Summary

-

In the current climate crisis context, investors have a role to play in the transition to a low-carbon economy. However, many institutional investors are still wondering how to define their approach to responsible investing. They are raising several questions such as: what specific targets can be set when determining investment objectives, how to organise the governance of investing sustainably, and what responsible investing strategies can be implemented.

-

We summarise below five key findings from our review of academic research and investors’ sustainability reports as well as those from qualitative interviews we conducted with various institutions across continents (Institutional investors’ approaches to responsible investing).

Geography, regulation and stakeholders impact responsible investing

There is a wide variation between investors in terms of the degree to which responsible investing and ESG considerations are integrated into investment approaches. Geography is a key factor of differentiation, as the degree of social norms in a country influences local investors’ focus on responsible investment. As an illustration, institutional investors in Europe have a relatively high sensitivity to sustainability investing, while the situation is more heterogeneous in the US, where the debate on ESG matters is politically tainted.

Cultural factors also influence the content of institutions’ responsible investment policies:

- The E pillar tends to be dominant in Europe.

- US institutions are inclined to focus on social considerations, particularly on the “Diversity and Inclusion” theme.

- Investors in all continents have long considered governance as a key element of their company analysis.

Beyond geography, other factors may impact investors’ attitude to responsible investing such as the nature of investors’ stakeholders and the structure of pension plans’ membership. In particular, the age of pension beneficiaries seems to play a role in impacting financial institutions’ approaches, as the younger generations are particularly sensitive to environmental and social issues.

Regulation is also an important factor1. Responsible investing may be encouraged by regulation, which investors recognise as a major driver in improving ESG disclosures and increasing the integration of sustainability considerations into investment strategies.

The European regulatory landscape related to responsible investing has considerably expanded in recent years, and Europe’s leading role in regulation is recognised by investors in other continents. However, for some investors, regulation is going too far and is becoming too complex. This is triggering a form of regulatory fatigue, as sustainability regulation already contains a lot of rules which are sometimes seen as redundant or contradictory. Moreover, the relationship between sustainability regulation and investors’ approach goes both ways, as local institutions also impact the way in which the regulation is designed to a certain degree. Overall, while sustainability regulations may be partly achieving their objectives, responsible investment still stands to gain further from increased disclosure requirements.

Responsible investing enhances returns and risk management

We are convinced that paying attention to ESG factors will pay off in terms of risk-adjusted performance in the long-term; for instance, climate regulation will clearly impact the stock prices of companies directly affected by it.

Most investors stress that their fiduciary duty to their stakeholders is to generate return, and that return is their priority. However, they also generally consider that investing sustainably is favorable to performance in the long-term. Moreover, some institutions complement their financial objectives with non-financial ones, convinced that their corporate reputations, which they highly value, can be improved through responsible investment.

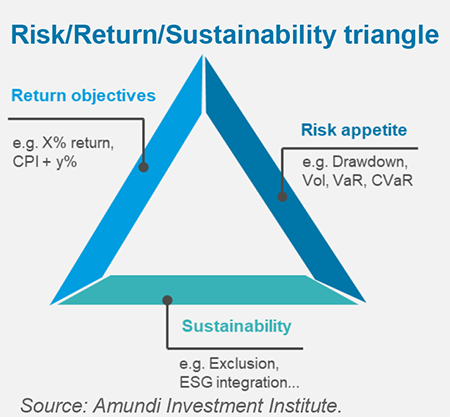

In many cases, responsible investing is also seen as a key element in investors’ risk management approaches. Climate risk in particular is increasingly integrated within institutions’ general risk framework, which many see as holistic, including both financial and non-financial risk sources.

Implementation by bottom-up integration with engagement and voting activities

For a number of investors, the responsible investing journey started with an exclusion policy, and product-based exclusions are still often present in investors’ responsible investment policies. Beyond this, ESG considerations are frequently integrated into investment approaches. They are not defined at the strategic asset allocation level, but essentially are integrated through a bottom-up approach and may result in certain sector and geographical tilts.

In terms of investment implementation, the move to ESG-specific benchmarks tends to remain limited and generally applies to investors’ passive portfolios. Most institutional investors also integrate ESG considerations into their manager selection process, generally through detailed sustainability-related questionnaires.

