Summary

Introduction

This article aims to explore how the inclusion of Environmental, Social, and Governance (ESG) criteria became a critical part of the management of Buy & Maintain (B&M) portfolios for insurers and other long-term investors and why we consider that the addition of new climate-aware guidelines such as temperature or carbon intensity should be implemented in all B&M portfolios, when possible, subject to a sound engagement policy.

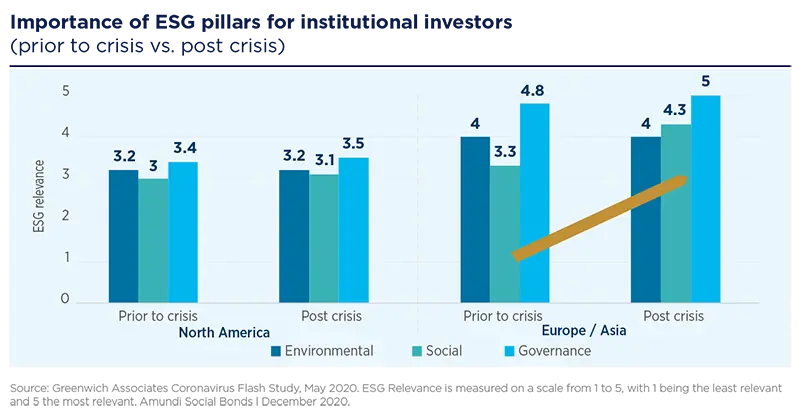

While early bird institutional investors started to incorporate ESG criteria in their portfolios some years ago, the trend intensified in 2021 with the Covid-19 crisis and the introduction of the new European Sustainable Finance Disclosure Regulation (SFDR) that encouraged investors to opt for more ESG transparency. B&M institutional investors showed a strong preference for asset managers to position their portfolios in the Article 8 category (portfolios that promote environmental and social characteristics in their investment strategy), rather than the more mainstream Article 6 definition.

In the case of B&M portfolios, it is key to define the most efficient way to integrate Article 8 SFDR portfolio requirements while also complying with the inherent features of this type of process, such as stability and low turnover. The SDFR classification must be declared by the asset manager and could lead to a modification of the investment objectives, IMA and the guidelines of the fund.

Today, we consider ESG inclusion in a portfolio as the new baseline for institutional investors. This is only a first step in a process towards more comprehensive commitment to climate investment. World leaders renewed their ambition for a real pathway to tackle climate change at the COP26 in Glasgow. This gives investors the incentive to advance a step further towards portfolios that have sustainable investment and impact objectives (SFDR Article 9) or, as is increasingly likely, Net-Zero strategies. Thanks to their relevance to long-term investments we consider that the inclusion of such climate criteria should be implemented in most, if not all, B&M portfolios. Long-term investors have a key role to play in financing the energy transition and have the power to influence companies to move towards to a more sustainable business model.

The paper concludes with a range of business cases that detail how an ESG portfolio. (Art 8 type) can be transformed into a sustainable portfolio (Net-Zero objective or Art 9 type). Amundi's B&M team can guide clients into adding more ESG, sustainable, climate and net-zero objectives to their investments.

The importance of ESG integration for B&M portfolios

Long-term investors have seen the extra-financial approach as an attractive complement to their investment strategy for some time. An ESG approach enlarges the spectrum of issuer analysis from classical financial analysis, adding a more global view of the company as well as qualitative criteria, in addition to quantitative. This approach matches with the main requirements of long-term investors who wish to stabilise any impact on their balance sheet through a low turnover approach, as well as reducing volatility. We believe issuers that manage their development in a sustainable way are best prepared to create value over the medium/long term. Extending the scope of traditional financial analysis through incorporating ESG analysis allows for improved assessment of the intangible assets of an issuer: reputation, management, etc. This logic can be extended at the sector level: ESG and climate transition considerations will be key discriminating factors among peers. As such, identifying the most sustainable sectors and best-in-class issuers will be a driver of the selection process with a greater weight in our B&M portfolios.

This selection process needs to be sufficiently stringent and agile to detect essential macro and micro sustainable trends. It is a crucial building block of the investment philosophy serving to shape the most robust portfolios over the long term by refining the investment universe.

Issuers that manage their development in a sustainable way are best prepared to create value over the medium/long term.

