Summary

KEY CONVICTIONS

- We are already reaching the peak of economic acceleration. What matters going forward is what will be left of this bounce in growth and inflation.

- Markets are pricing in a Goldilocks scenario: low inflation and higher growth at trend, but we will likely end up with higher structural inflation and lower growth instead.

- For the first time in decades, there is a desire for inflation. Central Banks will let the music play on, they will neglect inflation risk for as long as possible, and they will archive it as a temporary effect.

- We are moving away from the great moderation, with the end of the rule-based monetary and fiscal regime.

- It takes time before institutions adapt to a new regime. The next Volker is not around the corner. Higher inflation and the volatility of inflation will be key features of this new regime. Investors believe they will wake up in the 30s, while they will end up waking up in the 70s.

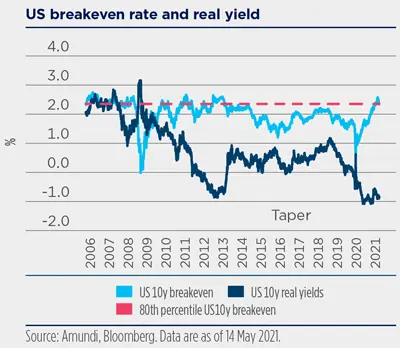

- The de-anchoring of the system may come at some point: the main risk is seeing the yield curve go out of control. The direction of real rates is key. The first sequence is for real rate to move down, and this is still positive for risk assets. The second, which is less benign, is for higher real rates.

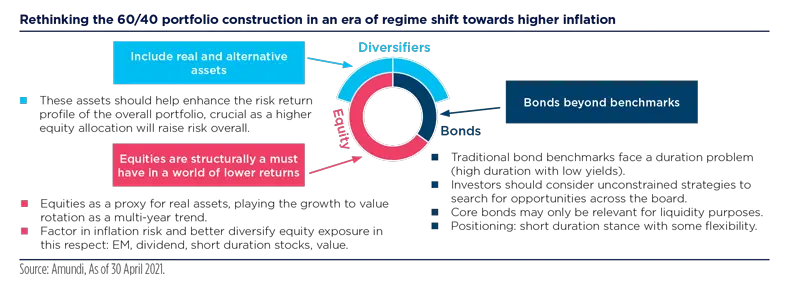

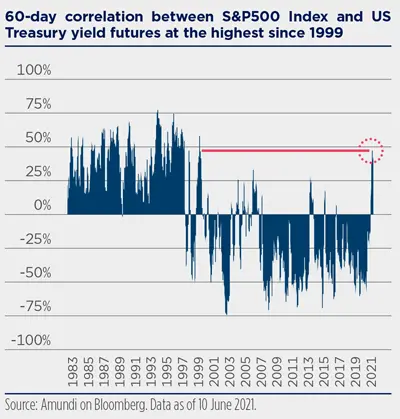

- The new regime may challenge the traditional 60/40 allocation. Investors will have to factor in inflation and enhance diversification to face the challenges of a higher level and volatility of rates.

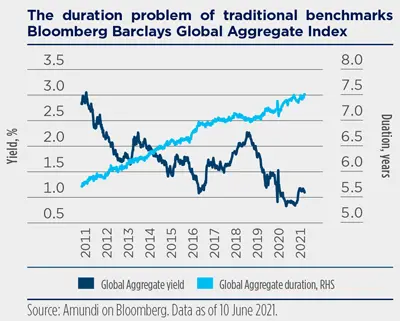

- In our view, government bonds are no longer the efficient diversifier of balanced portfolios, but they retain a role for liquidity purposes.

- Duration should remain short. Investors should resist the temptation to go long duration too soon, as the direction of rates is upwards.

- We believe that equities are a structural engine of returns, a sort of real asset. Investors should play equities through an inflation lens: value, dividend, infrastructure.

NARRATIVES, VALUATIONS AND THE INFLATION PATH

Markets will be tested by the temporary vs. structural inflation narratives

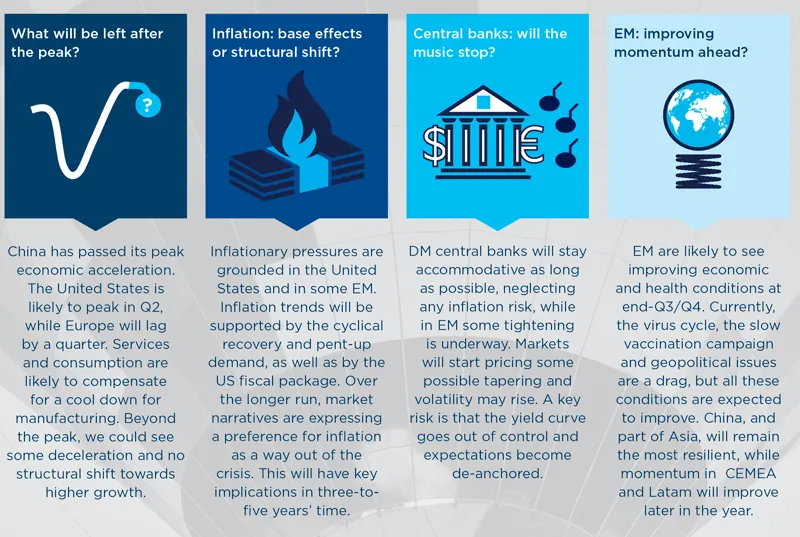

The Covid-19 crisis has transformed the world with far reaching consequences that markets are now starting to assess. The most important one being what will be left of the Great Recovery following the crisis.

