Summary

2022 will be the “year of reckoning” for DM economies when they will test the effectiveness of the policies deployed since the peak of the pandemic phase and face the challenge of retuning to normality: fiscal and monetary policies will tighten up at a time when the growth/inflation mix is becoming more challenging and there is much less room for manoeuvre in terms of policy. Fundamentals will be key to disentangling divergent trends, in a year that started on a much weaker footing than many expected.

For Emerging markets overall, the growth outlook into 2022, which had already moderated in comparison with 2021, has been further revised down. The Fed’s next actions will play an increasingly important role. In an orderly Fed outcome, the first rate hikers should revert to a dovish stance before the end of the year.

The Fed has no choice but to act quickly: the labour market is historically tight and inflation is well above target. The Fed’s priority is inflation. The high level of inflation is also challenging ECB stance.

Developed markets

In the United States, since we published our outlook, the growth/inflation mix has deteriorated, providing a much weaker start to the year for growth and more nearterm upside risks for inflation. Revisions to projected US growth (trimmed) and inflation (upgraded) ensued. Growth is still expected to remain above trend and move towards potential over our forecast horizon, while inflation remains above the Fed’s target for most of this year and next, but momentum has changed.

On the growth front, momentum has decelerated more than expected. While we did not have hopes for a smooth passage of the full Build Back Better plan in the first place, the mini fiscal cliff expected in January combined with the weakness related to the (unexpected) Omicron wave amplifies the headwinds on demand at the beginning of the year, after December’s already very weak retail sales data. The labour market has shown signs of strength and tightness, translating into healthy fundamentals for consumers, who are nonetheless facing higher prices and greater uncertainty on the inflation outlook. On the supply side, while acknowledging early signs of easing, we still see bottlenecks capping production. Growth is starting on a much weaker footing.

On the inflation front, momentum is consolidating, with inflationary pressures persisting longer and across a broader base, from food to energy to core. Coregoods inflation is not yet abating while services inflation still has not incorporated the rental price surge seen in past months. Key to this view some key aspects hoe evolution is important to monitor and confirm: 1. domestic demand that, despite its slowdown, remains on solid ground; 2. projected productivity growth that is unable to offset increased labour costs; 3. passthrough to final demand and pricing power that still has room to operate.

Eurozone

Similarly to the US, in the Eurozone we have also trimmed growth and upgraded inflation projections, but on different grounds.

On the growth front, momentum has slowed due to a combination of headwinds, in particular high energy prices, supply chain bottlenecks and the restrictions to contain the Omicron variant, which translated into much weaker activity between the end of 2021 and the beginning of 2022, deferring the recovery in sectors already lagging behind and delaying personal consumption recovery, which is still below pre-pandemic levels. Growth fundamentals within the Eurozone are diverse and have different vulnerabilities against a backdrop of less supportive fiscal and monetary policies, where any mishap in the recovery translates into more vulnerability.

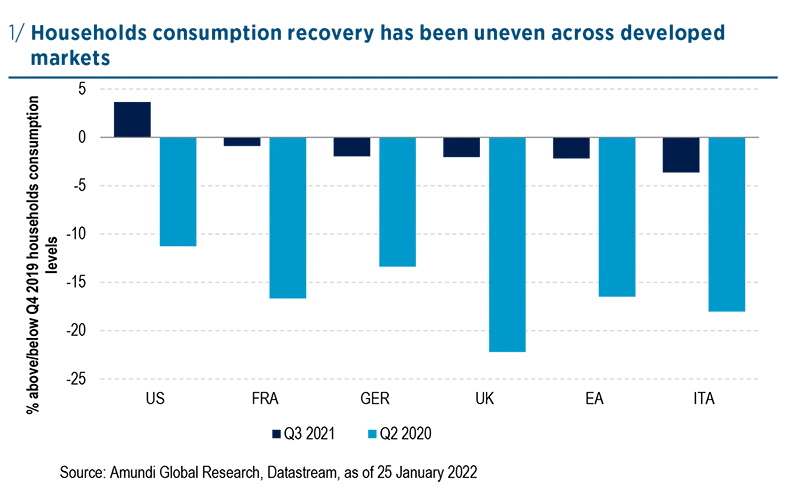

For instance, so far the recovery in domestic demand has been very uneven across the G4, with highly divergent recovery paths in terms of household consumption expenditure (the EZ is 2.2% below its pre-crisis level on average as of Q3 2021, with Spain being the laggard and France almost back to pre-crisis levels) and gross fixed capital formation (the EZ is still 9% below its precrisis level, with Italy significantly above pre-crisis and Spain on the other extreme).

