Summary

- The recent escalation: Hamas, most likely backed by Iran, attacked Israel over the weekend, resulting in a strong response from the Israeli defence forces. The Israeli Prime Minister termed this terrorist attack as an act of war.

- Hamas seems to be guided by its own weakening domestic position, while Iran and Hamas likely have the objective to derail the ongoing rapprochement between Saudi Arabia and Israel. The conflict may last for the next few weeks, but is likely to remain localised.

- Geopolitical implications of the conflict: There will likely be ramifications for Israel-Iran, Saudi Arabia-Israel and US-Saudi relations. A more aggressive stance from Israel is expected as it tries to control the conflict and becomes more hawkish on Iran. In addition, the West, particularly the US (as some hostages are US citizens), may be tempted to temporarily shift focus away from Ukraine in terms of military aid. Should the knock-on effect of the attack lead to higher oil prices, this would be negative for US president Joe Biden in an election year.

- On markets: While we do not expect a major impact as long as the crisis remains local, we see some risks for oil should the conflict take a broader dimension. While we do not change our inflation expectation for next year, the conflict nevertheless adds uncertainty to the inflation path, which is key to assess the economic outlook for the US.

1. What happened?

On 7 October, the Hamas terrorist group launched a deadly, multi-faceted offensive from the Gaza strip on Israel by firing rockets and sending its forces into the country through land, air and sea. In response, Israel’s Prime Minister Netanyahu declared that they are now starting a long and difficult war. It seems Israel’s usually sophisticated security surveillance and response failed, most likely because of internal divisions resulting from Netanyahu’s judicial reform, which saw growing divisions between the government and the security services.

2. Why this violence from Hamas and why now?

Hamas is backed by Iran and the latter is attempting to sabotage the recent normalisation of relations between Saudi Arabia and Israel. This normalisation poses significant threats to Iran and could have potentially extended into regional security agreements with the involvement of the US. This may have left Iran isolated in the region. Iran has significant leverage over the radical groups surrounding Israel, and the attack by Hamas was very likely supported by Iran, with the ultimate goals of making a Saudi-Israel rapprochement harder and reminding the Saudis of the power Iran wields in the region. On the other hand, Hamas is trying to shore up its credentials, given the group’s weakened domestic political position. In addition, as a terrorist organisation with little interest in securing peace with Israel, the group has an interest in preventing any Saudi-Israel normalisation in which the Saudis would have accepted a makeshift solution to the Palestinian issue.

3. How do you see the conflict evolving in the near term?

The conflict will likely last several weeks, with the hostage situation complicating Israel’s response, and the US will most likely be involved. On the domestic front, Prime Minister Netanyahu will face significant domestic backlash given the security failure, increasing the odds that he will act with little restraint. The conflict is likely to remain within Gaza and the West Bank. However, Iranian supported militias in Syria and Lebanon could become involved, and the conflict could spread there.

4. What are the broader geopolitical ramifications of the conflict?

The conflict could force Netanyahu to become more hawkish on Iran and the overall security threat in the region could affect additional Western support for Ukraine.

- Israel-Iran: The Hamas attack increases the risk of an Israeli aggression towards Iran. Israel seems to believe that if Iran can continue these attacks without actually possessing a nuclear bomb, these actions will only become more frequent should Iran become a ‘ready-to-go’ nuclear power. This will also likely lead to a deterioration of US relations with Iran, reversing the recent improvements. In response, the latter may well accelerate uranium enrichment activity again. These developments may see Israel face less resistance from the US for an attack on Iran.

- Israel-Saudi Arabia: The conflict, and Israel’s expected heavy-handed response, will complicate rapprochement between Israel and Saudi Arabia (as well as Israel and Turkey). Israel’s domestic discourse will shift further to the right, making it even harder to find a solution for the Palestinian issue.

- US-Saudi Arabia: The developments could undermine Biden’s hopes for good headlines ahead of the US elections, and may affect the recently improving Saudi-US relations. However, this does not mean that Saudi-Israel rapprochement is now hopeless, or that US-Saudi relations will deteriorate; the point is that they are now facing new risks.

- Effect on support for Ukraine: The scale of the security threat in the region could further threaten Western support to Ukraine, simply by shifting away the focus and by reminding the West that there may be other conflicts requiring military and financial support. The death of US citizens in Israel, and the allegations that some hostages are US citizens, will lead to calls in the US that there may be more imminent concerns to US security than Ukraine.

5. How could this attack affect the economy and markets?

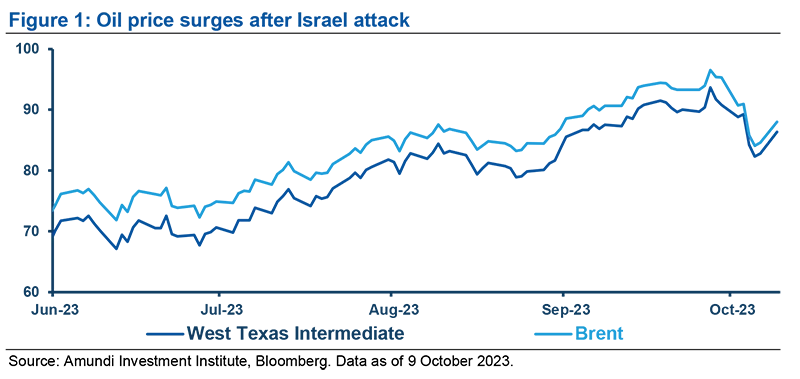

While global markets are unlikely to be affected significantly, the crisis has

ramifications for the oil sector and boosts defence companies.

The impact on markets should be limited as long as the conflict remains local and does not spread. It is marginally positive for the defence and the oil sectors, but slightly negative for some others such as aviation and long-haul travel, given the complications to travel to Israel and flying over the region. In the US, it is seen as a catalyst to have the government shutdown risk lifted in order to vote for some additional help to Israel. However, the biggest risk is to oil prices as we think the ongoing relaxation of US sanctions on Iranian oil sales will become harder. At the same time, once the immediate conflict will be under control, Israel could decide that now is the time to attack Iran’s nuclear capabilities - with the possibility of a larger regional conflict erupting - and this could lead to higher oil prices.

Higher oil prices may also impact the inflation trajectory. However, as we expect the conflict to remain localised, we do not change our inflation forecasts for next year. Nevertheless, this conflict adds uncertainty to the inflation path which is key to assess the economic outlook for the US. If inflation falls as expected, the Fed will be accommodative, but if inflation doesn’t come under control, the Fed is unlikely to cut rates and this will increase the risk of a hard landing for the US economy in 2024.