Post-Covid narratives and the road back to the 70s

Different narratives are evolving at this point in time, leading to higher uncertainty in the market. The monetary narrative is the clearest and most advanced one. Central Bank mandates are evolving from being anchored to keeping inflation under control, to a situation where extraordinary monetary policy becomes the new normal. What is uncertain is how long this extraordinary accommodation can last without risking the initiation of an inflation spiral.

Central Banks will let the music play on, neglecting inflation risks. Higher volatility is in the cards.

On growth, the secular stagnation narrative of low growth and low inflation forever is now leaving space for new possible regimes. The first is based on the idea that we will end up back in the 70s, with inflation making a comeback as a consequence of policy measures, the retreat of global growth “back home” and a rebalancing between labour and capital. On the opposite side there is the narrative that sees secular stagnation transforming into the roaring 20s supported by the idea of a new technological revolution that will justify higher earnings at trend.

Investors think they will wake up in the 30s, but the most likely outcome in our view is that we are starting to walk down the road back to the 70s.

The coexistence of the monetary narrative coupled with the consequences of Covid-19 is creating a fertile ground for inflation and the rise in inflation expectations can further turn a narrative into a prophecy.

Where are we today? Goldilocks is priced in, but stagflation risk is on the rise

Currently, markets are priced for perfection. Both bonds and equities are expensive versus their long-term equilibrium level.

On the bond side, the secular stagnation narrative is the only one that can justify stretched bond valuations otherwise we should assume that yields will rise further.

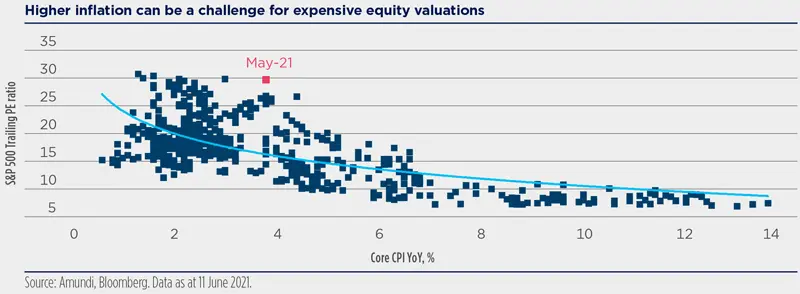

On the equity front, valuations are in excess of what the long-term expectations for earnings can justify unless we embrace the “roaring 20s” narrative of higher productivity growth, reflecting the one experienced at the beginning of the last century. If this is not the case, as we believe, a pause in equity growth is expected. Higher inflation also challenges high market valuations (see the chart below).

Markets are pricing a Goldilocks environment with temporary inflation and lasting higher potential growth. We could be left with the opposite situation, stagflation, with structurally higher inflation and lower growth.

Market direction ahead will depend on how much further we have to go in terms of the peak in economic activity and how much of the temporary bounce in growth and inflation will become structural. Currently, there is growing evidence that companies are passing on price pressures and that consumers are continuing to buy as the economy fully reopens. In addition, the mantra of overcapacity all around (too much of everything) is a thing of the past: scarcity is coming across as a theme driving inflation higher. In the end, structural is just something temporary that has lasted. Fear of inflation can become inflation: if the rush to buy and the move to increase prices continues, they will prolong the inflation uptrend, forcing the Fed to act.

The Fed is walking a tight rope

The big questions in the market are how and when the Federal Reserve (Fed) will start tapering and/or increase rates and what, effectively, is an average inflation approach (especially after 10 years of below-target inflation).

The Fed will certainly try to keep rates as low as possible for as long as it can. The recovery is built on a huge debt pile and the system should hold as long as liquidity remains ample and the cost of debt does not increase too much.

A controlled increase in bond yields as a consequence of economic growth is good, but if inflation gets out of control and rates rise while growth falters, that would have nasty consequences on most indebted areas and affect market sentiment overall.

Given the leads and lags in monetary transmission, there is little room for mistake.

The Fed has to reassure the market that inflation control is a target and that it will be addressed at some point (leaving no room for an inflation spiral to be triggered), but also dismiss worries of a too-fast-and-too-early tightening of financial conditions that would risk derailing the recovery in action. The loss of control of the yield curve is a rising risk at this stage.

Markets are stuck in the middle. Equity markets reached a high in early June. Inflation breakevens have also factored in higher inflation, while US Treasuries have continued to trade in the 1.45-1.7 range, also thanks to supply and demand imbalances.

