Summary

CIOs views: Fast and furious market gyrations

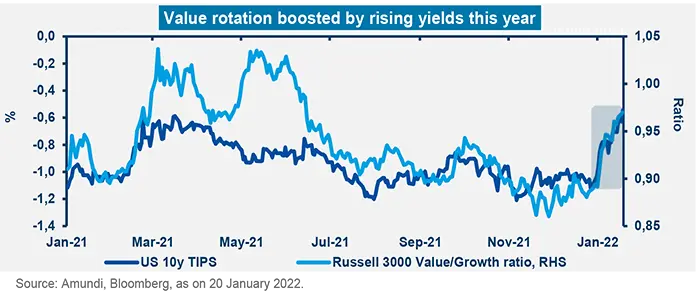

January has seen strong gyrations in markets, with nominal and real yields rising sharply, driving a strong shift from growth to value in equities. The reassessment of the inflation premium in the wake of demanding valuations has driven a strong repricing of risk premia. Going forward, we are likely to see continuation of this more uncertain and volatile environment as the market assesses four themes:

- evolution of the Omicron variant, which could impact growth negatively and further exacerbate supply bottlenecks;

- uncertainty over CBs’ reactions to high inflation numbers (US and Europe), in a context of growth slowing somewhat and the psychological dimension of inflation resurfacing, with the possible spiraling of wage/growth inflation;

- geopolitical risk is back, with Kazakhstan and Ukraine in the news and role of Russia and China in the region. Energy and commodity markets are tight, volatile and extremely exposed to political risk. In Europe, the political agenda is getting crowded with Italian and French elections at a time when new fiscal rules unfold and the Next Generation EU plan is implemented;

- ongoing troubles in the Chinese real estate sector. Policies are turning supportive but investors should forget the high GDP growth figures of the past.

Against this backdrop, we see three main themes for investors:

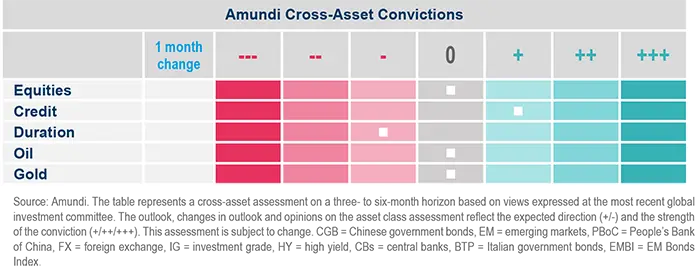

- A confirmation of a cautious risk allocation stance over the short term. This is not a time to add risk, but to stick to the core convictions (defensive on duration, preference for value, protection against inflation). It is too early to consider the recent repricing as an entry point. With a strategic perspective, in a world of low expected returns, it is paramount that investors enhance their diversification, include appropriate allocations to, for example, Asian markets such as China and India and real assets which could benefit from an inflationary environment. Low correlated strategies targeting absolute returns or real returns should be favoured as well, as with rising rates and inflation, the traditional bond-equity correlation dynamics tend to fade. Liquid alternative strategies could also help diversify portfolios while cost-efficient solutions will become even more important in a world of low yields. Tactical allocation will also be vital in capturing opportunities. Moving towards H2, we should see a mild slowdown for inflation and improvement in growth momentum (more positive for equities).

- Equity volatility is on the rise and will stay higher as markets reassess the inflation path and central banks’ response. However, decent economic growth and reasonably accommodative financial conditions should be able to prevent a major market crash. Single-digit equity returns in 2022 is our base case. Regionally, we prefer Europe/Japan and selective EM, such as India and China where valuations are more appealing. The US market could end the year almost flat, but with great divides that will provide relative value opportunities. Structurally high inflation is not yet priced in and the market is pricing the cost of capital remaining low for a long time. A modest repricing of inflation risk – and rates – could have a big impact on equities in terms of performance and composition (S&500 is broadly a growth market). The great rotation inside the indices and among value/growth markets is going to be the main theme for equity investors this year. Therefore, investors should favour value over growth in the US market and even more so at the global level. Higher inflation and higher rates will take a bite out of equity earnings and will be barely sustainable for expensive growth names. Value will be favoured vs technology growth. We are also more cautious on the large-sized overvalued names and prefer companies with high pricing power.

