Summary

Fed pivot is not around the corner

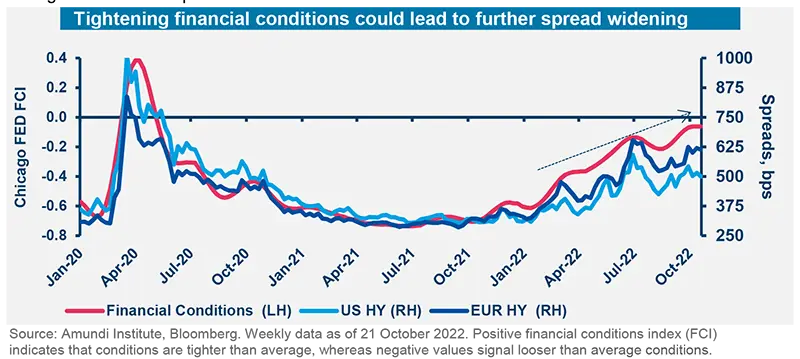

Central banks (CBs) are trying to work out how far they should go in terms of their aggressive tightening talk. We see four main factors to consider when assessing whether we will see pivots from CBs: (1) The still strong job market does not support a shift in stance from the Fed. Signs of some moderation are emerging in wage growth, but this remains above pre-crisis trends, though decelerating sequentially; (2) Inflation is persistent and challenging. While the peak in US inflation is likely behind us, recent data confirm that core inflation remains sticky. Goods inflation is falling, while the services inflation print came in at a 40-year high; (3) Sovereign debt sustainability is under scrutiny, together with the functioning of markets. Slowing economic growth would require a fiscal push, especially in Europe, at a time of rising interest rates. Questions over long-term debt sustainability come at a time when markets are clearly addicted to CB liquidity. This has become the key to supporting market functioning and the UK is an example that shows how miscalibrated fiscal and monetary policies can affect market functioning and force a central bank to act; and (4) Financial conditions are tight, but could become even tighter as the risk of the Fed being forced to overshoot remains high.

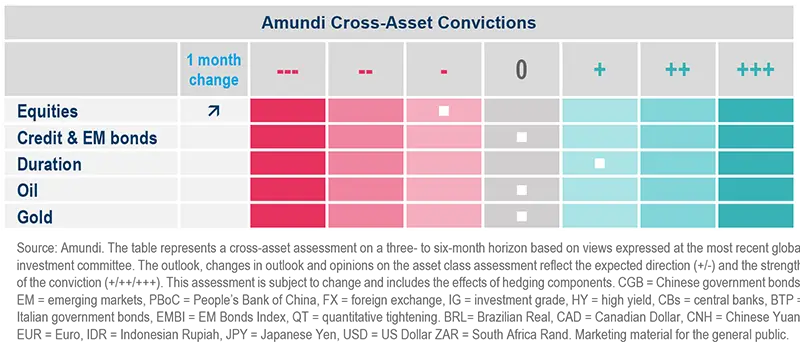

The high-inflation/low-growth backdrop, with CBs on a tightening path, means that a profit recession is materialising, not only in Europe but in the US as well, and the probability that this will translate into an economic recession as we move into 2023 is rising. After the September sell-off, risk assets are less expensive, but still do not discount a profit recession. It’s also difficult to see what catalyst might come before a Fed’s pivot and lower rates, although some short-term relief is possible after the recent sell-off. Therefore, we confirm an overall cautious stance around five investment convictions:

- We keep a cautious risk stance in light of stagflation fears, recession concerns and the energy crisis. Both in the US and Europe, we think downward revisions to earnings are on the cards. In particular, we are watching for pain points and forward guidance around rising input costs and their effects on margins, the strengthening dollar, which lowers international earnings for domestic companies, and supply chain constraints. Finally, investors should remain vigilant for some signs of capitulation in equities and downward EPS revisions that may pave the way for a better backdrop for equities. For now, we are convinced that relatively better inflation, economic growth and consumption in the US should mean US companies remain resilient compared with European firms, confirming our preference for the US over Europe. We also recognise that there could be a short-term rebound after the recent sell-off.