Aslo we don’t’ have to forget the different precrisis starting points in terms of economic performance (for instance, in Q4 2019, Italy had not yet managed to return to its 2007 real GDP level, unlike its peers) or national public and private indebtedness. Indeed, the NGEU will represent a significant direct and indirect support for growth, especially for the periphery, yet is subject to implementation risk. So, while we expect to see the recovery continue on the back of an improving labour market and decent demand, we are aware of the delicate juncture.

On the inflation front, we have revised our projections up for the Eurozone on the back of recent upside surprises and extended bottlenecks, while we continue to expect it to decline within the ECB’s target range by the end of this year. Unlike the US, EZ domestic consumption did not overheat on fiscal stimulus and labour markets do not appear to be as tight as in the US, where the reduced participation rate is likely to persist for some time. Meanwhile, the Eurozone has already recovered its pre-pandemic levels, with different implications on wage growth outlook and second-round effects.

Since the publication of our outlook, in the US and in the EA the growth/ inflation mix deteriorated somewhat

Emerging markets

In late 2021, across the emerging markets, the physiological deceleration expected after the sharp economic rebound post reopening was exacerbated by further Covid outbreaks driven by new variants such as Omicron, particularly impacting countries with low or less effective vaccination rates. Growth momentum has remained weak and has only recently stabilised.

Overall, the growth outlook into 2022, which has already moderated in comparison with 2021, has been further revised down, in a few cases reaching quite disappointing levels, such as in Brazil with GDP at 0% year-on-year. It’s worth adding that the largest Latin American economy, in addition to experiencing one of the biggest and fastest monetary policy hiking cycles since early 2021, remains one of the most exposed EM countries to the Chinese economic slowdown. In this regard, while two important drivers of China’s economic weakness – policy tightening and the decarbonisation effort – have eased, the continuous low tolerance towards the virus and the related restrictive measures have been dragging down economic performance and are responsible for the growth forecast downgrade in 2022 from 4.7% YoY to 4.5% YoY.

The greater than expected weakness to be registered in Q1 2022 hasn’t changed the sequential positive path moving forward. Indeed, on the monetary policy side, we do expect a further 10bp in cuts with growth continuing to disappoint on the downside and the Omicron variant spreading further. Meanwhile, for fiscal spending, the policy tone has been clear: issuance of local government bonds will speed up in early 2022 to support infrastructure and manufacturing investments.

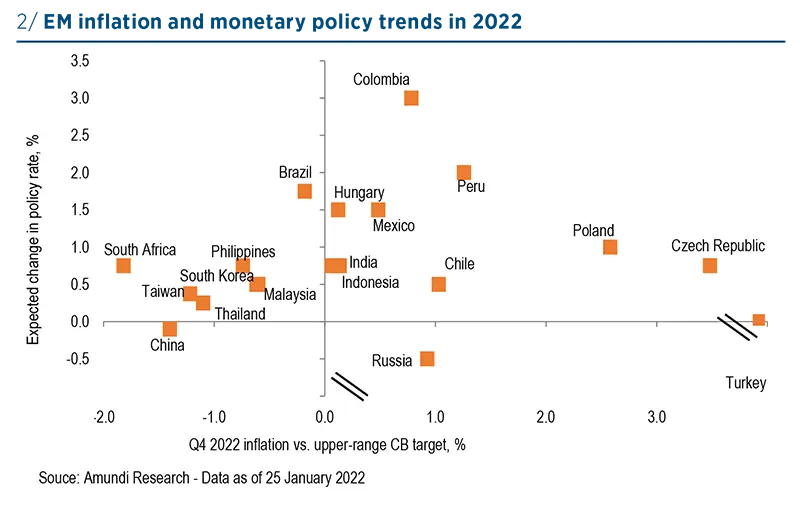

The significant change in the Federal Reserve’s stance on inflation, moving from tolerance to concern, is bringing a new catalyst into the EM central banks’ narrative. Throughout 2021, the normalisation process at most EM central banks had two distinct features: first, the domestic nature of the driver, namely inflation vs. their target mandate; second, its gradual pace when assessed through real rates levels, which remain pro-growth regardless the size of the hikes. Looking at 2022 monetary policy trends in EM, while inflation will remain a key driver, it is fair to say that the timeline and size of the Fed’s next actions (whether in terms of policy rate hikes or balance sheet reduction) will play an increasingly important role. Starting with the domestic driver, the EM inflation trends, we reiterate that the expected path has not changed. Overall, inflation will remain high in the first half of this year and will moderate substantially moving into the second half, though remaining in many cases above the central banks’ targets.

