Last year was a strong year for global bond markets, which were supported by the accommodative stance of the main central banks and strong investor demand. US, European and EM high yield (HY) bonds all returned more than 14% swapped into US dollars. The performance was led by the higher-quality segments of the market, such as BB-rated bonds, as well as the strong performance of CCC bonds in Europe. This was due to the search for yield across credit products, helped by positive risk sentiment.

As we enter 2020, financial markets appear to be in a tug of war between the cyclical stabilisation of the economy with the possibility of a rebound – thanks to the trade truce between the United States and China – and the emerging fears about the economic fallout of the coronavirus spread. The starting point is also a bit more challenging as financial market valuations are now less appealing than they were one year ago, before the US Federal Reserve’s dovish turn. Since then, equity markets have rallied and corporate spreads tightened throughout most of last year. Meanwhile, liquidity remains abundant at the macro level but this liquidity hinges critically on the general economic backdrop and deserves strict monitoring as it could dry up quickly.

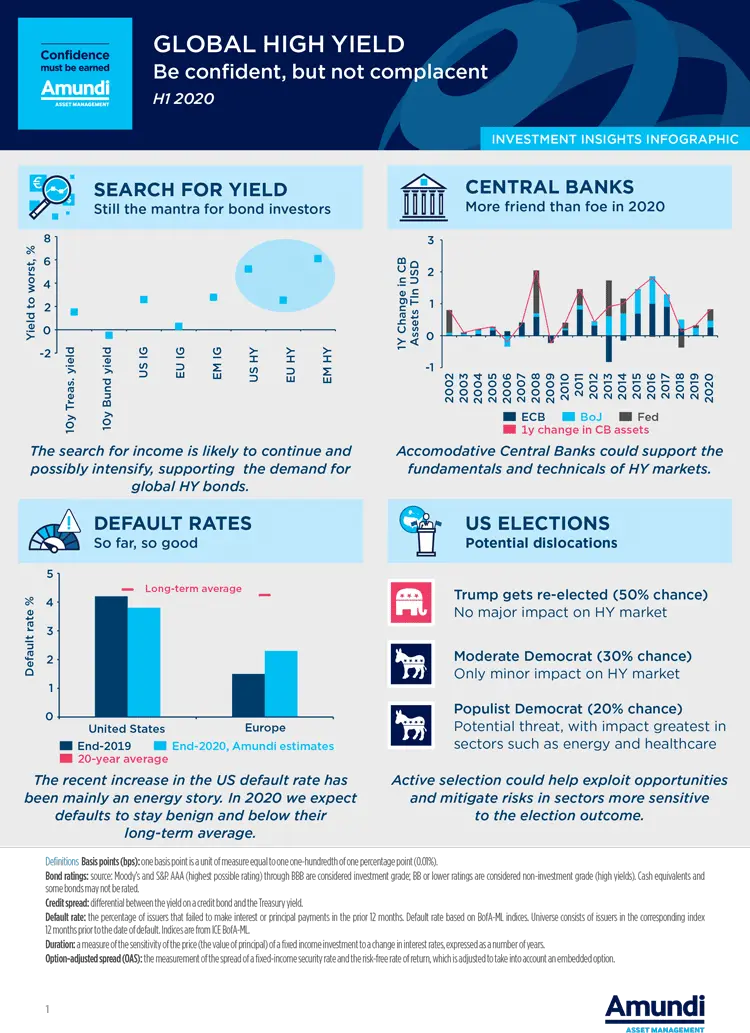

In this environment, we foresee four hot themes for investing in global HY in 2020.

To find out more, download the full paper