- In FI, current yields make US Treasury valuations attractive, allowing us to stay neutral on duration in the US. But we are active and keep a tactical view so we are ready to adjust this stance depending on the evolution of the Fed’s rhetoric and economic growth. In core Europe, we are close to neutral and believe the ECB’s tightening stance could move short-term yields in Euro area curves.

- Corporate refinancing is an important factor to watch. We retain a preference for US IG, but are cautious on HY as the risks are mounting. While corporate fundamentals are currently solid, the near future is uncertain, particularly when demand is slowing and margins are under pressure. Nonetheless, the effect of monetary tightening on IG and HY spreads in the US and Europe has been limited so far given companies currently have low refinancing needs and have dipped into their reserves. However, this has resulted in declining cash balances in most sectors, leading us to be cautious about the evolution of liquidity, companies’ working capital needs and the default outlook in low-quality segments. In Europe, fiscal policies could be supportive of businesses, thereby slightly limiting the drag on corporate cash holdings, but we do not rule out higher spread volatility.

- Still neutral on EM given the environment of weak global growth, with an increasing need for selection. On China, despite the short-term challenges, the country could see a rebound in demand next year amid accommodative policies and fiscal support for local governments. Across EM assets, our preference remains for HC debt, while we are defensive on local rates in light of the continuing USD strength. CBs for Latin American exporters, such as Brazil, have been proactive in tightening policy to tame inflation, providing a favourable environment given the attractive carry.

Investors should increase the focus on liquidity because any rise in market stress could make it difficult for them to exit more volatile assets.

Big picture in short

China stabilisation: recovery requires patience

|

Monica DEFEND |

Alessia BERARDI Head of EM Macro & Strategy Research, Amundi Institute |

Claire HUANG Senoir EM Macro Strategist, Amundi Institute |

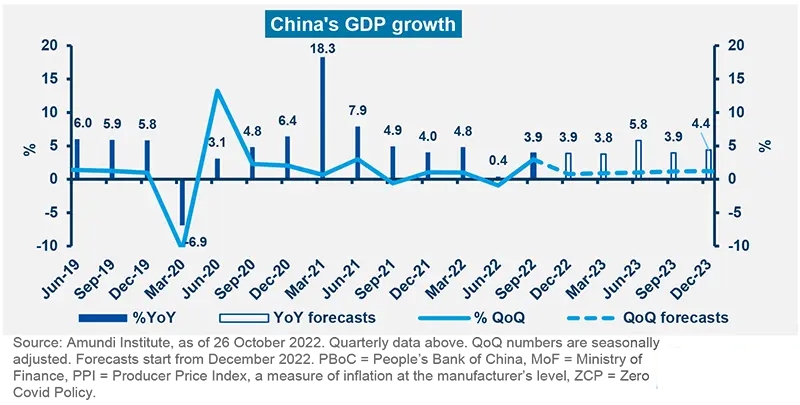

While China’s 2023 growth recovery hinges on its Covid policy, its domestic environment remains disinflationary. Q3 growth came in stronger than expected at 3.9%YoY (Amundi forecasts: 3.4%). The solid headline growth, in part attributable to a rebound in the trade surplus, masked the uneven recovery in domestic demand. Consumption is overall soft except for auto sales, whereas investment growth was underpinned by public projects. Given the better-than-expected Q3 results, we revise our 2022 growth forecasts up from 2.9% to 3.2%. However, we revise our 2023 GDP growth down to 4.5% from 5.2% due to the weaker Covid policy outlook. The main factors likely to affect growth are:

(1) Down. Our conviction of a full reopening in H2 2023 is now lower. While the ‘dynamic clearing’ slogan will likely remain in place, we expect a gradual relaxation is likely at execution level, but without a full reopening. Disruptions from time to time will continue to weigh on growth. (2) Unchanged. Housing sales still expected to stabilise at the end of 2022. We hold the view that housing sales are near their cyclical bottom. The transmission of policy easing has improved, thanks to the additional easing done by the PBoC since September. In 2023 we expect housing sales to register a small positive performance.

