Summary

Because of unorthodox economic policies, Turkey will face a tough year ahead, with inflation peaking at a 20-year high… but we do see some lights at the end of the tunnel!

Unorthodox government economic policies to ensure political continuity

President Erdogan and his party (AKP) are facing their lowest popularity ever, and elections are not far away, in June 2023. At this point, the government is betting on a policy-mix based on low interest rates, a weaker currency and a fiscal package to support economic growth and extend its political life. This is a highly risky bet in an environment where inflation is surging.

What is the economic “theory” behind the unorthodox policy-mix of the government? First, the government considered that high interest rates are a brake on productive investments and therefore on domestic demand and employment. Second, it expects that a weaker currency will boost exports, decrease imports, improve the current account balance, support growth and, by the way, stabilise the lira at some point, and then re-anchor inflation expectations. Third, the authorities assume that Turkey will: i) continue to attract foreign direct investment, as it is a huge market that offers many opportunities with a young population and low labour costs; and ii) avoid a balance of payments crisis, as Turkey is able in the current context to finance its external obligations for at least one year. Fourth, they think that administrated prices may help to contain inflationary pressures. Fifth, using the country’s fiscal room (with public debt now below 40% of GDP) and implementing fiscal stimulus should offset inflation’s negative impacts on households’ purchasing power and companies’ production costs.

The CBRT has launched an easing cycle that fed the storm

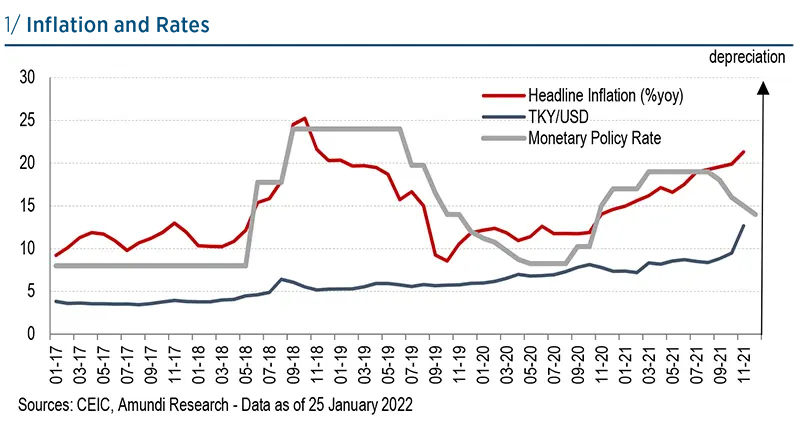

As a staunch defender of low interest rates, President Erdogan has called several times for rate cuts; Calls that have been likely heard by the Central Bank of the Republic of Turkey (CBRT) as the latest launched a monetary easing cycle in September 2021 while Turkish inflation was already approaching 20% year-on-year. The policy rate has been cut by a total of 500bp to 14% end of December (see chart 1). This unusual shift in monetary policy and the successive changes at the leadership of the central bank raised doubts among market participants on the CBRT’s independence and on the medium-term sustainability of such a policy. This has generated steep volatility and a sharp depreciation in the lira despite the CBRT’s various interventions.

Unorthodox monetary policy is one of the main causes of high Turkish inflation

#1: Measures to limit high inflation’s negative impact on the real economy and support domestic demand: |

|

On 16 December, the government announced a set of measures to limit the negative impact of high inflation on the real economy and to support domestic demand (see box 1) while at the same time the CBRT cut again its rate. The lira dropped by 20% in few days and reached an all time low of 18.4 per dollar. On 21 December, additional measures were put through to promote domestic deposits and savings in lira and de-dollarisation in order to stabilise the currency (see box 2). CBRT interventions and the new measures provided a slight boost to the lira, to about 13.5 today.

The stabilisation of the lira is key to the success of the government’s policies

#2: Measures to stabilise the lira (TRY) |

|

Nevertheless, few countries are suffering inflationary pressures as much as Turkey. Inflation hit 36.1% year-on-year in December, a 20-year high and far above November’s figure (21.3%) and consensus forecasts (27.4%). Higher prices for food (43.8% in December, vs. 27.1% in November) and for energy (42.9% vs. 32.1%) were the main drivers of the increase in total inflation. Services prices and core inflation also rose by 22.3% and 31.9%, respectively, in December, vs. 16.9% and 17.6% the previous month. Production prices rose by more than 80%. Inflation has spread throughout all goods and services.

As in many countries, inflationary pressures have been, and are still, driven by high commodity prices, increases in transport and freights costs, and higher prices of intermediate goods caused by supply-chain disruptions. Still, it is clear that the steep depreciation in the lira (fuelled by unorthodox monetary policy) has exacerbated higher prices of imported goods and is the main reason for the current inflation figures.

Given base effects, global inflationary pressures to stay longer than expected, incoming increases in domestic energy prices1, special consumption taxes such as on tobacco and alcohol (+25%), a large increase in the minimum wage (+50% in 2022) and wage hikes in the public sector, inflation is expected to rise above 50% year-on-year in the coming months. Against this backdrop, the CBRT could not afford to put further pressure on the lira by continuing to lower rates. The decision to pause at its latest monetary policy meeting, held on 20 January, was expected by market participants.

As long as the inflation path does not reverse, the lira will remain under pressure

Will supportive measures and the CBRT’s pause be sufficient to stabilise Turkey’s economic situation?

As the lira’s depreciation has been one of the main drivers of the surge in Turkish inflation, will official measures already taken and the CBRT’s pause manage to stabilise the currency? That is the crucial question!

