Summary

A realisation in Europe on the need to spend more on defence and infrastructure has created a positive sentiment, leading to the recent upside in the markets.

- Germany’s plan is estimated to provide up to €1tn in additional borrowing over the next decade, which is more than a fifth of German GDP.

- The euro has surged against the dollar, breaking a downward trend that started with the US election in November.

- German stocks have been outperforming US ones, especially mid-caps which are sensitive to domestic conditions.

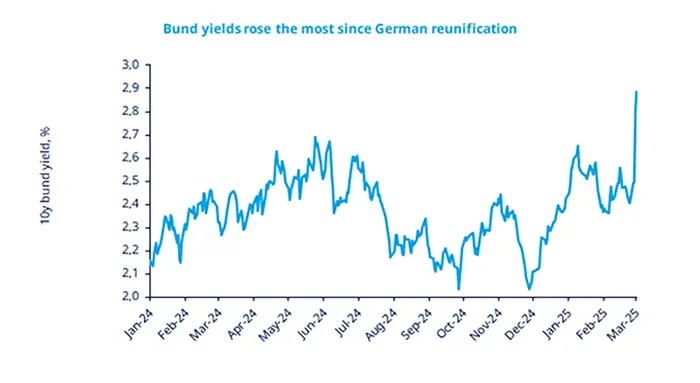

Europe – and Germany – are taking steps to increase their defence autonomy. On 4 March, the European Commission proposed a four-year fiscal rule exemption for defence spending, endorsed by EU leaders, with Germany calling for a longer-lasting change. This led to a sell-off in European bonds, with the largest increase in Bund yields since German reunification, on concerns over a large increase in supply of bonds. Equities were boosted by a potential push to economic growth. In particular, Germany announced the intention to borrow €900bn to be spent on two funds covering the defence and infrastructure sectors. This is a massive shift for Germany, as the country has traditionally been conservative when it comes to fiscal spending.

Actionable ideas

- Multi-asset investing

A multi-asset approach may allow investors to stay flexible and balanced, and potentially benefit from growth opportunities across the board, while adjusting to the evolution of the economic cycle.

- European equities

Attractive valuations along with decent improving economic growth could be positive for European businesses, particularly those with strong business model and differentiated* products.

*Diversification does not guarantee a profit or protect against a loss.

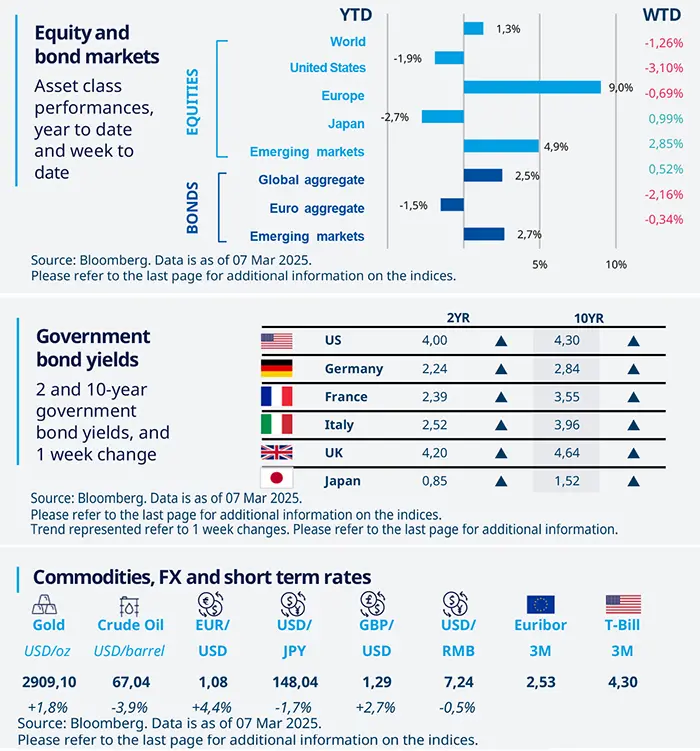

This week at a glance

Global stocks declined due to uncertainty on trade policy and concerns that tariffs could hurt economic growth. US equities also fell. Euro government bond yields were up amid plans to boost spending in Europe that may lead to higher debt burdens. In commodities, gold was supported by safe-haven demand, but oil prices fell.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short-term rates.

Source: Bloomberg, data as of 7 March 2025. The chart shows the German Bund 10-year yield.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

Trade policy uncertainty on the rise amid tariffs and counter-tariffs

US policy on import tariffs from its major trading partners is creating uncertainty around international trade. In response to US tariffs, China levied import duties on goods from US. Overall, these measures would increase difficulties for businesses as well as consumers who are likely to end up paying more. This may eventually affect US consumption and economic growth.

Europe

ECB cuts policy rates as expected

The European Central Bank continued on its rate cut path by reducing its policy rate by 25 basis points. While the bank downgraded its economic growth projections for this year, it could later update its forecasts to take into account the recent announcements of defence and infrastructure investments in Germany. Currently, we assess that the growth outlook is subdued in the region. Hence, we continue to expect further policy rate cuts this year.

Asia

China’s National People’s Congress (NPC)

China’s annual NPC outlined its plans to support the economy through fiscal spending, monetary support and directing additional resources towards domestic consumption. The government raised its fiscal deficit target (excess of expenditure over income) from 3% to 4% of GDP, and also announced plans to issue additional bonds. We think the speed of disbursing stimulus will be crucial in assessing the actual impact of the stimulus on the economy.

Key dates

11 Mar US JOLTS data, Japan GDP | 12 Mar Bank of Canada policy decision, US CPI, India CPI | 14 Mar France and Germany CPI, UK GDP, Brazil retail sales |