So, all in all, things are still pretty much under control. From here, we expect higher uncertainty as we pass through a couple of months of base effects, job market health becomes clearer and we can start assessing how temporary the inflation rise is. There will be a summer test for markets and the more we move towards it, the more markets will become nervous and volatile. In the short term, given the tight valuations in some areas of the market, a pause in the bull trend is due to readjust valuations and understand the earnings path on a case-by-case basis.

Markets will have to walk the inflation journey, with real yields being the key variable to watch.

We are approaching the end of the first leg on the road to a peak, characterised by strong rotations. We are now entering leg two, the peak phase. This is still relatively positive for investors as inflation is not seen as a threat to growth but a complement to reviving economies, but the more we advance into this phase, the higher the risk of nasty surprises. The next leg will be about what is left of the peak (most likely not the Goldilocks regime markets are currently pricing in).

The need to reinvent the balanced allocation

Higher inflation challenges traditional diversification, as correlation between equity and bonds turns positive.

This comes at a time of lower expected returns for a traditional balanced portfolio as the contribution of the fixed income component, in terms of performance, will likely be very little. Hence, investors should structurally increase equity exposure through an inflation lens, and build more diversified portfolios, beyond the traditional benchmark allocation, including real, alternative and higher yielding assets (i.e. EM bonds). In doing this, investors will have to consider three dimensions: risk, return and liquidity.

Focus on equities, rethink the bond engine and diversify differently.

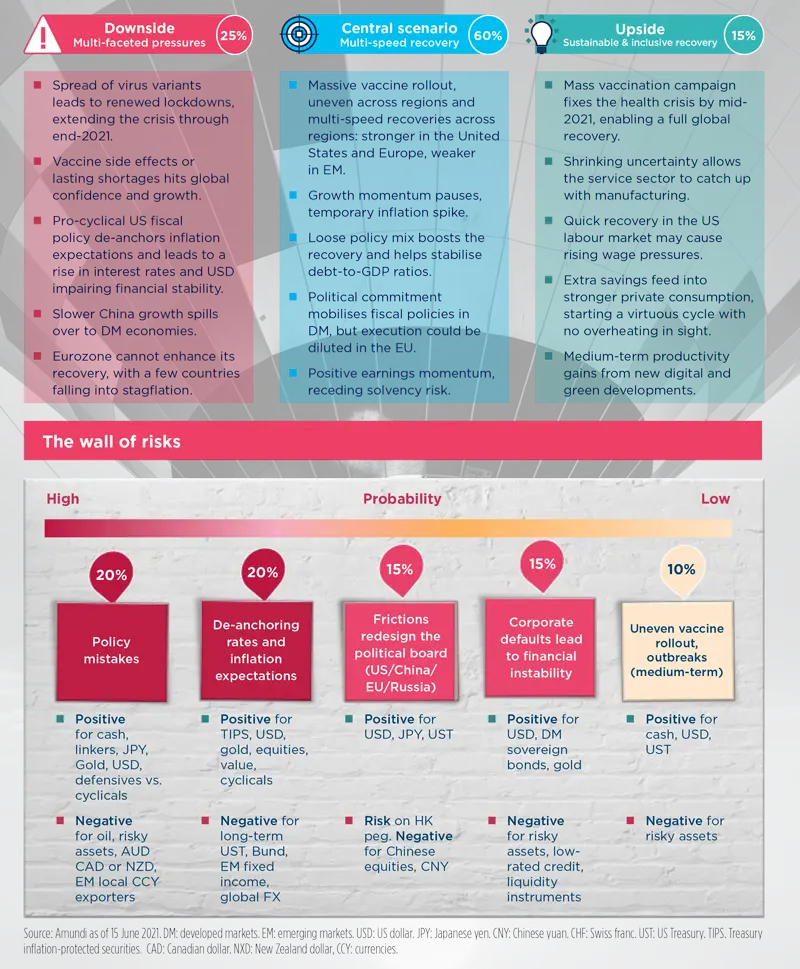

IN FOCUS: THE UNBALANCED NATURE OF THE RECOVERY

Short-term support to risk assets, but with caution

The global recovery continues to expand emphasising its uneven and increasingly multi-speed features.