Subdued domestic demand will keep inflation tepid. Core and services inflation rates are expected to stay below 3% throughout 2023 due to the disruptions from Covid restrictions. PPI inflation will turn negative soon. The policy mix will remain accommodative. We don’t expect the central government to step in to help individual private developers. The intention behind policy is clearly to preserve demand.

Regarding the reopening, we think patience is a virtue and there is no clear exit roadmap expected for 2023. Indeed, when China is going to fully reopen remains one of the main unknowns for the markets. We have low convictions on the various forecasts drawing up zero Covid exit roadmaps, and are skeptical that high vaccination rates will be a sufficient precondition for reopening.

We believe the death toll matters more to the government than the death rate. The change of this implicit target, if it exists, should trigger a change in the ZCP exit. Despite the ongoing ‘dynamic clearing’ goal, we could see adjustments at the execution level. During the small Omicron outbreaks in autumn, the measures taken were not as restrictive as in Shanghai’s April lockdown. For one, a nationwide logistics breakdown was avoided (zero expressway closures), ensuring production could continue. Second, the intervention was earlier and the lockdowns shorter in each city, helping to contain the overall economic impact. A gradual relaxation of restrictions is our baseline case, with disruptions from time to time but without paralysing the whole economy. This assumption underpins our growth forecasts.

Housing sales stabilisation is in sight. Our trend estimate of sales volumes indicates a stabilisation in momentum: the September sales volume trend dropped less when compared to August or April. We expect housing sales will finally turn positive in April 2023. Indeed, the latest high-frequency data suggest that the housing market has become more resilient to lockdown shocks. Thanks to the continuous easing efforts of the PBoC and the MoF, household expectations have started to shift in Q3, with an increased share of survey respondents willing to buy homes in Q4. Overall, we expect the housing market to be less of a drag on growth in 2023.

Party Congress: a confirmation of the Xi era. The 20th Party Congress confirmed Xi remains at the core of China’s leadership. The politburo is even more capable of executing and reinforcing policy execution. The 20th Party Congress report confirms China’s economic course, with a Leftism tilt in the long run. It emphasises security, growth quality and wealth redistribution. Xi’s administration has a high tolerance for slow growth, and a preference for a less debt-dependent model. The growth outlook will be more volatile and the risk of overreach needs to be monitored.

We upgrade China’s 2022 growth forecasts, but downgrade growth for next year on the impact of the ‘dynamic clearing’ Covid policy, with some relaxation at execution level.

Defensive, but open to some tactical readjustment

| Francesco SANDRINI Head of Multi-Asset Strategies |

John O’TOOLE Head of Multi-Asset Investment Solutions |

High (core) inflation prints confirm that the Fed could maintain a tightening trajectory despite the deteriorating economic backdrop, which is only partially reflected in asset valuations. On the earnings side, estimates in the US and Europe are still optimistic and are likely to be revised down. As a result, for now we remain cautious and patient in risk assets, and wait for an improvement in earnings growth before we increase risk. A vigilant but agile approach, with enhanced hedges, is the key to ensuring that investors navigate this uncertain environment, but we are ready to act on any attractive entry levels. We favour a well-diversified approach that rests on a combination of quality assets in DM and EM, commodities (oil, gold) and FX.

High conviction ideas

We remain cautious on equities, but from a tactical view, we think the recent decline presents opportunities to benefit from the brief rally in some segments. However, we remain flexible to alter this stance should the situation change. We continue to prefer the US over the EZ, given that the latter is more exposed to the stagflationary episode. In EM, we are monitoring the Chinese housing sector and Covid-19 policies. The country maintains its supportive fiscal and monetary policies. Hence, we continue to favour China over India, as Indian valuations are still high despite the recent falls. On duration, we are marginally constructive and we will upgrade this view only if we see signs of a dovish Fed pivot, although valuations look attractive from a historical perspective. In the UK, we became cautious well before Liz Truss’s budget plan announcement, which triggered a massive sell-off across the gilt curve due to concerns about increased issuance and fiscal imprudence. In Europe, we maintain a small preference for BTPs over the Bund, but are monitoring any signs of weakness from a risk management perspective. We think the BTP-Bund spread is no longer being driven by domestic Italian

factors. In addition, valuations are appealing given the ECB’s policy and supportive technicals, which provide time to reassess the stance if volatility increases.