On one hand, the cost pressure is expected to ease through more moderate growth in commodity prices (in comparison with 2021) and declining food prices; on the other hand, downward revisions to growth rates are further reducing the possible pressures from demand. However, the assumption we are making on the adjustment of supply bottlenecks must be watched closely.

Events such as the spread of the Omicron variant and further virus outbreaks could extend the supply disruption environment beyond the second half of 2022, not to mention more structural trends at play (such as inshoring). When looking at freight rates, their benign decline which started in October 2021 has already shifted towards stabilisation or even a slight increase in December/January. This is all to say that inflation will continue to play a leading role in the monetary policy normalisation movie, although going forward it will have the Federal Reserve as coprotagonist. More reluctant to hike central banks, that have so far enjoyed a more benign inflation environment, will find themselves in a need to keep a stable rate spread with the US curve and/or prevent any disruptive impact on their local currency.

Concerns about the Fed’s next moves have entered the most recent monetary policy statements by central banks such as the Bank of Indonesia. These concerns have not yet translated into any sudden and unexpected rate hike; however, liquidity withdrawal measures are starting through the announced increase in statutory reserves at the different banks.

The significant change in the Federal Reserve’s stance on inflation, moving from tolerance to concern, is bringing a new catalyst into the EM central banks’ narrative

On one hand, an earlier than expected hike by the Fed in March will move the laggards’ rate hike cycles ahead (Asia, primarily South Asia). On the other hand, a more or less orderly outcome by the Fed will dictate the pace for the new hikers, and will fine-tune the final rate for the EM central banks that are already fully engaged in their normalisation process. In this respect, the peak of the EM central banks’ hiking could end up being higher and brought forward versus previous expectations. With that said, in an orderly Fed outcome, the first hikers should revert to a dovish stance before the end of the year (e.g. Brazil, Russia, Chile and Czech Republic).

Meanwhile, it’s worth mentioning that the PBoC moved in this direction of a relatively dovish stance earlier than the other EM CBs. Early this year, responding to heightened downward pressures on growth, the PBoC explicitly signalled additional frontloaded easing. Walking the talk, it cut the OMO (7d repo) and 1yr Medium-term Lending Facility rates by 10bp, for the first time since March 2020. The 1yr Loan Prime Rate (LPR) was lowered again by 10bp following the 5bp reduction in December, while the 5yr LPR – the rate linked to mortgages – was down by 5bp. This easier stance should continue (LPR and RRR cuts) given that the weakness in domestic economy is likely to persist, in particular in the housing sector.

Inflation will continue to play a leading role in the monetary policy normalisation movie

With few exceptions, such as Turkey, the EMs’ external vulnerability has diminished but has not disappeared. Current account trends are safer for many but not all; foreign debt ownership has decreased.

All in all, the appetite for the EM asset classes remains tepid in light of the uncertainty surrounding growth (China and pandemicrelated) and the Fed’s shift in stance. Equity selection should follow the trend in earnings (recovery based or less moderating than the expectations) while fixed Income investors, in a stable global environment, should be ready to enter local debt at a mature hiking cycle and declining inflation trend and favouring shorter duration exposure through HY vs. IG.

Rate outlook

1. The Fed is accelerating the normalisation of its monetary policy on the back of inflationary pressures and a historical tight US labour market The Fed has no choice but to act quickly: the labour market is historically tight and inflation is well above target. The Fed’s priority is inflation.

The Fed is clearly concerned about more persistent inflation while it has no concerns about growth. The Fed will raise rates quickly until the Fed is comfortable with the outlook for inflation. The door is wide open for a quick tightening if needed. We expect four hikes this year, possibly at two back-to-back meetings (March and May) and a reduction in the Fed’s balance sheet starting in June or July. The Fed is committed to fighting inflation, which has been described as “high” and is focused on inflation risks. “Problems have been larger and longer-lasting than anticipated”. “Price increases have now spread to a broader range of goods and services”. “Wages have also risen briskly, and we are attentive to the risks that persistent real wage growth in excess of productivity could put upward pressure on inflation”. The median core inflation forecast was sharply revised to the upside to 2.7% (+0.4bp) in 2022, due to higher realised inflation and continued supply chain disruption.

The Fed is committed to fighting inflation, which has been described as “high” and is focused on inflation risks

- The Fed strongly emphasised the solid macro backdrop and the tight labour market. Jerome Powell was optimistic about economic growth in the US: “Economic activity is set to develop at a sustained pace this year, reflecting progress in vaccinations and the reopening of the economy” and “Global demand remains very strong”. 2022 GDP growth was revised up to 4.0% from 3.8%. Powell cited the falling unemployment rate as evidence that the job market is rapidly approaching maximum employment. The projected unemployment rate improved to 3.5% in 2022 from 3.8% previously. “Most FOMC participants agree that labour market conditions are consistent with maximum employment in the sense of the highest level of employment that is consistent with price stability.”