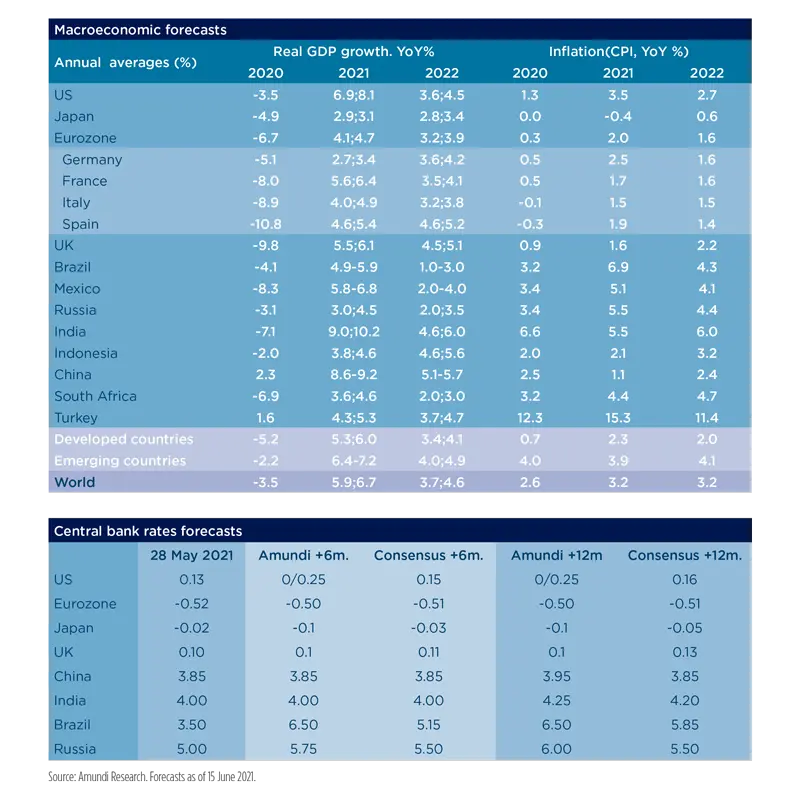

We expect global GDP to reach approximately 6.5% in 2021 and converge to 4% in 2022. The growth premium between EM and DM is narrowing not only because has growth already peaked in China, but also because most of the big economies in the EM space (namely India and Brazil) are still in the grip of the pandemic. The US has been leading and is at a climax while the Euro Area has lagged and will experience its economic momentum peak in Q3 2021, thanks to the vaccine rollout and the tourism season that we expect to eventually endorse peripheral countries.

With respect to our 2021 outlook, we now emphasise the unbalanced nature of the recovery. In fact, while the first leg of the recovery has been supply driven, with policy boosters at play to rescue and relieve economies, we are now noticing the second leg being primarily demand driven. We acknowledge that consumer confidence has not fully recovered yet, due to the fragmentation of the labour market and worries about job security once government benefits expire.

Friction between demand and supply dynamics, underpinned by supply chain bottlenecks, should be “temporarily extended”. We expect supply chain constraints to worsen over the next six months as more economies reopen (2022-2023). Moreover, as expected, consumer behaviour has been changing over the last year. We believe evidence is still too feeble to assess whether those changes in habits are going to be structural and will eventually result in higher inflation volatility ahead.

These conditions allow inflation prints to pick up and seal the end of the great moderation and suggest investors should start assessing what this means for asset classes and portfolio construction.

Higher inflation has an impact on valuations.

Historically, valuation metrics and PEs in particular, have a close link to inflation regimes. With inflation remaining below 3% and price dynamics on an upward trend from depressed levels, PE ratios decrease.

Risk assets benefit from inflation normalising from low to higher levels, particularly as a result of improved macro and micro fundamentals. Negative real rates offer further support. Historically, credit performs best in such a regime underpinned by economic growth and the risk appetite of markets. Equity returns are at their highest with inflation at 2-3%, as a healthy pace of growth and accommodative Central Banks support a risk-on market stance for financial markets. On the risk front, inflation creeping structurally beyond 3% would be progressively detrimental to risky assets.

Over the medium term, we expect lower cross asset returns, particularly when compared to past recoveries due to current extreme valuations and market levels.

Short term, markets have largely priced in inflation expectations and the focus is now on Central Banks where the Fed remains rather uniform, while the ECB has more disperse views on the need to cool down purchases. “Holds out” rhetoric allows equity market valuations to stay high, steeper curves, higher breakevens and FX volatility as currencies are the only price the Fed and ECB cannot control.

A policy mistake, in our view, is the foremost risk in the months to come while Producer Price Index is the key sentinel to look at.

BASE AND ALTERNATIVE SCENARIOS AND RISKS

HOT MACRO QUESTIONS

MAIN INVESTMENT THEMES

|

1 TACTICALLY ADJUST THE RISK STANCE

Start neutral and balance risk in a world of changing correlations

We expect equity markets to remain sidelined in the short term as markets assess the inflation path. Moving into the summer the inflation test will arrive once base effects fade and markets focus on central banks’ communication.

Entering this more uncertain phase at a time of high market valuations, it is wise to stay neutral in equities. A more cautious stance is also recommended amid possible higher volatility and changing correlation dynamics. In fact, with bond/equity correlation turning positive in phases of higher inflation expectations, US Treasuries are no longer effective as an equity hedge should yields start to rise further.

This is a short-term view while with a strategic view, as we said previously, exposure to equities is warranted amid higher inflation with protection against the bursting of the tech bubble. Hence, investors should see market setbacks as opportunities to add risk back.

- Market trigger: Growth rebalancing

- To watch: PPI dynamics and Fed reaction function

- Risks: Monetary policy mistakes, virus variants resistant to vaccines

The macro environment favours risk assets, but stretched valuations and possible inflation surprises call for a more neutral stance on equities.

