expect European countries’ domestic demand to suffer a significant hit. The EA economy was giving signs of improving until February, but the war has now put the recovery on hold; on the inflation front, in fact, we expect inflation to rise higher still for a few months and then to decelerate, assuming weaker energy and commodity price dynamics in the second half of the year.

- United Kingdom: high energy prices and faltering confidence have brought our forecast for inflation higher and for growth lower, as higher energy and commodity prices dent purchasing power and margins. On top of this, higher food prices will dent lower-income consumers in a more unequal way. Given the weaker growth outlook, concerns about a tight labour market becoming tighter may be easing, with possibly lower employment growth and less wage pressure. This in turn will underpin the squeeze in real income in front of persistent high inflation.

- Japan: the economy will continue to suffer from higher imported energy prices and supply chain disruptions. That said, as new Covid cases drop, the government lifted social distancing restrictions in mid-March and started to open its borders to a limited number of visitors. Private consumption is likely to recover at a faster pace, leading the overall economy in 2022. As for inflation, we expect the headline CPI to climb more decisively in Q2 and temporarily shoot above 2%, driven by energy components. However, core CPI will remain below 1%, with limited pass-through from oil prices.

|

|

|

|

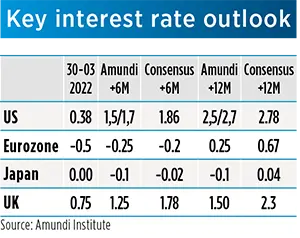

- Fed: The March FOMC meeting was hawkish on many fronts. The Fed wants get to a neutral policy stance as rapidly as possible, in order to move to more restrictive levels if that is what is required to restore price stability. Chair Powell was clear on its determination to do whatever it takes to bring inflation down. The Summary of Economic Projections is now showing a median terminal rate at 2.75%, which is above the neutral level of 2.5%. Furthermore, Powell recently reiterated his commitment to use all the tools available to achieve price stability, including 50bp moves during the coming meetings, which means that the neutral level of 2.5% could be reached in late 2022 or early 2023.

- ECB: The ECB surprised the consensus in announcing that it could end its net asset purchases in Q3, also with a more pronounced tapering in Q2, At the same time, guidance on interest rates, which the Bank now plans to increase “some time” after the end of net asset purchases rather than “shortly after”, suggests that it wants to keep more flexibility on the timing of rate hikes. The ECB is determined to deliver on its price stability mandate, but it acknowledged the high level of uncertainty and the path of monetary policy will therefore be even more data-dependent.

- BoJ: BoJ left its policies unchanged again in March. Governor Kuroda stated clearly that the expected cost-pushed jump in headline inflation to 2% from April would not be enough for BoJ to tighten its monetary policy, especially amid heightened uncertainty over Ukraine. BoJ is also offering unlimited bond buying to defend its yield target, amid rising UST yields. Until end-2021, Japan’s GDP was still below pre-Covid levels, and we don’t expect the output gap to close before late 2024, which will keep underlying inflation at bay and hold BoJ away from tapering.

- BoE: With a large majority of 8 to 1 members, the BoE increased its Bank Rate by 25bps to 0.75% in March, its third consecutive policy meeting hike, which brought the policy rate back to pre-pandemic levels. We expect the BoE to raise rates to 1.0% at the next meeting, in order to begin active QT. At the same time, the recent, more dovish tone suggests that the Monetary Policy Committee expects a more delicate balancing act in trade-off between high inflation and risks to growth. Thereafter a pause may come after the next hike.

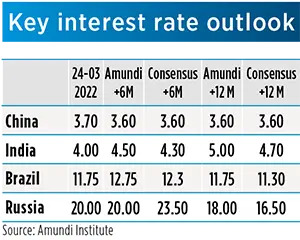

EMERGING COUNTRIES

- China: The new wave of Covid has hit a number of major cities (Shanghai, Shenzhen) as well as export hubs, prompting local governments to adopt targeted lockdowns and mass testing. Expecting a continuous zero Covid policy at least through H1, this round of tightening measures adds downside risks to our growth forecasts. As consumption is under greater pressure, underlying inflation remains subdued. The fading of negative base effects may push core inflation higher later this year, but this will not prevent the PBoC from maintaining an accommodative approach amid a fragile growth recovery.

- Poland: The war will further boost Polish inflation through higher commodity and food prices but also through more demand coming from refugees. The NBP will have to continue its hiking cycle and intervene on the FX market to support the zloty if needed. Fiscal metrics are not likely to be too eroded as financial aid will be provided by the EU, which has already decided not to use its “rule of law mechanism” against Poland. Even though the EU may attach conditions, the Polish NDP is likely to be approved in the coming weeks. The EU may also approve specific funds due to the delay in the NGEU process.

- Indonesia: Notwithstanding the Omicron variant, the economic recovery has continued at a gradual and steady pace. As the country is positively exposed to the commodity cycle (more metals/gas than oil), the impact on growth should be positive if the deterioration in Chinese growth does not pose a more substantial negative risk. Policy makers are now dealing with the dilemma of allowing higher inflation through lower subsidies, limiting the fiscal slippage. We expect the pass-through of energy prices to the end-consumer to be limited, allowing the BI to embark on a gradual normalisation of MP.