- In bonds, flexibility and a short duration bias are recommended. Traditional bond benchmarks face the challenges of high duration risk and low yields. If rates rise, these indices will experience losses. Investors should therefore favour flexible approaches in FI to exploit opportunities from the asynchrony among CBs and FX dynamics. Bonds are not dead, but relative value will be the name of the game. Opportunities across curves and geographies and in higher-yielding assets such as EM bonds will be crucial to extracting additional value in a negative real yield environment. Investors could benefit from dislocations by adding exposure to fixed income once some of the repricing in yields is behind us. In credit there are still opportunities, for example, in HY, but here investors should avoid over-indebted names that could suffer from lower liquidity.

After decades on the backburner, the great inflation comeback will mean investors need to shift their mindsets from nominal to real returns. Playing ongoing market gyrations will be paramount for generating returns and real yields will be the key driver of these.

Cross Asset Research Analysis: Growth, inflation and monetary policy

Monica DEFEND

Global Head of Research

A hawkish Fed now amid slowing growth momentum and persisting inflation signals high volatility ahead for markets, underscoring our cautious view on duration and the need for high selection across risk assets.

Since we published our Outlook in mid-November 2021, we have been witnessing significant evolutions in the main themes surrounding our convictions:

(1) growth/inflation mix and (2) monetary policy sequencing.

Growth and inflation

We noticed a broad-based deterioration in the growth/inflation mix.

We confirm the slowdown in economic momentum and believe growth will decelerate progressively to trend in 2022. In China, the Omicron outbreak complicates the Q1 recovery path. Holding to a Covid zero tolerance policy, local governments stepped up social distancing rules ahead of the Chinese New Year, which will weigh on mobility and services consumption again. Meanwhile, US labour markets showed widespread improvements in both levels and composition, surprising on the upside and encouraging the Fed to trend more hawkish.

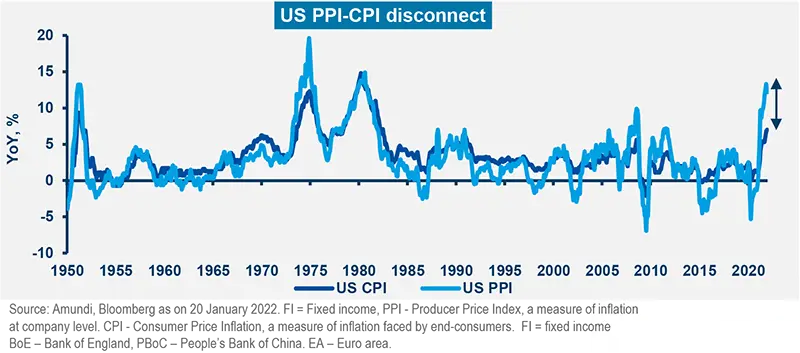

Here, it is key to monitor wage growth and capex. We assume salaries will be plateauing, reducing their contribution to inflation and pressures on corporate margins. Specifically, our US projections see a milder consumption profile, cooling savings, and inventory rebuilding moving forward. As often mentioned, we expect a more lasting inflation trend globally. Price dynamics continue to move on factors outside central banks’ control, diluting the efficacy of their interventions. Since December, the Fed, the BoE and the ECB have repositioned to control inflation. The ECB in particular surprised regarding its hawkishness, although it is still relatively dovish vs other CBs. We envisage that it will take some time for rate hikes to temper price dynamics while we are concerned about the effect of QT on financing conditions (accommodative at the moment) and the real economy. We expect supply chain bottlenecks to extend to H2 2022 while we are closely monitoring the gap between PPI and CPI for early signs of pipeline pressures globally. This is a risk worth considering, as it is not yet priced in by the markets. The forthcoming reporting season should shed some light on potential margin compression while possibly resulting in earnings disappointment. However, if the pass-through of inflation from producers to consumers has started, that will be another factor lifting CPI higher. On the other hand, inflation dynamics in China are on a different path: in general, figures have surprised to the downside due to the unusual decline in food prices before the Chinese New Year and a sharp fall in PPI. We expect China’s CPI to remain contained in 2022 and PPI to drop sharply, driven by high base effects and slower increases in commodity prices. Global commodities still have room to move higher on demand/supply imbalances fuelled by the green transition. These dynamics are assuming a political angle: the transition to net zero might be delayed.