2 EQUITIES: SEEK A “BARBELL” APPROACH

Favour cyclical quality value and balance with some defensives

Despite a possible pause in the market, the overall environment remains slightly pro-cyclical, favouring markets such as Europe, Japan, Emerging Markets and small caps.

Against a backdrop of higher inflation expectations and earnings growth, investors should favour value/cyclical names and balance this exposure with some defensive stocks with strong balance sheets. In fact we believe that the rotation from growth to value has further to go. The excess overvaluation of growth vs. value has not been reabsorbed yet and the improving earnings outlook further supports some value names, as well as the dividend income theme.

Company discrimination will be key: pricing power, exposure to higher input costs, ESG risks and higher corporate taxes will drive the equity selection. Moreover, we recommend being mindful of areas of potential bubbles in the hyper-growth space, while looking in the global technology at stocks exposed to compelling secular trends.

- Market triggers: European recovery to gain momentum on vaccine rollout and investment cycle deployment on Next Generation EU

- To watch: Real rates dynamics

- Risks: Policy mistake driving volatility in the market

Earnings trajectory is key to checking companies’ ability to navigate the higher inflation framework. Exposure to real economy and dividend themes will be key in H2.

3 BONDS: SHORT DURATION AND LONG CREDIT

Duration risk management is the name of the game

We recommend staying short duration, particularly in the US, and waiting for better entry points to move towards neutrality. Treasury yields are capped by supply-demand imbalances, but the inflation risk is real, in our view. When yields reach 1.8%-2% investors should resist the temptation to go long duration, and look at opportunities at curve levels and among short duration, higher yielding assets.

This means being positive credit markets where fundamentals are improving amid the economic recovery, Central Banks remain supportive and yields could offer a higher cushion against rising rates. with overall lower duration compared to traditional aggregate benchmarks.

High Yield credit, subordinated bonds and Emerging Markets bonds with a short duration bias can offer investors a good yield / duration / risk profile in this phase.

In Europe, investors can also benefit from peripheral bonds’ higher yields, while in the US robust consumer earnings and savings support a positive view on the consumer, residential mortgages and securitised credit markets.

- Market triggers: Change in Central Bank stance

- To watch: US labour market and the implementation of fiscal policy

- Risks: De-anchoring of inflation expectations

Duration management is key in this phase of uncertainty for the inflation path and Central Banks’ actions, while credit benefits from improving fundamentals in the recovery.

4 EMERGING MARKETS: CHINA AND ASIA THE WINNERS

Short-term caution, long-term income and growth story intact

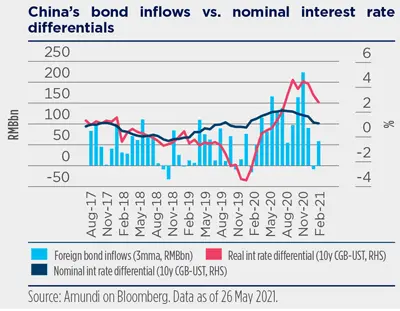

Inflation is a theme to watch also in EM. Many EM countries are facing price pressures that come from commodity markets. Some EM policymakers have already started to reverse their policy easing stance in order to limit new inflation forces. This trend coupled with the possible further rise in US Treasury yields could pressure EM bonds in the short term. In the mid term, a weaker dollar should be supportive for EM FX, hence benefitting EM equities and EM local currency bonds. Yet, the EM world is scattered with areas of vulnerability. China and some Asian countries will likely be the winners, the currencies will be the critical channel to adjusting relative prices in the new regime and will become core assets for investors. With low real rates, Chinese bonds are appealing for global investors. China is one of the few countries that has not embraced unconventional monetary policy and is targeting an ordered slowdown of credit growth. The Renmimbi could become a reference currency for Asia and its internationalisation could go ahead further supporting the appeal of Chinese assets

- Market triggers: vaccination campaign September 2021

- To watch: Rising US rates and appreciating USD

- Risks: Spreading of variants, Fed policy mistake

Short-term possible rise in US Treasuries is a headwind for EM, but they still offer higher risk-adjusted return potential in the medium term. Chinese bonds appeal in a world of low real rates.

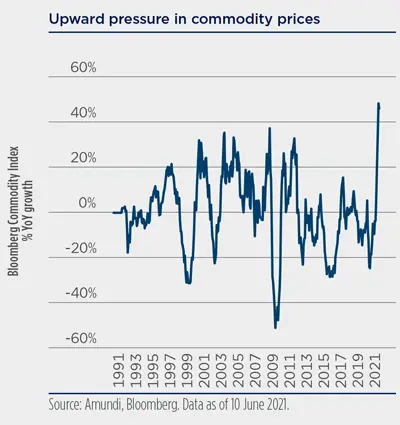

5 COMMODITIES: SHORT AND LONG-TERM POSITIVES

Imbalances due to the pandemic and long-term shortages

The global economic rebound is supporting commodity prices. Base metals in particular witnessed a jump in prices due to rising demand and concerns over supply shortages. This is the case of copper, for which the potential demand boost from strong fiscal stimulus and the transition towards greener economies, together with the still concentrated production (mainly in Chile, Peru, Republic of Congo and Zambia) should support copper prices in the long term.