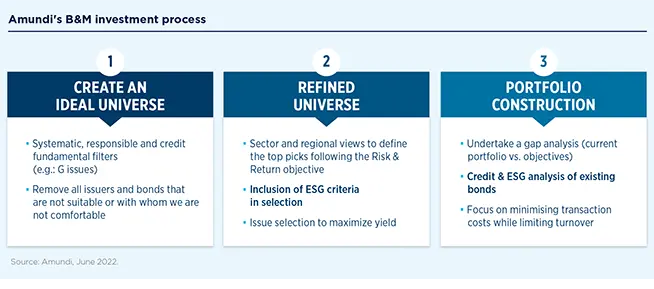

At all stages our process combines both traditional credit and ESG analysis, mixing sector exclusion and negative issuer screening based on our proprietary methodology or that of the partner/client. Our process relies on three steps:

The inclusion of responsible investing in B&M portfolio management is upgraded continuously and relies on the evolution of Amundi’s ESG policy. The B&M management process focuses strongly on a combined SRI1 approach. An equally great emphasis is put on identifying and selecting ESG leaders, a robust process, which is shared by most long-term investors. As such, the vast majority of our clients’ mandates are eligible under SFDR Article 8.

Climate change commitments: What are the implications for fixed-income investors?

As long-term investors, insurers are at the heart of social and sustainable efforts. They have been pioneers, taking into account the ESG concept whilst being the first to bear climate risks associated with both their assets and also their liabilities. Below we will discuss the different degrees of sustainability considerations, from ESG mainstream to impact investment, how to incorporate carbon reduction targets and how to apply a socially inclusive investment approach.

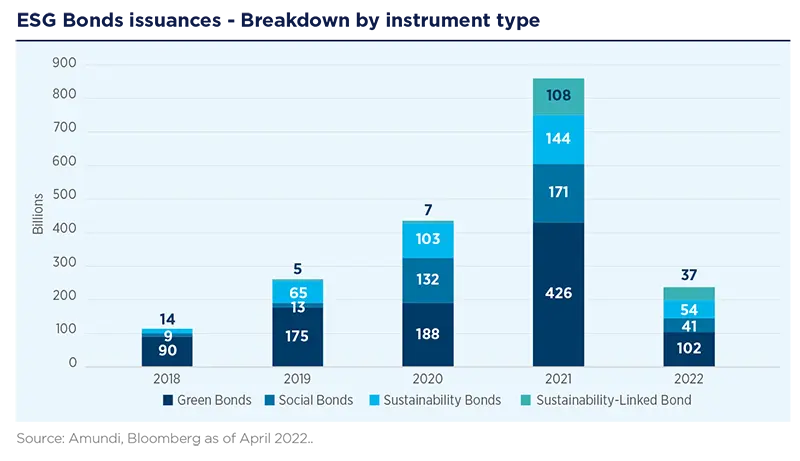

1. From ESG mainstream to Impact Investing

Impact investing is the new workhorse for insurers. Its aim is to generate a positive and measurable green and social impact in addition to financial performance. The need to add a social and environmental aspect to financial performance makes green, social, and sustainability (GSS) bonds and sustainability-linked bonds (SLB) efficient instruments from an insurer’s perspective. GSS bonds fall in the category of ‘use of proceeds’ bonds. Their purpose is to provide full transparency on the allocation of funds raised. According to the principles implemented by the ICMA2, green and social bonds are those whose proceeds are used exclusively to finance or refinance new or existing eligible projects. This high level of transparency is attractive to investors who can measure the impact of their investments and provide clear and powerful communication.

Insurers have been pioneers, taking into account ESG whilst also being the first to bear climate risks.

In addition to ‘use of proceeds’ bonds, the sustainability-linked bond market has been in development for years. Unlike GSS bonds, SLBs have a direct financial incentive embedded in the bond structure. This instrument complements sustainable product ranges available to long-term investors by setting a commitment at the issuer level (rather than at the project level, as previously), which acts as a guarantee that the issuer is genuinely committed to achieving its ESG objectives. In the context of a fast growing market, increasing numbers of long-term investors have defined strict objectives to invest a portion of their fixed income allocation into GSS bonds, not only on a standalone basis, but also as part of a more global ESG strategy. These bonds can be seen as an improver feature for issuers that would not otherwise be eligible for ESG reasons. For example, an issuer that is prohibited due to high carbon emissions could become eligible in the case of a ‘use of proceeds’ issuance that has a goal of improving carbon reduction.