Monetary policy sequencing

We remain convinced that the Fed, BoE and ECB will have to act to control inflation: an aggressive Fed (and ECB) amid high inflation and decelerating growth is

negative for risky asset, and exposes authorities to reputational risk and financial instability. While the US growth profile will flirt with trend levels, we are sceptical as to whether growth in the EA will be strong enough to justify the end of QE in 2023. In contrast, the PBoC has positioned itself for more accommodation to control FX fluctuations and support the economy. At this stage, further monetary easing is likely (not yet our base case) if growth continues to disappoint or if we see a new outbreak. All this translates into higher volatility for FI, affecting the short end of yield curves. We will look into the reporting season as a potential trigger for equity repricing that could weigh on credit spreads. We remain defensive duration and neutral equity, emphasising the tilt to value stocks. To trigger a change in our positioning, we look for a stabilisation (or improvement) in the growth/inflation mix reverberating into real interest rate dynamics.

Multi-Asset: Rotation in equity risk favouring China and Europe

Matteo GERMANO

Head of Multi-Asset

Risks, such as inflation, are discouraging us from changing our neutral stance, even as we became positive on European equities at the margin and more constructive on Chinese assets.

We start the year with inflationary pressures looking more persistent, along with a sharp upward movement in rates and geopolitical risk. On the other hand, the economic backdrop remains constructive, driven by a lower-than-expected impact of the Omicron variant. This, coupled with decent earnings expectations for next 12 months, continues to favour risky assets. However, volatility and valuations in some segments call for a neutral risk stance. We believe investors should avoid the temptation to enter the markets without carefully evaluating fundamentals. Instead, they should fine-tune exposure, balancing long-term and tactical opportunities with valuations. In addition, we recommend keeping hedges in place and exploring a broad array of global, diversified assets to extract real returns from multiple sources.

High conviction ideas

On equities, we are neutral on DM and EM. Importantly, recent movements in the more expensive segments that were weighed on by inflation concerns convince us of our selective approach. Investors should consider rotating their exposure to benefit from the recent movement without increasing their overall risk. This allows us to be marginally positive on Europe (overall, we stay neutral equities), given prospects of robust economic recovery and earnings growth, attractive relative valuations, and the region’s tilt towards value stocks. Similarly in China, Hong Kong listed stocks appear attractive now, given that policy visibility has improved and current low valuations already price in future uncertainty.

In FI, with an overall cautious stance on duration, we confirm our defensive view on 5Y German bunds. This view is consistent with the global environment of high inflation, more hawkish CB (Fed, BoE) communications, and a potential gradual reduction in QE by the ECB, which has been less dovish than expected but seems in no rush to hike policy rates. However, we are monitoring the political situation in Euro peripheral countries such as Italy. In Asia, we are more positive on Chinese government local debt owing to its diversification benefits, a favourable backdrop amid weakening growth, and targeted monetary easing. We are following the PBoC’s more accommodative policy tone and the weak growth momentum there. In broader EM bonds, we maintain our neutral stance. On the other hand, we are optimistic about EUR IG and HY amid a continued search for real yields. Despite weakening slightly, economic momentum remains supportive. Secondly, technicals, reasonably strong demand from the ECB (albeit slightly reduced), and low defaults in HY support the case for European credit. Nonetheless, we cannot lose sight of asymmetric risks, the negative effects of higher real rates, and potentially tighter financial conditions (not a risk currently). Hence, we stay vigilant amid tightening spreads in IG. FX remains a playground for us to implement our views through a geopolitical and relative value lens.