This brings opportunities for investors, as exposure to base metals could help to inflation-proof portfolios.

On gold different forces are at play, driving volatility. On one front, being a safe haven, a positive economic environment is not supportive. Yet, negative real interest rates with higher inflation have helped gold prices recover initial losses in the year and could further prolong this trend. Hence we recommend keeping a neutral stance on gold at this stage.

- Market triggers: Green economy transition

- To watch: Base materials dynamics

- Risks: Geopolitical risk

Exposure to base metals (or equities linked to them) could benefit investors amid higher inflation dynamics.

6 FX: SHORT-TERM POSITIVE USD AND SELECT EM FX

Playing the USD growth premium and commodities cycle

In the medium term, the huge liquidity injections and deteriorating US fiscal position remain strong headwinds for the dollar, pointing to some depreciation and possibly even a sell-off, based on eroded investor confidence. Large-scale capital outflows might take place at that stage, especially should the rest of the world proceed in the recovery.

In the short term, the fiscal boost is building a US growth premium versus the rest of the world, suggesting that international capital inflows should stay anchored to dollar-denominated assets. This should keep the dollar in the 1.16-1.18 range at end-2021. Such a trend could be bumpy though, as any consolidation in US rates could cause the dollar to weaken somewhat.

In addition, growth proving strong and rising commodity prices support commodity-related currencies (namely CAD, NOK, AUD and NZD) that should continue to outperform.

On EM FX, we see some potential for a recovery in the second half of the year, as currencies are also generally undervalued vs. the USD.

- Market triggers: Time varying growth premium

- To watch: Real rates

- Risks: Monetary policy mistake

USD will benefit from the growth premium in the short term, but the medium-term outlook is more uncertain. USD will likely pay the bill of ultra-Keynesian policies.

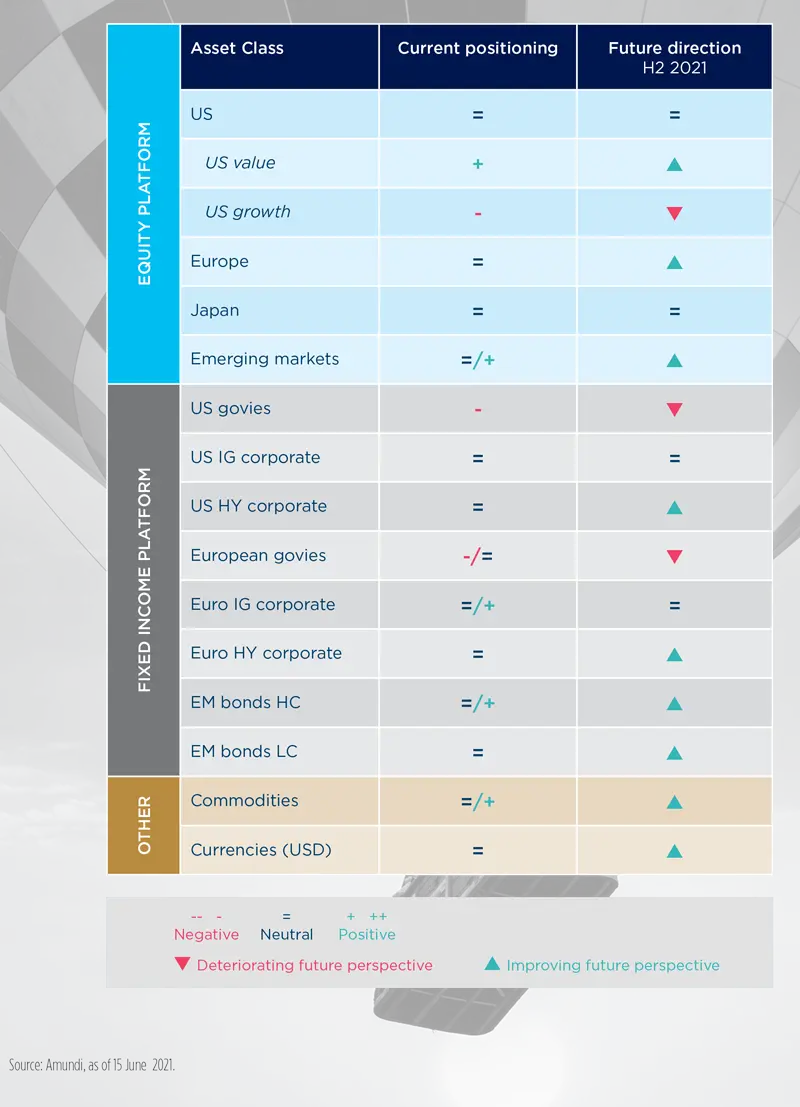

AMUNDI ASSET CLASS VIEWS

REAL ASSETS FAVOURED IN A POST-COVID WORLD

Private market investors should focus on quality

The post-covid world not only could feature higher inflation, but it could also see further long-term trends be reinforced. The digitalisation of economic activity and trade, as well as the strategic importance of supply chains, clearly cannot be denied. This crisis has also rekindled the willingness of governments and central banks to steer economies and financial markets by means of aggressive policies; these efforts are currently ongoing and could help to maintain a low interest rate environment. Lastly, the main lesson of this crisis is undoubtedly a greater global awareness of the fragility of our environment and way of life, as well as a growing recognition of environmental, social and governance issues.