However, given the quantity of new issues under these frameworks (diversification by type of issuer, geographical area, country, etc), the risk of green or social washing that could negatively impact investor reputation is increasing and additional effort to select the best sustainable issuances is essential.

As a consequence, dual analysis of issuers and issuances should be at the heart of any impact strategy, thus ensuring project quality and consistency. This includes project and impact analysis: intentions, issuer consistency (investors must ensure that projects are aligned and consistent with the issuer's overall strategy), transparency/reporting (allocation of funds to the social/green projects stated in the issue), alignment with existing standards, controversies and second-party opinion.

As our societies integrate the need for green transition, impact investing has the potential to become an efficient vehicle to support sustainable ambitions. The development of GSS bonds and SLB markets offer opportunities for insurers to align their strategies with global challenges.

2. Moving to a low carbon economy

Climate transition is a very visible and politically sensitive ESG topic. It has a material impact in particular on the insurance industry affecting its regulatory framework, asset, and liability base. The combined impact of financial fragility and climate change consequences increases the need to tackle systemic climate risk.

Dual analysis of issuers and issuances should be at the heart of any impact strategy.

a. Carbon reduction: a means of climate action

A noteworthy initiative taken by the insurance industry is the creation in 2019 of the Net Zero Asset Owner Alliance by major insurance and reinsurance companies. It aims to ensure long-term commitments are attained through a roadmap of term objectives. The Alliance now has 65 members, representing over $10tn of assets under management.

Through the inclusion of new investment objectives such as carbon reduction indicators, B&M investors can support the transition to a low-carbon economy.

We believe valuations will benefit over the long term. Defining a set carbon reduction target is a primary step, but Amundi encourages investors to align with the Paris Agreement and add a temperature contribution equivalent to their investments. Amundi has developed sophisticated tools and indicators that include carbon reduction targets and temperature analysis that may support investors’ climate transition commitments.

The objective is to finance activities and promote companies that are fully committed to making a positive contribution to such a transition. To do this, the methodology targets companies that are aligned with the Paris agreements in terms of 1) Physical and transition risk exposure and 2) Carbon footprint reduction targets and strategies.

For B&M portfolios with a carbon reduction target, we have adopted a holistic approach:

- The first step is to define a carbon reduction target. Even if the B&M process used follows a benchmark-free process for issuer selection, when it comes to carbon reduction strategies, using an approach which applies the reduction target relative to a standard benchmark is a practical solution. Alternatively, a dynamic carbon reduction target can be considered, i.e., an annual reduction or a specific percentage reduction over a certain period (i.e. 5, 10, 20 years).

- The second step is to define the pathway to reach the target and formalise it in the guidelines. The main principle is to consider both the carbon intensity and the carbon reduction trajectory of each company.

In addition to carbon intensity figures, two types of leading indicators can also be used in the issuer selection process:

- Carbon reduction targets, for example from the CDP and Science-Based Target initiatives, which show a company’s ambition to reduce its carbon emissions.

- Temperature scores (as illustrated in the picture below) that assess each emitter's ambitions and their credibility when compared against global climate targets.

These leading indicators allow us to detect the issuers that may have a high carbon intensity but also have a sound carbon reduction trajectory, so as not to discard them automatically from our issuer selection. Similarly to GSS bonds, which have a special treatment in the selection process (see section 1 above), these leading indicators will act as an ESG improver in the issuer selection: discarded issuers could turn eligible. This "forward-looking" approach is of crucial importance for B&M strategies with a low turnover and a long-term holding period. Investment must focus on the issuers with the best carbon reduction ambitions.

As shown in Case Study 2, specific and tailored exclusions (maximum level of temperature, etc…), targets and an implementation timeline can be set. Amundi's expertise in B&M strategies is built around tailor-made solutions, which take into consideration all type of client objectives.

b. Just transition for climate: an inclusive approach to leave no one behind

It is our belief that combining climate transition and sustainable development within investment portfolios is essential as both are closely linked. There is a need to address the social challenges caused or exacerbated by the transition to a low-carbon economy, which affects workers in different economic sectors, as well as communities around the world. Given the significant impacts of climate change on societies, approaching the transition in an inclusive manner is crucial: a green transition cannot be achieved without a socially inclusive approach.