In DM, we are constructive on the FX carry trade basket of GBP/CHF, but are cautious on the GBP vs the EUR and USD. While we acknowledge that slowing global economic momentum and rising inflation is less supportive for a negative view on safe-haven FX such as the CHF, we believe the franc is among the most overvalued FX in the G10 universe. Furthermore, the GBP is likely to be supported by the less severe (than earlier expected) impact of the Omicron variant on the country’s growth. Meanwhile, in EM, we continue to believe that China’s ambitions of becoming a global superpower and its geopolitical importance in Asian trade would support Chinese assets, including the CNH. However, we now believe, the current international environment around Russia could weigh on the RUB despite the country’s strong current account and the currency’s attractive valuations.

Risks and hedging

Inflation and policy mistakes are some of the main risks that could have a huge impact on markets. In general, investors should use derivatives to safeguard DM equity and credit (US HY) exposure from downside risks and volatility.

Fixed Income: Easy financial conditions still supportive of credit

|

Amaury D’ORSAY |

Yerlan SYZDYKOV |

Kenneth J. TAUBES |

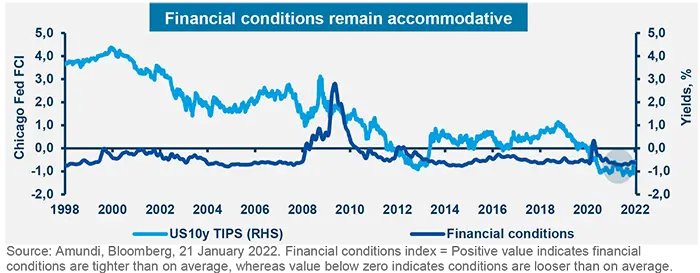

Despite markets pricing in multiple rate hikes by the Fed this year, financial conditions remain accommodative for now and will be key for the pricing of and sentiment regarding risk assets.

Recent yield movements are similar to those seen at the beginning of last year, but the pace of increase and monetary policy stances are much different. Now, the Fed seems concerned that inflation may get ‘entrenched’ if it doesn’t act. For the moment, the ECB believes, and the market agrees, that inflation is not as big a problem as it is in the US and hence the regulator is on hold with respect to rate hikes. We however think there could be some room for surprises here, as inflation will be structural in Europe too, led by commodity prices, supply bottlenecks and resurging demand. Thus, investors should be vigilant and cautious on duration with an eye on financial conditions. Carry opportunities exist in credit, peripheral bonds and EM assets, but the focus should be on areas resilient to rising real rates.

Global and European fixed income

Current market moves fall within our ambit of a cautious duration stance in the US and core Europe. But, we are flexible and manage this from both long- and short-term perspectives to benefit from yield curve movements. We are positive on China and Euro peripheral debt such as Italy, but are monitoring political events. Breakevens present some opportunities, but valuations are getting tight here. With limited yield options in traditional areas, we look for income in credit HY and IG. We focus more on selection and prefer short-term maturities and loans. We also believe there is a need to be selective to identify winners and losers through a focus on a companies’ pricing power and stay clear of companies with unsustainable business models and tendencies to add leverage. In addition, we like BBs as their spreads are likely to tighten vs BBBs. From a sector view, we like subordinated debt, banks & insurers, and energy names, but avoid consumer, transportation and utilities. Banks in particular should see consolidation in Europe and we are following any opportunity that may emerge.

US fixed income

The Fed may be under pressure to act on inflation (excess savings, wage pressures), despite slowing economic momentum. The recently indicated rate hikes point to this and have already caused upward yield movements. But, we think the Fed is likely to stay behind the curve even as financial conditions remain accommodative. We remain cautious on USTs with an active stance. Instead, we look for income in securitized credit, such as agency MBS, which present selective opportunities that offset the risk of spread-widening. We are also exploring consumer markets where demand, earnings and savings remain strong. However, the impact of the concluding fiscal support and persistent inflation must be monitored. Corporate credit is another area where we stay moderately positive, given that valuations are attractive. But investors should consider limiting beta and longduration IG, and prefer idiosyncratic risks. As new issue premiums expand, we remain selective in identifying high-quality credit.

EM bonds

EM present a heterogeneous universe in which the failure to recognise the inherent fragmentation may wrongly hide the key benefits for a global portfolio: inflation (low inflation in China), internal demand and currency valuation themes (well remunerated for the risk of depreciation). While we stay watchful overall, we continue to favour HY over IG. On LC, we are more selective. Our preference remains for commodity-driven countries, and we like Indonesia but are cautious on Kazakhstan, Brazil and Turkey.