- The Fed is accelerating the normalisation of its monetary policy. The Fed announced the acceleration of tapering in light of elevated inflation pressures and a historical tight labour market. The pace of tapering will be doubled to $30bn per month in January. As a result, the Fed will end net asset purchases at the end of March, which should allow for a first rate hike in March. He indicated that communication with the market was working well, implying that the pricing of the fed funds was fairly in line with their views. However, Powell highlighted that the FOMC will be “humble and nimble”. “It is not possible to predict with much confidence exactly what path for our policy rate is going to prove appropriate”. It should be noted that the economy is in a very different situation than it was when the Fed started raising rates in 2015.

- The Fed intends to reduce holdings significantly as well as sooner and faster than over last cycle. The QT will be discussed at the next two meetings and the pace, composition and timing will be communicated subsequently. It could start as soon as June or July.

- The Fed sold and the market bought the story that a short, rapid rate hike cycle will be enough to stem these inflationary pressures. The Fed continues to believe that the upward trend in prices will weaken next year, as global supply chains are restored. It is unanimous in thinking that in 2023 it will be barely above 2%. Median core inflation is projected to be back to 2.3% in 2023 (range: 2%-2.5%). At the same time, the rate hiking cycle is expected to remain gradual and limited. The median forecast for rates in 2024 increased only from 1.8% to just over 2.1%. The longer run dots have stayed the same. In the coming quarters, monetary policy will be highly accommodative, with negative real Fed Funds rates. The Fed is signalling a policy move close to neutral only by 2024.

Our views

- This cycle is very different from the previous ones. The Fed is tightening the monetary policy while the labour market is already tight. The US demand is currently supported by temporary factors (savings, inventory rebuilding). The strength of US demand in the second half of 2022 will be decisive. We also have to monitor cost-push inflation and the boom in the real estate market.

- Regarding the Fed: we expect four hikes in 2022 and a reduction of its balance sheet.

- In the short term, we expect strong data on the US labour market and US inflation to remain high. The recovery in the US labour market is so far impressive and broad based. Consequently:

- We are short duration. 5Y yields are usually the most responsive when the employment gap closes.

- We expect a massive upside for short-term real rates.

2.The ECB wants to massively reduce its purchases while maintaining a backstop strategy

The outcome of December’s meeting was more hawkish than expected, but ECB policy will remain much more dovish than the Fed and BoE, with QE to persist and no rate normalisation in sight next year. The ECB is strongly focused today on high inflation data.

- The ECB will end its emergency measures linked to the pandemic (PEPP and TLTRO III), while leaving itself some room for manoeuvre if the situation were to deteriorate again in the Eurozone.

- The ECB wants to massively reduce its purchases while maintaining a backstop strategy. A “large majority” on the Governing Council finally agreed upon 2022 for the quantitative easing outlook, combining more than EUR 500bn in additional net purchases. These decisions represent a very significant reduction in net asset purchases: they will be progressively reduced from EUR 90bn per month in 2021 to EUR 20bn in October 2022. At the same time, the ECB adopted a backstop strategy while maintaining the open nature of the asset purchase programme and introducing potential flexibility on reinvestment of the PEPP by asset class and by jurisdiction. This is to avoid financial fragmentation as long as economic fragmentation prevails in the Eurozone. The credibility of the ECB will be crucial in this approach.

- The ECB’s inflation projection is below target in the medium term. As we were expecting, the revision to the set of forecasts kept showing mid-term inflation below target, despite having been raised to 1.8% in both 2023 and 2024. Therefore, the unchanged forward guidance still looks consistent with an accommodative stance through QE in 2022 and a stable rate outlook.

ECB policy will remain much more dovish than the Fed and BoE, with QE to persist and no rate normalisation in sight next year

Our views on EUR rates and spreads

The strength and sustainability of the Eurozone recovery will be essential for the ECB to reduce its monetary support. We need to monitor the impact of stimulus packages and structural reforms on potential growth in peripheral countries. Anyway, we should be vigilant in the face of the growing divergence of views and interests within the ECB’s Executive Board. This could bring some volatility late in 2022. In the short term:

- ECB announcements reinforce our short duration and curve steepening views going into Q1 2022. Despite the taper and improved macro picture, however, we still expect the ECB’s QE to absorb most of net issuance to contain the upward yield move vs. other developed areas. The potential tilt of reinvestments into non-core bonds may be an additional factor supporting the expected curve move.

- We are more cautious on peripheral debt.

The APP will continue to support the euro credit market, but to a lesser extent than in previous years.