Through its role as an asset manager, Amundi seeks to provide concrete and relevant responses to such challenges, in line with its fiduciary duties. To this end, resources have been deployed to integrate the concept of a ‘just transition’ in its investment processes. In addition to strategies for alignment with a temperature reduction trajectory, a methodology based on a ‘just transition’ score has been set-up that integrates the different social facets of the transition to a low-carbon economy. The ‘just transition’ score integrates the notion of impact on workers, consumers, local communities and society in general and measures the performance of issuers relative to their peers.

The social acceptance of a green transition is an important principle to integrate in B&M portfolios because it can affect an issuer’s performance over the long-term. Indeed, a good just transition score combined with a sound carbon reduction trajectory will give more comfort and will improve long-term visibility on these companies which is a fundamental pillar of B&M strategies.

3. The role of engagement

Due to the long-term horizon of investment, B&M investors will not only be unique partners to the various economic agents developing best practices but will also help to maximise its benefits. Dialogue and behaviour take time to evolve and consequently are naturally aligned with B&M. An asset holder can seek to modify and influence company practices. Moreover, they will be able to monitor and accompany the company over this long journey, whilst assessing the entire process. These improvements should lead to the superior long-term performance of these investments.

Dialogue and behaviour take time to evolve and consequently are naturally aligned with B&M.

At Amundi, we recognise that company approaches take time to evolve and we look for progress and momentum as much as achievement; our dialogue with companies aims to encourage ongoing improvement over time.

Amundi’s strategy of engagement is linked to the concept of double materiality. Engagement with issuers should not only be on how sustainability issues may affect the company (sustainability risk) or the material issues that affect profit & loss, cash flows, balance sheet or valuation. Engagement must also address how the company affects society and the elements of sustainability (such as impacts on environmental, social and employee matters, respect for human rights, anti-corruption and anti-bribery matters), which are material to society and the global economy even though they might not be material for the financial statements of the company on a short to medium-term horizon. For more details on Amundi’s engagement activity, please refer to 2021 Engagement report.

Practical examples of application in B&M portfolios

Case study 1: Large French insurance company

Supporting a French insurer in becoming an ESG leader in its industry

Context:

In 2016, our client wanted to integrate sustainable development criteria into its global portfolio. The ambition was to reflect its values but also comply with emerging regulation on the subject. Due to the size of the portfolio and the very large scope of assets concerned by this project, they asked us to support them with the help of our proprietary tools and KPIs to gradually adapt and reinforce their investment policy in a climate oriented way.

Our proposal:

Drawing on Amundi’s expertise and proprietary ratings, we performed an indepth screening and analysis of their holdings applying our ESG approach. The goal was to define key ESG criteria to be integrated to the investment process. These criteria had to be sufficiently stringent but also adapted to insurer investment constraints. The objective was to transpose the insurer’s group climate-related sectorial policy into a specific, applicable investment policy.

Simultaneously, we assessed the portfolio’s carbon footprint. The monitoring of a list of sensitive industries and projects, exclusion lists and sectorial policies covering twelve sectors complemented the policy. These commitments formed the basis for setting up a climate strategy. Adapting the group policy also allowed the requirements of the French article 173 of the energy transition law to be met. Following COP 21, monitoring the carbon footprint became even more critical as aligning the portfolio with the targets set by the Paris agreement became a portfolio objective. For instance, one key outcome was it triggered a total withdrawal from the thermal coal sector by 2030 or 2040 (depending on the region).

In parallel, to match our client’s ambition to remain an ESG leader, we analysed the gaps and requirements of the most relevant ESG market initiatives for insurers. Finally, the group joined the Net-Zero Asset Owner Alliance, setting a goal of a carbon-neutral investment portfolio by 2050. Reducing the global carbon footprint requires daily follow-up of issuers carbon intensity expressed in tCO2/€M invested to reach the reduction goal of 30% by the end of 2024.

Regarding engagement with issuers, our client relies on Amundi’s engagement policy where areas addressed focus on both ESG challenges for companies and the impact companies can have in their operational activities as well as their impacts on society as a whole.