FX

We are constructive on the USD amid prospects of US policy tightening and cautious on low-yielding currencies (JPY and CHF). However, we are positive on high-beta EM currencies including the IDR and MXP and watchful on the RUB in light of geopolitical risks.

GFI = global fixed income, GEMs/EM FX = global emerging markets foreign exchange, HY = high yield, IG = investment grade, EUR = euro, UST = US Treasuries, RMBS = residential mortgage-backed securities, ABS = asset-backed securities, HC = hard currency, LC = local currency, MBS = mortgage backed securities

Equity: Play the value theme, beware of concentration risks

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

We are witnessing a moment of truth for growth stocks. The rotation towards value, along with the selection of companies resilient to inflation risk, remains a multi-year theme for investors.

Overall assessment

Sharp movements in core yields have caused a powerful rotation so far this year and we believe this will continue but not in a straight line. The question now is: to what extent will future rate hikes and inflation fears affect economic growth? On the demand side, we think there are enough excess savings, pent-up demand, and easy financial conditions to support economic recovery. However, as rates rise, it is fair to conclude that valuation multiples will contract, particularly for non-profitable companies and expensive growth stocks, which also present concentration risks. Thus, investors should remain selective and watchful regarding earnings growth and valuations. Overall, the strength of business models and balance sheets remains important for us.

European equities

With a normalisation tilt, we focus on how inflation is likely to affect profits because, for now, companies are comfortably passing rising costs on to consumers. But we are evaluating how this could impact volumes and it is an important criterion in our selection process. Businesses that can sustain earnings growth should be able to offer attractive dividends in times of scarcity of real returns. At a sector level, we believe earnings will rise in rate-sensitive sectors, eg, financials, value and others linked with economic reopening. In this respect, we remain positive industrials (more so) and banking owing to valuations and continued potential for strong returns on capital. On the other hand, we remain skeptical of IT and discretionary, although we reduced our cautious stance in the latter. At the other end of the barbell, we are constructive on attractive defensive names in sectors such as health care. Overall, we look for quality businesses with potential for improving ESG profiles.

US equities

We are witnessing high valuations for some growth stocks and concentration risks in market indices. This is aggravated by labour shortages (due to the evolving Covid situation) amid rising wages that could feed into the wageinflation loop. We believe investors should be aware of these risks and adopt a very selective approach. Thus, we explore high-quality, cyclical value stocks that display core competencies, sustainable pricing power, and potential for longterm earnings growth. Company-specific drivers remain more important than directionality, and we look for attractive relative value opportunities. On the other hand, growth stocks, which were boosted by low rates and QE-driven flows last year, could be weighed on. We are cautious on highmomentum growth stocks and long duration names. At a sector level, we prefer financials (mainly banks), materials and energy in the cyclicals space. We also note that some segments in defensive sectors, eg, health care, staples and telecoms, are becoming attractive from a valuation perspective. Overall, we remain active in markets where expensive segments exist in tandem with attractive long-term structural growth stories.

EM equities

While we note some headwinds for EM, we keep a medium-term constructive stance owing to attractive valuations. We also think fears about China – a key component of the EM universe – are overdone. Going forward, we believe, the cyclical (loosening of the stance) and the structural (a source of diversification and of positive real returns) factors are likely to play in favour of the country, even as some risks remain. In addition, we favour positive consumption and energy and commodities stories, such as India, Russia and Hungary. Here, we are monitoring geopolitical risk.

Amundi asset class views

Definitions & Abbreviations

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

- Bear steepening of yield curve: Widening of the yield curve caused by long-term rates increasing at a faster rate than short-term rates.

- Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

- Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

- Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

- Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied. Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

- Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXP – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won.

- Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities. Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years. High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market. Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss. P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS). QE: Quantitative easing (QE) is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions. QT: The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply. Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage. Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

- TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

- Trade-weighted dollar: It is a measurement of the foreign exchange value of the dollar vs certain foreign currencies. It weights to currencies most widely used in international trade, rather than comparing the value of the dollar to all foreign currencies. Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-tobook and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

- Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.