In this context, real assets appear a compelling opportunity for investors with an adequate time horizon, as they aim to combine protection against inflation with the prospect of higher returns than traditional liquid assets.*

The performance of real assets remains equally attractive in the context of contained inflation.

In our view, they offer the best return prospects of all asset classes. Thus, over ten years, all things being equal, our analysis** anticipate that private equity markets should offer a possible risk premium of 230 bps in the US and 200 bps in Europe compared to listed equities, while real estate assets should offer a risk premium of 450 bps compared to public bonds in the Eurozone and 390 bps compared to investment-grade bonds***.

Infrastructure should offer a premium of more than 300 bps compared to these same investment-grade bonds. Such a sizeable spread of anticipated yields should accelerate capital flows into real assets as investors seek to optimise their risk/return trade-off.

Infrastructure: a key element of many government stimulus plans

With the Covid-19 crisis, investment in infrastructure has experienced significant differences between sectors in terms of transaction levels and valuations. In "safe haven" sectors such as healthcare, technology and renewable energy, the number of transactions and valuations has remained stable.

The crisis is expected to lead to a favourable political and regulatory environment for infrastructure investing, as the pandemic has not only brought to light the need for health and communication infrastructure, but also highlighted the urgency of the energy transition.

We believe diversification will be key to generating attractive returns, while “buy & hold” strategies are gaining traction.

Assets relating to the energy transition will remain resilient to Covid-19 propagating waves of economic shock due to their critical nature for business continuity. Infrastructure projects are expected to be a key element of many government stimulus plans.

Private debt: investing at the top of the capital structure

The Covid-19 crisis has had a significant impact across private debt markets, with fundraising and deal making having been affected from early 2020. While the onset of this crisis was unexpected, concerns were already being raised about late-cycle conditions in private debt markets related to underlying economic conditions and to emerging risks associated with demand-supply imbalances, tightening spreads and looser credit standards, which showed up in the prevalence of covenant-lite transactions, increased EBITDA adjustments, and rising leverage.

All this led to a challenging year for private debt in 2020. However, prospects are improving for 2021.

The focus in H2 2021 will be on new opportunities, which should be plentiful as lower financing from banks will leave the door open for private debt funds to cover issuers’ financing needs.

Historically, private debt has delivered diversification, stable income streams and consistent premium returns over liquid and traditional debt, with modest drawdowns over the long term. Additionally, it has been a systemically important contributor to economic growth, thanks to the support it provides to the real economy, counterbalancing the lower contribution from banks after the Great Financial Crisis due to more stringent regulation.

Private debt encompasses a wide range of opportunities (e.g., senior debt, direct lending, distressed debt, etc.) which have different goals, underlying dynamics and risk-return profiles.

In H2 2021, investors with a long-term view could focus on safer strategies at the top of the capital structure where risk-adjusted returns are attractive, resulting in a key test arising for general partners (GPs). Some GPs might even exit the market.

Private equity: time to seize opportunities

Despite the depth and suddenness of the Covid-19 crisis, private equity markets have done very well in 2020, with many funds posting a double-digit performance over the year.

Today, transactions valuation multiples are back to pre-crisis levels on average. This overall trend, however, masks widely disparate situations.

On the one hand, there are still few transactions in the sectors that were most affected by the restrictions put in place to fight the pandemic (mainly catering, travel agencies, event organisation).

Market activity is nevertheless increasing and we expect to see many built-up opportunities in these sectors.

On the other hand, many sectors are benefiting from the reinforcement of some long-term themes (technology, healthcare). Most of the transactions today are centred on these sectors, as their strong growth prospects attract investors.

Furthermore, it is worth mentioning that the amount of dry powder (i.e. cash available for investments in funds) is stable relative to the size of the market for private equity as well as for private debt, thanks to the parallel slowdown of fund raising and market transactions last year.

We see no major imbalances in private equity markets and thus expect the continuation of positive market trends in H2 2021.