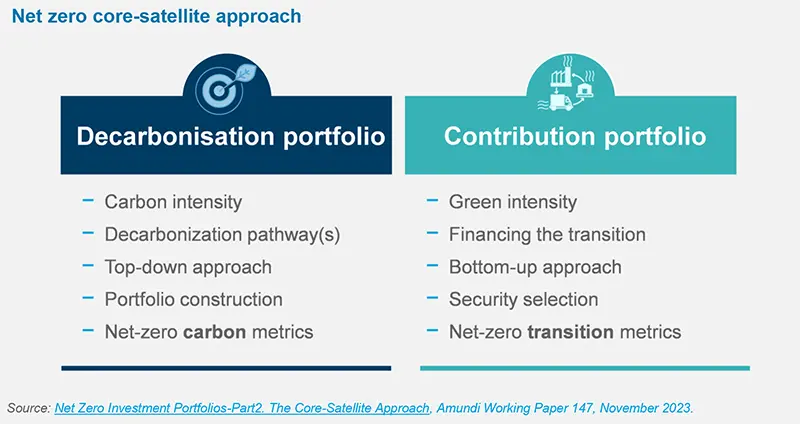

We also observe a trend towards thematic investing, with the definition of a portfolio’s “green and social” bucket referring to investments in specialised equity strategies, green or social bonds, green infrastructure and low-energy buildings. However, some investors worry about the valuation of these strategies. In addition, those pursuing a net zero objective are also aware that they need to complement their allocations to these types of investments with transition-focused strategies, both to pressurise companies to decarbonise and to maintain sufficient portfolio diversification.

For this approach to be successful, engagement is seen as a key pillar of many institutions’ responsible investment approach, even though there is some skepticism regarding the success of their engagement. Engagement must indeed be conducted using a highly professional approach, including a definition of objectives, a list of target companies and a clear engagement process. It is vital to include a monitoring step in this process, as it can take time to achieve results. Engagement is also an area where coordinated action is an advantage. According to some investors, it may be more efficient to work at industry rather than at a single company level.

Another important element of investors’ responsible investing approaches is their voting policy. Academic research underlines a positive link between active ownership on responsible investing issues and company performance. Investors may vote against the re-election of Board members, if climate strategy is not sufficiently addressed, or if some key governance criteria are not met. However, not all investors are equipped to have their own voting policies. A number of them rely on proxy advisors and coordinated actions to influence companies.

Divestment can be a last-resort strategy

Abruptly divesting would result in immense volatility and higher tracking errors in investment returns

When engagement and voting are not successful, divestment may be considered, but all surveyed investors mentioned it as a last-resort instrument that they are reluctant to use. One explanation is that divestment would reduce their influence to improve responsible investing standards and, in particular, climate policies within invested companies.

Divestment can also lead to reduced portfolio diversification, although academic literature overall is not fully conclusive on the effects of divestment. The issue is particularly acute regarding fossil fuel companies. Divestment campaigns are frequent in the non-profit sector where investing in these companies is sometimes seen as immoral or in conflict with an institution’s fundamental values.

Sustainability governance and resources: data remains a key challenge

We engage with companies with high emissions that have sound and realistic business plans to transition to a low-carbon economy within a timeframe deemed acceptable to the Fund.

Many investors still see ESG data as a challenge, in terms of quality, consistency and availability for certain asset classes, particularly private assets that are not easily susceptible to quantifiable criteria. Beyond measurement, there is a debate among investors about whether to apply the same criteria uniformly across markets or to adjust them, for instance, for emerging markets. Furthermore, the reliance of investors on systematic quantitative rating tools is rare, while a number of them are developing climate scenarios to support their climate risk analysis framework.

The importance of the data challenge puts pressure on investors to expand resources in the sustainability field, and we observe that the organisation of internal resources varies in this area, between a centralised and decentralised model. In the latter, sustainability issues are discussed in a transversal multi-disciplinary way, underlining the benefits of responsible investing across all functions within institutions.

It is essential to put the concept of transition at the center of the agenda. Financing the transition of leading European companies is crucial: sustainable savings should be mobilised to support the emergence of a competitive European green industry.