In corporate credit, we now believe EUR IG should outperform the HY segment (slightly high valuations). The latter would be more vulnerable in a recession, which would hurt earnings and fundamental metrics. The default rate is holding low but is expected to tick higher on growth concerns. In the US, we stay marginally positive on IG credit, given the better valuations after the recent spread widening, the low risks of debt refinancing and the lack of increase in leverage in the near term.

Finally, FX remains a key pillar of our multi-asset strategy and we think the USD will remain strong amid the prospects of higher rates in the US. However, we are no longer positive on USD/CAD. This is not due to any negative view on the dollar, but because the greenback has already risen substantially vs. the CAD this year. Secondly, the negative news flow from the Swiss banking sector could affect the CHF/EUR, considering the franc has already gained. We stay positive on USD/EUR and JPY/EUR. On the other hand, we think the ZAR is a good way to play the weak sentiment in EM FX. Hence, we are now constructive on BRL/ZAR (attractive carry, macro environment and a lot of negative news on elections already priced in). In Asia, we maintain our view on IDR/CNH due to Indonesia’s improving fiscal position and growth.

Risks and hedging

The risk of CB policy mistakes in the form of excessive tightening is high in light of inflation. Hence, we think increasing the protection on credit (US HY) is appropriate. At the same time, investors should maintain safeguards on US equities and consider exploring opportunities arising from the weakening of the EUR/USD.

We are defensive overall, but remain vigilant for opportunities to benefit from any tactical market movements, without altering our medium-term convictions.

Vigilant on the liquidity evolution in credit

| Amaury D’ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Recent economic data pushes any dovish pivot from the Fed further into the future, with implications for global bond yields at a time when the risk of policy mistakes is increasing and economic growth is slowing. Furthermore, rising real rates are leading to some tightening of financial conditions, which in turn are affecting corporate credit spreads. On the other hand, we are seeing pressures on earnings and cash flows. Hence, investors should be watchful of the cash/liquidity on balance sheets as companies spend their cash (accumulated during the Covid-19 crisis), and take note of whether any policy tightening turns into a solvency/financial stability issue. Select opportunities in the high-quality area of the market, including in EM HC, should be explored with an agile duration mindset.

Global and European fixed income

We are marginally cautious/close to neutral on duration in the US, core Europe and the UK (less than before), but slowing economic growth keeps us tactical on this front. We are active on multiple yield curves, thereby exploring flattening opportunities in Europe, Japan and the US. In the UK, we are assessing the monetary/fiscal policies and their effects on sovereign yields. On the global front, we continue to believe in the diversification potential of Chinese debt. Regarding inflation, we are slightly constructive on the US and European breakevens. So far, the impact of monetary tightening on credit spreads has been limited due to companies’ limited refinancing needs as they used their internal cash holdings. But this might change in the near future. Thus, we maintain a neutral risk stance, look for short maturity debt and prefer IG over HY, without increasing our exposure to high-risk securities. We favour quality assets at the higher end of the capital structure.

US fixed income

The Fed maintains its focus on controlling inflation, which is causing a decline in the possibility of our ‘soft landing’ scenario. The reasons for both upwards and downward yield movements persist, and as a result, we have been active in our stance on duration. We think the risk-reward of being cautious on duration is less compelling now than it was earlier because of emerging growth concerns. Consequently, we are neutral with a bias to raise our stance. In addition, TIPS are looking attractive, particularly in the intermediate range. In corporate credit, high-quality businesses with low leverage will fare better if things deteriorate. IG and HY spreads remain close to average despite the weak economic environment, with markets not fully appreciating the downturn. We favour IG over HY and within IG, financials over non-financials. Elsewhere, we favour securitised over unsecuritised credit, under an actively managed stance.