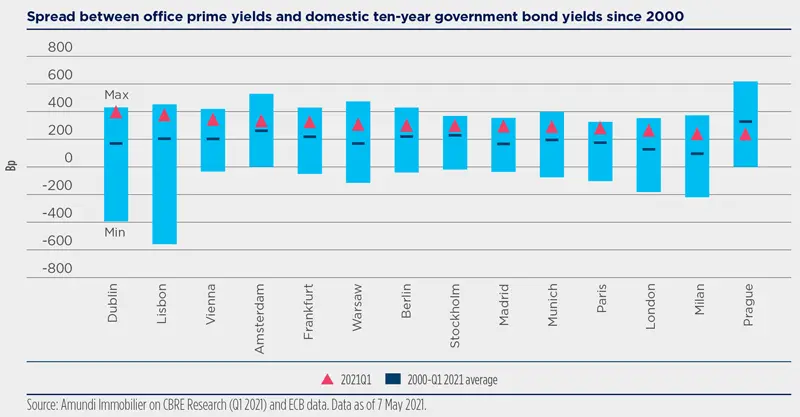

Real estate: strong investors’ appetite for H2 2021

Real estate market activity was significantly impacted in 2020 although capital values held up relatively well overall: according to MSCI, capital values in Europe declined YoY by less than 1% in 2020, leading to a positive total return in Europe – with significant discrepancies across asset classes, hotels and retail asset having been particularly impacted. The expected economic rebound in H2 2021 should favour a relative improvement for real estate market leasing activity, which should remain constrained by occupiers’ wait and see attitude as long as uncertainty remains. Occupier demand – both qualitatively and quantitatively – will be key in the short run and could make market rents of prime assets in sought after locations more resilient.

Investors’ appetite for real estate should remain strong in H2 2021, fostered by a relatively high gap between prime real estate yields and 10-year government bonds.

As a growing concern for investors has been the possible increase of inflation in the coming years, some long-term institutional investors see real estate as a way to protect income return from inflation (when an asset is leased), since rent is generally indexed. Of course, market fundamentals and conditions remain key as market rent and capital values may vary. Investors’ appetite for assets such as logistics or housing, which, so far, have been resilient during the pandemic, should remain strong, particularly as the Covid-19 crisis could have accelerated structural trends such as e-commerce. The focus of long-term investors on cash-flow visibility should favour competition for prime assets – including offices – and ensure prime yields remain low in our central scenario during H2 2021.

______________________

*There are risks of liquidity and capital loss. **Source: Amundi, May 2021. *** Expected returns are not necessarily indicative of future performance, which may differ significantly. Past performance is not indicative of future results.

Source: Amundi Asset Management CASM Model, Amundi Asset Management Quant Solutions and Research Teams, Bloomberg. Data as at 20 April 2021, Macro figures per last release. Returns on credit asset are comprehensive of default losses. Forecasts for annualised returns are based on estimates and reflect subjective judgments and assumptions. These results were achieved by means of a mathematical formula and do not reflect the effects of unforeseen economic or market factors on decision-making.

ECONOMIC FORECASTS

GDP growth (YoY%), inflation (CPI, YoY%) and central bank rates

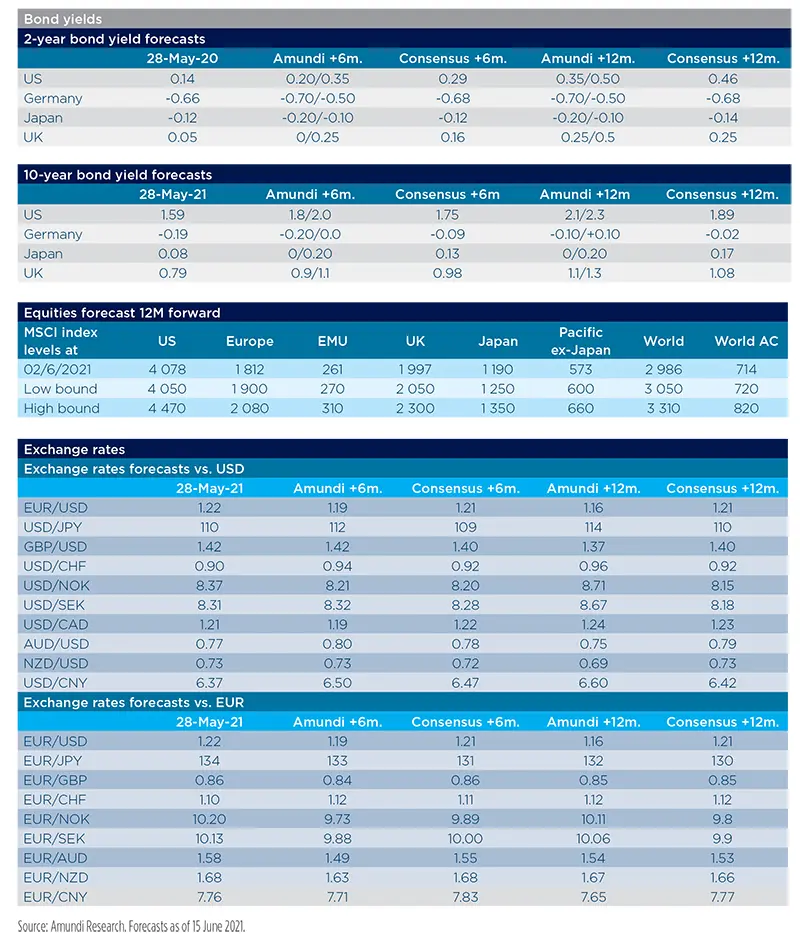

FINANCIAL MARKET FORECASTS