- Brazil: The geopolitical shock will have a less damaging impact on Brazil (and LatAm in general) given the geographical distance, less trade with and financial exposure to the European region and the net commodity producer status. Still, there will be winners and losers. Inflation is likely to be impacted despite efforts by policy makers to cushion the blow, which will put pressure on disposable income and consumption in turn. Commodity-related output and capex, however, will increase. The BCB will have to raise the SELIC rate a bit higher too and for a touch longer. One factor remains unchanged on the political front - Lula’s race to lose.

|

|

|

|

- PBoC (China): After disappointing February credit data and the sell-off in the stock market, the Financial Stability and Development Committee indicated stronger supports to restore market confidence. Hence, although the PBoC left the MLF rate and the LPR unchanged in March, we believe the easing cycle is not over yet, with a challenging recovery outlook and soft consumer inflation. An additional 10bp policy rate cut (MLF & LPR) plus a 50bp RRR cut are still likely. We also expect a resumption of credit growth, driven by higher public lending.

- RBI (India): With the April Monetary Policy meeting approaching, the RBI is in a challenging position given its dovish stance, Headline CPI slightly above the target and a clear upside risk coming from new cost pressures (energy, food and fertilisers). Even though the authorities are delaying the pass through of the fuel increase to the end-consumer, inflation is expected to be broadly higher than in the RBI outlook. The April meeting will likely bring an upward revision to the inflation outlook and a shift towards a neutral stance; the first rate hike has been confirmed for Q2 2022, more likely in June than April.

- BCB (Brazil): COPOM slowed the pace of tightening (to 100bps) in March, as previously pre-announced and hinted at another hike of the same magnitude in May as it needed to push rates “significantly into an even more restrictive territory.” But in another twist the Governor Campos declared June hike was not a given as inflation was projected to peak in April and the tightening cycle was in a mature stage after 975bps of hikes. That would suggest a terminal rate of 12.75%.

- CBR (Russia): Following the surprise hike on 28 February to 20% from 9.5%, the CBR left the policy rate unchanged on 18 March, saying the current rate should be temporary. The previous drastic move was made against the backdrop of further depreciation and inflation risks, especially the sharp depreciation of the RUB. Given the heightened inflation prospects as a result of the war with Ukraine and various sanctions on Russia, we expect the CBR to keep the rate on hold at least through Q2-2022. On the positive side, Elvira Nabiullina was nominated as governor for a third term.

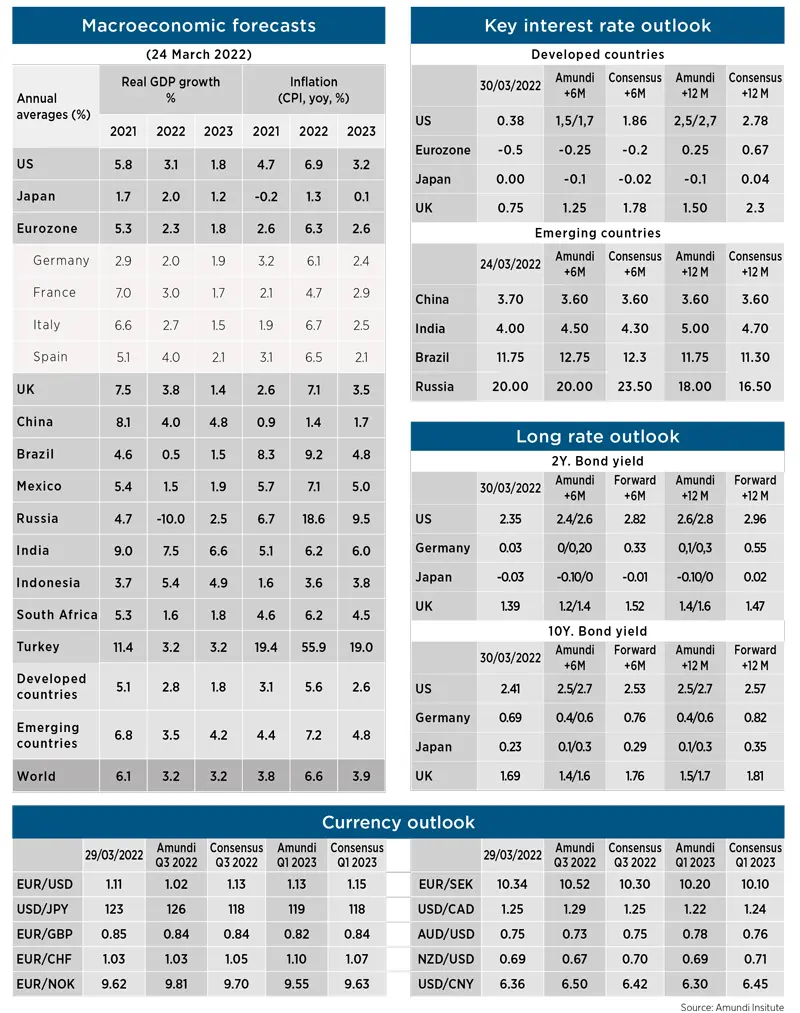

MACRO AND MARKET FORECASTS

DISCLAIMER TO OUR FORECASTS

The uncertainty around the macro forecasts is very high, and it triggers frequent reassessments any time fresh high frequency data are available. Our macroeconomic forecasts at this point include a higher qualitative component, reducing the statistical accuracy and increasing the uncertainty through wider ranges around them.

METHODOLOGY

— Scenarios

The probabilities reflect the likelihood of financial regimes (central, downside and upside scenario) which are conditioned and defined by our macro-financial forecasts.

— Risks

The probabilities of risks are the outcome of an internal survey. Risks to monitor are clustered in three categories: Economic, Financial and (Geo)politics. While the three categories are interconnected, they have specific epicentres related to their three drivers. The weights (percentages) are the composition of highest impact scenarios derived by the quarterly survey run on the investment floor.