EM bonds

We are monitoring liquidity and financial stability risks across EMs and remain selective, favouring HC. But we keep a more cautious stance on local rates amid regional inflation divergences, the different paces of policy normalisation and the dollar strength. Our preference is for countries where CBs have been proactive in taming inflation, and those providing compelling carry (Brazil).

FX

Any change in the strong USD trend could only come from a change in the Fed’s stance or inflation moving lower. Policy uncertainty in the UK is affecting the GBP’s stability, on which we are negative. In EM, we are slightly positive on select LatAm FX (MXN, COP) but are cautious on Eastern European FX, TWD and KRW.

GFI = global fixed income, GEMs/EM FX = global emerging markets foreign exchange, HY = high yield, IG = investment grade, EUR = euro, UST = US Treasuries, RMBS = residential mortgage-backed securities, ABS = asset-backed securities, HC = hard currency, LC = local currency, MBS = mortgage-backed securities, CRE = commercial real estate, QT = quantitative tightening.

When nominal revenues grow due to inflation, companies do not usually default. But if FCs tighten, the situation may deteriorate (spreads, distress) particularly for low-quality names.

Follow earnings resilience

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

We expect earnings downgrades to continue for some time as we enter a stock picker’s market. Until now, earnings have been supported by companies’ pricing power, which has allowed higher input costs to be passed on to consumers. At the same time, consumer spending has been sustained, partly due to the high level of savings accumulated during the Covid-19 crisis. But now some of the benefits of these factors are beginning to fade. Thus, we are focusing on margins and carefully evaluating forward guidance to better understand how long these margin pressures will persist. In addition, we continue to prioritise bottom-up analysis, and maintain a focus on our dynamic ESG approach.

European equities

In a barbell-style investing approach, we like defensive consumer staples names and quality cyclical stocks, and prefer taking cyclical risks through banks than autos. Financial names are likely to benefit from higher interest rates. Retail banks, in particular, are trading at huge discounts to fair value, in our view, as the markets have excessively priced in the worsening economic environment. However, we are selective and look for resilient business models and balance sheet strength. We also acknowledge that a depreciating euro would benefit global European companies. Importantly, the energy crisis is an opportune moment to encourage ESG investing and guide Europe towards greener and cleaner energies. We are cautious on the technology (excessive valuations) and utilities sectors, given the latter’s high level of regulatory risk.

US equities

We are seeing a bit of a mixed bag, wherein hard data, i.e., labour market and industrial production, are strong but surveys (ISM) and leading indicators are weak. On the other hand, while inflation seems to have peaked, consumers are dipping into their savings as wage growth is slower than inflation (falling real incomes). Thus, we are evaluating how changes to consumption could affect corporate earnings, leading us to be very selective. We like names that can deliver dividends even in a difficult environment, and where customer stickiness is maintained through market leadership, pricing power and product differentiation. From a style perspective, we prefer quality value stocks. Some quality cyclical and quality growth names have been hammered excessively, and we are selective on this front. However, the large cap defensive names are still expensive. At sector level, we like energy, materials and banks. Banks are showing very limited credit-related issues and their investments in technologies, which could help them maintain leadership, are not appreciated by the markets.

EM equities

Our current stance remains prudent and selective given the rising global rates and geopolitical risks. Even though the stagflationary scenario is gaining momentum and affects all geographies, the EM space seems somewhat insulated, and the EM-DM growth differential favours the former. We keep our preference for Brazil and the UAE, as well as a close to neutral position on China, with a special focus on discretionary, amid the expected rebound in Chinese demand.

We believe earnings expectations are still to high, leading us to focus on bottom-up selection and to prefer idisyncratic risks.

Amundi asset class views

Definitions & Abbreviations

-

ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

-

Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

-

Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

-

Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

-

Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

-

Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

-

Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

-

Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

-

Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

-

Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

-

Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

-

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

-

Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

-

Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

-

High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

-

Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

-

P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

-

QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

-

QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

-

Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

-

Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

-

Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

-

TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

-

Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

-

Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.