Outcome:

Our client decided to rely on Amundi’s expertise to implement its ambitious climate goals and accompany it in its ambitious ESG journey. This project is ongoing and constantly evolving. Integrating new metrics and tools reinforce the investment process. We plan to continue to support the ambitions of our client to tackle the challenge of climate change.

The goal was to define key ESG criteria. These had to be sufficiently stringent but also adapted to insurer investment constraints.

Case study 2: UK Pension Fund

Transforming an existing portfolio

Context:

A mandate managed for a UK pension fund invested mainly in GBP investment grade corporate bonds. Originally, this mandate had no specific reference to ESG investment criteria, but in 2020 the trustees decided to develop their own responsible investment approach and align with their corporate sponsor’s ambitious targets.

The trustees shared with us their “Responsible Investment Belief” statement which aimed to be the first building block in a comprehensive responsible investment policy, to which the scheme’s investment managers would have to adhere.

Our proposal:

Initially, we determined which ESG KPIs could be implemented in the mandate to mirror the trustees’ beliefs and ambitions. Assessing their priorities, the main consideration was climate change with the goal of achieving to achieving Net-Zero carbon emissions.

As a result we proposed integrating an advanced set of “climate guidelines” based our on our proprietary metrics to converge towards this objective.

We have proposed implementing three new environmental/climate guidelines:

- Carbon emissions: Define a carbon intensity decarbonisation target vs reference index.

- Carbon reduction targets: Focus investments on issuers that have already set clear goals and commitments to carbon reduction targets.

- Temperature alignment: Define a maximum temperature per issuer.

As we believe climate change should be addressed in a socially responsible manner, we also included the two other pillars (Social and Governance) with the target of maintaining a higher ESG score than the reference index at all times.

Establishing a clear plan and strategy for implementation was crucial. As the low turnover and stability of B&M portfolios are critical objectives, our proposal was not to comply with new guidelines from Day One but to start implementing them gradually and rigorously:

- At inception, for all new investments

- Gradually for the existing stock: frame the completion of implementation over the next two years (for example: 75% completion by year-end, 90% completion Y+1 & 100% Y+2).

In order to guide the issuers that do not yet comply with the above guidelines (i.e. no set carbon reduction target or temperature alignment), but that do issue green bonds or SLBs with a use of proceeds that demonstrate an improvement on its carbon reduction strategy, then such green bonds issues are permissible assets.

Outcome:

The trustees decided to follow our recommendations and adopt the recommended guidelines, allowing us to accompany them in their climate ambitions.

Case study 3: French medium sized insurance company

Strengthening ESG goals

Context:

Mandate managed for a French insurance company (retirement plan) invested mainly in Euro investment grade corporate bonds. The client is an advanced ESG investor who was a pioneer in this field on the local market. Since inception, this mandate has been managed according to Amundi’s B&M ESG policy, which has been enlarged with additional sector exclusions defined in collaboration with the client: Tobacco, Alcohol, Gaming etc…

In due course, the client specified its commitment to ESG by defining a detailed plan, which captured their ambitions over time. This plan aims to target climate change with a focus on a just transition in terms of social factors. We were happy to accompany them on this journey and provide the support and the data to implement it.

Our proposal:

This plan relies on several pillars:

- Reinforced exclusions with stricter definitions and specific targets such as coal exclusions based as a percentage of revenue.

- Integration of positive screening:

- Commitment to SFDR article 8.

- Clear decarbonisation strategy: ambitious 30% reduction over 6 years.

- Define target allocations to green bonds, social, SLBs.

- Monitoring of the portfolio versus a rebased investment universe excluding the 20% lowest SRI ratings.

- Engagement and market watch:

- Engagement reports.

- Provision of additional indicators that capture advanced social/environmental data such as gender pay gap or biodiversity. These indicators may become investment objectives in the future.

The high proportion of sectors producing a high level of greenhouse gas in the existing portfolio alongside its inherent low turnover nature meant the defined decarbonisation target needed to be well-planned. We were able to simulate reinvestment to define this strategy

Outcome:

Our client agreed with our proposal. The on-going dialogue we have with partners such as this one is highly valued by Amundi, allowing us to fully understand and meet our clients’ needs. We expect this mandate will continue to evolve in the future continuing this philosophy.