We expect FX-linked TRY deposits measures to have a kind of “one-off” and limited impact on lira stabilisation and to be costly. Demand for FX is “structural” in Turkey (the share of FX in household’s deposits is above 60%) and in an environment where inflation and related uncertainties are huge, we do not expect households to massively change their behaviour. Furthermore, high inflation and negative real interest rates are not factors driving an increase in deposits, demand for assets and savings. In other words the incentive for saving is low.

Moreover, while the public deficit should widen from 3% of GDP to 5% in 2022 and public debt is expected to rise by 2ppt to 5ppt, these measures could deteriorate fiscal indicators further. An additional 10% depreciation of the lira would widen the fiscal deficit by 1ppt of GDP over a six-month horizon.

Another way to stabilise the lira would be, as mentioned earlier, an improvement in the current account balance. In theory, a weak currency helps to boost exports through gains in competitiveness and reduced demand for imports, so the current account improves. However, in Turkey’s case today, several factors could play the other way around.

First, regarding Turkish trade, a high share of goods is invoiced in FX currencies, and a large share of imports are intermediate goods. In that configuration, competitiveness gains might be limited.

Second, many studies show that exports are more sensitive to external demand than real effective exchange rate depreciation. In the global context of high pandemic-driven uncertainties and downward revisions of global growth, external demand could disappoint. More importantly, Turkish exports receipts are mainly driven by tourism, which may fail to return to its pre-pandemic level, considering the new Omicron variant and further mobility restrictions.

Third, if domestic demand and especially household consumption remains robust, thanks to loan growth and increased wages, then imports will not shrink; on the contrary, the lira’s depreciation will make them more expensive.

Finally, last year’s improvement in the current account was due partly to the narrowing of the gold trade deficit. Now that this is close to being in balance, it is unlikely to be a source of improvement going forward.

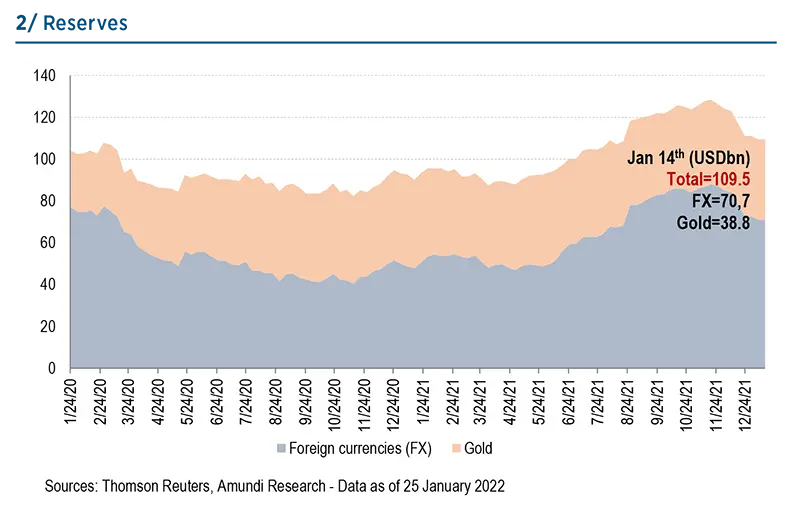

The CBRT could continue to intervene in the market but it is costly and in any case, it will not be sustainable in the medium term. On 19 January, CBRT would have signed swap agreements amounting to about USD 6bn with the Centrals Banks of United Arab Emirates (USD 5bn) and of Azerbaijan (USD 1bn). These would be the fourth and fifth swap agreements the CBRT would have done with another central bank, following a USD 15bn swap agreement with with Qatar, USD 6bn with China and USD 2bn with South Korea; all of these were done in lira. Turkish gross reserves are now around USD 110bn, of which USD 40bn in gold and USD70n of FX currencies. Bilateral swaps account for around USD 30bn. Only around USD40bn FX is cash usable for direct interventions. In last December alone, CBRT’s official interventions amounted USD 7.2bn and allegedly the same size unofficially (see chart 2).

No doubt, 2022 will be a tough year for Turkey

As long as inflation expectations are not anchored, i.e., as long as the inflation path has not reversed, the lira will remain under pressure. The government will likely adopt further administrative and regulatory measures to contain inflation. Barring a further massive lira depreciation, we do not expect the CBRT to make a U-turn and to hike rates either in Q1 or in Q2. We expect the CBRT to adopt a wait-and-see attitude until the summer season, to monitor the recent moves’ impact on inflation and to act after according inflation path.

In fact, both the short-term outlook and the government are so unpredictable that no consensus is emerging. Analysts are largely divided. Some are expecting the CBRT to remain on hold this year, whatever the inflation trend. Others see that the CBRT has no other choice than to hike rates in Q1 or, at worst, in Q2. Few, but some, believe that, given the authorities’ pro-growth bias, the CBRT will cut rates again before this summer. There’s no need to emphasise how much the economic and political outlook is fragile, increasing the risk perception.

There is no consensus on CBRT’s short-term monetary policy

Another element could also change the game: the Turkish people are starting to protest in the streets. The erosion of household purchasing power could play against the government and erode its popularity even more. Risks of social unrest are increasing. Even government supporters are raising their voices and will do so more as economic conditions will get direr.

This is not the first time Turkish policy makers have tried to implement unorthodox macroeconomic policies but they have generally returned to orthodoxy when the situation has got out of control. Would another U-turn by the authorities be possible especially will the CBRT hike rate? We think so, but expect it to be as late as possible.